Dr. Agarwal’s Health Care Ltd - IPO Note

Hospital & Healthcare Services

Dr. Agarwal’s Health Care Ltd - IPO Note

Hospital & Healthcare Services

Stock Info

Shareholding (Pre IPO)

Shareholding (Post IPO)

Company Description

Dr. Agarwal’s Health Care (DAHL) provides a comprehensive range of eye care services, including cataract, refractive, and other surgeries; consultations, diagnoses, and non-surgical treatments; and sells opticals, contact lenses and accessories, and eye care related pharmaceutical products. As per CRISIL & MIA report, the company had a market share of ~ 25% of the total eye care service chain market in India during the FY 2024.

As of September 30, 2024, the company had a network of 209 Facilities, through which it endeavors to address all the needs of the patients in their eye treatment journey. Among the compared listed and unlisted peers, Dr. Agarwal’s Health Care had the highest number of eye care service facilities in India, as of September 30, 2024, 737 doctors served the patients across the company’s Facilities as of September 30, 2024, and during the FY 2024, the company served 2.13 million patients and performed 220,523 surgeries. For 6 months ended September 2024, the company served 1.15 million patients and performed 140,787 surgeries.

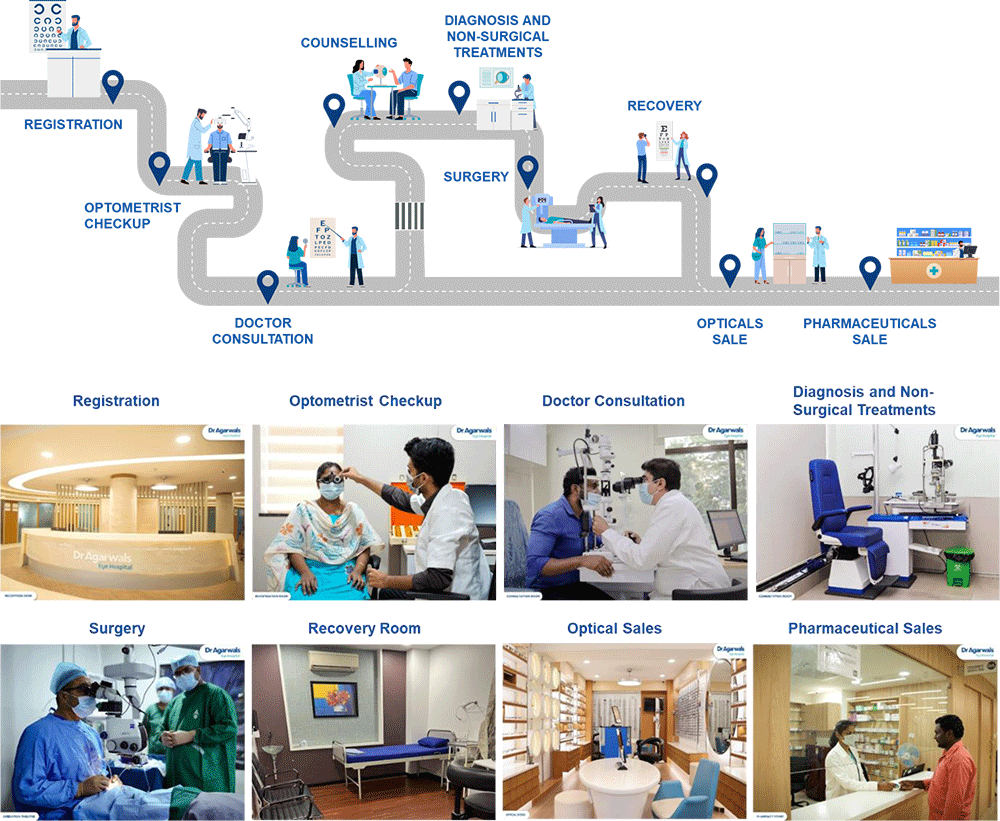

The company’s offerings cover Services, which comprise the following

- Surgeries

- Cataract surgeries: The Company offers cataract surgical treatments at its Facilities, such as small incision cataract surgery, phacoemulsification, robotic cataract surgery, and glued intraocular lens treatments.

- Refractive surgeries: The refractive surgeries include surgical procedures to correct the refractive error of the eye to get rid of or reduce dependence on glasses and contact lenses. Primary refractive treatments include laser-assisted in-situ keratomileusis (“LASIK”) surgeries, small incision lenticule extraction (“SMILE”) treatments, implantable collamer lens treatment and photo-refractive keratectomy.

- Other surgeries: The Company also offers a range of other surgical treatments for eye ailments, such as surgical retinal treatments, corneal transplantation and pinhole pupilloplasty, oculoplasty and surgeries for the treatment of glaucoma and pterygium.

- Consultations, diagnoses, and non-surgical treatments

The company also offers doctor consultation services, diagnostic services for eye disorders along with non-surgical treatments, including retinal laser therapy and dry eye treatment. - The company’s product offerings cover the following:

- Sale of opticals, contact lenses, and accessories: The company offers a wide range of glasses, lenses, contact lenses, and frames at its Facilities.

- Sale of eye care-related pharmaceutical products: The Company sells certain eye care-related pharmaceutical products at its Facilities, as prescribed by the doctors.

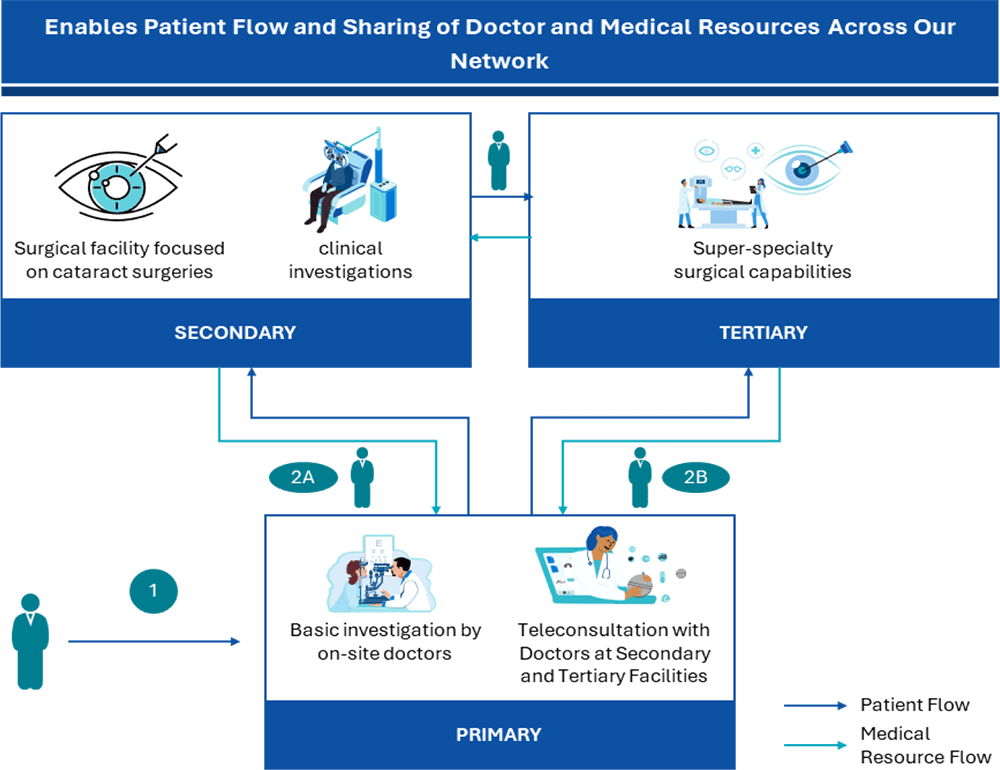

The company categorizes its Facilities as Primary Facilities (which are non-surgical eye care facilities); Secondary Facilities (which are surgical Facilities); and Tertiary Facilities (which are super-specialty surgical Facilities and include three centers of excellence (“COEs”)), depending upon the nature of services provided.

The company’s business operations are structured as a “hub and spoke” model, which enables it to build a scalable and accessible platform for the continued growth of its business. As of September 30, 2024, the company’s network in India includes 28 “hubs” (which are Tertiary Facilities, including three COEs) and 165 “spokes” (comprising 53 Primary Facilities and 112 Secondary Facilities).

Primary Facilities: The Company’s Primary Facilities, which are non-surgical eye care facilities, act as the closest patient touch points and facilitate patient acquisition for the company. These clinics have basic investigative equipment with ophthalmologists and trained professionals present and also offer tele-consultation with the company’s ophthalmologists in its other spoke and hub Facilities. They are usually located on the periphery of metro and non-metro cities. Many of the company’s Primary Facilities also have embedded pharmacies and optical product counters.

Secondary Facilities: The Company’s Secondary Facilities, which are surgical facilities, provide select services including cataract surgeries and clinical investigations, in addition to also offering the services available at the Primary Facilities.

Tertiary Facilities: The Company’s Tertiary Facilities, which are super-specialty surgical facilities, have comprehensive surgical capabilities including surgeries such as retinal, corneal, and refractive surgeries. The company has 3 COEs across Chennai (Tamil Nadu), Tirunelveli (Tamil Nadu), and Cuttack (Odisha). These COEs offer all services provided at the company’s Tertiary Facilities. Further, the COEs provide, among others, postgraduate and fellowship programs in ophthalmology, training for its doctors, optometrists, and counsellors, and avenues for clinical research. They operationalize the protocols for centralized quality control and assurance services across the company’s network.

Competitive Strengths

Largest eye care services provider in India with a trusted brand

Dr. Agarwal’s Health Care is India’s largest eye care service chain

by revenue from operations for the FY 2024, with ~ 1.7 times the revenue from operations

of the second- largest eye care service chain in the country during such period.

The company had a market share of approximately 25% of the total eye care service

chain market in India during the FY 2024 and had the highest number of eye care

service facilities in India, as of September 30, 2024. As of September 30, 2024,

the company had 193 Facilities in India spanning 14 states and 4 union territories,

and 16 Facilities spread across 9 countries in Africa. The company has a diversified

presence across Tier-I cities (70 Facilities) and other cities (123 Facilities)

in India.

With a long-standing operational history, Dr Agarwal’s Eye Hospital is a trusted brand in the eye care services industry, as demonstrated by awards received for its brand. The company has been consistently recognized for delivering quality eye care services including the “Best Employer 2024 – 2025 – Tamil Nadu” at the 19th Employer Branding Awards “Digital Initiative for Patient Education” award at the Smart Hospitals and Diagnostic Summit and Awards, 2024, “Best Use of TV in Healthcare – Gold” and “Best Use of Print in Healthcare – Silver” awards at the annual e4m Indian Marketing Awards, 2024 – South, “Most Trusted Eye Hospital Brand in India” award at the Trust Research Advisory Awards, 2023, “One of the Best Healthcare Brands of 2023” by the Economic Times, the “Centre of Excellence in Ophthalmology in India” award at the Healthcare and Wellness Awards 2023, and “Best Eye Hospital” at Vikatan Pulse Health Care Awards, 2022.

End-to-end, comprehensive eyecare services offering

The company is an end-to-end eye care services provider offering a comprehensive

set of services, which allows it to cater to all ophthalmic needs of its patients.

The company provides a comprehensive range of eye care services and products, covering

cataract surgeries, refractive treatments, and other surgeries; and other services,

such as consultations, clinical investigations, and nonsurgical treatments; along

with optical and eye care-related pharmaceutical products.

The company offers surgeries for multiple eye ailments, including cataract, corneal, retinal, and refractive, and other surgeries. The company also offers other treatments, including glaucoma treatments, squint treatments, and oculoplasty surgeries, among others. Some of the key surgical capabilities include intraocular lens procedures, cornea transplantation, pinhole pupilloplasty, single-pass four-throw pupilloplasty, and LASIK surgeries.

Several of the company’s Facilities also have embedded pharmacies and optical product counters, which facilitate cross-selling of optical and eye care-related pharmaceutical products to patients. The pharmacy business comprises sales of ophthalmic and nutraceutical products prescribed by doctors while the optical product counters offer a wide range of glasses, lenses, contact lenses, and frames.

Scalable, asset-light, hub-and-spoke operating model

The company’s network operates on a “hub-and-spoke” model which

supports high patient volumes and yields economies of scale, allowing greater accessibility

and choice to patients while driving efficiency of crucial doctor resources across

the network. The company has leased all (except one) facilities which allows it

to scale operations with minimal upfront investment. Through this hub and spoke

and asset light approach, the company was able to grow to 193 Facilities in India

as of September 30, 2024, from 91 Facilities as of March 31, 2022.

As of September 30, 2024, the company’s network in India includes 28 “hubs” (which are Tertiary Facilities, including 3 Centres of excellence) and 165 “spokes” (comprising 53 Primary Facilities and 112 Secondary Facilities).

In the company’s “hub and spoke” model, patients can walk-in to a “spoke” (i.e., the Primary Facilities and Secondary Facilities) nearest to them and can eventually be referred to a Secondary Facility or a Tertiary Facility (i.e., a “hub”), as required. This model facilitates greater sharing of crucial doctor resources and helps the company to build a scalable platform for the continued growth of the company’s business. Further, as a result of the “asset-light” approach, the upfront capital expenditure requirement for the company’s new Facilities is limited and primarily attributable to the cost of installing medical equipment and ancillary infrastructure.

Proven clinical excellence driven by a strong clinical board and history of

surgical innovations

The company has a clinical board to ensure standardization of clinical protocols,

products, and processes across its network. The company’s clinical board is

overseen by its international advisory team and internal specialty expert team,

which provide strategic direction and oversight acrossits operations. The company’s

3 COEs in Chennai, Tirunelveli and Cuttack operationalize the protocols for centralised

quality control and assurance services across its network; perform clinical research,

and also offer post-graduate and fellowship programs specializing in ophthalmology.

Further, the company’s doctors have developed and published research on surgical techniques including Glued IOL Technique, Scaffold IOL Extrusion Cannula Assisted Levitation (“ECAL”), Pre-Descemets Endothelial Keratoplasty (“PDEK”), Contact Lens Assisted Cross-Linking (“CACXL”), and Corneal Allogenic Intrastromal Ring Segments (“CAIRS”), among others. As of September 30, 2024, the company’s doctors hold 2 patents for their innovations. The company believes this gives it a distinct advantage over its competitors in delivering a diverse range of high-quality services to its patients.

The company is also committed to its clinical research in collaboration with its sponsors, such as pharmaceutical manufacturers, and has completed 28 clinical trials during the6 months ended September 30, 2024, and FY 2024, 2023 and 2022, with 17 trials presently ongoing. In addition, the company’s doctors have published 58 publications in international medical journals during the 6 months ended September 30, 2024, and the past three Financial Years.

Further, the company’s Facilities have received national and international accreditations, such as from the National Accreditation Board for Hospitals and Healthcare Providers (the “NABH”). As of December 2024, the company had the highest number of NABH-accredited eye care facilities (excluding accreditations under renewal) with 29 accredited eye care facilities.

Peer Comparison

| Name of the company | Revenue (Rs. in cr) | EBITDA Margin (%) | ROE (%) | ROCE (%) |

|---|---|---|---|---|

| Dr.Agarwal's Healthcare Ltd | 1332.00 | 29.54% | 9.33% | 14.61% |

| Apollo Hospitals Ltd | 19059.00 | 13.03% | 13.50% | 15.73% |

| Max Healthcare Institute Ltd | 6849.00 | 27.84% | 13.37% | 34.55% |

| Fortis Healthcare Ltd | 6893.00 | 18.84% | 7.75% | 18.88% |

| Global Health Ltd | 3275.00 | 26.08% | 17.93% | 18.94% |

| Narayana Hrudayalaya Ltd | 5018.00 | 24.10% | 31.47% | 23.13% |

| Krishna Institute of Medical Sciences | 2498.00 | 26.02% | 16.67% | 16.48% |

| Aster DM Healthcare Ltd | 3699.00 | 16.19% | 4.28% | 6.26% |

| Rainbow Children's Medicare Ltd | 1297.00 | 34.93% | 18.74% | 17.52% |

Key Risks & Concerns

Operates in a regulated industry: The Company operates in a regulated industry, and failure to comply with applicable safety, health, environmental, labor and other regulations, or to obtain or renew approvals, may adversely affect their business, reputation, financial condition, results of operations and cash flows.

Failure to keep pace with technological changes: The eyecare services industry is characterized by technological changes from time to time, new equipment and service introductions, changes in patients’ needs, and evolving industry standards. If they are unable to keep pace with technological changes, new equipment and service introductions, changes in patients’ needs and evolving industry standards, their business and financial condition may be adversely affected.

Contingent liabilities: The Company has certain contingent liabilities worth Rs.29 cr, which if materialized, could adversely affect company’s financial performance.

Operates in a competitive industry: The eyecare industry is highly competitive in India. It faces competition from a large number of public hospitals, private hospitals, and eye clinics located in the same geographic areas in which it operates.

Outlook and Valuation

Dr. Agarwal’s Health Care is India’s largest eye care service chain by revenue from operations for the FY 2024, with ~ 1.7 times the revenue from operations of the second-largest eye care service chain in the country during such a period. Dr. Agarwal’s Health Care (DAHL) provides a comprehensive range of eye care services, including cataract, refractive, and other surgeries; consultations, diagnoses, and non-surgical treatments; and sells opticals, contact lenses and accessories, and eye care-related pharmaceutical products. The company had a market share of approximately 25% of the total eye care service chain market in India during the FY 2024 and had the highest number of eye care service facilities in India, as of September 30, 2024.

The Indian eye care industry is projected to grow at a CAGR of 12% to 14% from the Financial Year 2024 to the Financial Year 2028. The size of the Indian eye care services industry was approximately Rs.378 billion in Financial Year 2024 and is projected to grow to Rs.550 – 650 billion by the Financial Year 2028. Further, according to the International Agency for Prevention of Blindness, India had the highest number of citizens with vision loss in the world as of 2020, with 275 million individuals with vision loss. The share of eye care service chains in India is about 13% to 15% of the total eye market in the Financial Year 2024 and was estimated to be 12% to 14% in the Financial Year 2023, signifying the headroom for growth for the organized eye care service chain market in India.

We believe that the Dr Agarwal’s Healthcare is well positioned to deliver steady growth considering the company’s network operates on a “hub-and-spoke” model which supports high patient volumes and yields economies of scale, end-to-end comprehensive eyecare services offering, Proven clinical excellence driven by a strong clinical board and history of surgical innovations, Proven track record of delivering organic growth, integrating and scaling acquisitions and improving operating profitability, superior return ratios. On the valuation front, the issue is priced/valued at 33x EV/EBITDA based on FY24 earnings at the upper end of the price band. Therefore, aggressive investors may SUBSCRIBE to the issue for the long term.

Key Information

Use of Proceeds:

The total issue size is Rs.3027.26 cr, which comprises of a free issue of Rs.300

cr and an Offer for Sale worth Rs.2727.26 cr. From the net proceeds of the issue,

the company will utilize Rs.195 cr towards Repayment/prepayment, in full or in part,

of certain outstanding borrowings availed by the Company for general corporate purposes

and unidentified inorganic acquisition (Rs.105 cr).

Book running lead managers:

Kotak Mahindra Capital Company Limited, Morgan Stanley India Company Private Limited,

Jefferies India Private Limited, and Motilal Oswal Investment Advisors Limited.

Management:

Dr. Amar Agarwal (Chairperson and Non-Executive Director), Dr. Adil Agarwal (Whole-time

Director and Chief Executive Officer), Dr. Anosh Agarwal (Whole-time Director and

Chief Operating Officer), Sanjay Dharambir Anand (Non-Executive Independent Director),

Venkatraman Balakrishnan (Non-Executive Independent Director), Dr Ranjan Ramdas

Pai (Non-Executive Independent Director), Archana Bhaskar (Non-Executive Independent

Director), Nachiket Madhusudan Mor (Non-Executive Independent Director), Ankur Nand

Thadani (Non-Executive Nominee Director), Ved Prakash Kalanoria (Non-Executive Nominee

Director), Yashwanth Venkat (Chief Financial Officer).

Financial Statement

Profit & Loss Statement:- (Consolidated)

| Particulars (Rs. in cr) | H1FY25 | FY24 | FY23 | FY22 |

|---|---|---|---|---|

| Revenue from operations | 820.00 | 1332.00 | 1018.00 | 696.00 |

| COGS | 82.00 | 137.00 | 113.00 | 83.00 |

| Gross Profit | 738.00 | 1195.00 | 905.00 | 613.00 |

| Gross Margin (%) | 90.00% | 89.71% | 88.90% | 88.07% |

| Employee benefit expenses | 156.00 | 243.00 | 190.00 | 140.00 |

| Other expenses | 371.00 | 590.00 | 444.00 | 290.00 |

| EBITDA | 211.00 | 362.00 | 271.00 | 183.00 |

| EBITDA Margin (%) | 25.73% | 27.18% | 26.62% | 26.29% |

| Depreciation expenses | 113.00 | 170.00 | 128.00 | 98.00 |

| EBIT | 98.00 | 192.00 | 143.00 | 85.00 |

| Finance costs | 55.00 | 96.00 | 72.00 | 45.00 |

| Other Income | 18.00 | 44.00 | 13.00 | 18.00 |

| PBT | 60.00 | 140.00 | 84.00 | 57.00 |

| Tax expenses | 21.00 | 45.00 | -20.00 | 14.00 |

| PAT | 39.00 | 95.00 | 103.00 | 43.00 |

| EPS (Rs.) | 1.00 | 3.14 | 4.01 | 1.83 |