Fino Payments Bank Limited - IPO Note

Finance - Others

Fino Payments Bank Limited - IPO Note

Finance - Others

Stock Info

Shareholding (Pre IPO)

Shareholding (Post IPO)

Key Strengths and Strategies

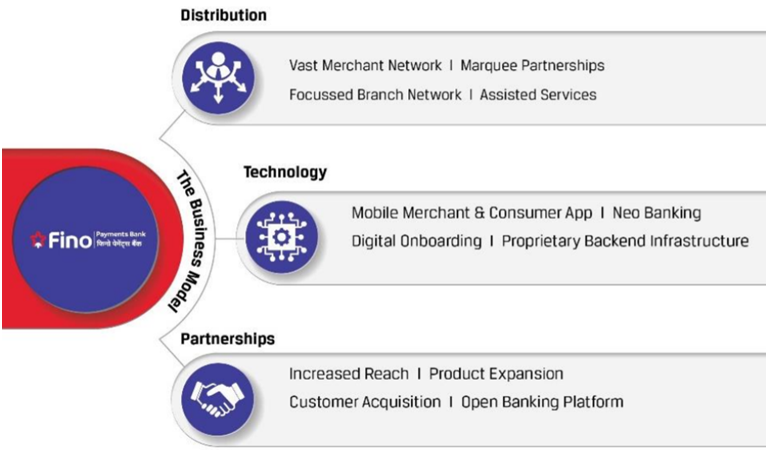

Distribution, Technology, and Partnership (DTP) Framework

The bank’s DTP enables it to serve target market efficiently and is designed

to achieve improvements on three key challenges like scale, service, and sustainability

associated with serving such target market. This framework creates a network effect

and facilitates interplay between each of distribution, technology, and partnerships.

With respect to:

Source: Company RHP

As per RHP, the framework differentiates the bank from its competitors, is difficult to replicate, promotes effective delivery of products, reinforces positive customer experiences, facilitates strong relationships, and improves operational and strategic decision making.

Asset Light Business Model

Banks’s merchant-led model is a capital light business strategy in respect

of network expansion and except for referrals of third-party loan providers, Fino

do not offer any lending products and it do not hold credit risk for loans. In addition,

its technology platform allows it to service a pool of customers and cater to their

diversified requirements. In addition, its focus on and use of technology helps

Fino in expanding reach in India without incurring relatively higher costs associated

with traditional bricks and mortar branch presence.

Fino incurs minimal capital expenditure costs in connection with on-boarding merchants, because the on-boarding and setup costs are borne by the merchant, and Fino’s technology simplifies merchant on-boarding and training process. This approach presents opportunities of high operating leverage. Further, once a merchant has been onboarded, it is possible for Fino to offer additional products through the same merchant. Over time, the merchant cross-sells new or third-party products, which increases the revenue per customer at minimal to no cost to Fino, which in turn, improves operating leverage and ability to achieve profitability.

Continued Innovation Leading to High Growth Products and Diversified Revenue Streams

Fino payments bank is committed to establish itself as a modern technology-enabled

bank that offers a comprehensive suite of products to target market via a range

of touch-points. It intends to target high growth products with high margins within

existing offering, as well as exploring new products, in each case with a focus

towards products offered through its “own” channel. Typically, the “own”

channel products generate higher margins and the banks aims to expand this through

new products and additional merchants. The bank has identified and expect that CASA

and micro-ATMs have high growth potential. It is actively exploring the potential

of tie-ups with third party financial institutions such as NBFCs for referral credit

products designed for customers, where fino payments bank will earn fees on such

referrals.

Expand and Deepen Customer Sourcing Capabilities

As of September, 2021, the Fino had presence in over 90% of districts, and during

the last three financial years and three months ended June, 2021, it acquired ~6,96,500

merchants across its network (including “own” and API channel merchants).

Additionally, it had several strategic relationships with businesses across the

country, including with a State Road Transport Corporation where they introduced

a near field communication-based contactless payments solutions for the mass transit

system. With a goal to acquire more customers, it intends to continue expanding

network to drive deeper penetration and sustainable operations in these regions

and communities, focusing on underserved and unserved individuals and micro businesses

that have limited or no access to formal banking channels.

It also intends to focus on increasing the adoption of CASA offering by customers as they believe this acts as a key customer sourcing gateway for certain of its other products. It expects that growth will come via further expansion of geographic footprint and deeper penetration in the regions it currently operates in. This is likely to be achieved by ensuring that more merchants are on-boarded, departure rates of existing merchants remain low, continuing to provide merchants with opportunities to cross-sell various products and ensuring that merchant commission paid per transaction increases.

Risks

High Concentration of Merchants in a Few States: Out of the total number of ‘own’ merchants, 46% of them are in three states of Uttar Pradesh (70,847), Bihar (58,452), and Madhya Pradesh (38,277) as of June 2021. Also, the revenue from these three states contributes 43% (FY21) and 47% (As of June 2021) to the total revenue. There can be no assurance that the demand for its products and services will grow in the future in these regions.

Attrition Rate of Business Correspondent Merchants: Though the overall merchants of the bank are growing over the years but attrition rate has also needed to be looked at. In FY19, FY20, FY21, and June 2021, the attrition rate of BC merchants was 69.06%, 32.88%, 11.38%, and 8.81%. In addition, to the extent these third-party entities violate laws, other regulatory requirements or act inappropriately in the conduct of their business, the bank’s business and reputation could be impacted, contracts may be terminated or penalties could be directly imposed (HDFC Bank has alleged certain irregularities by Fino Payments Bank and has filed a suit for damages of ~Rs. 1.86 crores).

Highly Competitive Industry: The banking and financing sector in India is highly competitive and Fino payments bank faces competition across all its products and services from other payments banks, certain fintech companies, micro finance institutions, small finance banks, as well as from scheduled commercial banks, public sector banks, private sector banks, NBFCs, and foreign banks in India.

Negative Cash Flows: In FY20 (-83.67 crores), FY21 (-32.22 crores), and as of June 2021 (-64.06 crores), the bank has negative cash flow from operations.

Offer for Sale: Only ~25% (~Rs. 300 crores) of the issue size of the IPO will come to the company and balance (~Rs. 900 crores) is OFS.

Company Description

Company Profile

The promoter of Fino Payments Bank Limited – Fino PayTech Limited –

got RBI licence to set up payments bank in March 2017. Fino Payments bank is a fintech

which offers a diverse range of financial products and services that are primarily

digital and have payments focus. It operates an asset light business model that

relies on fee and commission-based income generated from merchant network and strategic

commercial relationships. These merchants also cross-sell other financial products

and services which Fino offers such as third-party gold loans, insurance, bill payments,

and recharges. As per the filings, Fino targets those customers which are typically

been overlooked by most of the large Indian financial institutions. This section

of Indian society is characterized by low levels of financial literacy and technology

use, lack of financial inclusion and typically does not have access to even basic

banking services.

The products and services which Fino offers include current accounts and savings accounts, issuance of debit card and related transactions, facilitating domestic remittances, open banking functionality, withdrawing and depositing cash (via micro-ATM or Aadhaar Enabled Payment System), and cash management services. In addition, in August, 2021 it launched Sampaan Current Account, the second current account in its suite of accounts offered to customers.

Valuation

Outlook and Valuation

The Fino Payments bank is focused on financial inclusion and helping average Indian

in remote areas to access banking services by going to nearby mom-and-pop store.

From Q4FY20, it has started being profitable. Though it is seen that number of merchants

are growing and number of transactions has also picked up, we believe the platform

may not have high growth in near-to-medium term as financial inclusion will take

more time. We also see that the bank faces competition from banks, NBFCs, other

payment banks, among others which are also trying to tap the hinterland. We would

like to track the performance of the bank for a few more quarters. At the upper

price band of Rs. 577, the issue is richly valued at 16.7x of FY21 P/BV. The investor

can give this issue a pass . We recommend AVOID on this issue.

Financial Highlights

| Particulars | FY19 | FY20 | FY21 | Q1FY22 |

|---|---|---|---|---|

| Own Merchants | 96843 | 192464 | 335359 | 366861 |

| Marchants on API Channel | 4387 | 84935 | 306533 | 357810 |

| Net Worth (Rs. Cr) | 162 | 130 | 151 | 154 |

| Deposits (Rs. Cr.) | 48 | 118 | 243 | 251 |

| Investments (Rs. Cr.) | 73 | 128 | 504 | 558 |

| Capital Adequacy Ratio % | 65.45% | 60.87% | 56.25% | - |

| Diluted EPS | -8.00 | -4.11 | 2.62 | 0.40 |

| ROE | -32.30% | -21.90% | 14.60% | - |

| NAV | - | - | 19.3 | 19.70 |

Peer Comparison

| Particulars FY21 (Rs. in Cr) | Deposits | Net Worth | CRAR (%) | Branches | Banking Touch Points | Debit cards outstanding | Volume of transaction at ATM & POS |

|---|---|---|---|---|---|---|---|

| PayTM Payments Bank | 3450 | 480 | 62.4% (FY20) | 6 | 2.1 | 6.377 | 4.606 |

| India Post Payments Bank | 855 | 570 | 79.2% | 650 | 0.014 | 0.111 | 0.07 |

| Airtel Payments Bank | 596 | 320 | 90.2% (FY20) | 31 | 0.05 | 0.172 | 0.446 |

| Fino Payments Bank | 251 | 150 | 54.8% | 54 | 0.072 | 0.226 | 0.691 |

| Jio Payments Bank | 17 | 130 | 2347.0% | 9 | NA | NA | NA |

| NSDL Payments Bank | 7 | 140 | 230.0% | 1 | NA | 0.01 | 0.02 |

Source: Company RHP

Key Information

Use of Proceeds:

The total issue size is ~Rs. 1,200 crores, of which ~Rs. 300 crores are fresh issue

and balance (~Rs. 900 crores) is OFS. The company will utilise the net proceeds

from the fresh issue to augment its Tier – 1 capital base to meet future capital

requirements.

Book running lead managers:

Axis Capital Limited, CLSA India Private Limited, ICICI Securities Limited, and

Nomura Financial Advisory and Securities (India) Private Limited

Management:

Rishi Gupta (MD and CEO), Ashish Ahuja (Chief Operations Officer), and Ketan Dhirendra

Merchant (Chief Financial Officer)