Doms Industries - IPO Note

Printing & Stationery

Doms Industries - IPO Note

Printing & Stationery

Stock Info

Shareholding (Pre IPO)

Shareholding (Post IPO)

Company Description

DOMS Industries Limited was incorporated on October 24th, 2006. It designs, develops, manufactures, and sells a wide range of stationery and art products mainly under its flagship brand DOMS. DOMS Industries Limited is the second largest player in India’s branded stationery and arts products market, with a market share of 12% by value, as of Fiscal 2023. It is one of the fastest-growing stationery and art material products companies in India in terms of revenue over the period from Fiscal 2020 to Fiscal 2023.

The company's focus is on backward integrated manufacturing, and operations along with emphasizing on multi-channel pan-India distribution network which has enabled them to create a brand image among customers. Scholastic stationery and scholastic stationery art material are the biggest contributors to its revenue. Scholastic stationery contributes 46.18% whereas Scholastic stationery art material contributes 23.77% to the revenue.

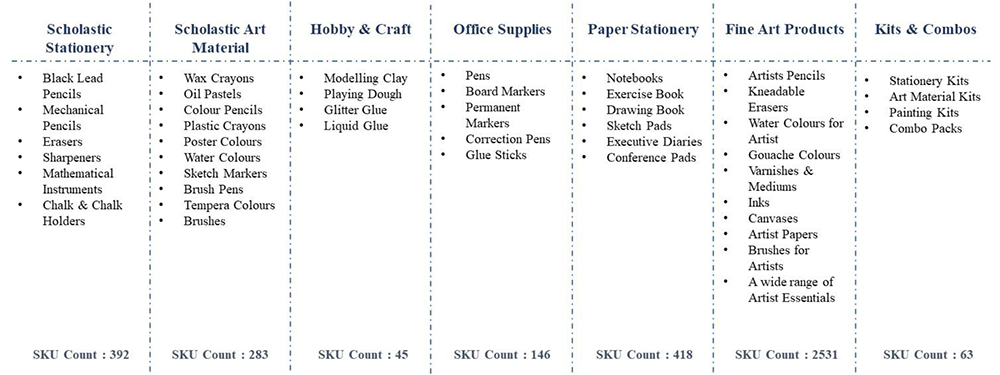

DOMS offers finely crafted ‘Stationery and art material’ which are classified into 7 following categories:

- Scholastic Stationery

- Scholastic art material

- Paper Stationery

- Kits and combos

- Office supplies

- Hobby and craft

- Fine art products

Their domestic distribution network for general trade comprises over 120 super-stockists and over 4000 distributors. It has 1,20,000 retail touchpoints in over 3500 cities and towns. The company operates 13 manufacturing facilities across Umbergaon, Gujrat which is spread over 34 acres of land. It also has one manufacturing facility which is spread across 2 acres of land in Jammu & Kashmir.

Their partnership with FILA has enabled the company to gain a strong foothold in international markets such as America and Europe and to augment R&D and technological capabilities.

The company’s products are marketed under its own flagship brand ‘DOMS’ along with other brands which include ‘CR’, ‘Amariz’ and ‘Fixyfix’. Wooden pencil is the largest contributor to its revenue. It contributes 31.66% to the revenue.

This is the company’s flagship brand. Products are known for their premium quality and product design. Doms sells all products in the scholastic stationery, scholastic art material, paper stationery, hobby and craft, office supplies, and kits and combos under this brand.

C3 was launched in 2012, to capture the affordable market segment. The key product in this category is polymer pencils, which when compared to wooden pencils are slightly cheaper. It also has products like sharpeners, colour pencils, erasers, chalks, mathematical instruments etc.

AMARIZ - ‘Amariz’ was launched in the year 2022, as a sub-brand under its flagship brand ‘DOMS’. They have introduced and continued to introduce fine art products under ‘Amariz’ with a specific focus on artists and professionals as an end user.

FixyFix ‘FixyFix’ was launched in the year 2023, as a sub-brand under the flagship brand ‘DOMS’. They offer an exclusive range of glues and adhesives under this sub-brand. They have recently launched glue sticks, glitter glues, fragrance glues, and white glues under ‘FixyFix’.

One of the Industry leaders with an extensive product portfolio

The company has a leadership position in the stationery and art material products

industry in India. It is the second largest player in the industry with a market

share of 12% as of FY23. The company's products such as pencils and mathematical

instrument boxes enjoy the highest market share of 29% and 30% as of FY23 respectively.

The product category of the company includes 3800 SKUs which are spread across scholastic

stationery, scholastic art material, paper stationery, office supplies, etc. The

company is not dependent on a single product for its revenue as it has a diversified

product base. Along with being present across multiple product categories, the company

also ensures that the products are available across various price points through

its different brands.

Strong brand recall driven by R&D

The company over the years has focused on R&D and innovation across both products

and processes. Its R&D efforts are mostly focused on product development, cost

reduction, and integration of modern technologies. R&D motive helps the company

improve its operational efficiency. Before starting the initial commercial production,

the company processes its product on a pilot basis at its facility. The company's

house setup has resulted in diminishing dependency on third-party developers which

leads to improved efficiency and greater control on product quality. Its partnership

with FILA has enabled it to augment its R&D capabilities and has also helped

it to remain updated with the emerging global trends in the industry.

Robust manufacturing infrastructure with a focus on backward integration for

enhanced efficiency

The company has one of the largest stationery manufacturing facilities in India.

It undertakes end-to-endoperations from conceptualisation to distribution of our

product portfolio. Backward integration has helped the company to improve its efficiency,

ensure quality control, reduce dependency on third parties, and enhance profitability.

So, this backward integration has helped them to achieve economies of scale which

will help them to competitively price its products in the market.

Multi-channel distribution network with a formidable presence across India

The company sells its products through channels such as General trade, modern trade

&e-commerceplatforms, etc. In general trade, they make use of Super- stockists,

who sell it to a distributor and then in turn sell it to a wholesaler or retailer.

Currently, the company has a longstanding relationship with 120 super stockists

and 4000 distributors. Presently company’s products are sold in over 3500

cities and towns in India. The company generates the majority of its sales through

General trade which accounts for 74.34% for FY23. The company has a geographical

diversification as well with the majority of its revenue flowing from North followed

by West, East, and then South.

Focus on Inorganic growth through acquisitions or strategic partnerships.

The company intends to pursue strategic investments and acquisitions that are helpful

for its business. Inorganic growth will help them increase their market share further

and will increase profitability. In fiscal year 2024, DOMS undertook the acquisition

of Micro Wood Pvt Ltd, which helped them achieve a greater degree of backward integration

for the manufacturing of certain products. The company also acquired a minority

stake in ClapJoy Innovations Pvt Ltd, which is in the business of manufacturing

and sale of toys. The acquisition was mainly aimed to cater to a complementary line

of business.

Peer Comparison

| Particulars (FY23 figures) | P/E | EPS | RoNW(%) | ROE(%) | ROCE(%) | EBITDA Margin |

|---|---|---|---|---|---|---|

| (Rs in crores) | ||||||

| DOMS Industries Limited | 43.00 | 18.00 | 28.00 | 33.00 | 33.00 | 15.00 |

| Kokuyo Camlin Limited | 64.00 | 2.00 | 9.00 | 9.00 | 12.00 | 7.00 |

| Linc Limited | 28.00 | 25.00 | 21.00 | 24.00 | 31.00 | 13.00 |

| Navneet Education Limited | 16.00 | 9.00 | 17.00 | 15.00 | 19.00 | 18.00 |

| Flair Writing Industries Limited | 36.00 | 13.00 | 27.00 | 31.00 | 33.00 | 20.00 |

Key Risks Concern

Product Concentration Risk

The company is dependent on the sales of its top-selling product ‘wooden Pencils’

which contributes to 31.66% of its gross product sales in FY23. A decline in the

sales of wooden pencils due to reasons such as increased competition, pricing pressures,

or changes in demand will affect the company’s topline.

Product Distribution Risk

The company generates most of its sales through general trade which accounted for

70% of its gross product sales in each of the last 3 fiscal years. If any of the

super stockists discontinues its relationship, then it will result in a loss to

the company.

Competitive intensity

The company faces significant pressure from its competitors; its inability to compete

effectively would affect its business.

Outlook and Valuation

DOMS Industries Limited is the second largest player in India’s branded stationery and art products market with a market share of 12% by value as of Fiscal 2023 and is one of the fastest growing stationery and art material products companies in India in terms of revenue over the period from Fiscal 2020 to Fiscal 2023. The IPO is valued at 43x FY23 (EPS – Rs.18.29) calculated at the upper price band of Rs.790 which is higher than the average industry valuation. We like DOMS Ind due to its strong leadership position, extensive product portfolio, strong brand recall driven by differentiated products, focus on backward integration for enhanced efficiency, a multichannel distribution network with formidable presence, focus on inorganic growth to drive growth, robust R&D capabilities, strategic partnership with FILA, and shift in consumer preference towards premium products. Hence, we assign a subscribe rating to the issue.

Key Information

Use of Proceeds:

The total issue size is Rs. 1200 crores, of which Rs. 350 crores is Fresh issue

and balance (Rs.850 crores) is Offer for Sale (OFS). The company will utilize

the net proceeds from the fresh issue for a new manufacturing facility to expand

production capabilities for writing instruments, watercolour pens, markers, and

highlighters. Kindly find the bifurcation for fresh Issue proceeds below.

| Particulars | Rs in Cr |

|---|---|

| Cost of establishing a new manufacturing facility at Umbergaon | Rs 280Cr |

| General Purpose | Rs 70Cr |

| Fresh Issue | Rs 350Cr |

Book running lead managers:

JM Financial, BNP Paribas, ICICI Securities, IIFL Securities

Management:

Santosh Rasiklal Raveshia (Managing Director), Sanjay Mansukhlal Rajani, Ketan Mansukhlal

Rajani, Chandni Vijay Somaiya (Wholetime Director), Mehul Shah (Chief Financial

Officer), Rajiv Ishwarbhai Mistry, Darshika Thacker (Independent Director), Christian

Nicoletti, Luca Pelosin, Massimo Candela (Non-Executive Director).

Financial Statement

Profit & Loss Statement:- (Consolidated)

| Particulars (in Crores) | FY21 | FY22 | FY23 | Q2FY24 |

|---|---|---|---|---|

| Revenue | 403.00 | 684.00 | 1212.00 | 762.00 |

| COGS | 245.00 | 432.00 | 763.00 | 459.00 |

| Gross Profit | 157.00 | 252.00 | 449.00 | 303.00 |

| Gross Margin | 39.00% | 37.00% | 37.00% | 40.00% |

| Employee Benefit Expense | 71.00 | 101.00 | 142.00 | 103.00 |

| Other Expense | 56.00 | 80.00 | 120.00 | 73.00 |

| EBITDA | 30.00 | 70.00 | 187.00 | 127.00 |

| EBITDA Margin (%) | 7.00 | 10.00 | 15.00 | 17.00 |

| Depreciation & Amortisation | 35.00 | 38.00 | 41.00 | 23.00 |

| EBIT | -5.00 | 32.00 | 146.00 | 105.00 |

| Finance Cost | 9.00 | 10.00 | 12.00 | 8.00 |

| Other Income | 6.00 | 3.00 | 5.00 | 2.00 |

| Share of profit/ loss | - | - | 0.00 | -1.00 |

| PBT | -8.00 | 24.00 | 139.00 | 98.00 |

| Tax Expense | -2.00 | 7.00 | 36.00 | 25.00 |

| PAT | -6.00 | 17.00 | 103.00 | 73.00 |

| EPS (In Rs.) | 1.07 | 3.05 | 18.29 | 13.14 |