Easy Trip Planners Limited - IPO Note

Online Travel Agency

Easy Trip Planners Limited - IPO Note

Online Travel Agency

Stock Info

Shareholding (Pre IPO)

Shareholding (Post IPO)

Key Strengths

One of the Leading Online Travel Agencies (OTAs) in India with a Customer Focused

Approach, Including the Option of No-Convenience Fee

The company ranked second among the key OTAs in India in booking volume terms during

9MFY21 and third in gross booking revenues terms in FY20. Its market share in the

total Indian OTA industry in gross booking revenues terms was 4.6% and 5.5% - 6.5%

in gross booking revenues for airline ticketing segment in FY20. It was recognised

by GoAir and SpiceJet as amongst the top travel partners in revenue and passenger

count terms in FY19. Also, it was Vistara’s ‘Gold Partner 2018-19 in

2019. It has a certificate of accreditation from the International Air Transport

Association, an approval as a travel agent from the Ministry of Tourism, Government

of India and is an allied member of the Indian Association of Tour Operators.

It has been providing an option of no-convenience fee to the customers so that they are not required to pay any service fee in instances where there are no alternate discount or promotion coupon being availed. Also, it has endeavoured to avoid hidden costs in its pricing model. These models are one of the factors that has contributed to developing and strengthening the customer base. Between April 2017 – December 2020, the company had a repeat transaction rate of 85.95% in the B2C channel.

In-House Advanced Technology Infrastructure

The company has dedicated in-house technology team focused on developing a secure,

advanced and scalable technology infrastructure and software which has enabled to

better manage its product and service offerings and improve operating efficiencies

by integrating sales, delivery and customer service functions. The in-house technology

team enables the company to strengthen scalable technology infrastructure, support

customer focused initiatives, introduce innovative services and solutions, and improve

product and service delivery.

The company’s websites and mobile applications are designed to provide customers with low-cost options and flexibility in choosing routes. In FY19, its Look-to-Book ratio of 5.08% on websites and mobile applications in the B2C channel which increased to 5.32% in FY20. During FY20 and 9MFY21, it recorded a Booking Success Rate of 98.37% and 98.01%, respectively on its websites and mobile applications in the B2C channel for domestic transactions. The company’s booking engine infrastructure is designed to link suppliers’ systems either through Global Distribution System (GDS), direct connections, as well as Application Programming Interface (API) and is capable of simultaneously delivering real-time availability and pricing information for multiple options. Its web hosting facilities are equipped with back-up capabilities and perform real-time mirror back-up and additional back-up facilities for offsite storage on a daily basis. It has also developed a cloud-based scalable technology that can be upgraded to allow for an increase in customer traffic, transactions and bookings.

Wide Distribution Network Supported by a Hybrid Platform

The company’s distinct distribution channels – B2C, B2E and B2B2C –

provides a diversified customer base and wide distribution network. These channels

enable it to provide end-to-end travel solutions for passengers traveling domestically,

as well as traveling to and from international destinations. Further, its presence

in three distinct distribution channels enable us to cross-sell products and services

between such distribution channels.

The B2C channel of the company focuses on the growing Indian middle-class population and their increasing travel requirements, and provides them with travel products and services through its websites and mobile applications. The B2E channel of the company aims at providing end-to-end travel solutions to corporates and have developed a customizable portal on its website for corporate customers that provides exclusive benefits and discounts as well as customer support services and online modes to handle inquiries and provide onsite support. As of March 2020, the company has 11,644 corporate customers which grew to 12,505 as of December, 2020. The B2B2C channel of the company is focused on catering to the travel requirements of customers specifically from Tier II and Tier III cities. The company addresses the travel requirements of such customers by providing access to its registered travel agents to a customizable portal on website. As of December, 2020, the company had 59,274 registered travel agents across almost all major cities in India.

| Particulars | Gross Booking Volumes – Airline Tickets | ||||

|---|---|---|---|---|---|

| FY18 | FY19 | FY20 | 9MFY21 | ||

| Unconsolidated | Consolidated | ||||

| B2C | Websites | 1.42 | 2.02 | 2.49 | 0.81 |

| Mobile Applications | 0.43 | 1.06 | 1.95 | 0.71 | |

| B2B2C | 1.58 | 0.46 | 0.55 | 0.09 | |

| B2E | 0.02 | 0.04 | 0.14 | 0.02 | |

| Total | 3.45 | 3.58 | 5.13 | 1.63 | |

Source: Company RHP

Well-recognized Brand with a Targeted Marketing Strategy

The company has a well-recognised brand, EaseMyTrip. In FY20, it had the

lowest marketing and sales promotion expense as a percentage of gross booking revenues

among the key OTAs in India. Over the years, the strength of its brand has increased.

Website visits have increased at a CAGR of 51.2% from 22.58 million in FY18 to 51.59

million in FY20. Further, it recorded 28.16 million visits during 9MFY21. Downloads

of its mobile app increased at a CAGR of 64.13% from 1.57 million in FY18 to 4.24

million in FY20 and further increased to 5.47 million during 9MFY21. The direct

traffic percentage on its websites and mobile traffic percentage on mobile applications

were 42.56% and 80.67%, respectively, in FY20, while during 9MFY21, they were 64.93%

and 87.15%, respectively.

Since inception, the company has invested in developing and promoting its brand by using a combination of online, offline, cross-marketing, social media and other marketing initiatives. Its customer acquisition cost in the B2C channel was Rs. 173.85 in FY20, which further reduced to and Rs. 138.13 during 9MFY21. Its marketing programs and initiatives also include promotional, seasonal, festival and event related offers including certain women centric marketing campaigns. As part of its cross-marketing efforts, it has entered into arrangements with various banks and payment gateways to offer promotions and discounts on the purchase of tickets on the company’s websites and mobile apps in addition to providing cash-back options.

Focus on Expanding Hotel and Holiday Packages and Railway Ticketing Operations

As of December, 2020, the company has partnered with 23 APIs for hotels, which has

increased its hotel suppliers’ network and provided access to more international

hotels on a real time basis. The company aims to undertake certain digital marketing

tools such as metasearch engine marketing for hotels. Also, it endeavours to expand

the presence in hotels and holiday packages outside India through partnerships and

arrangements as well as by strengthening relationships with international hotel

suppliers. The UK has been one of the top countries for foreign tourists’

arrivals in India during 2014 - 2019 and in order to capitalize on this opportunity,

the company has incorporated a subsidiary in the UK. Additionally, it has acquired

Singapore Arrivals Pte Limited in Singapore and Easemytrip Middle east DMCC in UAE

which provides the company with a local presence enabling it to contract with the

local travel suppliers at competitive rates as well as better support to the customers

during an international holiday.

The company has entered into two agreements with the IRCTC for the sale of train tickets one commencing from December 2018 and valid for a period of three years whereas the other, commencing from January 2020, and valid for a period of three year. The company has been granted a direct connection access to the Indian Railways’ passenger reservation system online and accordingly, customers are allowed to reserve and purchase Indian Railways tickets on a real-time basis. Its Gross Booking Volumes for rail tickets were 25,357, 189,169 and 94,323 in FY19, FY20 and 9MFY21, respectively.

Industry

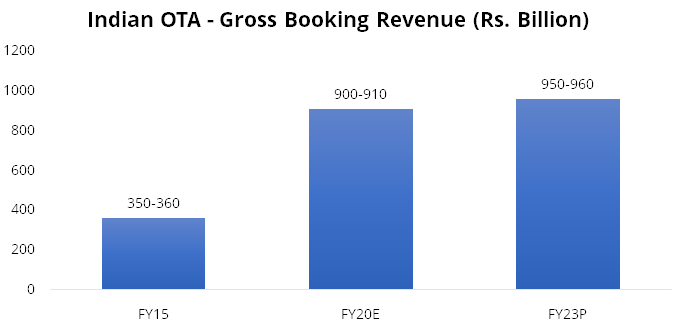

Online Travel Agencies (OTAs) are defined as companies that specialize in sale of travel-related products and services, such as, booking of air tickets, hotel rooms, travel packages, bus tickets and railway tickets through their websites and applications. Based on gross booking revenues, the market has increased at a CAGR of 20% - 22% from Rs. 350 billion – Rs. 360 billion as of March 2015 to Rs. 900 billion – Rs. 910 billion as of March 2020, driven by rapid growth in affordable access to internet penetration, growing awareness and comfort with online transactions, competitive prices offered by OTA players to attract consumers, and growing network of service providers on OTA platforms. These factors are likely to continue driving growth of Indian OTA market in the medium term, with the OTA industry expected to grow at a CAGR of 1% - 2% to reach ~Rs. 950 billion – Rs. 960 billion in FY23.

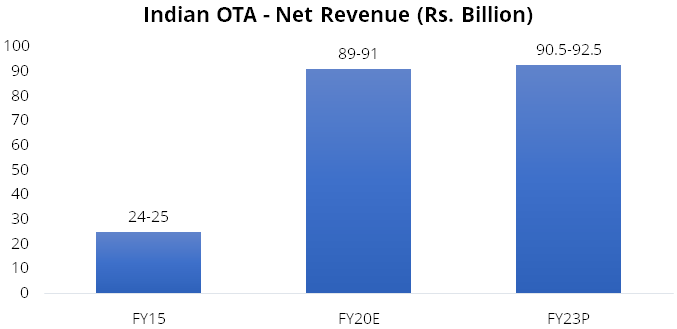

In terms of net revenue, Indian OTA industry expected to increase at a CAGR of 0% to 2% from FY20 to FY23. The industry has increased at a CAGR of 28% - 30% from Rs. 24 billion – Rs. 25 billion in FY14 to ~Rs. 89 billion – Rs. 91 billion in FY19. Going forward, the industry is expected to increase traction as online bookings across segments will increase due to factors like technological improvements, evolution of travellers and increasing security in case of online payment options. The industry is expected to increase at a CAGR of 0% - 2% to reach Rs. 90.5 billion – Rs. 92.5 billion in FY23. The slower growth is on account of slow revival in international passenger traffic, revival to pre-Covid-19 levels of domestic passenger traffic in Fiscal 2023 only and decrease in the market size of the hotel industry on account of decline in average room rents.

Segment-wise bookings made through OTAs

In value terms, air ticketing segment accounts for 51% - 53% of the Indian OTA industry

in FY20, according to industry estimates at net revenue terms. Indian customers

began to adopt and accept the online booking process, online booking of airline

tickets became more popular and accounted for 68% - 70% of the total airline ticketing

segment. Though there has been an increase in the booking volumes for OTAs, the

share of air ticketing in their revenue has been declining on account of lower margins

in this segment. As a result, OTAs are now shifting focus to other higher-margin

segments.

According to industry estimates Hotel bookings accounted for 37% - 38% of India’s OTAs revenues in FY20. In the online segment, OTAs have managed to increase their share over captive websites of hotel chains. Similar to airline ticketing segment, easy comparison of multiple options and highly competitive pricing has helped OTAs increase market share over captive websites. Further, compared with airline ticketing, margins in hotel bookings are higher, accordingly, making it a profitable segment for OTAs to focus on.

In online booking of railway tickets, the IRCTC remains the preferred player for travellers. Although some OTAs have started offering railway tickets, the ticket bookings are routed through the IRCTC platform. Further, railway tickets account for a marginal share in OTA revenue. In addition, in relation to online booking of bus tickets, the state transport buses lead the inter-state travel and tickets for such buses are typically booked through TTAs or at their respective offices. Given the availability of such tickets in the offline channels, online channels that offer the tickets are relatively few although players, such as, the Gujarat State Road Transport Corporation, the Maharashtra State Road Transport Corporation and Karnataka State Road Transport Corporation, provide online booking facility on their captive websites. Further, there are several cities or region-specific private players, which traditionally have a significant market share. In addition, OTA also provide tickets from such players on their platforms.

The OTA industry in India primarily caters to three different categories of customers: (i) retail customers under the B2C category; (ii) corporate clients under the B2E category; and (iii) other smaller travel agents under the B2B2C category. According to industry estimates, the B2C segment accounted for 55% - 65%, B2E accounted for 20% - 30% and B2B2C accounted for 10% - 20% of the overall OTA revenue in FY19.

Peer comparison

| Particulars | Easy Trip Planners Limited | MakeMyTrip Limited | Yatra Online, Inc |

|---|---|---|---|

| Gross Booking Revenues (Rs. billion) | 42.00 | 452.00 | 85.00 |

| Gross Booking FY20 vs FY 19 (YoY) | 43.00% | 18.00% | -23.00% |

| Gross Booking CAGR FY18-FY20 | 47.00% | 27.00% | -4.00% |

| Opearting Revenue FY20 (Rs. billion) | 1.40 | 38.00 | 7.00 |

| Opearting Revenue FY20 vs FY19 (YoY) | 40.00% | 11.00% | -23.00% |

| Gross Booking Revenue Per Employee (Rs. Mn) | 87.60 | 114.03 | 42.65 |

| Employee Count | 480.00 | 3960.00 | 2000.00 |

| Marketing and Sales Promotion Expenses FY20 (Rs. Bn) | 0.35 | 12.35 | 0.82 |

| MSP expenses as a % of Gross Booking Revenue FY20 | 0.83% | 2.73% | 0.96% |

| Customer Promotion Expenses FY20 (Rs. Bn) | 1.20 | 26.80 | 1.50 |

| Customer Promotion Expenses as % of Gross Booking Revenue | 3.00% | 5.93% | 1.74% |

| Operating Profit as a % of Gross Booking Revenue | 0.20% | -1.15% | -0.23% |

| Net Profit Margin % (FY20) | 24.60% | -87.00% | -11.00% |

| Booking Volume (9MFY21) (In Mn) | 2.70 | 8.50 | 1.52 |

| Network of Agents | 55981.00 | ~26,000 | ~26,000 |

| Repeate Transaction Rate (%) | 85.70% | NA | 88.00% |

| RoE FY20 (%) | 39.50% | -208.73% | 0.00% |

| RoCE FY20 (%) | 58.50% | -197.58% | -58.38% |

| App Rating on Google Play (Feb 2021) | 4.70 | 4.10 | 4.20 |

| Ratings and Reviews | 62780.00 | 9323164.00 | 298870.00 |

Source: Company RHP

Risks

- The company’s airline ticketing business generates a significant percentage of its revenues and is derived from a small number of airline suppliers in India. The dependence on limited number of airlines implies that a reduction or elimination in base commissions and incentive payments by one or more of these airlines could have an adverse impact on the company’s revenues. Also, due to higher bargaining power of the airlines, the company is subject to various obligations and restrictive covenants in the agreements.

- The company operates in the intensely competitive travel industry where it has to compete against various established and emerging competitors, including other online travel agencies, traditional offline travel companies, travel research companies, payment wallets, search engines and meta-search companies. Also, some of its competitors could have greater financial resources, more experienced management, longer history with well-reputed names/brands, etc. The inability of the company to compete with existing and new entrants, effectively could adversely impact its business.

- In air ticketing segment, the company primarily generates revenue via commissions and incentive payments, including performance-linked bonus, from Global Distribution System (GDS) service providers, credit card companies as well as certain airlines. These travel suppliers may reduce/eliminate the commission, incentive and other compensation for the sale of airline tickets, which could adversely impact the business operating performance of the company.

- Any disruption to the supply of air, train and bus tickets, and reduced demand for hotel accommodation or an increase in the prices of travel elements could adversely affect the operations of the company.

Company Description

Easy Trip Planners Limited offers a comprehensive range of travel-related products and services for end-to-end travel solutions, including airline tickets, hotels and holiday packages, rail tickets, bus tickets and taxis as well as ancillary value-added services such as travel insurance, visa processing and tickets for activities and attractions. It provided access to more than 400 international and domestic airlines, more than 10,96,400 hotels in India and international jurisdictions, almost all the railway stations in India as well as bus tickets and taxi rentals for major cities in India.

The company started its operations in 2008 by focusing on B2B2C distribution channel by providing travel agents, an access to its website for booking domestic air tickets in order to cater offline market. As of December 2020, the company had 59,274 travel agents registered across almost all major cities in India. Further, in 2011, it commenced operations in the B2C distribution channel by primarily focusing on the growing Indian middle class population’s travel requirements. Consequently, in 2013 it commenced operations in the distribution channel with an aim to provide end-to-end travel solutions to corporates. The company ranked second among the key online travel agencies in India in booking volume terms during 9MFY21 and third among the key online travel agencies in India in gross booking revenues terms in FY20.

Valuation

Easy Trip Planners Limited is one of the leading Online Travel Agencies (OTA) in India and is the only profitable player amongst key Indian OTAs in terms of net profit margins. Also, among the key OTAs in India, it is ranked second in booking volume terms during 9MFY21 and third in gross revenue terms in FY20. As the company is the part of travel industry, its business has been impacted by the covid-19 pandemic during 9MFY21 and it is expected that as the situation to improve gradually, the performance of the company to improve as well. The company is focusing on expanding its high-margin hotels & holidays packages, which could increase the performance of the company as we come out of the pandemic gradually. Further, the company’s focus on developing and promoting its brand could result in more traffic on its websites and more downloads of its applications, which could in turn, increase its customer base. On the upper price band of Rs. 187, the issue is valued at 49x of annualised EPS of FY21. We recommend to Subscribe the issue.

Key Information

- Use of Proceeds:

The entire issue is Offer for Sale. The company will not receive any proceeds from the Offer. - Book running lead managers:

Axis Capital Limited and JM Financial Limited - Management:

Nishant Pitti (Whole-time Director and CEO), Rikant Pittie (Whole-time Director) and Prashant Pitti (Whole-time Director)

Financial Statement

Profit & Loss Statement:- (Consolidated)

| Particulars (Rs. in Crores) | 2018 | 2019 | 2020 | 9M FY21 |

|---|---|---|---|---|

| Net Revenue from Operations | 100.11 | 101.11 | 140.99 | 49.25 |

| COGS | - | - | - | - |

| Gross Profit | 100.11 | 101.11 | 140.99 | 49.25 |

| Employee Benefits Expense | 15.92 | 22.02 | 29.95 | 14.73 |

| Other Expenses | 85.38 | 84.28 | 98.41 | 23.20 |

| EBITDA | -1.18 | -5.20 | 12.62 | 11.33 |

| Depreciation and Amortisation Expense | 0.24 | 0.46 | 0.71 | 0.49 |

| EBIT | -1.43 | -5.66 | 11.91 | 10.84 |

| Finance Cost | 1.51 | 3.17 | 3.10 | 1.32 |

| Other Income | 13.47 | 50.00 | 38.74 | 32.32 |

| Profit Before Tax from Continuing Operations Items and Tax | 10.53 | 41.18 | 47.55 | 41.84 |

| Tax Expenses | 3.91 | 11.84 | 12.87 | 10.73 |

| Profit from Continuing Operations | 6.61 | 29.34 | 34.69 | 31.11 |

| Profit/(Loss) from Discontinued Operations | -6.58 | -5.35 | - | - |

| Profit for the Year | 0.03 | 23.99 | 34.69 | 31.11 |

| EPS | - | 2.21 | 3.19 | 2.86 |