Denta Water and Infra Solutions Ltd - IPO Note

Engineering - Construction

Denta Water and Infra Solutions Ltd - IPO Note

Engineering - Construction

Stock Info

Shareholding (Pre IPO)

Shareholding (Post IPO)

Company Description

Established in 2016, Denta Water and Infra Solutions Limited, commonly known as "Denta Water," has emerged as one of the key playersin the field of water engineering, procurement, and construction (“EPC”) services. Denta Water and Infrastructure Solutions is engaged in design, installation and commissioning of water management infrastructure projects with expertise in groundwater recharging projects. The company also provides operations and maintenance services for projects (typically, for 3- 5 years). Additionally, the company undertakes construction projects on railways and highways.Denta Water is one of the few companies in India with experience and expertise in design, installation, commissioning, operations and maintenance of groundwater recharging using recycled water. The company’s water management projects are concentrated in the state of Karnataka. The company has been awarded 3 projects under the “Jal Jeevan Mission.” As of November 30, 2024, it has successfully completed 445.77 km of infrastructure for water management projects.

Denta Water has been a contributor to addressing the rising demand for water-related solutions in the country. Some of the notable projects include the Byrapura and Hiremagaluru LIS Project, Karagada LIS Project, and others, primarily executed through lift irrigation systems. Denta Water played a substantial role in the first phase of the KC Valley project, contributing to Bengaluru's reputation as the second-largest city globally in terms of treated wastewater quantity. The company’s significant involvement in the government’s "Jal Jeevan Mission" reflects the company’s commitment to critical water management initiatives. Further, Denta Water secured contracts for lift irrigation projects in various regions, such as Makali, Makali Hosahalli, Krishnapura, Karnataka and neighbouring villages in the Channapatna Taluk of Ramanagar District, Karnataka.

The company is awarded contracts through transparent competitive bidding process undertaken by the State and Central Governments. The company also undertakes contracts as sub-contractors from various private parties. The company participates in tenders for developing projects such as infrastructure for groundwater recharging, lift irrigation, and infrastructure for supplying drinking water to various habitations under “Jal Jeevan Mission” on a competitive basis.

The company renders a range of services from “concept-to-commissioning” and beyond to various water management projects. The company’s services for any given project include any one or a combination of (i) preliminary investigations and reconnaissance; (ii) feasibility studies, (iii) planning and project formulation; (iv) field surveys and testing of soil; (v) design; (vi) tender bidding consultancy; (vii) project management and construction supervision; (viii) formulation of operation and maintenance guidelines; (ix) engineering procurement consultancy, turnkey projects; etc. regarding water management projects.As on November 30, 2024, the Company has executed 32water management infrastructure projects, where they have undertaken 11projects as the main contractor, 1project has been undertaken under a consortium / joint venture arrangement and 20projects have been undertaken under a sub-contract arrangement with the main contractor.

Competitive Strengths

Efficient Business Model:

Focused segment:

The Company has been focusing on particular segment since incorporation. They are

majorly concentrated in GWR (Water Management), Irrigation, O&M pertaining to

water projects. The projects which are undertaken by the company are either through

joint venture, sub-contract basis or direct in the State of Karnataka. Focusing

on selected segment enables competitive advantage at the time of award evaluation.

Asset light model

The Company’s business model relies on the strength of project execution and

management capabilities as well as established relationships with clients, architects

and contractors. Leveraging these capabilities and relationships, it seeks to transition

to a combination of designing and execution based business model. As a part of this

model, they focus on development management and joint development agreements or

joint ventures, which require lower upfront capital expenditure compared to direct

approach. We believe that asset light business model results in efficient utilization

of capital resulting in lower debt and regular income allowing them to have higher

return on capital employed. We believe that focus on development management model

and commitment to leverage project execution and management capabilities will continue

to contribute to growth and development of business.

Established expertise in water management projects with special focus on ground

water recharging

Since incorporation, the company has completed 32 water management infrastructure

projects for Government of Karnataka. They have established credentials as a water

management solutions provider, particularly, in the field of ground water recharge

projects (“GWR projects”) and lift irrigation projects. The company

has successfully completed projects involving the filling up of numerous tanks and

check dams, showcasing proficiency in managing water resources efficiently. Owing

to technical expertise in GWR projects, they are now able to procure direct contracts

as well as sub-contracts from the successful bidders. As on November 30, 2024, they

have procured direct contracts (as consortium partner) worth Rs.774 cr direct contracts

(independent) worth Rs.47 cr and sub-contracts worth of Rs.465 cr in GWR projects.

We believe that the consistent growth in the Order Book of the Company is the result of continued focus on management projects and ability to successfully bid and win new projects. Further, we believe that experience in execution of water management infrastructure projects, technical capabilities, timely performance, reputation for quality, financial strength as well as the price competitiveness of bids have enabled them to successfully bid for and win projects.

In-house expertise in designing and engineering of water management infrastructure

projects

DWISL has an in-house design and engineering team which focuses on design capabilities

for geographical complexities and critical aspects of the projects such as identification

of potential ground water recharging sites, hydraulic flow calculations, and drainage

laying design, process flow diagram, hydraulic flow diagram, and water balance.

This capability enables the company to correctly bid with project specifications.

The company has diverse capabilities that enable it to offer tailor-made solutions

for meeting exigencies due to extreme changes in project, design and installation.

The company offers bespoke solutions taking into consideration the geographical

and the gradient of each location for designing the GWR Projects which are then

implemented either by us directly or through sub-contracting.

Established track record for project execution

One of the important differentiators in water management infrastructure solution

provider is its capacity to timely complete the project within the given budget.

A project's timely or early completion results in greater credibility and technical

competency, which is advantageous when a company is being evaluated technically

before being awarded the contract.

The company leverages strong designing and execution capabilities to complete projects in a timely manner while maintaining high quality of engineering and construction. Their design and engineering teams, ensures operational efficiencies through overall supervision of the project execution process. We believe that steady track record of successful completion of complex projects in a timely manner has allowed them to grow business over the years. They have the three important ingredients required by any company in the industry i.e in-house design and engineering team, skilled manpower to execute projects in a timely manner and strong post completion team for operations and maintenance of completed projects.

Strong order book lends earnings visibility

DWISL is a growing water and infrastructure solutions companies engaged in design,

installation, commissioning of water management infrastructure projects with expertise

in GWR Projects. As on November 30, 2024, they have 17 ongoing projects being implemented

either directly by or under consortium arrangements with other entities and Company`s

share in the aggregate contact value comprises of Rs.1100 cr, out of which Rs.1067

cr is in relation to water management projects. As on November 30, 2024, out of

total contract value of Rs.1100 cr they have completed work amounting to Rs.348

cr and outstanding order book is of Rs.752 cr. The aforesaid Order Book value can

get realized within a period of 2 years from the date of this RHP. The Company has

proven its execution capabilities in executing GWR projects such as Byrapura &

Hiremagaluru LIS Project, Karagada LIS Project etc in State of Karnataka for filling

of major tanks by lifting the water through lift irrigation system. The average

period of completion of GWR projects varies from 24 months to 36 months. Details

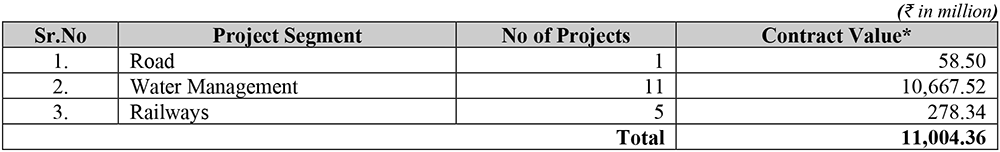

of contract value of order book as on November 30, 2024 is as under

Peer Comparison

| Name of the company (FY24) | Revenue from operations (Rs. in cr) | P/E (x) | ROE (%) | ROCE (%) | EBITDA Margin (%) |

|---|---|---|---|---|---|

| Denta Water and Infra solutions | 238.00 | 9x | 36.36% | 76.99% | 33.29% |

| VA Tech Wabag | 2856.00 | 38.41x | 14.76% | 21.56% | 12.82% |

| EMS Ltd | 538.00 | 27.47x | 23.69% | 24.77% | 25.70% |

Key Risks & Concerns

Geographical concentration: The company relies heavily on the Government of Karnataka for its business. 84% of revenue from operations in six months period ended September 30, 2024, is the government of Karnataka. Any adverse development within the region may affect business, results of operations and financial condition.

Customer concentration: In FY24, the company derived 32% of its revenue from the top customer. Failure to retain the customers and/or execute orders in favourable conditions could result in financial losses. Top 5 and top 10 customers constitute 50.35% and 45% of the overall revenues as of FY24.

Dependency on water/irrigation with high competition: The company derived more than 90% of its FY24 sales from water management projects. Also, all its projects are won by winning tender based bids which is highly competitive in nature.

Outlook and Valuation

Denta Water and Infrastructure Solutions is engaged in design, installation and commissioning of water management infrastructure projects with expertise in groundwater recharging projects. Denta Water and Infra Solutions Ltd. operate in the Indian water and wastewater treatment industry, which is projected to reach USD 23.9 billion by 2033. The company, a key player in this industry, is set to benefit from this growing trend due to its strong track record, including 32 successful execution of water management projects, particularly in groundwater recharge (GWR) and wastewater management with projects like Byrapura and Hiremagaluru LIS. Currently, the company has an outstanding order book of Rs. 752 cr, mainly from the government of Karnataka. Additionally, the company is focusing on diversifying its geographic footprints in high-potential regions like Gujarat, Madhya Pradesh, Maharashtra and Uttar Pradesh, which will reduce the reliance on Karnataka. The company follows an efficient, asset-light model that enhances project execution through joint ventures and development management.

With the growing focus of the government on water reuse and recycling, Denta Water plans to leverage its expertise to capitalise on these trends and expand its participation in water conservation and infrastructure development projects. The company’s expanding portfolio, including ventures in railways and highways, further strengthens its position in the infrastructure sector, positioning it well for continued growth amidst evolving market conditions. Further, we believe that Denta Water’s strategic focus on water management projects, healthy orderbook, established track record for project execution, In-house expertise in designing and engineering of water management infrastructure projects, asset light business model, Established expertise in water management projectspositions it well for future growth in water management and infrastructure sectors. On valuation front, the issue is priced/valued at a P/E ratio of 9x based on FY24 earnings at the upper end of the price band which appears reasonable. Hence, we assign SUBSCRIBE rating to the issue.

Key Information

Use of Proceeds:

The total issue size is Rs.220.50 cr, which comprises of an entire fresh issue of

Rs.220.50 cr with no Offer for Sale (OFS) component. From the net proceeds of the

issue, the company will utilize Rs.150 cr towards working capital requirements and

rest (Rs.70.50 cr) for general corporate purposes.

Book running lead managers:

SMC CAPITALS LIMITED

Management:

Manish Shetty (Managing Director), Sujith TR (Whole-time Director), Nista U Shetty

(Non-Executive Director), Gopalakrishna Kumaraswamy (Independent Director), Pradeep

N (Independent Director), R. Narendra Babu (Independent Director), Deepa S (Chief

Financial Officer)

Financial Statement

Profit & Loss Statement:- (Consolidated)

| Particulars (Rs. In cr) | H1FY25 | FY24 | FY23 | FY22 |

|---|---|---|---|---|

| Revenue from operations | 98.00 | 238.00 | 174.00 | 119.00 |

| Cost of materials consumed | 60.00 | 152.00 | 104.00 | 67.00 |

| Employee benefit expenses | 3.00 | 4.00 | 1.00 | 1.00 |

| Other expenses | 2.00 | 4.00 | 2.00 | 1.00 |

| EBITDA | 33.00 | 78.00 | 67.00 | 50.00 |

| EBITDA Margin (%) | 33.67% | 32.77% | 38.51% | 42.21% |

| Depreciations expenses | 0.00 | 1.00 | 0.00 | 1.00 |

| EBIT | 33.00 | 78.00 | 67.00 | 49.00 |

| Finance costs | 0.00 | 1.00 | - | - |

| Other Income | 1.00 | 3.00 | 1.00 | 1.00 |

| PBT | 33.00 | 81.00 | 68.00 | 52.00 |

| Tax expenses | 9.00 | 22.00 | 18.00 | 13.00 |

| PAT | 24.00 | 60.00 | 50.00 | 38.00 |

| EPS (Rs.) | 12.60 | 31.11 | 26.10 | 19.97 |