Anupam Rasayan India Limited - IPO Note

Chemicals

Anupam Rasayan India Limited - IPO Note

Chemicals

Stock Info

Shareholding (Pre IPO)

Shareholding (Post IPO)

Key Strengths

Strong and Long-Term Relationships with Diversified Customers Across Geographies

The company has developed strong and long-term relationships with various multinational

corporations that has aided in expanding its product offerings, processes and geographic

reach. Its customers are engaged in various industries including agrochemicals,

personal care, pharmaceuticals, specialty dyes & pigments, and polymer additives,

and spread across various geographies, which helps the company to mitigate risks

resulting from customer, industry and geographic concentration.

It has established relationships with various multinational corporations like Syngenta Asia Pacific Pte. Limited, Sumitomo Chemical Company Limited and UPL Limited, across Europe, Japan, United States and India. During 9MFY21, the company has manufactured products for over 53 domestic and international customers, including 17 multinational companies. Its custom synthesis and manufacturing agreements are long-term in nature, where the validity of the contract ranges between 2 – 5 years, with certain agreements being automatically renewed for a period of one year at a time.

Core Focus on Process Innovation Through Consistent R&D, Value Engineering

and Complex Chemistries

The company’s focus on process innovation through continuous R&D and value

engineering has aided in its growth and improved its ability to customize products

as well as cost reduction. Its R&D is focused on enabling to perform multi-step

synthesis as well as developing in-house processes and identifying complex chemistries.

The company has in-house R&D facility and a pilot plant located at Sachin, Gujarat,

which is equipped with laboratories engaged in process development, process innovation,

new chemical screening and engineering, which assists the company in pursuing efficiencies

from the initial conceptualization up to commercialization of a product. Its in-house

R&D facility is recognised by the department of scientific and industrial research.

The company’s R&D team has successfully carried out multi-step synthesis and scale-up for several new molecules in the area of life sciences related specialty chemicals and other specialty chemicals, and as a result, its commercialized product portfolio has expanded from 25 products in FY2018 to 41 products in 9MFY21. It is one of the leading companies in manufacturing products using continuous and flow chemistry technology on a commercial scale in India. The continuous process technology has distinct advantages over the traditional batch process in reducing the batch cycle time of a chemical production process and making the process safer and environment friendly as well as energy and cost efficient.

Diversified and Customized Product Portfolio

Over the years, the company has diversified, expanded and evolved its operations

from a manufacturer of conventional products into custom synthesis and manufacturing

of life science related specialty chemicals and other specialty chemicals. Its life

science related specialty chemical products cater to the agrochemicals, personal

care and pharmaceuticals industries, while its other specialty chemicals cater to

specialty pigments and dyes, and polymer additives industries. Its commercialized

product portfolio primarily consisting of products that is manufactured using in-house

innovative processes, which enables it to cater to a wide range of customers in

domestic and international markets. Additionally, its diversified product portfolio

allows for limited dependence on individual products, helps counter seasonal trends

and addresses different business cycles across industries.

The backward integration enables the company to reduce its reliance on imports, third-party supplies & logistics costs, provides flexibility to control manufacturing processes and improve operating margins, while the forward integration in operations enables the company to innovate processes, customize products and broaden its product offering to meet the needs of the customers.

Automated Manufacturing Facilities with Focus on Environment, Sustainability,

Health and Safety

Currently, the company has six manufacturing facilities located in Gujarat, with

four facilities located in Sachin and two facilities located in Jhagadia with an

aggregate installed capacity of 23,438 MT, as of December, 2020. In manufacturing

operations, the company provides large-scale custom synthesis and manufacturing

services, offer multi-step synthesis and undertake complex chemical reactions. Its

automated manufacturing facilities enables in manufacturing a diverse range of products,

minimise the number of employees, and as a result, reduce cost and human error.

Further, its facilities are supported with sophisticated analytical infrastructure,

which enables the company to provide accurate analysis to its customers.

The company has made capital expenditure in maintaining and growing its existing infrastructure, purchase equipment, and develop and implement new processes and technologies in its manufacturing facilities. Between FY18 to 9M FY21, the company has done the capital expenditure of ~Rs. 800 crores. Additionally, the manufacturing facilities are multi-purpose that allows a level of flexibility enabling it in manufacturing a range of products and provide the ability to modify and customize product portfolio.

Its Jhagadia Unit – 4 is ISO 14001:2015 certified for environment management systems and ISO 45001:2018 certified for occupational health and safety management system, while its Sachin Unit – 1, 2 and 3 have received ISO 9001: 2015 quality management systems certification. The processes are defined and introduced at its facilities only after hazard and operability studies have been performed before commencing commercial production of a new product. It has also implemented various distillation and filtration systems as well as new chemical technologies and heat exchangers to minimise water pollution and waste.

Consistent Financial Performance

The Company’s topline has registered a CAGR of 24.22% during FY18 –

FY20 and stood at Rs. 528.88 crores in FY20. Despite economic headwinds due to covid-19

pandemic, the company was able to post a revenue growth of ~45% during 9MFY21 compared

to 9MFY20. Revenues and profitability are not expected to be materially impacted

during the current fiscal. The company’s EBITDA has grown at a CAGR of 35.44%

during FY18 – FY20. The EBITDA Margins have grown from 21.54% in FY18 to 25.51%

in FY20. Further, the PAT margins of the company have been constant at ~10% and

it is expected that the margins to improve on the back of lower finance costs, a

result of repayment/prepayment of certain debt from issue proceeds.

Industry

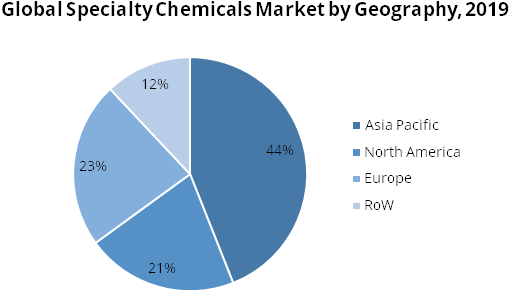

Specialty chemicals are low-volume and high-value products which are sold on the basis of their quality or utility, rather than composition. Thus, they may be used primarily as additives or to provide a specific attribute to the end product. Specialty chemicals are more likely to be prepared and processed in batches. The focus is on value addition to the end-product and the properties or technical specifications of the chemical. Rapid industrialization in India and China is expected to drive demand for specialty chemicals. The Asia-Pacific region dominates the market across the world, with a share of 44%, owing to the large customer base, leading to high demand for specialty chemicals, increasing industrial production, and robust growth of the construction sector in the region. The Asia-Pacific region is followed by Europe and North America. Out of the total international chemical industry, the global specialty chemicals industry only constituted ~12% in FY18 and is expected to grow at a CAGR of ~13% from FY18 - FY25.

Source: Company RHP

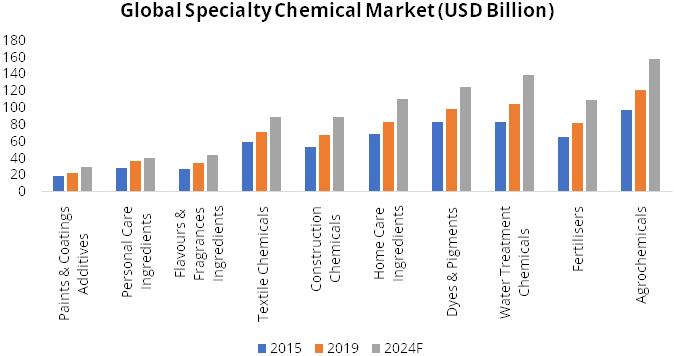

Specialty chemicals industry can be categorized into a mix of end-use driven segments and application-driven segments.

Source: Company RHP

Capacity utilization had reduced to ~40% - 60% during the peak of the Covid-19 pandemic and lockdown in April to June 2020 due to labour shortages and disruptions in the supply of raw material. Demand for chemicals for automotive, transportation and consumer products sectors also reduced by ~30%. Products that are less exposed to the price of oil have seen stable prices whereas crude dependents have significantly impacted.

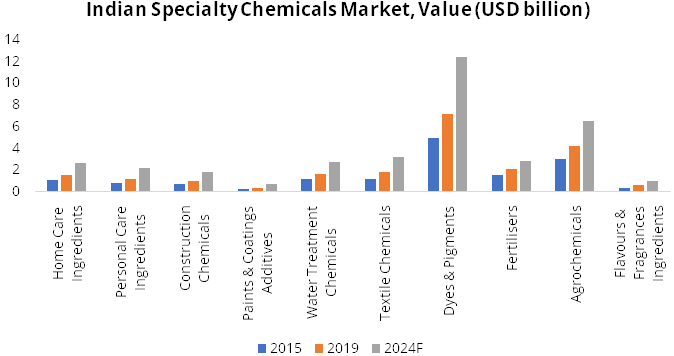

The Indian chemicals market is valued at ~USD 200 billion in 2019 with basic chemicals, also known as commodity chemicals or bulk chemicals, accounting for majority share of 56%. The specialty chemicals industry is driven by both domestic consumption and exports. India’s specialty chemical companies are gaining favour with international multinational companies on account of the geo-political shift after the outbreak of Covid-19 as the world looks to reduce its dependence on China. Currently, China accounts for ~17% - 18% of the world’s exportable specialty chemicals, whereas India accounts for only 1% - 2%, indicating that India has a large scope of improvement and widespread opportunity. It is anticipated that specialty chemicals will be the next export pillar for India. Overall, the specialty chemicals industry is likely to continue to perform well in the near to medium term and is expected to capitalize on the ‘Make in India’ benefits to assume leadership position in the market.

Source: Company RHP

Exports are on the rise, as India is becoming a central manufacturing hub for such chemicals. Tightening of environmental norms, such as, registration, evaluation, authorisation and restriction of chemicals regulations, in developed countries and the slowdown of China are contributing to the growth of exports. China’s specialty chemicals market has seen a downturn in recent years due to various factors. Most prominent being the introduction of stringent environmental norms. Tightening environmental protection norms added additional operating costs and led to factory closures in high-polluting sectors, which weighed on industrial production.

In terms of region-wise demand, India’s specialty chemicals industry is expected to experience a CAGR of ~10% - 11% over the next five years compared with other markets, due to rising demand from end-user industries, along with tight global supply on account of stringent environmental norms in China. Markets like the USA, Europe and Japan are expected to register a CAGR of less than 3% over the next five years, due to industry saturation in these regions. The recent downturn observed in China’s specialty chemicals industry is serving as an opportunity for Indian manufacturers, who have now gained a cost advantage over their Chinese counterparts.

Risks

- The company derives a significant portion of its revenue from certain customers. Therefore, any loss of one or more customers or decrease in their demand for the company’s products could adversely affect its business. For instance, revenues generated from sales to top 10 customers represented 86.65% and 84.01% of revenue from operations in FY20 and 9MFY21.

- The company faces competition from both domestic as well as multinational corporations. Therefore, inability of the company to effectively compete with existing players, could result in the loss of market share which could in turn adversely impact its business and financial conditions.

- A significant proportion of the company’s revenues are derived from life science related specialty chemicals segment and any reduction in the demand for such life sciences products could impact on its business and profitability.

- A significant portion of the company’s revenues are derived from a limited number of markets and any adverse developments in these markets could impact its business and profitability.

- The company is subject to interest rate risk as well as foreign exchange rate risk which could adversely impact its business, financial condition and results of operations.

Company Description

Anupam Rasayan India Limited is one of the leading companies engaged in the custom synthesis and manufacturing of specialty chemicals in India. It commenced business as a partnership firm in 1984 as a manufacturer of conventional products and have evolved into custom synthesis and manufacturing of life science related specialty chemicals and other specialty chemicals for a diverse base of Indian and global customers. It has two distinct business verticals: I) life science related specialty chemicals comprising products related to agrochemicals, personal care and pharmaceuticals, and II) other specialty chemicals, comprising specialty pigment and dyes, and polymer additives.

The company has developed long-term relationships with various multinational corporations, including Syngenta Asia Pacific Pte. Limited, Sumitomo Chemical Company Limited and UPL Limited, that has helped it in expanding product offerings and geographic reach across Europe, Japan, United States and India. During 9MFY21, it has manufactured products for over 53 domestic and international customers, including 17 multinational companies. The company has expanded its commercialized product portfolio from 25 products in FY18 to 41 products in 9MFY21. It operates six multi-purpose manufacturing facilities in Gujarat with four facilities located at Sachin and two at Jhagadia with an aggregate installed capacity of 23,438 MT.

Valuation

Anupam Rasayan India Limited has established market position in the specialty chemical business, which is backed by a healthy product portfolio, strong clientele, and long-term contract manufacturing agreements with customers. The strong and reputed customer base includes Sumitomo, Syngenta, UPL, etc. The company’s continuous focus on R&D has aided in widening the product portfolio (from 15 in FY15 to 41 during 9MFY21), cater to a larger customer base, and thereby, achieve revenue growth over the past few years. Since the company operates in the essential segment, its manufacturing operations have not been materially impacted due to the covid-19 induced lockdown and therefore the revenues and profitability are not expected to be materially impacted during the current fiscal. At the upper price band of Rs. 555, the issue is valued at 46.4x of FY22E earnings. We recommend to subscribe the issue.

Key Information

- Use of Proceeds:

The net proceeds are proposed to be utilised towards Repayment/prepayment of certain indebtedness availed by the company and general corporate purposes. - Book running lead managers:

Axis Capital Limited, Ambit Private Limited, IIFL Securities Limited and JM Financial Limited - Management:

Dr. Kiran C Patel (Chairman and Non-Executive Director), Mona A Desai (Vice Chairman and Whole-time Director), Anand S Desai (Managing Director), Milan Thakkar (Non-Executive Director) and Afzal Malkani (CFO).

Financial Statement

Profit & Loss Statement:- (Consolidated)

| Particulars (Rs. in Crores) | FY 2018 | FY 2019 | FY 2020 | FY 2021E | FY 2022E |

|---|---|---|---|---|---|

| Revenue from Operations | 341.43 | 501.50 | 528.88 | 699.22 | 839.22 |

| COGS | 153.52 | 257.08 | 210.53 | 283.18 | 335.69 |

| Gross Profit | 187.91 | 244.41 | 318.35 | 416.04 | 503.53 |

| Gross Profit Margin (%) | 55.04% | 48.74% | 60.19% | 59.50% | 60.00% |

| Employee Benefits Expense | 15.92 | 18.59 | 20.95 | 27.00 | 29.00 |

| Other Expenses | 98.45 | 132.69 | 162.50 | 203.47 | 250.93 |

| EBITDA | 73.54 | 93.14 | 134.90 | 185.56 | 223.61 |

| EBITDA Margin (%) | 21.54% | 18.57% | 25.51% | 26.54% | 26.64% |

| Depreciation, Amortization and Impairment Expenses | 17.57 | 22.53 | 28.71 | 52.00 | 59.00 |

| EBIT | 55.97 | 70.61 | 106.19 | 133.56 | 164.61 |

| Finance Cost | 13.96 | 24.35 | 45.32 | 57.60 | 21.87 |

| Other Income | 7.76 | 19.46 | 10.51 | 25.00 | 17.00 |

| Profit Before Tax | 49.77 | 65.72 | 71.37 | 100.96 | 159.73 |

| Tax Expenses | 9.42 | 15.51 | 18.40 | 25.41 | 40.21 |

| Profit After Tax | 40.34 | 50.21 | 52.98 | 75.55 | 119.53 |

| Share of Net Profit/(Loss) of Associates | 0.97 | -0.96 | - | - | - |

| Profit After Tax and Share of Profit of Associates | 41.31 | 49.25 | 52.98 | 75.55 | 119.53 |

| PAT Margin (%) | 12.10% | 10.01% | 10.02% | 10.80% | 14.24% |

| EPS | 6.59 | 6.60 | 6.94 | 7.56 | 11.96 |