Bikaji Foods International Limited - IPO Note

FMCG

Bikaji Foods International Limited - IPO Note

FMCG

Stock Info

Shareholding (Pre IPO)

Shareholding (Post IPO)

Company Description

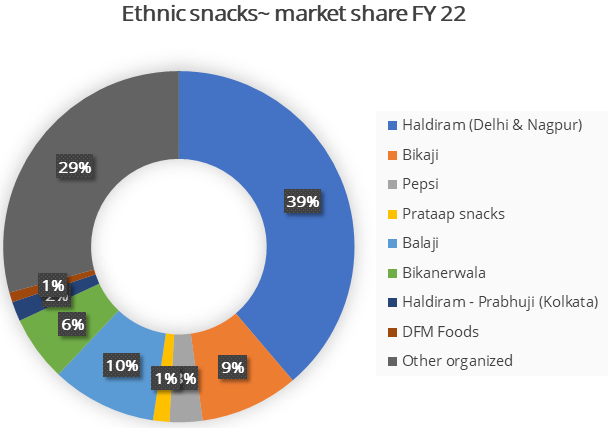

Bikaji Foods International Ltd. was incorporated on 6th October 1995. It is the 3rd largest ethnic snacks company in India with international footprints. The company is the 2nd fastest growing company in Indian organized snacks industry (Source F&S report). The company was the largest manufacturer of Bikaneri Bhujia in FY22, with an annual production capacity of 29380 Tonnes and was the 2nd largest manufacturer of handmade papad with annual production capacity of 9000 Tonnes in FY22. (source F&S report). Under the organised sweets market the company had an annual capacity of 24000 tonnes for packed Rasgulla , 23040 Tonnes for Soan papdi and 12000 Tonnes for Gulab Jamun. Bikaji’s footprints on international grounds are vast with export to 21 countries namely North America, Europe, Middle East, Africa, etc.

Company’s business model includes both B2B & B2C segments. It’s diverse product portfolio is divided into three major categories Ethnic snacks, Western snacks and Frozen sweets & snacks. The five major products are Bhujia, Namkeen, packed sweets, Papad and western snacks including mainly chips and wafers. In states such as Rajasthan, Assam and Bihar it has witnessed market share of 45%, 58% and 29% respectively in FY22.

Manufacturing

Currently company has 7 operational manufacturing facilities with 4 facilities at

Bikaner (Rajasthan), 1 in Guwahati (Assam), 1 in Tumakuru (Karnataka) and 1 in Muzaffarpur

(Bihar).

Product – wise capacity utilisation

| FY20 | FY21 | FY22 | June 30, FY22 | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Products | Average estimated annual capacity available (metric tonne) | Actual production (metric tonne) | capacity utilisation (%) | Average estimated annual capacity available (metric tonne) | Actual production (metric tonne) | capacity utilisation (%) | Average estimated annual capacity available (metric tonne) | Actual production (metric tonne) | capacity utilisation (%) | Average estimated annual capacity available (metric tonne) | Actual production (metric tonne) | capacity utilisation (%) |

| Bhujia | 45600 | 23801 | 52.20% | 52372 | 29672 | 56.66% | 57600 | 32055 | 55.65% | 14400 | 8077 | 56% |

| Namkeen | 67938 | 27504 | 40.48% | 71133 | 30442 | 42.80% | 77446 | 33144 | 42.80% | 22380 | 9185 | 41% |

| Machine made papad | 1200 | 317 | 26.47% | 1896 | 449 | 23.72% | 2400 | 405 | 16.88% | 600 | 139 | 23% |

| Western snacks | 10800 | 2902 | 26.88% | 10800 | 3232 | 29.93% | 12263 | 3331 | 27.17% | 4650 | 152.9 | 32% |

| Packaged sweets | 38173 | 11061 | 28.98% | 47572 | 13384 | 28.13% | 56734 | 15836 | 27.91% | 14183 | 267.9 | 18.80% |

Investment Rational

Leading player in the industry, with PAN India network

Bikaji is a well - established player ranked as 3rd largest player under

ethnic Indian food snacks industry. They sell their products under the brand name

‘Bikaji’. Under this they have a diverse product portfolio covering

Bhujia, papad, etc, ethnic Indian snacks which serves best to the taste of people

at minimum possible prices. A major part of their sales is derived from sale of

‘Family packs’ , which constitute around 61% of total sales of the company

in FY22. It is the market leader in family packs segment. The company has strategically

built its brand Bikaji, where various product innovations are done in terms of packaging

& advertisement to lure the customers from different parts of India and outside

India. The advertisement expenses in FY20, FY21 and FY22 were Rs 36.78 Cr., Rs30.6

Cr. and Rs 29.1 Cr. which was 3.4%, 2.3% and 1.8% respectively of the total sales.

Moreover Bikaji is the only Indian snacks brand which has brand ambassador as Amitabh

Bachan.

Source: Company RHP

Source: Company RHP

Diversified product portfolio, designed to serve various consumers and regions

They have a well-defined understanding of Indian taste and preferences of customers.

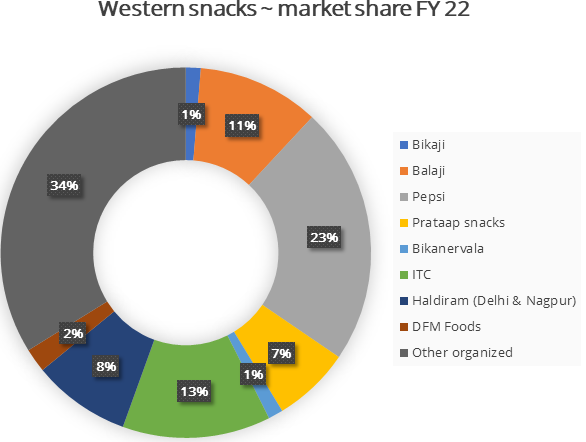

The company’s diverse product portfolio of 300 products. Under Western snacks

segment company is not a major player of the industry but they are in progress of

building a strong product base under this segment too. With quality and diversity

in products company is not dependent on anyone product or segment for generating

revenues. The company keeps innovating & exploring new avenues to diversify

its product portfolio. For example during current year they have ventured into frozen

foods segments, with frozen sweets and snacks. The company is in process of setting

up a manufacturing facility in Bikaner to manufacture frozen products. This will

de risk company’s dependence from ethnic and western snacks segment and will

open doors of opportunity to a fast growing frozen segment. The company’s

revenue is well spread over basket of 6-7 products with no over dependence on any

one item.

| Product | FY20 | % Sale of food products | FY21 | % Sale of food products | FY22 | % Sale of food products | 30June FY22 | % Sale of food products | CAGR (FY20-FY22) |

|---|---|---|---|---|---|---|---|---|---|

| Bhujjia | 347.9 | 32.46% | 464.1 | 35.51% | 560.1 | 34.96% | 145.8 | 34.98% | 26.87% |

| Namkeen | 401.6 | 37.47% | 480.5 | 36.77% | 570.4 | 35.60% | 163 | 39.18% | 19.17% |

| Packed sweets | 129.7 | 12.10% | 160.5 | 12.29% | 203.4 | 12.70% | 31.5 | 7.57% | 25.21% |

| Papad | 82.2 | 7.67% | 91.4 | 6.99% | 107.3 | 6.70% | 29 | 6.97% | 14.24% |

| Western snacks | 56.1 | 5.23% | 65.7 | 5.03% | 91.9 | 5.74% | 36 | 8.64% | 28.02% |

| Other snacks | 33 | 3.08% | 29.5 | 2.26% | 40.4 | 2.52% | 5.6 | 1.34% | 10.54% |

| Others | 21.2 | 1.98% | 14.9 | 1.14% | 28.4 | 1.78% | 5.4 | 1.31% | 15.69% |

| Total | 1072.1 | 100% | 1306.9 | 100% | 1602.2 | 100% | 416.8 | 100% | 22.25% |

Extensive distribution network on PAN-India basis, Export market and Retail &

E-commerce channels

The company has large distribution network with 6 depots, 38 super stockists, 416

direct and 1956 indirect distributors that work with stockists located across 23

states and 4 union territories of India as of June 30 FY22. This has enabled the

company to increase its customer base. The company primarily focuses on integrated

inventory and distribution system which uses strategic approach across distribution

channels, proper availability of stock with such sellers.

The company has engaged with modern retail channels such as supermarkets, hypermarkets and retail store chains, either through direct channels or through super stockists. Sales through modern retail chains for FY20, FY21 & FY22 accounted for Rs 71.6 Cr., Rs 77.6 Cr. & Rs 110 Cr., respectively. In International markets company has direct arrangements with the help of distributors with International retail stores.

Under E-Commerce platforms company has arrangements with various E-commerce platforms, start-up distributors and its own website www.bikaji.com. Sales through E-commerce channels in FY20, FY21 & FY22 accounted for Rs 2.9 Cr., Rs 10.2 Cr. & Rs 18.6., Cr respectively.

| Channel | FY20 | % Sale of food products | FY21 | % Sale of food products | FY22 | % Sale of food products |

|---|---|---|---|---|---|---|

| General Trade | 915.6 | 85.40% | 1128 | 86.37% | 1358.1 | 84.77% |

| Modern Trade | 71.6 | 6.68% | 77.6 | 5.94% | 110 | 6.87% |

| Exports | 46 | 4.29% | 66.4 | 5.09% | 63.7 | 3.98% |

| E-commerce platforms | 2.9 | 0.28% | 10.2 | 0.78% | 18.6 | 1.17% |

| Others | 35.9 | 3.35% | 23.8 | 1.82% | 51.6 | 3.22% |

| TOTAL | 1072.1 | 100% | 1306.9 | 100% | 1602.2 | 100% |

Peer Comparison

| Name of the Company | Total Income FY22 (In Cr.) | Market Cap. | EPS (Basic in Rs/ share) | PE | RoNW (%) | M.cap/sales |

|---|---|---|---|---|---|---|

| Bikaji Foods International Ltd. | 1610.00 | 7485.00 | 3.15 | 95.23 | 9.51% | 4.64 |

| Prataap snacks Ltd. | 1396.00 | 2152.00 | 1.24 | 748.91 | 0.47% | 1.54 |

| DFM Foods Ltd. | 554.00 | 1866.00 | -4.93 | -77.84 | -16.21% | 3.36 |

Note: Other significant but unlisted peers are Haldiram and Balaji Wafeers

Risks

- Intensely competitive environment

The company faces intense competition from domestic and multinational companies. The organised snacks industry operates in a highly competitive environment where price differentiation plays a key role. Major players of the industry are Haldiram, ITC, Balaji Wafers Pvt. Ltd. etc, are big competitors of the company. - Product innovation and strategic marketing

Company has to consistently work towards building its diverse product portfolio which suits to the taste & flavour of customers from all parts of India. Under this kind of business marketing of products plays a huge role & needs heavy spends on advertising . Apart from this product packaging also impacts the sales of the companies to a great extinct & accounts for major expenses.

Valuation

Company has a strong business model, with consistent growth in its operations. Over the years Bikaji foods has established itself as a strong market leader in ethnic snacks industry. It has delivered consistent growth in its financial operations. Bikaji’s Bhujia has witnessed immense popularity in the market on PAN India basis. Now, the company is ready to venture into frozen foods segment, which will help the company to accelerate its growth. We believe Bikaji is direct play on India consumption story which has a long runway of growth ahead.

At upper band of IPO price Rs 300/ share asking valuation is 95.23x of its FY22 earnings and M.cap/sales of 4.64x .

We recommend subscribe rating.

Key Information

Use of Proceeds:

- The offer is ‘Offer for sale’ of 29,373,984 equity shares of face value Rs1 in the price band of Rs 285-300. The issue size is between Rs 837 Cr. – Rs881 Cr. The bid size is of 50 shares and in multiple thereof.

- The company wants to achieve the benefits of listing the Equity shares as it will enhance the brand value and visibility of their products. The offer is an offer for sale hence selling shareholders are solely entitled to the entire proceeds from the issue. The company will not receive any proceeds.

Book running lead managers:

JM Financial Limited Axis Capital Limited IIFL Securities Limited Intensive Fiscal

Services Private Limited Kotak Mahindra Capital Company Limited

Management:

Shiv Ratan Agarwal ( Promoter, Chairman and Whole-time Director) Deepak Agarwal

(Promoter, Managing Director) Rishabh Jain (Chief Financial Officer)

Financial Statement

Profit & Loss Statement:- (Consolidated)

| Particulars | FY20 | FY21 | FY22 | 30 June 2022 |

|---|---|---|---|---|

| Equity share capital | 24.31 | 24.31 | 24.95 | 24.95 |

| Reserves | 504.86 | 579.79 | 794.31 | 809.85 |

| Net worth stated | 529.17 | 604.10 | 819.26 | 834.80 |

| Revenue from operations | 1074.50 | 1310.75 | 1610.96 | 419.16 |

| Revenue growth % | - | 21.98% | 22.90% | 25.48% |

| Gross Margin | 30.68% | 28.52% | 27.35% | 24.37% |

| EBITDA | 94.60 | 144.77 | 139.54 | 30.79 |

| EBITDA Margin | 8.80% | 11.04% | 8.66% | 7.35% |

| PAT | 56.30 | 90.34 | 76.03 | 15.70 |

| PAT Margin | 5.25% | 6.89% | 4.72% | 3.75% |

| Current asset ratio | 2.19 | 1.45 | 1.80 | 1.77 |

| Inventory turnover ratio | 19.76 | 16.02 | 15.59 | 3.39 |

| trade receivable turnover ratio | 25.76 | 27.71 | 21.98 | 5.95 |

| ROE | 10.65% | 14.89% | 9.50% | 1.94% |

| ROCE | 12.79% | 20.88% | 13.89% | 2.63% |

| Debt/ Equity | 0.10 | 0.14 | 0.17 | 0.19 |