Belrise Industries Ltd - IPO Note

Rs. 85-90

Price range

-

Issue Period: May 21, 2025

May 23, 2025

-

Rating: Subscribe

-

Reco. Date: May 21, 2025

Stock Info

- Sensex 81518.88

- CNX Nifty 24762.80

- Face Value (Rs) 5

- Market lot 166

- Issue size Rs. 2150 cr.

- Public Issue 23.88 cr. shares

- Market cap post IPO 8008.91 cr.

- Equity Pre - IPO 65.09 cr.

- Equity Post - IPO 88.98 cr.

- Issue type Book Built Issue

Shareholding (Pre IPO)

- Promoters 99.80%

- Public 0.20%

Shareholding (Post IPO)

- Promoters 73.00%

- Public 27.00%

Data Source: Ace equity, stockaxis Research

Belrise Industries Ltd - IPO Note

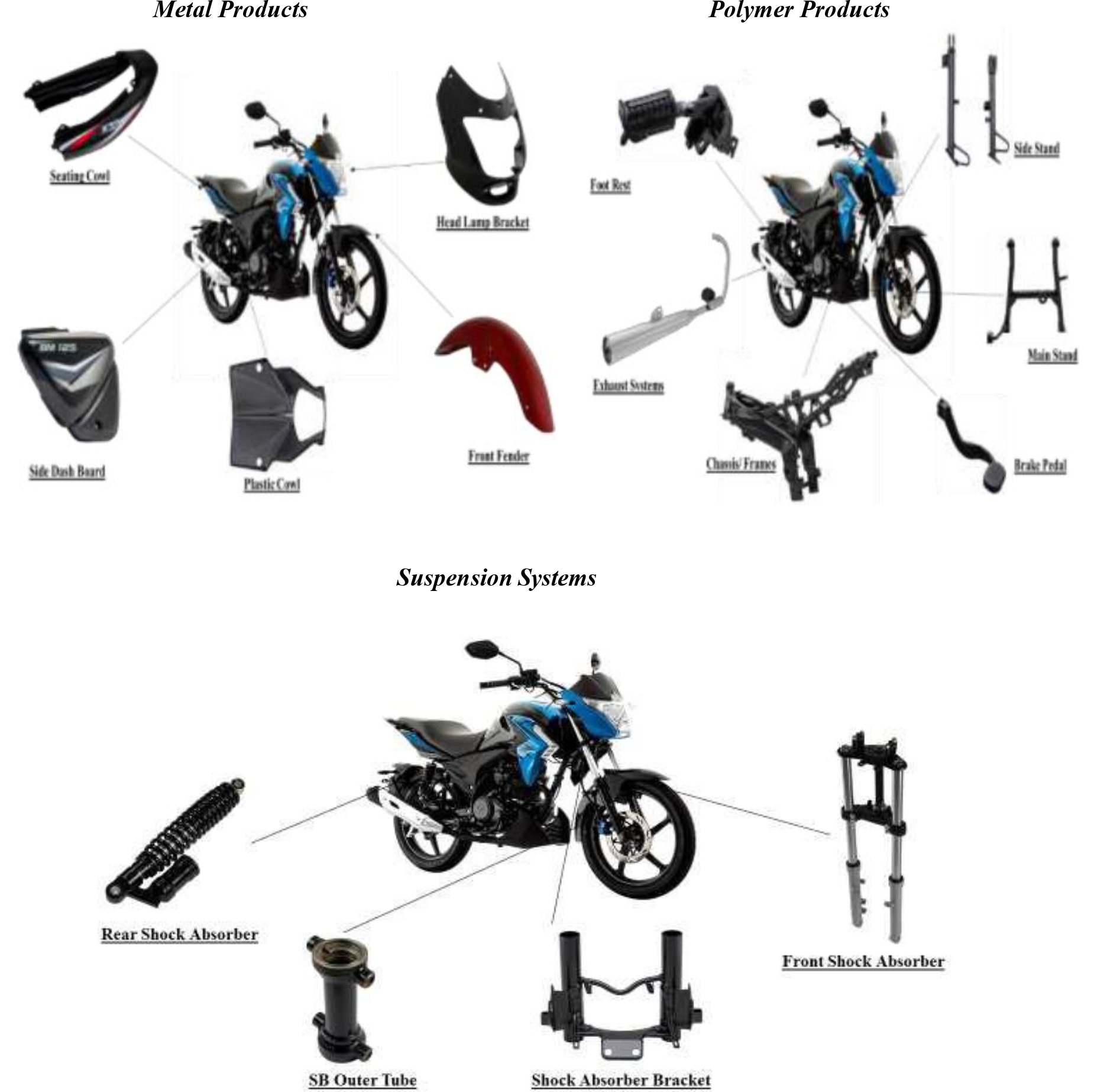

Company Profile Belrise Industries (BIL) is an automotive component manufacturing company based in India offering a diverse range of safety critical systems and other engineering solutions for two-wheelers, three-wheelers, four-wheelers, commercial vehicles and agri-vehicles. The company’s products are largely agnostic to vehicle powertrain types, reflecting its ability in catering to both electric vehicles and internal combustion engine vehicles, thus positioning it favorably to adapt to the growing electric vehicle market. The company’s product portfolio includes metal chassis systems, polymer components, suspension systems, body-in white components and exhaust systems, among others.

The company specializes in precision sheet metal pressing and fabrication and is one of the Top 3 companies with a market share of 24% in the overall 2-wheeler metal components segment in India as of March 31, 2024, in terms of revenue. The company also specializes in precision sheet metal pressing and fabrication for three-wheelers and Four-Wheelers (passenger vehicles as well as commercial vehicles). Being a well-established precision sheet metal pressing and fabrication company Belrise Industries is well positioned to capitalize on the growing two-wheeler, three-wheeler and four-wheeler markets in India and internationally.

Over the years, the company has expanded its operational capabilities to include precision sheet metal pressing and fabrication, the manufacturing of polymer components, the design and production of suspension systems, along with coating and painting services. The company’s automotive product portfolio comprises over 1,000 distinct products across chassis systems, exhaust systems, body-in-white parts, polymer components, battery containers, suspensions and steering columns, among others. The company’s product portfolio is diverse and designed to meet the varying requirements of OEMs across multiple vehicle types. As of December 31, 2024, the company markets its products both domestically and internationally, with operations extending to several key global markets including Austria, Slovakia, the United Kingdom, Japan and Thailand. The company sells its products directly to OEMs located outside of India.

Product portfolio across metal products, polymer products and suspension systems, for a motorcycle, as of December 31, 2024.

The company has established 15 manufacturing facilities across 9 cities in 8 states, as of December 31, 2024, and expanded its manufacturing capabilities through both backward and forward integration. Belrise Industries acquired H-One India Pvt. Ltd (“H-One”), the erstwhile subsidiary of H-One Company Ltd, a listed entity in Japan, in March 2025 and consequently, as of March 31, 2025, the company operated 17 manufacturing facilities across 10 cities in 9 states in India.

The company’s backward integration includes tool making, tube bending and press operations, while its forward integration encompasses system assembly, along with coating and painting. Annually, the company’s facilities process over 60,000 tons of steel, reflecting its extensive production capacity. The company has received 31 awards for quality at its manufacturing facilities, received from both customers and esteemed national and international manufacturing audit organizations. The company has a strong focus on development and process engineering to meet customer requirements. As of December 31, 2024, the company’s design, engineering and new product development team comprised 159 members, having expertise in product design, product simulation, prototyping and testing. The company has built a portfolio that includes engineering products such as heavy engineering chassis systems and air tanks, as well as proprietary products such as patented suspensions and high-precision steering columns.

Competitive Strengths

Distinguished market leader in the high-growth field of precision sheet metal pressing and fabrication within a large and growing automotive component industry Belrise Industries is one of the Top three companies with a market share of 24% in the overall two-wheeler metal components segment in India as of March 31, 2024, in terms of revenue. The two-wheeler metal products market size is projected to grow at a CAGR of ~11-13% over the next 5 years till FY2030. This enables them to realize significant economies of scale and benefit from geographic diversification, including opportunities across multiple product component markets and mitigation of customer, product and regional risks. Moreover, the global two-wheeler metal components market valued at ~Rs.1,453.85 billion in 2023 and is expected to grow at a CAGR of 3.29% to ~ Rs.1,767.28 billion in 2029. The extensive testing and validation process required by customers for purchasing automotive components such as chassis systems and air tanks, suspensions and high- precision steering columns creates a significant barrier to entry for new market entrants, making it difficult for them to establish relationships. The company has strategically established its manufacturing facilities near customer locations, allowing it to work closely with the customers to design, engineer and manufacture products tailored to their specific needs.

The company has a track record of growth and between FY 2022 and 2024; its revenues have grown at a CAGR of 17.76%. With sufficient installed capacity at its manufacturing facilities and access to land in key automotive hotspots across India, the company is well-equipped to scale its production volumes in response to customer demand. This allows the company to effectively capitalize on the expanding markets for two-wheelers, four-wheelers and commercial vehicles within the country.

Vertically integrated manufacturing facilities offering a diverse range of products The company specializes in precision sheet metal pressing and fabrication, progressively enhancing its manufacturing capabilities through both backward integration (including tool making, tube bending and press operations) and forward integration (including system assembly and coating and painting). Further, the company has strategically diversified its product offerings to polymer components and suspension systems, thereby increasing the components it supplies per vehicle and enhancing its competitive positioning in the market.

As of December 31, 2024, the company has 15 manufacturing facilities across nine cities in eight states, with capabilities to produce over 1,000 distinct products across chassis systems, exhaust systems, body-in-white parts, polymer components, battery containers, suspensions, steering columns, among others. It acquired H-One in March 2025 and consequently, as of March 31, 2025, it operates 17 manufacturing facilities across 10 cities in nine states in India. Their manufacturing facilities are strategically located in key automotive hubs in India such as Pune, Bhiwadi, Chennai and Narasapura, Karnataka, among others, which enables them to achieve cost savings in product distribution. Additionally, this proximity supports implementation of a ‘just-in-time’ inventory model that optimizes inventory levels and enhances its ability to meet OEM customers’ needs with agility.

The company has broadened its product offerings and enhanced its collaborative design and engineering services to OEMs. In FY2024, the Company sub- assembled a variety of vehicle models for Bajaj Auto. This engagement has positioned it as the largest supplier of sheet metal components to Bajaj Auto. Additionally, the company is the first supplier to establish a cathodic electro-deposition plating facility for Bajaj Auto.

Technology-enabled, innovation driven development and process engineering capabilities The company has an established track record in process engineering, and using technology it endeavors to maintain high levels of manufacturing proficiency across all its facilities. Their manufacturing facilities are equipped with several advanced features such as real-time tracking, information transparency and visualization and modularity in operations. The company has developed a variety of distinguishing capabilities across metal processing, polymer processing and suspension systems, which it utilizes in the manufacturing of its products.

- Metal Processing: The Company deploys over 700 robots for fabrication to ensure low defect parts per million and high predictability.

- Polymer Processing: For injection molding, the company deploys over 100 machines ranging up to 1,800T, incorporating critical processes such as gas-assisted injection molding, polyurethane painting and ultrasonic and vibration welding of plastic parts.

- Suspension systems: The company designs, develops and manufactures a variety of suspension components, including shock absorbers, springs, forks and steering columns, through precision machining, casting, or forging processes. The company has been granted 1 patent for its suspension designs.

The company’s design, engineering and new product development team has strength of 159 members as of December 31, 2024. The company has co-develop engineered products for customers including the complete chassis system for one of Tata Motors commercial vehicle platform and a jointly developed completely automated manufacturing line for the production of the passenger vehicle seat slider system for a major French automotive component manufacturer. The company has also established a front visor manufacturing set up for Bajaj Auto.

Largely EV-agnostic product portfolio, strategically positioned to scale in tandem with burgeoning electric vehicle market in India The company’s product portfolio includes chassis systems, body-in-white components, polymer components and suspension systems, and is agnostic to powertrain types, placing the company in a strong position to capitalize on the growth of electric vehicles while continuing to meet the demands of the internal combustion engine OEM customers.

The company supplies to its customers a diverse range of products specifically designed for electric vehicles. These products include steering columns for Bajaj Auto’s electric two-wheeler, complete underbodies for Tata Motors’ commercial vehicle models, body-in-white parts and cross car beams for a large OEM’s electric SUV models, and accessories for Honda Motorcycle & Scooter India’s e-Active model.

Longstanding customer relationships developed through years of collaboration and value addition The company has developed longstanding relationships with its customers, including global OEMs. The company’s offerings include metal chassis systems, exhaust systems, polymer components and body-in-white components. As per CRISIL, OEMs prefer multi-product vendors as they provide consistent quality standards and a rationalized supply chain network. As of December 31, 2024, the company services a total of 29 OEMs globally. The company’s top 3 OEM customers collectively accounted for 33.58%, 30.45%, 31.91%, 34.64% and 44.20% of its revenue from operations during the 9 months period ended December 31, 2024, and 2023 and FY2024, FY2023 and FY2022, respectively. Deep understanding of customer requirements allows us to develop complex products with quick turnaround times, while extensive testing and validation process required by customers purchasing automotive component products creates a significant barrier to entry for new market entrants

- Bajaj Auto: Belrise Industries is their largest sheet metal and fabricated parts supplier and the first supplier to set up a cathodic electro-deposition plating facility. The company commenced supplying products to Bajaj Auto over 15 years ago.

- Honda Motorcycle & Scooter India Pvt Ltd: The Company supplies both plastic and metal components and it is also their supplier to undertake complete chassis system manufacturing for one of their two-wheelers. The company is also the supplier of a few sheet metal components for their inaugural electric scooter. The company commenced supplying products to Honda Motorcycle & Scooter India over 12 years ago.

- Tata Motors: Belrise Industries has been a regular supplier for over the past decade. It supplies complete frame assembly for one of their commercial vehicle platforms and have been selected to assist in developing and producing chassis for one of their electric vehicle platforms.

- Jaguar Land Rover: The Company has exported more than 190 different components to their facilities in Austria, Slovakia and United Kingdom as a single-source supplier, during the 3 months period ended June 30, 2024. The company also supplies parts for their electric and hybrid vehicle models. The company commenced supplying to Jaguar Land Rover 7 years ago.

Peer Comparison

| Particulars (FY24) | Sales (Rs. cr) | Net Profit (Rs. cr) | EBITDA Margin (%) | P/ E (x) | RoE (%) | RoCE (%) |

|---|---|---|---|---|---|---|

| Belrise Industries Ltd | 7484.00 | 323.00 | 12.40 | 24.80 | 13.80 | 14.10 |

| Bharat Forge Ltd | 15682.00 | 910.00 | 16.30 | 24.10 | 12.30 | 13.10 |

| Uno Minda Ltd | 14031.00 | 925.00 | 11.30 | 59.50 | 18.90 | 19.90 |

| Mothersons Sumi Wiring India Ltd | 8328.00 | 638.00 | 12.20 | 7.50 | 35.90 | 42.50 |

| JBM Auto Ltd | 5009.00 | 194.00 | 11.70 | 17.70 | 16.00 | 14.20 |

| Endurance Technologies Ltd | 10241.00 | 680.00 | 13.00 | 53.60 | 15.50 | 18.20 |

| Minda Corporation Ltd | 4651.00 | 227.00 | 11.10 | 12.30 | 12.80 | 15.20 |

Key Risks & Concerns

Exposure to Cyclicality in the Automotive Sector - Belrise’s business is closely tied to the performance of the automotive industry, which is inherently cyclical and sensitive to macroeconomic factors such as interest rates, fuel prices, and consumer demand. Any downturn in the automotive sector-whether due to economic slowdown, regulatory changes, or shifts in technology-can directly affect the company’s sales volumes and margins.

Raw Material Price Volatility and Margin Pressure - The Company’s margins are vulnerable to fluctuations in the prices of key raw materials, especially steel and polymers. Persistent volatility in raw material prices or supply chain disruptions could erode profitability and strain working capital, impacting overall financial health.

High share of related party transactions and trading revenues - Belrise Industries has significant related party transactions with promoter group entities, which pose potential risks around governance, transparency, and conflict of interest. In 9MFY25, the company did transaction worth Rs.3,434 crores with related parties. These transactions primarily include purchases of raw materials and components from group companies (at ~Rs.1,720 crores, i.e. ~30% of total expenses) and sales to other group companies (at ~Rs.1,600 crores, i.e. ~26.5% of its consolidated revenue).

Outlook and Valuation

Belrise Industries Limited is a leading automotive component manufacturer in India, specializing in safety-critical systems and engineering solutions for two-wheelers, three-wheelers, four-wheelers, commercial vehicles, and agricultural vehicles. The company produces a wide range of products, including automotive sheet metal and casting parts, polymer components, suspension and mirror systems, metal chassis systems, body-in-white components, and exhaust systems. The company is one of the top three companies with a market share of 24% in the overall two-wheeler metal components segment in India as of March 31, 2024, in terms of revenue. Driven by rising product sales and increasing international presence, BIL has demonstrated strong growth in revenue.

Being a well-established precision sheet metal pressing and fabrication company, Belrise Industries is well positioned to capitalize on the growing two-wheeler, three-wheeler and four-wheeler markets in India and internationally. The company has demonstrated steady growth in revenues and profits, however, margins have come under pressure. To address this, BIL is focused on increasing its content per vehicle, which is expected to enhance profitability. Additionally, the planned debt repayment is likely to contribute further to margin improvement. The company’s recent acquisition is expected to enhance its product offerings and drive sales growth, contributing positively to its overall business performance.

Belrise has grown at a healthy double digit in the past and with introduction of new products aims for similar growth trajectory going forward as well. With bulk of exposure to 2W space, near term prospects at Belrise also look promising coupled with its premiumisation led content/vehicle increase at play. At the upper end of the price band, the issue is valued at 25x FY24 EPS which is reasonable as compared to its peers. Hence, we recommend SUBSCRIBE rating to the issue for the long term.

Key Information

Use of Proceeds: The total issue size is Rs.2150 cr, which is a complete fresh issue with no Offer for Sale component (OFS). The company intends to utilize a portion of the Net Proceeds for prepayment of in full or in part, of certain outstanding borrowings availed by the (Rs.1618.13) cr as of March 31, 2025 and rest Rs.531.87 cr to be utilized for general corporate purposes.

Book running lead managers: Axis Capital Limited, HSBC Securities and Capital Markets (India) Private Limited, Jefferies India Private Limited, SBI Capital Markets Limited

Management: Shrikant Shankar Badve (Managing Director), Supriya Shrikant Badve (Whole-time Director), Ashok Vishnu Tagare (Non-Independent Non-executive Director), Sangeeta Singh (Non-executive Independent Women Director), Dilip Bindumadhav Huddar (Non-Executive Independent Director), Girish Kumar Ahuja (Non-Executive Independent Director), Milind Pralhad Kamble (Non-Executive Independent Director), Arun Kumar Mallik (Chief Financial Officer)

Financial Statement

Profit & Loss Statement:- (Consolidated)

| Particulars | 9MFY25 | 9MFY24 | FY24 | FY23 | FY22 |

|---|---|---|---|---|---|

| Revenue from operations | 6013.00 | 5958.00 | 7484.00 | 6582.00 | 5397.00 |

| Other Income | 51.00 | 55.00 | 71.00 | 38.00 | 14.00 |

| Total Income | 6065.00 | 6013.00 | 7556.00 | 6621.00 | 5411.00 |

| Cost of materials consumed | 3735.00 | 3555.00 | 4685.00 | 4154.00 | 3762.00 |

| Change in Inventories Of Finished Goods, Stock ln Trade& Work in Progress | -39.00 | 44.00 | 60.00 | -50.00 | -17.00 |

| Purchase of Stock-in-trade | 1166.00 | 1235.00 | 1283.00 | 1149.00 | 474.00 |

| Employee benefits expense | 225.00 | 199.00 | 275.00 | 236.00 | 223.00 |

| Finance costs | 243.00 | 222.00 | 290.00 | 250.00 | 216.00 |

| Depreciation and amortisation expense | 247.00 | 233.00 | 321.00 | 307.00 | 246.00 |

| Other Expenses | 181.00 | 175.00 | 257.00 | 218.00 | 199.00 |

| Total Expenses | 5758.00 | 5662.00 | 7171.00 | 6264.00 | 5103.00 |

| Profit / (Loss) before exceptional items and tax | 306.00 | 351.00 | 384.00 | 357.00 | 307.00 |

| Exceptional items | 0.00 | 0.00 | 12.00 | 0.00 | 0.00 |

| Profit/(Loss) before tax | 306.00 | 351.00 | 372.00 | 357.00 | 307.00 |

| (1) Current tax | 63.00 | 64.00 | 77.00 | 60.00 | 40.00 |

| (2) Short/(Excess) Provision Previous Financial Year | 5.00 | 2.00 | 2.00 | 1.00 | 4.00 |

| (3) Deferred tax | -7.00 | -13.00 | -17.00 | -17.00 | 2.00 |

| Profit/(Loss) for the period | 245.00 | 298.00 | 311.00 | 314.00 | 262.00 |

| EPS (Rs.) | 2.80 | 3.30 | 3.60 | 3.50 | 2.90 |