Barbeque Nation Hospitality Limited - IPO Note

Chain Casual Dining

Barbeque Nation Hospitality Limited - IPO Note

Chain Casual Dining

Stock Info

Shareholding (Pre IPO)

Shareholding (Post IPO)

Key Strengths

One of the Fastest Growing and Recognised Restaurant Brands

The company has grown its owned and operated Barbeque Nation Restaurant network

from a single restaurant in 2008 to 147 Barbeque Nation Restaurants across 77 cities

in India and 6 International Barbeque Nation Restaurants in three countries outside

India as of December 2020. Additionally, as of December 2020, it has granted franchise

rights in respect of one Barbeque Nation Restaurant.

| Year | No. of owned & operated BBQ Nation Restaurants added | Total owned & operated BBQ Nation Restaurants | No. of cities added in India | Total Cities in India | Number of States in India | Total States in India |

|---|---|---|---|---|---|---|

| FY17 | 13 | 79 | 11 | 40 | 4 | 19 |

| FY18 | 23 | 102 | 20 | 60 | 3 | 22 |

| FY19 | 24 | 126 | 8 | 68 | 1 | 23 |

| FY20 | 21 | 150 | 9 | 77 | 1 | 24 |

| 9MFY21 | - | 147 | 1 | 77 | - | 24 |

Source: Company RHP

Steady Growth in Covers and Consistent Average Per Cover (APC)

In recent financial years, the company has experienced consistent cover growth.

The number of in-dining covers served at BBQN Restaurants in India increased from

6.86 mn in FY17 to 9.92 mn in FY20, a growth of 13.08% CAGR. In addition to its

consistent cover growth, the APC for dine-in customers at BBQN Restaurants in India

(excluding food delivery) has grown from Rs. 707 in FY17 to Rs. 764 in FY20 at a

CAGR of 2.62%. Its business was significantly impacted due to Covid-19 pandemic,

which led to its restaurants being temporarily closed, therefore impacting its covers

and sales.

| Yea | Number of Covers (Consolidated) | APC (in. Rs) | |

|---|---|---|---|

| (in Mn.) | YoY (%) | ||

| FY17 | 6.90 | 21 | 710 |

| FY18 | 7.79 | 13 | 750 |

| FY19 | 9.23 | 19 | 793 |

| FY20 | 10.38 | 12 | 789 |

| 8MFY21 | 2.03 | NA | 809 |

Source: Company RHP

Excluding taxes, the average bill size for BBQN Restaurants owned and operated in India was Rs. 3,026, Rs. 3,215, Rs. 3,249 and Rs. 2,757 in FY18, FY19, FY20 and 8MFY21, respectively. Its weekday covers from BBQN Restaurants were 48.7%, 48.4%, 48.6% and 53.4% of its total covers in India in FY17, FY18, FY19 and FY20, respectively. Further, lunch covers at its BBQN Restaurants in India were 45.0%, 45.5%, 46.1% and 44.4% of its total covers in FY17, FY18, FY19 and FY20, respectively.

Attractive Offerings Based on Menu Innovation and Customer Focus

The company offers new menu options, both vegetarian and non-vegetarian, based on

Indian cuisine and use seasonal customer preferences to introduce new dishes. Also,

it runs food festivals at BBQN Restaurants, thereby offering its customers a range

of Indian and international cuisines. Its fixed price ‘all you can eat’

concept at its BBQN Restaurants offers its customers a varying spread of food at

a value-oriented price in a casual dining environment.

It constantly endeavours to increase the number of live counters at its BBQN Restaurants, offering its customers customised dishes prepared in accordance with their requests. Recently, it has diversified into the Italian food segment pursuant to acquisition of 61.35% of the share capital of Red Apple, which operates 11 Italian Restaurants in three cities in India. This acquisition has enabled the company in diversifying its brand, cuisine and customer segment. BBQN places a strong emphasis on customer reviews and feedback. It gathers daily feedback across multiple satisfaction parameters from the previous day’s transactions. The current Guest Satisfaction Index criteria include areas such as ambience, hygiene, reservation experience, food and beverage quality and restaurant service.

Strong Business Processes and Back-end Systems Leading to Efficient Operations

The company benefits from processes and systems that have been established over

the last 14 years. It has been successful in opening BBQN Restaurants without typically

paying high street premium rentals. On a consolidated basis, its rent to revenue

ratio was 10.58%, 11.63%, 12.46% and 18.26% for FY18, FY19, FY20 and 8MFY21, respectively.

The company conducts regular audits to check food quality and service standards.

As of December 2020, it had two commissaries, which serve a number of nearby BBQN

Restaurants by preparing dishes on a volume basis.

The company’s Central Reservation System (CRS) synchronised system allows it to track all reservations for BBQN Restaurants centrally, with all interconnected booking systems feeding the central cloud database. It has integrated in-house business intelligence software, which allows it to track restaurant-wise data for BBQN Restaurants at a granular level. The software has a direct interface with its ERP system for BBQN Restaurants, which is designed to handle and streamline the workings of financials, inventory, warehousing, sales, purchases and manufacturing and enhance the ability to predict trends and business data through advanced detailed reporting.

Industry

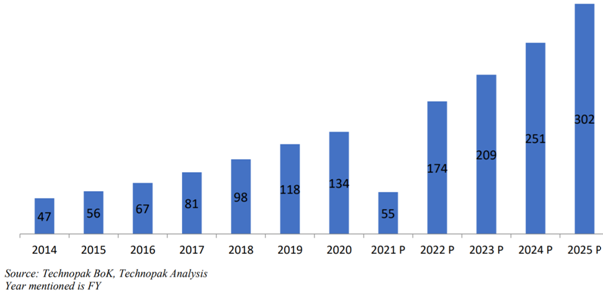

The Chain Casual Dining market in India has been thriving over the last few years. The Chain CDR segment represents the 2nd largest share in the chain food services market in India after QSR. Exhaustive menus, quality food, high focus on presentation and the presence of specific cuisines are all features of the CDR segment. In FY20, the size of the Chain Casual Dining market is estimated at Rs. 134 billion. Further, the segment is expected grow at a healthy CAGR of 18% to reach Rs. 302 billion by FY25.

North Indian cuisine contributes highest share of 26.6% to the Indian organised food services market followed by Chinese at 19% and South Indian of 7.7% cuisines. North Indian restaurants brands are fuelling the growth of casual dine space. Due to their regularity among different restaurants formats, these cuisines have broad appealing among consumers. Also, factors such as young population, increase in working women, rise in disposable income are aiding the growth of Indian Food Services market.

Currently, the chain CDR segment has ~4,700-5,200 outlets in FY20 across India compared to ~1800-2000 in FY14. With the diminishing lines between each format type, some players from the QSR and FDR segment have started venturing into the chain CDR segment. These transitions between various players within the chain CDR market have only added to its burgeoning growth.

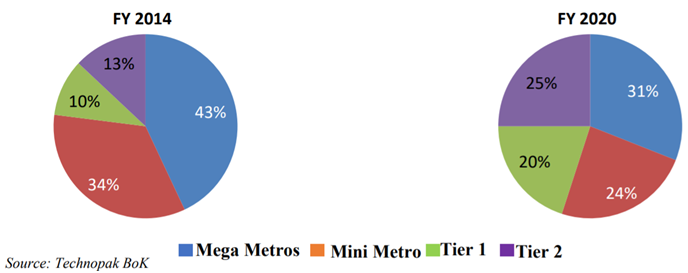

Mega Metros have the highest presence of chain CDR outlets at 31% while Mini-metros are next with a share of 24%. The remaining 45% market share is accounted for by Tier I and Tier II cities. However, with existing higher penetration in Metros and Tier I cities, most of the chain CDR formats have taken cue from the QSR players like Domino’ s and McDonald’s and have ventured into Tier I & II cities.

Chain Casual Dining Market: Key Trends

Varied Offerings and Shifting Consumer Need to Drive CDR Market

- The Chain CDR segment based on its varied cuisine offerings along with higher APC, has more chances of a faster growth as compared to other food services segments. QSRs have a price and volume advantage over CDRs. However, the same is anticipated to undergo changes in the coming years based on shifting consumer habits, higher disposable income, increasing experimentation and urge to try new & different things.

- The Indian consumer is becoming demanding and gets bored with one type of restaurant food very fast and is continually looking for different options and newer concepts. This nature has reduced the life of a restaurant to 7-8 years from 10-12 years a decade back. To cater to this changing ecosystem, the brands have to continuously offer something different.

Multiple Brands vs. Single Brand

The brands operating in the Chain CDR segment are continuously introducing newer

concepts based on ambience and food offerings. These brands are just not limiting

to a single brand or format and are venturing into different formats. Companies

like Massive Restaurants, Impresario Hospitality and Specialty Restaurants not only

have different brands in the same formats but are also venturing into different

formats.

Streamlined Standard Operating Procedures

With high focus on craftsmanship and fresh produce, the format of Chain CDR with

limited usage of standardized products in the ready to cook, restricts the fast

scalability of this format along with expansion in smaller cities. CDR brands can

also expand at a faster pace without the backing of centralised commissary and supply

chain.

Efficiency Staff Development Initiatives

It would be important for the brands to communicate the same to its staff through

regular training programme. Most of the home-grown brands have started investing

in various training programmes for their staff at regular intervals. These training

programmes by brands are also helping in reducing the attrition rate and attracting

new talent.

The Digital Connect

Food services are increasingly using options like website, social media platforms,

apps etc. for continuously communicating with consumers. The instant turnaround

time is one of the biggest advantages of digital media over traditional media. The

offers, incentives, product information, and promotions can be communicated in real

time and the responses are also received quickly. Brands are also able to see feedback

and reviews generated by consumers instantly and are able to take immediate corrective

actions and carry out recoveries.

Peer comparison

| Name of the Company | Mcap | Total Revenue (FY20) | Basic EPS | RoNW (%) | Mcap/Sales |

|---|---|---|---|---|---|

| Barbeque-Nation Hospitality Limited | 1877.00 | 850.80 | -11.77 | NA | 2.20 |

| Jubilant Foodworks Limited | 37999.00 | 3996.90 | 21.22 | 24.95% | 9.50 |

| Westlife Development Limited | 7286.00 | 1560.80 | -0.47 | NA | 4.70 |

| Burger King India Limited | 5260.00 | 846.80 | -2.87 | NA | 6.20 |

| Speciality Restaurants Limited | 211.00 | 368.10 | -8.09 | NA | 0.60 |

Risks

- In spite of an increasing number of Barbeque Nation Restaurants and growth in consolidated revenues, the company has incurred losses in some of the recent fiscal years. As per financial data the company has posted a cumulated loss of Rs. 154.78 crores for the last 32 months.

- The company faces competition from the restaurant industry in general and particularly from the CDR market (organised as well as unorganised) and potential new entrants to the CDR market.

- The company’s Same Store Sales Growth (SSSG) on a standalone basis has been declining from 7.2% in FY18 to -2.8% in F20. If the company is unable to maintain consistent in same restaurant sales growth, its operational results could be adversely impacted.

- The company’s revenue is subject to seasonal variation as it typically receives higher revenues between September to March.

- The company has undertaken a Pre-IPO Placement of 5,951,132 Equity Shares at a price of Rs. 252 per share, aggregating to ~150 crores. Current IPO is at Rs 500

- The company has a leveraged balance sheet. As of November 2020, the company has a total borrowing of Rs. 173.34 crores. Though, the company has proposed to prepay/repay Rs 75 cr in FY22 out of proceeds of the IPO issue, the total debt of the company will still remain elevated. As of September 2020, BBQN has a negative net worth of Rs. 11.62 crores.

- The company generates substantial amount of revenue from three cities (Delhi NCR, Mumbai and Bengaluru). As of 8MFY21, it generated 30% of revenues from these three cities. The concentration of revenues generated from these areas enhances its exposure to developments related to competition as well as economic, political, demographic and other changes in these 3 cities.

- One of the company’s Promoters and Directors, Raoof Dhanani, is involved in a criminal proceeding and in an insolvency proceeding. Any adverse decision in these matters could have an indirect impact on the reputation and business of the company.

Company Description

Barbeque-Nation Hospitality Limited (BBQN) owns and operates Barbeque Nation Restaurants and International Barbeque Nation Restaurants. Also, it owns and operates Toscano Restaurants and UBQ by Barbeque Nation Restaurant. Steadily, the company has grown its owned and operated Barbeque Nation Restaurant network from a single restaurant in 2008 to 147 restaurants across 77 cities in India and six international restaurants in three countries as of December, 2020. Further, the company’s subsidiary, Red Apple, owns and operates nine restaurants under the brand name, Toscano, a casual dining Italian restaurant chain and operates one restaurant each under the brand names La Terrace and Collage respectively. The acquisition of Red Apple has enabled BBQN to diversify its brand, cuisine and customer segment beyond its flagship concept of ‘over the table barbeque’. Also, it periodically run food festivals at its restaurants, offering its guests a range of Indian, international and fusion cuisines.

Valuation

Barbeque Nation Hospitality Limited is India’s one of the fastest growing and well-recognised restaurant brands. However, we believe there are several risks involved in the business. The company has a high leveraged balance sheet and its net worth as of November 2020 is negative. Though the company has proposed to repay/prepay certain borrowings from the proceeds of the fresh issue, the debt will still remain elevated. The company has been continuously raising capital which signals that it needs to keep raising cash, investing/burning it to stay relevant and clock growth.

Further, the company has been making losses despite an increase in number of restaurants and revenue growth on a consolidated basis. It operates in a competitive business environment and its business model does not have any moat. Therefore, intense competition could result into market share loss, loss of revenue due to pricing pressure and decrease in demand. It has made a pre-IPO placement at Rs. 252/share two months before the issue and is now bringing the IPO at Rs. 500. At the upper price band of Rs. 500, the issue is valued at 2.2x of Mcap/Sales of FY20. We recommend to ‘Avoid’ the issue.

Key Information

Use of Proceeds:

The company has proposed to utilise the proceeds from the fresh issue for capital

expenditure for expansion and opening of the new restaurants, prepayment or repayment

of all or a portion of certain outstanding borrowings availed by the Company on

a consolidated basis and general corporate purposes.

Book running lead managers:

IIFL Securities Limited, Axis Capital Limited, Ambit Capital Private Limited and

SBI Capital Markets Limited.

Management:

T Narayanan Unni (Chairman, Non-Executive Director and Independent Director), Kayum

Dhanani (Managing Director), Rahul Agrawal (Whole-time Director and CEO) and Amit

V. Betala (CFO).

Financial Statement

Profit & Loss Statement:- (Consolidated)

| Particulars (Rs. in Crores) | FY18 | FY19 | FY20 | As at November 2020 |

|---|---|---|---|---|

| Revenue from Operations | 586.34 | 739.02 | 846.97 | 201.00 |

| EBITDA as stated | 140.37 | 149.39 | 168.04 | 12.59 |

| EBITDA (%) as stated | 23.77% | 20.12% | 19.75% | 5.32% |

| Adj. EBITDA as stated | 82.39 | 77.73 | 78.25 | -52.17 |

| Adj. EBITDA (%) as stated | 13.95% | 10.47% | 9.20% | -22.05% |

| Profit Before Tax | 19.16 | -6.82 | -25.14 | -126.50 |

| Net Profit/(Loss) for the Period | -5.80 | -38.39 | -32.93 | -100.65 |

| Net Profit/(Loss) (%) as stated | -0.98% | -5.17% | -3.87% | -42.54% |