Data Patterns (India) Limited - IPO Note

Defence and Aerospace

Data Patterns (India) Limited - IPO Note

Defence and Aerospace

Stock Info

Shareholding (Pre IPO)

Shareholding (Post IPO)

Key Strengths and Strategies

Integrated Defence and Aerospace Electronic Solutions Provider, Positioned to

Benefit from Make in India Opportunity:

Since inception, the company has focused on designing and building its own products.

It is focussed on developing complete systems and sub-system solutions such as radars,

electronic warfare, communication systems, radio frequencies and microwave, Military

Commercial Off the Shelf, avionics, missile and torpedo electronics, fire and launch

control systems, space-based systems, and automatic test equipment. Defence Research

and Development Organisation (DRDO) is one of the company’s valuable customers.

The company's management feels that the company’s competency, along with

the government's emphasis on indigenization, puts DPIL in a good position to

rapidly scale-up several existing products, allowing it to reap benefits from the

Make-in-India initiative.

The company successfully bid for and obtained a Rs. 380 crores contract from the Ministry of Defence for nine precision approach radars for the Navy and Air Force, which are currently in the delivery stage. With Indian defence requirements being opened out to indigenous manufacturers, the management believes that opportunities are now available which can be addressed based on in-house capabilities to develop such large systems.

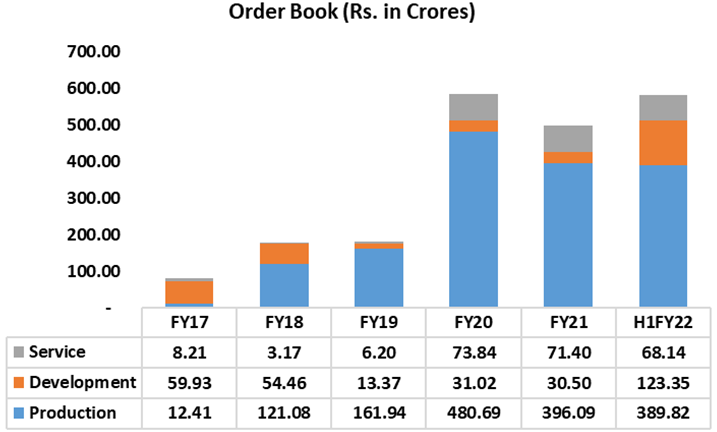

Sound Order Book Across Product Categories Supplying to Marquee Customers:

As of September 2021, the company has an order book of Rs. 581.3 crores with orders

from several marquee customers including Ministry of Defence, Defence Research and

Development Organisation, BrahMos Aerospace, Hindustan Aeronautics, Bharat Electronics,

India Government Space Organisation (supplying products for 20+ years), and Defence

Public Sector Undertakings involved in missile space. The company is currently engaged

in supply of products to several prestigious defence projects in India including

LCA (Tejas Mk I A Light Combat Aircraft), the HAL Dhruv, Light Utility Helicopter

(LUH), and the BrahMos missile programme and in each of these projects, the company’s

products are critical in nature. It continues to invest in product development on

various platform-specific products which has an annuity requirement thus ensuring

continuity of business in the coming years.

Due to its diversification, the company’s order book has increased from Rs. 80.5 crores as on March, 2017 to Rs. 581.3 cores as on September, 2021. The break-up of the order book is as follow:

Source: Company RHP

Certified Manufacturing Facilities having International Standards:

The company’s 100,000 sqft manufacturing unit has facilities for design, manufacturing,

qualification, and life cycle support of electronic systems. The company is certified

for various standards across product life cycles, including aerospace systems under

AS9100D by TUV-SUD, IPC Standards for PCB design, DO 178B for software for airborne

systems, Software life cycle processes, and environment standards MIL-STD-810, JSS-55555

and EMI-EMC standard MIL-STD-461. The company’s systems and processes are

subject to periodic audit by its customers. Its Electronic Manufacturing Services

(EMS) line is certified for production by the Indian government space organisation.

Sound Financial Profile

As per the company’s filings, it is one of the fastest growing companies in

Defence and Aerospace Electronics Sector in India with higher margins and return

ratios. The company’s top line has grown at a CAGR of 30.7% between FY19 –

FY21. The absolute EBITDA has posted a CAGR of 89.8% and EBITDA margin has seen

consistent up move from 19.5% in FY19 to 41.1% in FY21. Its PAT has grown from Rs.

7.7 crores in FY19 to Rs. 55.57 crores in FY21. PAT margin has also improved from

5.9% in FY19 to 24.8% in FY21. RoE and RoCE stood at 26.8% and 34.7%, respectively

in FY21.

| Particulars (Rs. in Crores) | FY19 | FY20 | FY21 | H1FY22 |

|---|---|---|---|---|

| Revenue | 131.06 | 156.10 | 223.95 | 96.45 |

| EBITDA | 25.55 | 43.16 | 91.99 | 37.82 |

| EBITDA Margin | 19.49% | 27.65% | 41.08% | 39.21% |

| Profit After Tax | 7.70 | 21.05 | 55.57 | 23.21 |

| PAT Margin | 5.88% | 13.48% | 24.81% | 24.06% |

| RoE | 5.80% | 13.71% | 26.75% | 10.71% |

| RoCE | 12.45% | 23.39% | 34.69% | 13.41% |

Source: Company RHP

Expansion of Product Portfolio Focused on Complex Technologies:

The company intends to continue expand its capabilities and product portfolio to

enhance offerings in the defence and aerospace electronics space, especially in

complex technology products. It also intends to opportunistically bid for higher

value projects demanding significant use of complex technologies. For instance,

the company has developed and deployed its first Nano satellite in 2017, after which,

it has received additional two contracts to design and build nano satellite.

DPIL is further investing in AESA radars, modern EW Systems, Airborne sensors, among others in a view that these complex products have wide range of applications and would provide a higher value growth opportunity. The company also intends to avail the benefits from the Make-in-India programme by participating in tenders for large and complicated projects.

Expanding Manufacturing Facility:

The company intends to deploy a part of fresh issue towards upgrading and expanding

its existing facility. The proposed expansion includes acquisition of additional

2.8 acres of land, large systems integration hangar, complete radar integration,

electronic warfare vehicle integration, augmented environmental test infrastructure,

multi ton material handling, additional EMS line, and clean room for satellite integration.

The company also intends to augment its design and development capabilities for

various verticals through procurement of software, testing equipment and other related

hardware.

Risks

Dependence of Government of India: Contracts from the Government of India and related entities provide for the majority of the company's revenue. Any drop in orders, termination of current contracts, or postponement of existing or projected contracts, as well as any decline or reprioritization of the Indian defence or space budget, could have an adverse effect on the company.

Concentration of Customers: A substantial amount of DPIL's revenue comes from a small number of customers, including DRDO, MoD, BrahMos Aerospace, and the Indian government space organisation. The loss of any big client or a considerable drop in business could have an adverse impact on the company.

Significant Working Capital Requirements: The business requires to maintain a high level of working capital because the activities are characterised by long product development periods and production cycles. Delays in payment under on-going contracts, increase in inventory, and accelerated payments to suppliers could adversely impact working capital. However, the company expects gradual decrease in inventory and receivables days in coming years, thereby, improving working capital days.

Shares Pledge: one of the Promoters, Srinivasagopalan Rangarajan, has pledged 12,521,025 Equity Shares with the State Bank of India, accounting for 26.2% of the company's paid-up capital for a loan facility from State Bank of India for Rs. 103.88 crores, (Out of the total credit facilities, the fund-based working capital facilities may be repaid with the proceeds of the fresh Issue.)

Changes in Raw material Prices: The company sources its raw materials from both domestic and foreign markets. However, the majority of the raw material (75%) is imported. Multiple variables can influence raw material pricing, including transportation costs, worldwide demand and supply disruptions, import levies, and so on. These factors might affect the company's import expenses, which can affect profits.

Operates in Competitive Business Environment: Price is a major factor in most tenders and biddings are usually subject to intense price competition. With the liberalisation of the Indian defence and space sector that allows private and foreign companies to participate in defence and space contracts, the company will face competitive biddings.

Company Description

Incorporated in 1998, Data Patterns (India) Limited (DPIL) is vertically integrated defence and aerospace electronics solutions provider catering to defence product industry. It caters to entire spectrum of defence and aerospace platform such as space, air, land, and sea. It has a design capability across processors, power, radio frequencies and microwave, embedded software and firmware, and mechanical engineering. Its competencies include design and development in (electronic hardware software, firmware, mechanical, product prototype), functional testing and validation, environment testing and verification, and engineering services opportunities.

The company has invested in and developed a reusable building block model leading to capabilities and competence across various product domains. Some of the notable achievements include (see image below)

Source: Company RHP

Its production plant in Chennai is a 100,000-square-foot factory. An Electronic Manufacturing Services line, clean rooms, board, box, and rack level integration capability, and environmental testing are all available at the facility. The company is certified for aerospace systems under AS9100D by TUV-SUD, International Printed Circuit Standards for Printed Circuit Board design, and DO 178B for software for airborne systems. The company is planning to expand its facility, which will include a proposed doubling of available floor space and manufacturing capacity, as well as the ability to handle large and heavy equipment, the integration of large radars and mobile electronic warfare systems, and a satellite integration facility.

Valuation

Data Patterns (India) Limited has had a strong topline performance and has consistently improved margins. It also outperforms its listed peers MTAR Technologies, Bharat Electronics, and Paras Defence and Space Technologies in terms of return ratios. The company's order book has also improved significantly from FY17 levels to H1FY22 levels. Pursuant to increase in order book, the company intends to expand its facility in Chennai, which gives us confidence that the company could cater to the growing demand and enhance product portfolio. Given the company's focus on extending its product offerings in complicated technologies, we believe it is capable of winning more orders.

We also expect the company's working capital days to improve in the coming years. The inventory holding period levels could gradually decrease as contracts in the order book are scaled up. Also, the receivables days has been consistently trending down over the past three years and the trend is likely to continue going forward owing to higher production-based contracts.

At the upper price band of Rs. 585, the issue is valued at ~49x of FY21 earnings, which looks comparatively decent compared to average of ~90x of the other listed peers. We recommend to SUBSCRIBE the issue.

Peer Comparison

| Particulars (Rs. in Crores) FY21 | Revenue CAGR (FY19 - FY21) | OPM (%) | PAT (%) | RoE (%) | RoCE (%) | EPS | PE (x) |

|---|---|---|---|---|---|---|---|

| Data Patterns | 30.72% | 41.08% | 24.81% | 26.75% | 34.69% | 11.89 | 49.20 |

| MTAR Technologies | 15.83% | 33.72% | 18.70% | 9.67% | 19.21% | 14.98 | 159.54 |

| Bharat Electronics | 7.70% | 22.78% | 14.88% | 18.98% | 27.92% | 8.61 | 23.93 |

| Paras Defence and Space Tech | -7.26% | 32.06% | 11.36% | 50.52% | 22.41% | 5.04 | 145.04 |

| Astra Microwave Products | 47.78% | 12.00% | 4.50% | 5.16% | 10.03% | 3.33 | 78.38 |

| Centum Electronics | -6.27% | 10.82% | 2.10% | 7.69% | 8.34% | 13.30 | 42.41 |

Source: Company RHP, Screener

Key Information

Use of Proceeds:

The total issue size is Rs. 588.22 crores, of which Rs. 240 crores is fresh issue

and balance (Rs. 348.22 crores) is OFS. The company will utilise the net proceeds

from the fresh issue to prepay/repay of certain borrowings, funding working capital

requirements, and upgrading and expanding existing facility in Chennai (See the

table below)

| Sr. No. | Particulars | Amount (INR. CR.) |

|---|---|---|

| 1 | Repay/Prepay Certain Borrowings | 60.80 |

| 2 | Funding Working Capital Requirements | 95.19 |

| 3 | Upgrading and Expanding Facility in Chennai | 59.84 |

| 4 | General Corporate Purposes | - |

Book running lead managers:

JM Financial Limited and IIFL Securities Limited.

Management:

Srinivasagopalan Rangarajan (Chairman and Managing Director), Rekha Murthy Rangarajan

(Whole-time Director), Vijay Ananth K (Chief Operating Officer and Chief Information

Security Officer), Desinguraja Parthasarathy (Chief Technical Officer), Thomas Mathuram

Susikaran (Senior Vice President-Business Development), Venkata Subramanian Venkatachalam

(Chief Financial Officer), and Manvi Bhasin (Company Secretary and Compliance Officer)

Financial Statement

Profit & Loss Statement:- (Consolidated)

| Particulars (Rs. in Crores) | FY19 | FY20 | FY21 | H1FY22 |

|---|---|---|---|---|

| Revenue from Contract with Customers | 131.06 | 156.10 | 223.95 | 96.45 |

| COGS | 48.95 | 56.09 | 70.40 | 21.02 |

| Gross Profit | 82.12 | 100.01 | 153.55 | 75.42 |

| Gross Profit Margin (%) | 62.65% | 64.07% | 68.56% | 78.20% |

| Employee Benefit Expenses | 37.65 | 42.27 | 48.42 | 28.12 |

| Other Expenses | 18.92 | 14.58 | 13.14 | 9.48 |

| EBITDA | 25.55 | 43.16 | 91.99 | 37.82 |

| EBITDA Margin (%) | 19.49% | 27.65% | 41.08% | 39.21% |

| Depreciation and Amortisation | 5.86 | 5.48 | 5.55 | 2.96 |

| EBIT | 19.69 | 37.68 | 86.44 | 34.86 |

| Finance Cost | 10.78 | 13.34 | 14.50 | 4.81 |

| Other Income | 1.45 | 4.09 | 2.60 | 0.73 |

| Profit Before Tax | 10.36 | 28.43 | 74.53 | 30.78 |

| Tax Expenses | 2.66 | 7.38 | 18.96 | 7.57 |

| Profit After Tax | 7.70 | 21.05 | 55.57 | 23.21 |

| PAT Margin (%) | 5.88% | 13.48% | 24.81% | 24.06% |