Electronics Mart India Limited - IPO Note

Consumer Durables - Electronics

Electronics Mart India Limited - IPO Note

Consumer Durables - Electronics

Stock Info

Shareholding (Pre IPO)

Shareholding (Post IPO)

Key Strengths and Strategies

Procuring Goods at Competitive Prices Is Made Possible by The Scale of Operations

and Long-Standing Relationships with Leading Brands

EMIL has a history of collaboration with reputed electronic brands. It currently

has relationships lasting more than 15 years with a select few brands and is affiliated

with more than 70 electronic brand names. Because of its reputation for dependability

and trustworthiness with these brands, EMIL has been able to develop its domestic

market and broaden its product line.

With these brands, the company forms long-term agreements and strategic partnerships. Long-term contracts make it easier to plan capital expenditures, take advantage of economies of scale thanks to greater purchasing power and a lower cost base, and keep costs competitive to achieve sustainable growth and profitability. Revenues from associations with brand partners have grown consistently across all product categories. Below is the revenue from top five brands:

| Particulars (Rs. in Crores) | FY20 | FY21 | FY22 | Q1FY23 |

|---|---|---|---|---|

| Brand 1 | 739.90 | 740.30 | 882.14 | 310.31 |

| Brand 2 | 554.83 | 543.97 | 667.73 | 234.61 |

| Brand 3 | 246.84 | 246.15 | 355.41 | 107.11 |

| Brand 4 | 227.90 | 242.73 | 321.75 | 82.55 |

| Brand 5 | 168.59 | 190.74 | 272.22 | 68.55 |

| Total | 1,938.06 | 1,963.9 | 2,499.24 | 803.13 |

Source: Company RHP

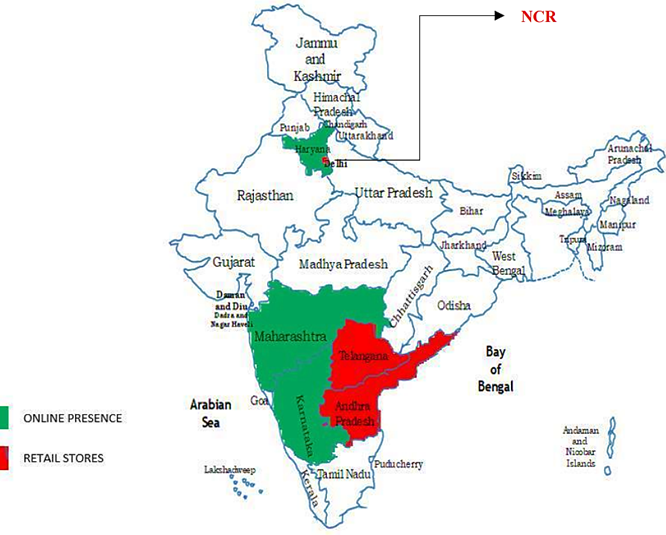

Expanding Reach Across Select Geographies and Deepen Footprint in Existing Ones

The business has grown steadily in the recent years, primarily through store expansion.

As of August, 2022, it operates 112 stores in 36 cities, of which 104 stores are

concentrated in Andhra Pradesh and Telangana and eight stores in NCR.

| Particulars | FY20 | FY21 | FY22 | FY23E | FY24E | FY25E |

|---|---|---|---|---|---|---|

| New Stores Opened | 12 | 22 | 11 | 12 | 25 | 21 |

| Cumulative Stores | 71 | 93 | 103 | 115 | 140 | 161 |

Source: Company RHP

When it first started operating, the company set up shop in Hyderabad. In order to increase its presence in this market, it opened more locations. Over time, it also opened stores in Tier-II and Tier-III cities in Telangana and Andhra Pradesh. In order to gain market share in the Hyderabad, Telangana, and Andhra Pradesh markets, it intends to continue expanding its store network within existing clusters.

Additionally, EMIL plans to use the proceeds from the IPO to open 26 MBOs in the NCR region, expanding its store network.

| Particulars | Amount from Net Proceeds | FY23E | FY24E | FY25E |

|---|---|---|---|---|

| Funding Capex for expansion and opening of stores and warehouses | 111.44 | 23.45 | 46.93 | 41.06 |

Source: Company RHP

It operationalized eight stores in the NCR as of August 2022, and it is currently in various stages of negotiations to enter into agreements to lock up such retail property for future needs.

One of the Fastest Growing Consumer Durable and Electronics Retailer with Consistent

Track Record of Growth and Profitability

EMIL is one of the top four retailers with the fastest growth between FY16 and FY21

is EMIL, followed by Aditya Vision (the only Listed Peer of EMIL), Sathya, and Reliance

Retail. According to the business, it has a proven track record of increasing revenue

and profitability. Despite the Covid-19 pandemic and the fact that some stores were

closed or only partially open during various lockdown phases, revenue increased

at a CAGR of 17.1% from FY20 to FY22. During FY21, EMIL’s revenue per store

was one of the highest in the pure-play consumer durables space.

After Vijay sales, EMIL had the second-highest operating margin among its competitors in FY21. In comparison to peers, Vijay Sales, Reliance Retail, Aditya Vision, and EMIL all recorded higher post-tax profit margins during the year. Reliance, Croma, EMIL, and Aditya Vision are the four players; Croma recorded the highest growth of 53% YoY during FY22, followed by EMIL at 36%.

Increasing Sales Volumes by Maintaining a Focus on Customer Satisfaction Through

Product Selection and Value-Based Pricing

A) Good/Right Mix at Competitive Pricing: The company offers a

wide selection of products at reasonable prices. The business will continue to provide

products at competitive prices thanks to low procurement, supply, operational, and

other costs in order to maintain its competitive position. EMIL will continue to

introduce new products based on customer needs.

B) Leveraging Consumer Finance: The company intends to expand financing options to make products accessible and widen customer base. It has entered arrangements with financing partners, which allow the company to offer low cost/zero EMIs.

Lean Operating Principles and Effective Inventory Management Driven by Technology

to Maintain and Increase Operational Efficiencies

To monitor and minimise shrinkage and pilferage, EMIL plans to strengthen internal

systems and controls pertaining to inventory management. By I) investing in technological

systems to increase productivity and time management thereby increasing operating

efficiency, II) expanding and upgrading the warehouse to improve the efficiency

of inventory and supply management, III) continuing to absorb best industry practises,

and IV) enhancing the current security system, which consists of manual checks and

electronic surveillance. The management is confident that enhancing supply chain

management will enable the business to maximise product availability in stores and,

as a result, effectively meet customer demands.

The company's digital strategy is designed to meet customer expectations as well as internal needs in order to guarantee that investments in analytics and technology enhance the existing business model. The business intends to be set up for an omni-channel business model as well to offer a seamless shopping experience.

Risks

Geographic Concentration: Majority of the stores are concentrated in Andhra Pradesh and Telangana; as of August, 2022, it operates 112 stores in 36 cities, of which 104 stores are concentrated in Andhra Pradesh and Telangana and eight stores in NCR. Any unfavourable events affecting these states' operations could have a negative effect on earnings and finances.

Intense Competition from E-Commerce Players: The business and financial health of EMIL may be impacted by competition from online retailers who are able to offer a wide variety of products at competitive prices.

Does Not Own Trademarks: Currently, EMIL does not own specific trademarks or logos (for example, Bajaj Electronics, Electronics Mart, EMI Electronics Mart India Limited, EMIL, and Electronics Mart India Limited), and if third parties are able to circumvent the protection measures, the business reputation could suffer. The company is currently involved in legal proceedings against Bajaj Electricals Limited, which has filed a suit against the Company, Promoters, and Astha Bajaj (Director), alleging trademark infringement of "Bajaj Electricals."

Dependence on Top Five Brands: ~61% of the company’s revenue (down from ~65% in FY20) is generated from Top 5 Brands. Revenues and profitability will be materially impacted by the loss of any major brand or a reduction in the supply or volume from such brands.

Legal Proceedings: There are outstanding legal proceedings involving the company, amongst which, two are the actions taken by statutory/regulatory authorities amounting to Rs. 84.2 crores, four claims related to direct and indirect taxes of Rs. 12.37 crores. Any of these proceedings' outcomes could have a negative effect on the company.

Working Capital Intensive: Because it operates in the retail industry, the company needs a sizable amount of working capital to sustain its growth. Inventory uses up most of the working capital.

Company Description

Incorporated in 1980, Electronics Mart India Limited (EMIL), is electronics and consumer durables retailer based in India and dominant in the states of Telangana and Andhra Pradesh. As of FY21, it had the second-highest operating margin among its peers, was one of the fastest-growing players, and was the fourth-largest player overall (Source: Company RHP). With a focus on large appliances (such as air conditioners, televisions, washing machines, and refrigerators), mobile devices (such as phones, tablets, wearables, etc.), small appliances, IT, and other products (laptops, printers, coolers, kitchen appliances, etc), it provides a wide range of goods. It has 6,000+ SKUs from 70+ consumer durable and electronic brands are available across various categories. The company operates business activities across three channels: Retail, Wholesale, and E-commerce.

The company uses a hybrid business model that combines ownership and lease rental. Out of the total of 112 stores, 11 are owned as of August 2022, 93 are leased for an extended period, and 8 are partially owned and partially leased. EMIL has consistently increased retail business area from 0.76 million sq. ft in FY20 to 1.12 million sq. ft. as on August, 2022.

Currently, EMIL is associated with 70+ electronic brands and has long-standing relationship of 15+ years with a certain number of brands. Revenue from large appliances contributed 50.4% and 53.8% in FY22 and Q1FY23, respectively, followed by Mobiles, which contributed 34.3% and 30.8% in FY22 and Q1FY23, respectively and, small appliances, IT and others contributed 15.2% and 15.4% in FY22 and Q1FY23, respectively.

|

Parameter |

FY20 | FY21 | FY22 | June 2022 |

|

New Stores Opened: |

||||

|

A) Multi-Brand Outlet |

11 | 19 | 10 | 5 |

|

B) Exclusive-Brand Outlet |

1 | 3 | 1 | - |

|

Cumulative Stores |

71 | 93 | 103* | 108** |

|

Avg. Ticket Size (Rs.) |

19,482 | 20,248 | 21,862 | 23,077 |

|

Same Store Sales Growth % |

-0.7% | -9.8% | 23.37% | NA |

|

Summer Season Sales (Apr-June) (Rs. in Crores) |

811.92 | 440.52 | 861.30 | 1,297.34 |

|

Festive Season Sales (Sep-Nov) (Rs. in crores) |

856.11 | 974.69 | 1,153.36 | NA |

|

Retail Business Area (in million sq. ft.) |

0.76 | 0.94 | 1.04 | 1.09 |

|

Sales per Retail Business Area sq. ft. (in Rs.) |

37,912 | 31,167 | 38,010 | 11,734 |

Source: Company RHP

* While the total number of new stores opened in FY22 was 11, one MBO was shut down, hence the total cumulative number of stores stands at 103.

**From July, 2022 to August, 2022, the Company has opened four MBOs taking the total store count to 112 as on August, 2022.

Valuation

Before making an investment, one should carefully weigh the many advantages and disadvantages of this business. When compared to its listed competitor, Aditya Vision, we think the company's financial situation is decent. Although when comparing financial metrics like revenue, operating margin, PAT margin, return ratios, & debt position etc., the peer has the advantage. However, it should be noted that a portion of the proceeds from the new issue will be used to pay off the company's outstanding debt. After that, we anticipate the net debt at ~Rs. 392 crores. The debt repayment would help the bottom line and margins and improve compared to current levels.

Additionally, we anticipate that sales during the current festive season, which began with Nav Ratri on September 26, 2022, will be higher than in previous years, when they contributed 25% to 30% of total sales. This is due to higher consumption following the Covid-19 pandemic. On the other hand, we can't completely rule out the possibility that customers will switch to online shopping as a result of aggressive discounts from E-commerce players.

The company's strategy to expand into new regions may or may not be successful, so it is important to monitor its progress. We are also concerned about the lack of trademarks (legal action is being taken against Bajaj Electricals Limited on the grounds that "Bajaj Electricals" is being used without permission), dependence on the top five brands, geographic concentration of stores, and expired lease agreements, among other things.

In terms of valuation, using a back-of-the-envelope calculation, we estimate that the company may report earnings per share of ~Rs. 3 on post-issue outstanding shares as of March 2023. The company is asking a valuation of 18.8x of one-year forward earnings, which is lower than +30x that its listed peer is trading on a TTM basis. Investors are advised to subscribe for the issue for short term gains.

Key Information

Use of Proceeds:

The total issue size is Rs. 500 crores, which is entirely a fresh issue. From the

net proceeds, the company is expected to use 1) Rs. 111.44 crores

to fund capital expenditure for expansion and opening of stores and warehouses

2) Rs. 220 crores to fund incremental working capital requirements

3) Rs. 55 crores to repayment/pre-payment, in full or part, of

all or certain borrowings, and 4) General Corporate Purposes.

Book running lead managers:

Anand Rathi Advisors Limited, IIFL Securities Limited, and JM Financial Limited.

Management:

Pavan Kumar Bajaj (Promoter, Chairman, and Managing Director), Karan Bajaj (Chief

Executive Officer and Whole-time Director), Astha Bajaj (Whole-time Director), Premchand

Devarakonda (Chief Financial Officer), Giridhar Rao Chilamkurthi (Vice President

– Sales) and Virinder Singh Sandhu (Vice President, Sales – North).

Financial Statement

Profit & Loss Statement:- (Consolidated)

| Year End March (Rs. in Crores) | 2019 | 2020 | 2021 | 2022 |

|---|---|---|---|---|

| Net Sales | 2823.65 | 3172.48 | 3201.88 | 4349.32 |

| Expenditure | ||||

| Material Cost | 2396.80 | 2702.22 | 2767.33 | 3755.39 |

| Employee Cost | 49.41 | 58.63 | 61.43 | 78.80 |

| Other Expenses | 161.44 | 183.99 | 169.24 | 223.19 |

| EBITDA | 215.99 | 227.64 | 203.88 | 291.94 |

| EBITDA Margin | 7.65% | 7.18% | 6.37% | 6.71% |

| Depreciation & Amortization | 42.31 | 50.76 | 58.14 | 71.32 |

| EBIT | 173.68 | 176.88 | 145.74 | 220.62 |

| EBIT Margin % | 6.15% | 5.58% | 4.55% | 5.07% |

| Other Income | 2.45 | 6.54 | 5.49 | 3.76 |

| Interest & Finance Charges | 52.57 | 63.38 | 71.67 | 84.61 |

| Profit Before Tax - Before Exceptional | 123.56 | 120.04 | 79.56 | 139.76 |

| Profit Before Tax | 123.56 | 112.18 | 79.56 | 139.76 |

| Tax Expense | 46.47 | 30.57 | 20.94 | 35.87 |

| Effective Tax rate | 37.61% | 27.25% | 26.32% | 25.66% |

| Exceptional Items | - | -7.87 | - | - |

| Consolidated Net Profit | 77.10 | 81.61 | 58.62 | 103.89 |

| Net Profit Margin | 2.73% | 2.57% | 1.83% | 2.39% |