Ami Organics Limited - IPO Note

Chemicals

Ami Organics Limited - IPO Note

Chemicals

Stock Info

Shareholding (Pre IPO)

Shareholding (Post IPO)

Key Strengths and Strategies

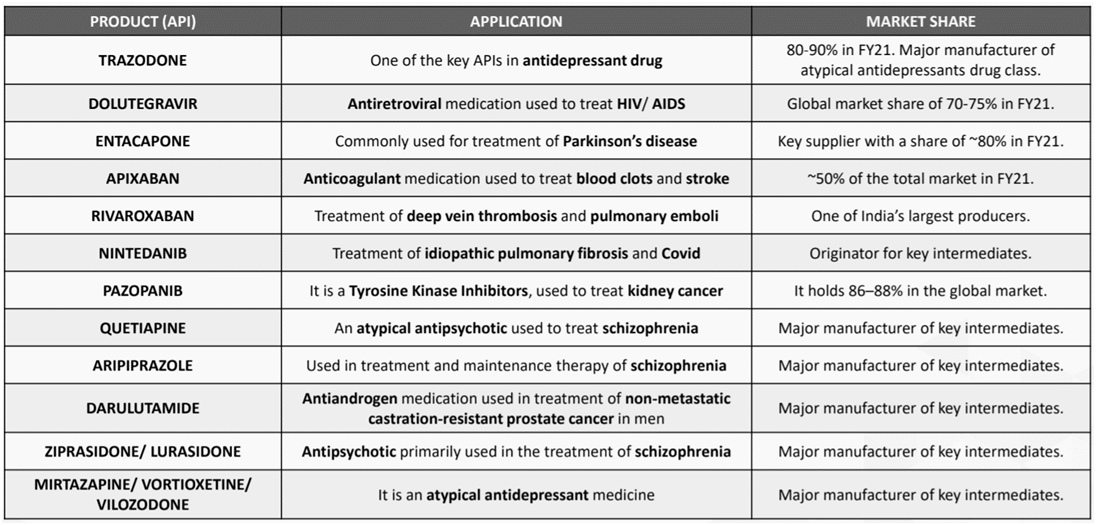

Diversified Product Portfolio Supported by R&D and Process Chemistry

The company has developed and commercialised over 450 Pharma intermediates which

includes Dolutegravir, Trazodone, Entacapone, Nintedanib and Rivaroxaban and NCEs

across 17 therapeutic areas, such as anti-retroviral, anti-inflammatory, anti-psychotic,

anti-cancer, anti-Parkinson, anti-depressant, and anti-coagulant. Following table

shows the market share of the company’s products:

Source:RHP

The company, as a result of its R&D capabilities, have been able to file 11 process innovation patent applications in India out of these 3 were pending for which applications were made in March 2021. The R&D centre at Sachin has been approved by DSIR and has a team of 66 people across various sections including R&D, regulatory affairs, quality control, quality assurance and analytical development laboratory.

Diversity Across Geographies and Customers

Ami Organics caters to domestic as well as multi-national pharma companies in Europe,

China, Japan, Israel, UK, Latin America, and the USA. In FY20 and FY21, the revenue

from exports was ~46% and ~52%, respectively. The company supplies products across

25 countries and enjoys long standing relationships with various domestic and international

companies. Some of its domestic customers include Laurus Labs and Cipla and export

customers includes Organike s.r.l.a Socio Unico, Fermion Oy, Fabbrica Italiana Sintetici

S.p.A, Chori Co. Ltd., Medichem S.A., and Midas Pharma GmbH. The top ten customers

as of FY21 have been engaged with the company for over 3 years and contributed to

~61% to the topline.

| Particulars | % Exports | ||

|---|---|---|---|

| FY19 | FY20 | FY21 | |

| Pharma Intermediates | 56.09% | 46.52% | 53.47% |

| Speciality Chemicals | 100% | 100% | 86.30% |

| Others | - | - | - |

| Total Rev. from Operations | 49.61% | 45.89% | 51.57% |

Consistent Financial Performance

On a consolidated basis, the company’s revenue has grown at a CAGR of 17.3%

over FY16 – FY21. Its operating margin has also witnessed consistent improvement;

in FY16, EBITDA margin stood at 11.8% and in FY21, the margin jumped to 23.5% (17.1%

in FY20). In absolute terms, the company’s bottom line has grown at a CAGR

of 33.7% and margins has also witnessed an improvement from 8.2% in FY16 to 15.9%

in FY21. The company’s ROCE has improved in last three years, as on March

2021, ROCE stood at 25.9% (21.5% in FY20). ROE as of March 2021 was 32.3% (24.6%

in FY20). As of March 2021, the total borrowings stood at Rs. 136.64 crores and

the company propose to use Rs. 140 crores from fresh issue to repay certain indebtedness.

The company intends to reduce its debt levels by Rs. 140 crores from the proposed

fresh issue.

| Rs. in Crores | Net Sales | EBITDA | EBITDAM | PAT | EPS | ROE |

|---|---|---|---|---|---|---|

| FY19 | 238.5 | 42.1 | 17.6% | 23.3 | 22.2 | 28.3% |

| FY20 | 239.6 | 41.0 | 17.1% | 27.5 | 26.2 | 24.6% |

| FY21 | 340.6 | 80.2 | 23.5% | 54.0 | 17.1 | 32.3% |

Source: AceEquity

Diversification of Business by Focussing on Organic and Inorganic Growth Opportunities

To supplement its organic expansion, the company plans to pursue strategic acquisitions

and partnerships. The company's management believes that by pursuing strategic

acquisitions, such as the recently completed GOL acquisition, it will improve its

capabilities and technical expertise, as well as form partnerships to strengthen

product infrastructure and manufacturing capabilities in the specialty chemicals

sector. The management may pursue brownfield expansion opportunities on portion

of the 15,830 sq. mtr of land at the Jhagadia site.

Industry

Peer comparison

| Particulars (Rs. in Crores) FY21 | Revenue CAGR (FY19 - FY21) | OPM (%) | PAT (%) | RoE (%) | RoCE (%) | EPS | PE (x) |

|---|---|---|---|---|---|---|---|

| Ami Organics | 19.50% | 23.53% | 15.85% | 32.35% | 25.80% | 17.14 | 35.59 |

| Aarti Industries | 3.98% | 21.78% | 11.62% | 14.94% | 13.56% | 15.02 | 62.12 |

| Hikal | 4.03% | 18.77% | 7.74% | 14.26% | 16.14% | 10.80 | 59.81 |

| Valiant Organics | -2.63% | 27.39% | 19.96% | 22.83% | 27.94% | 42.13 | 30.86 |

| Vinati Organics | -8.02% | 37.02% | 28.23% | 17.45% | 23.80% | 26.20 | 68.36 |

| Neuland Labs | 18.53% | 15.70% | 8.61% | 10.25% | 12.69% | 62.99 | 26.59 |

| Atul | -3.87% | 24.60% | 17.57% | 17.14% | 24.69% | 221.54 | 41.32 |

Risks

- Product Concentration: The company generates significant portion of its revenue from a few products (pharma intermediates). As of March 2021, its major products such as Trazodone and Dolutegravir contributed ~44% to the topline. Slowdown in demand in any of the company’s top contributing products could impact the financial condition.

- Working Capital Intensive: The company’s business is working capital intensive. WC days has increased over the years from 58 days in FY19 to 82 days in FY21 (Source: AceEquity Data).

- Customer Concentration: The company depends on limited number of customers for large part of its revenue. As of March 2021, its top five customers contributed 44.4% of the revenue. Further, it does not have long-term contracts with most of its significant customers and conduct business on purchase order basis.

- Supplier concentration: The company rely on limited number of suppliers. As of March 2021, its top five suppliers accounts for 34.58% of total purchase value. Dependence on a select few suppliers, could restrict the company’s ability to negotiate and that could impact margins.

- Foreign Exchange Risk: As the company is engaged in exports and ~52% of the revenue comes from exports, it is subject to fluctuation in foreign currency.

Company Description

Incorporated in January 2004, Ami Organics Ltd. is engaged in the development and manufacturing of pharma intermediates for active pharmaceuticals ingredients (APIs) and key starting material for agrochemical and fine chemicals, especially from the recently acquired Gujarat Organics Ltd (GOL). The company acquired two plants from GOL which has added preservatives (parabens and parabens formulations – end use in cosmetics, animal food and personal care industries) and other speciality chemicals in the company’s portfolio. Ami organics is one of the major manufacturers of pharma intermediates for certain key APIs such as Dolutegravir, Trazodone, Entacapone, Apixaban, Nintedanib, etc.

Since inception, the company has developed and commercialised over 450 pharma intermediates across 17 therapeutic areas which are supplied to over 150 customers in India and 25 countries overseas. Currently, the company has 8 process patent applications and 3 additional pending process patent applications, for which applications were made recently, in March 2021. The company also supplies pharma intermediates to various multi-national companies in Europe, China, Japan, Israel, UK, Latin America, and the USA. In FY21, exports contributed 51.6% to the topline vs. 45.9% in FY20. Currently, the company has three manufacturing units located in Gujarat. Sachin facility has an installed capacity of 2,460 MTPA while facilities at Ankleshwar and Jhagadia has installed capacity of 1,200 MTPA and 2,400 MTPA, respectively.

| Particulars (Rs. in Crores) | FY19 | FY20 | FY21 | |||

|---|---|---|---|---|---|---|

| Revenue | % | Revenue | % | Revenue | % | |

| Pharma Intermediates | 203.39 | 85.3% | 217.88 | 90.9% | 301.14 | 88.4% |

| Speciality Chemicals | 2.22 | 0.9% | 7.43 | 3.1% | 16.59 | 4.9% |

| Others | 32.91 | 13.8% | 14.33 | 6.0% | 22.88 | 6.7% |

| Total | 238.52 | 100.0% | 239.64 | 100.0% | 340.61 | 100.0% |

Source: RHP

Valuation

Outlook and Valuation

Ami organics has large global market share (refer table in key strengths and strategies

section) in some of the key products/pharma intermediates such as Dolutegravir,

Trazodone, Entacapone, Nintedanib, Rivaroxaban, etc. and these products are expected

to see gradual volume growth over next five years. The company enjoys long standing

relations with its key customers; it supplies products to over 150 customers, out

of which, thirteen have been engaged with the company from a decade now and fifty

of them have been engaged for five years. On financial front, the company has performed

well over the years and returns ratios has also seen an improvement. At an upper

price band of Rs. 610, the issue is priced at 35.6x of FY21 earnings. We recommend

to “Subscribe” the issue.

Key Information

Use of Proceeds:

The total issue size is Rs. 569.6 crores, of which Rs. 200 crores is fresh issue

and balance is OFS. The company will utilise the net proceeds from the fresh issue

by repaying certain financial facilities, funding working capital requirements,

and for general corporate purposes. Details are as follow:

| Objects | Amount (Rs. in Crores) |

|---|---|

| Repayment/Prepayment of Certain Financial Facilities | 140 |

| Funding Working Capital Requirements | 90 |

| General Corporate Purpose | - |

The company has undertaken a Pre-IPO Placement at a price of Rs. 603 per share, aggregating to Rs. 100 crores. Details are as follows:

| Name of the Entity | Amount (Rs. in Crores) |

|---|---|

| Plutus Wealth Management LLP | 30 |

| Malabar India Fund Limited | 44 |

| IIFL Special Opportunities Fund – Series 7 | 20 |

| Malabar Value Fund | 6 |

| Total | 100 |

Book running lead managers:

Intensive Fiscal Services Private Limited, Ambit Private Limited, and Axis Capital

Limited.

Management:

Nareshkumar Ramjibhai Patel (Promoter, Executive Chairman and Managing Director),

Chetankumar Chhaganlal Vaghasia (Promoter and Whole-time Director), Virendra Nath

Mishra (Whole-time Director), and Abhishek Haribhai Patel (Chief Financial Officer).

Financial Statement

Profit & Loss Statement:- (Consolidated)

| Year End March (Rs. in Crores) | 2018 | 2019 | 2020 | 2021 |

|---|---|---|---|---|

| Net Sales | 188.22 | 238.51 | 239.64 | 340.61 |

| Growth % | 26.72% | 26.72% | 0.47% | 42.13% |

| Expenditure | ||||

| Material Cost | 112.95 | 148.43 | 128.91 | 179.50 |

| Employee Cost | 9.89 | 11.75 | 17.81 | 21.01 |

| Other Expenses | 34.86 | 36.25 | 51.90 | 59.95 |

| EBITDA | 30.52 | 42.08 | 41.02 | 80.15 |

| EBITDA Margin | 16.21% | 17.64% | 17.12% | 23.53% |

| Depreciation & Amortization | 1.91 | 2.60 | 3.52 | 4.19 |

| EBIT | 28.62 | 39.48 | 37.50 | 75.96 |

| EBIT Margin % | 15.20% | 16.55% | 15.65% | 22.30% |

| Other Income | 2.96 | 0.38 | 2.84 | 1.38 |

| Interest & Finance Charges | 3.23 | 4.75 | 5.59 | 5.62 |

| Profit Before Tax - Before Exceptional | 28.35 | 35.11 | 34.75 | 71.73 |

| Profit Before Tax | 28.35 | 35.11 | 34.75 | 71.73 |

| Tax Expense | 9.85 | 11.82 | 7.28 | 17.73 |

| Effective Tax rate | 34.75% | 33.65% | 20.96% | 24.71% |

| Net Profit | 18.50 | 23.30 | 27.47 | 54.00 |

| Net Profit Margin | 9.83% | 9.77% | 11.46% | 15.85% |

| Consolidated Net Profit | 18.50 | 23.30 | 27.47 | 54.00 |

| Net Profit Margin after MI | 9.83% | 9.77% | 11.46% | 15.85% |