Antony Waste Handling Cell Ltd - IPO Note

Other

Antony Waste Handling Cell Ltd - IPO Note

Others

Stock Info

Shareholding (Pre IPO)

Shareholding (Post IPO)

Competitive Strength

Leading player in the MSW management industry

The company is one of the top 5 players in the Indian MSW management industry and

among the key players in landfill construction and management sector with in-house

expertise for landfill construction along with its management. They are also present

in the emerging waste management area in India which is MSW based WTE. They have

developed internal capabilities across various stages of solid waste management

projects, commencing from collection to disposal, which has enabled them to grow

into a comprehensive service provider. In addition to significantly expanding their

scale and scope of operations, they have enhanced their geographic footprint across

India.

Reasonable track record of MSW project execution.

Antony Waste has a reasonable track record of 19 years in executing solid waste

projects. They primarily undertake specialized MSW C&T projects, MSW Processing

projects and mechanized sweeping projects for municipalities and private players.

Having undertaken more than 25 projects as of November 15, 2020, of which 18 are

on-going, they have a demonstrated track record as a comprehensive service provider

equipped with the resources to handle large-scale projects for municipalities and

private players.

Diversified project portfolio.

In this industry, the number, size and duration, of simultaneously on-going projects

is considered an indicator of future performance since they provide an indication

of anticipated future revenue. The company’s project portfolio is diversified

across services provided, counterparties, project duration, nature of contracts

and geographical areas where they operate. By diversifying its internal capabilities

and on-going project portfolio across multiple municipalities with favourable dynamics,

they have been able to pursue a broader range of projects in urban or semi-urban

areas with limited counter-party risk, and therefore, optimize its business volume

and operating margins. Its project contracts have different time periods, thus expire

at different times, thus de-risking its business model by giving them a staggered

revenue stream.

Latest technology tools, vehicles, and equipment to manage the operations efficiently

The company has consistently invested in its fleet of vehicles. As of November 15,

2020, they had a fleet of 1,147 vehicles of which 969 were equipped with GPS technology,

which allows them to operate its projects efficiently. The vehicle ownership provides

them with a competitive advantage and helps them meet its service level commitments

in a cost-effective manner. They have also equipped most of their fleet with GPS

tracking devices, to actively monitor movement of its vehicle fleet. Easy access

to and high availability of modern fleet enables the company to undertake complex

and challenging projects and complete its projects efficiently and profitably.

Experienced team of promoters with domain expertise

The individual Promoters, namely Jose Jacob and Shiju Jacob associated with the

company since its incorporation, have an experience of more than 19 years in the

solid waste management industry. Further, 2 of its Promoters also serve as Whole

Time Directors on its Board and have been intrinsically involved in the business

operations. They have a qualified key management team, with diversified experience

in the areas of operations, logistics, marketing and finance, which assists the

Board in implementing its business strategies. They will continue to leverage the

experience of its Promoters and management team and their understanding of the solid

waste industry, to take advantage of current and future market opportunities.

Key business strategies

Continue with rational selection of projects and strategically expand the geographical

footprint

The company is currently undertaking projects in multiple States / Union Territories

and they will continue to expand into states with high GDP, growing urbanization,

high standard of living, favourable geographic and climatic conditions. Traditionally

in India, municipal waste management services have been controlled by relevant municipal

corporations with only 30-35% being managed by professional waste management players.

While, the trend toward privatization has grown slowly since 2013, with the Central

Government’s push (through Swachh Bharat Mission and Smart City Mission) more

and more municipalities will move towards privatization in coming years.

Moving up the MSW value chain by increasing the presence in the emerging waste

management areas in India

The company believe that with assured raw material and a power off-take agreement,

the business offers limited risks and will help in improving predictability of its

cash-flows. Waste segregation is considered a crucial activity as it involves separation

of organic waste from recyclables and inert materials. They, through their step-down

subsidiary Antony Lara Renewables Energy Pvt. Ltd.(“ALREPL”), has been

awarded a contract for setting up and operating a WTE plant having a capacity of

up to 1,000 TPD by PCMC. The company is currently engaged in bio-mining at its Kanjurmarg

site, as this forms an integral part of its bio-reactor landfill. There is huge

scope for Bio-mining projects since most of metro, tier 1 and tier 2 cities have

dumping sites with 15+ years and need to clear the legacy waste for new waste dumping

in the site which will attract more organized companies to invest for Bio-mining

projects across pan India

Industry

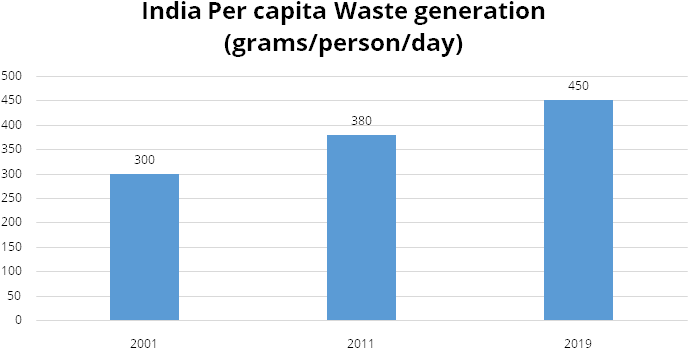

Indian municipal solid waste management services market is a Rs 5000 crores industry which is expected to grow at reasonable space driven by increase in urban population, changing consumption patterns, improved awareness of modern methods of waste management, increased participation by private players and investments by ULBs towards scientific disposal of such waste. In India, municipal solid waste is managed in two ways: Centralized and Decentralized Waste Management approaches. The centralized approach is also termed as Integrated Solid Waste Management and is a technology-driven system for handling bulk wastes at a central processing facility. At the processing facility, value is derived out of waste in the form of compost, incineration, Refuse Derived Fuel (RDF), plasma gasification, and biomethanation. Cities such as Mumbai, Delhi, Navi Mumbai, Pune, Hyderabad and Guwahati have adopted this approach where all services are bundled across the value chain ensuring economies of scale and commercial viability. In the decentralized method, waste is managed by various small waste management centres within the locality. These centres are run by either profit-making or not-for-profit organizations engaged in collecting, transporting and processing around 2 to 20 metric tons of waste from the surrounding localities. These small centres are mainly engaged in making compost out of the organic content in the waste besides selling recyclables such as plastic and glass to local traders and scrap dealers. This approach is not suitable for large and densely populated cities as such facilities generally occupy space within each locality/residential colony which may be opposed by people residing in that vicinity. Currently, as per Frost & Sullivan analysis around 85-90% of the municipal solid waste generated in India is being collected and transported out of which approximately 30-35% gets processed.

MSW in India generally consists of compostable/biodegradable, recyclables and inerts. Compostable/ biodegradable/organic items are food waste, from households, retail/wholesale markets and institutions such as hotels and restaurants, which account for around 48% of the overall waste composition. Recyclables include paper, plastics, metal and glass and account for 19% of the total MSW composition while the balance 33% comprises of inert waste.

Emerging waste management areas in India are MSW based waste-to-energy (WTE) and E-waste recycling. WTE market is in its nascent stage and holds huge potential in the long run. With increasing energy demand and government initiatives, WTE market is anticipated to see more PPP (Public Private Partnership) based projects. Recycling of e-waste is critical to safeguard our environment from its ill effects. E-waste recycling market is gradually getting organized with increased enforcement of new regulations.

Peer comparison

| Player | Collection & Transportation | Treatment & Disposal | Landfill |

|---|---|---|---|

| Ramky Enviro Engineers |

|

|

|

| Antony Waste |

|

|

|

| Metro Waste handling Pvt ltd |

|

|

|

| BVG |

|

|

|

| A2Z |

|

|

|

| SPML Infra |

|

|

|

| Terra Firma |

|

|

|

| Essel Group |

|

|

Risks

- Dependency on municipal authorities for a substantial proportion of their business and revenue. Many Municipalities have been struggling to fund various solid waste management projects from their own revenue receipts and are highly dependent on state/central grants/budget allocation. Any decline in the budgetary allocation towards MSW projects will have a material adverse impact on their business, financial condition, and results of operations.

- The company depends a lot on a limited number of customers for a significant portion of their revenue. The top five clients contributed, 90.78%, 93.70%, 81.76% and 77.55% of their total revenue in Fiscal years 2018, 2019, 2020 and for the six-month period ended September 30, 2020 respectively. The loss of any of their major customer due to any adverse development or significant reduction in business from their major customer may adversely affect their business.

- The company operates in limited geographies for a significant portion of their revenue. Projects in new geographies may not be as profitable as the current major contracts that the company has.

- High working capital requirements: Working capital management has been a critical issue in the management of urban waste. Receivables risk from municipalities can lead to financial instability of a private company. This also restricts further investment in asset development. The company’s inability to meet its working capital requirements may have a material adverse effect on its business, financial condition and results of operations. The working capital as a percentage of total revenue was 10.87%, 14.34%, 18.22% and 42.19% for Fiscal 2018, Fiscal 2019, Fiscal 2020, and for the six-month period ended September 30, 2020 respectively

Company Description

Incorporated in 2001, Antony Waste Handling Cell Limited started with a simple business of collection and transportation of waste and has now established a track record of 19 years in providing full spectrum of Municipal Solid Waste (MSW) management services that include solid waste collection, transportation, processing & disposal services, along with landfill construction and emerging waste management area like MSW based Waste-to-Energy (WTE). It is amongst a selected few who have pioneered in MSW collection & transportation and is one of the top five players in Indian MSW management industry. The company has been adopting latest technologies and innovations in garbage compaction, processing, use of transfer stations and managing sanitary engineered landfills thereby making it an exceptional company in India that can manage MSW through multiple technologies. The company is undertaking many projects of Navi Mumbai Municipal Corporation (NMMC), Thane Municipal Corporation (TMC), Pimpri Chinchwad Municipal Corporation (PCMC), Mangaluru Municipal Corporation (MMC), New Okhla Industrial Development Authority (NOIDA), and Greater Noida Industrial Development Authority (GNIDA).

The company has portfolio of 18 ongoing projects as on November 15, 2020 which comprises of 12 MSW Collection & transportation (C&T) projects, 2 MSW processing projects and 4 mechanized sweeping projects which is carried on by the company itself and/or through its subsidiaries. Most of the C&T and sweeping contracts are within a term of more than 7 years whereas the MSW processing project has a residual term of 15 years plus, which gives a comfortable revenue visibility over the next few years.

The company’s biggest project - MSW processing site at Kanjurmarg is Asia’s largest single location waste processing site, located in Mumbai with a capacity of handling 7,000 TPD MSW. The company was awarded Kanjurmarg landfill project by MCGM in FY10. The project involves, inter alia, design, construction, operation and maintenance of integrated waste management facilities. The site is currently run by Antony Lara Enviro Solutions Private Ltd (ALESPL), a JV between the company and Lara Central De Tratamento De Residuos Limited. As on November 15, 2020, the site has a bio-reactor landfill with a capacity of 4500 TPD, and a sanitary landfill of 250 TPD. Moreover, the site also has a material recovery and compost facility with a capacity of 1,000 TPD. Also, its subsidiary ALESPL has been operating a 0.97 MW landfill gas-to-energy plant at Kanjurmarg facility with the electricity produced being used for internal consumption. As on November 15, 2020 the company had a fleet of 1147 vehicles. The vehicle ownership gives the company a competitive advantage and helps it meet the service level commitments in a cost-effective manner. Given the nature of the contracts, the company actively monitors movement of its huge vehicle fleet which are equipped with GPS system.

Key Business Activities

- MSW C&T Project: MSW collection from commercial establishments, households, and community bins.

- MSW Processing Project: Sorting and segregating waste from MSW C&T through composting, shredding, recycling, etc.

- Mechanized sweeping Project: Deploying power sweeping machines, maintenance, consumables, safe waste disposal, and others to complete cleaning operations.

Details of the on-going projects as on November 15, 2020

Type of project

| Sr.no | Name of Project | MSW C&T | Mechanized sweeping | MSW processing |

|---|---|---|---|---|

| 1 | Thane project |

|

- | - |

| 2 | Navi Mumbai project |

|

- | - |

| 3 | Mangalore project |

|

|

- |

| 4 | Greater Noida project- zone 1 |

|

|

- |

| 5 | Greater Noida project- zone 2 |

|

|

- |

| 6 | Jaypee project |

|

- | - |

| 7 | North Delhi project |

|

- | - |

| 8 | Dahisar project |

|

- | - |

| 9 | Pimpri chinchwad municipal corporation- South Zone project |

|

- | - |

| 10 | Nagpur municipal corporation |

|

- | - |

| 11 | Noida Project |

|

- | - |

| 12 | Varanasi project |

|

|

- |

| 13 | Navi mumbai sweeping project | - |

|

- |

| 14 | Greater Noida sweeping project # 1 | - |

|

- |

| 15 | Greater Noida sweeping project # 2 | - |

|

- |

| 16 | Greater Noida sweeping project # 3 | - |

|

- |

| 17 | Kanjur project | - | - |

|

| 18 | Pimpri chinchwad municipal corporation | - | - |

|

Valuation

We recommend an AVOID rating on Antony Waste Handling Cell Ltd (AWHCL) IPO issue considering factors like i) highly competitive local markets with national and international players ii) large dependency on projects from State government authorities primarily Municipal Corporations for substantial proportion of its business and revenue and iii) it’s dependency on limited number of customers for a significant portion of their revenues. At the upper end of the price band, the issue is trading at PE of 11.46x as on FY20 earnings.

Key Information

Use of Proceeds:

The Issue public offer of Rs 300 crores comprises a fresh issue of up to 2,698,412

Equity Shares aggregating to Rs 85 crores and an Offer for Sale of up to 6,824,933

Equity Shares aggregating to Rs 215 crores by the selling shareholders. The Company

proposes to utilize the Net Proceeds of the fresh issue towards funding of the following

objects i) Part-financing of Rs 40 crores for PCMC (Pimpri Chinchwad municipal corporation)

Project through investment in their subsidiaries ii) Reduction of the consolidated

borrowings worth Rs 38.5 crores iii) General corporate purposes.

Book running lead managers:

Equirus Capital, IIFL Securities

Management:

Jose Jacob Kallarakal (Chairman & M.D): One of the founders of the company with

19 years of experience in the field of waste management. He holds a Bachelor’s degree

in Engineering (Mechanical) from Bharati Vidyapeeth’s College of Engineering, University

of Mumbai and has completed the Authentic Leader Development Course from Harvard

Business School, Boston. Shiju Jacob Kallarakal (Chief Financial officer): He holds

a Bachelor’s degree in Engineering (Chemical) from Bharati Vidyapeeth’s College

of Engineering, University of Mumbai. He overlooks the accounting and finance along

with the legal functions of the company Shiju Antony Kallarakkal (Whole time director):

Over 18 years of experience in the automobile sector and more than five years in

the waste management sector.

Financial Statement

Profit & Loss Statement:- (Consolidated)

| DESCRIPTION | FY18 | FY19 | FY20 | H1FY21 |

|---|---|---|---|---|

| Net Sales | 276.10 | 283.60 | 450.50 | 207.30 |

| COGS | 36.50 | 31.90 | 39.20 | 10.70 |

| Gross Profit | 239.60 | 251.70 | 411.30 | 196.60 |

| Employee Cost | 63.90 | 66.30 | 114.80 | 73.60 |

| Other Expenses | 106.10 | 109.40 | 171.10 | 71.20 |

| EBITDA | 69.60 | 76.00 | 125.40 | 51.80 |

| EBITDA Margin% | 25.20% | 26.80% | 27.80% | 25.00% |

| Depreciation | 12.70 | 18.30 | 24.20 | 15.50 |

| EBIT | 56.90 | 57.70 | 101.20 | 36.30 |

| Margins% | 21.00% | 20.00% | 22.00% | 18.00% |

| Other Income | 14.60 | 14.80 | 14.10 | 7.70 |

| Interest | 22.80 | 24.90 | 30.20 | 14.10 |

| Exceptional Items | 3.20 | |||

| Profit Before Tax | 48.70 | 47.60 | 81.90 | 29.90 |

| Provision for Tax | 8.90 | 12.90 | 19.88 | 0.85 |

| Tax rate | 18.30% | 27.10% | 24.30% | 2.80% |

| Profit After Tax | 39.80 | 34.70 | 62.02 | 29.05 |

| Pat margins% | 14.40% | 12.20% | 13.80% | 14.00% |

| Adjusted EPS | 22.49 | 20.38 | 27.48 | 7.68 |