Aegis Vopak Terminal Ltd - IPO Note

Rs. 223-235

Price range

-

Issue Period: May 26, 2025

May 28, 2025

-

Rating: Avoid

-

Reco. Date: May 26, 2025

Stock Info

- Sensex 82097.62

- CNX Nifty 24973.05

- Face Value (Rs) 10

- Market lot 63

- Issue size Rs. 2800 cr.

- Public Issue 11.91 cr. shares

- Market cap post IPO 26737.80 cr.

- Equity Pre - IPO 98.88 cr.

- Equity Post - IPO 110.80 cr.

- Issue type Book build issue

Shareholding (Pre IPO)

- Promoters 97.41%

- Public 2.59%

Shareholding (Post IPO)

- Promoters 86.93%

- Public 13.07%

Data Source: Ace equity, stockaxis Research

Aegis Vopak Terminal Ltd - IPO Note

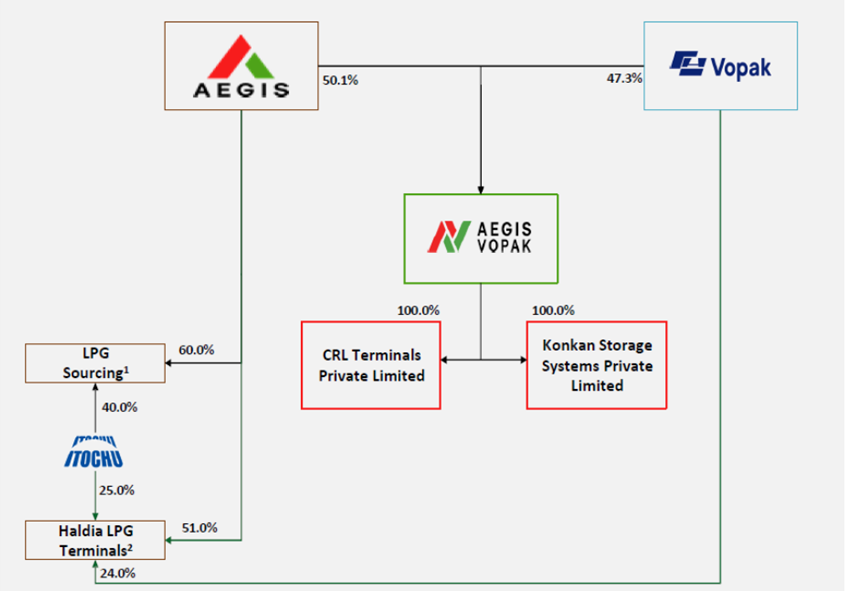

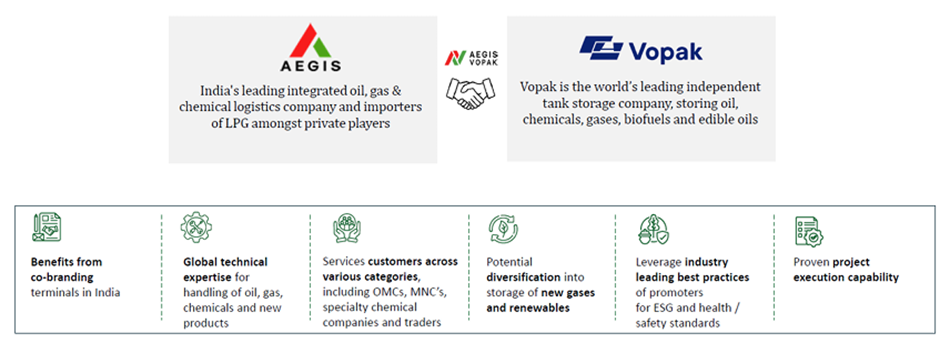

Company Profile Aegis Vopak Terminals Ltd. (AVTL) was established as a joint venture between Aegis Logistics Limited (“Aegis”) and Vopak India BV, a part of Royal Vopak (“Royal Vopak”). One of its Promoters, Aegis, is a listed Indian conglomerate providing sourcing, storage, distribution, and storage and third-party logistics services in the oil, gas, and chemicals sector. Aegis is India’s largest third-party LPG handler and handles more than 20% of India’s LPG imports as of December 31, 2024.

Further, as of December 31, 2024, Aegis operates a liquid terminal with a storage capacity of 275,000 cubic meters, and owns and operates a 21,000 MT cryogenic LPG terminal capable of handling a throughput of 1.5 million metric tons (“MMT”) per annum (“MMTPA”) in Mumbai, Maharashtra. (Source: CRISIL Report). Its other Promoter, Vopak India BV, is part of Royal Vopak, a listed company headquartered in the Netherlands and is among the world’s leading tank storage companies, with an experience of over 400 years in the storage industry. Royal Vopak has a network of 77 terminals in 23 countries with an aggregate storage capacity of approximately 35.40 million cubic meters as of December 31, 2024, along major trade routes. It is focused on the storage and handling of gases such as LPG, in addition to ammonia, as well as liquid products such as crude oil, petroleum, oil and lubricants, chemicals, and biofuels.

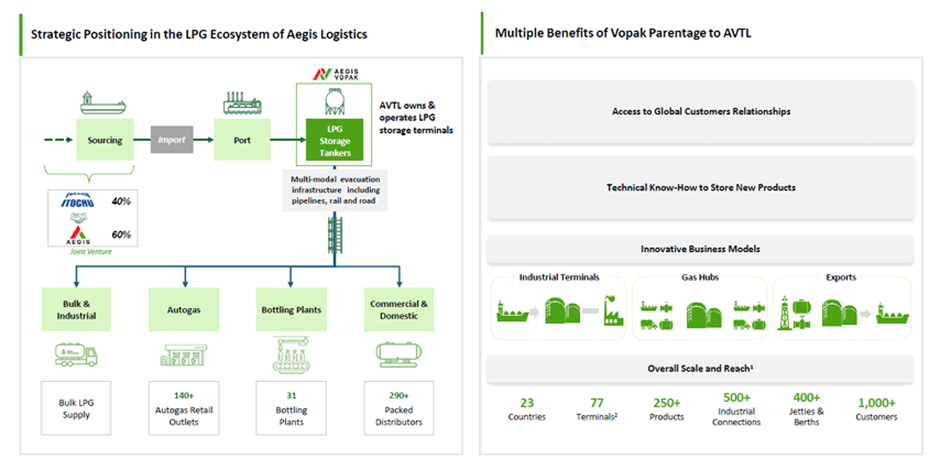

AVTL is the largest Indian third-party owner and operator of tank storage terminals for liquified petroleum gas (“LPG”) and liquid products in terms of storage capacity, as of December 31, 2024. It owns and operates a network of storage tank terminals having an aggregate storage capacity of approximately 1.50 million cubic meters for liquid products and 70,800 metric tons (“MT”) of static capacity for LPG as of December 31, 2024, and offer secure storage facilities and associated infrastructure for liquids such as petroleum, vegetable oil, lubricants, and various categories of chemicals and gases such as LPG (including propane and butane). It has the largest storage capacity in India’s LPG tank storage sector, contributing to approximately 11.50% of the total national static capacity, as of December 31, 2024. In terms of storage of liquid products, AVTL is the largest third-party tank storage company in India, contributing to approximately 25.53% of India’s third-party liquid storage capacity as of December 31, 2024. As of December 31, 2024, it has a diversified network of terminals spread strategically across five key ports in operation on the West and East coast of India. These key ports together handle approximately 23.00% of liquid and 61.00% of total LPG import volumes in India. At these terminals, it owns and operates facilities for different functions including product storage tanks, firefighting facilities, self-owned pipelines connected to jetty, ship loading and unloading infrastructure, as well as infrastructure for product evacuation by ship, rail, road and pipelines.

AVTL categorizes its business segments into two key segments Gas Terminal Division - The Gas Terminal Division primarily involves the storage and handling of LPG (including propane and butane);

Liquid Terminal Division - The Liquid Terminal Division involves the storage and handling of liquid products, including petroleum, chemicals, and vegetable oils. It handles more than 30 chemicals of various classes and categories. They also handle more than 10 products in the edible oil and non-edible oil category.

It currently owns and operates two LPG storage terminals across two Indian ports, and 18 liquid storage terminals across six Indian ports, where they handle coastal movement of goods along with imports and exports. Their terminals, located in the ports of Haldia, West Bengal (“Haldia Terminal”), Kochi, Kerala (“Kochi Terminal”), Mangalore, Karnataka (“Mangalore Terminal”), Pipavav, Gujarat (“Pipavav Terminal”), Kandla, Gujarat (“Kandla Terminal”), and Navi Mumbai, Maharashtra (“JNPA Terminal”) have an aggregate storage capacity of approximately 1.68 million cubic meters for liquid products and 70,800 MT of static capacity for LPG.

Competitive Strengths

India’s Largest Third-Party Owner and Operator of Tank Storage Terminals for LPG and Liquid Products AVTL is the largest Indian third-party owner and operator of tank storage terminals for LPG and liquid products in terms of storage capacity, as of December 31, 2024. It boasts of the largest storage capacity in India’s LPG tank storage sector, contributing to approximately 11.52% of the total national static capacity, as of December 31, 2024. In terms of storage of liquid products, they are the largest third-party tank storage company in India, contributing to approximately 25.53% of India’s third-party liquid storage capacity as of December 31, 2024.

It owns and operates a network of storage tank terminals having an aggregate storage capacity of approximately 1.50 million cubic meters for liquid products and 70,800 MT of static capacity for LPG as of December 31, 2024^, offering secure storage facilities and associated infrastructure for liquids and gases such as petroleum, oil, lubricants, LPG and various categories of chemicals. Their comprehensive storage systems comprise tanks with a designed life of approximately 40 years and can store and handle over 40 different complex and critical products, including specialized chemicals, petrochemicals, and LPG.

The company currently owns and operates two LPG storage terminals across two Indian ports, and 18 liquid storage terminals across six Indian ports. At these terminals, it operates facilities for various functions, including product storage tanks, firefighting facilities, pipelines connected to the jetty, ship loading and unloading infrastructure, as well as infrastructure for product evacuation by ship, rail, road, and pipelines. We believe that strategic locations provide them with the advantage to leverage market opportunities for the storage of LPG and liquid products.

Strategically Located Necklace of Terminals across the Indian Coast As of June 30, 2024, the company has a diversified network of terminals spread strategically across five key ports in operation on the West and East coasts of India. These key ports together handle approximately 23.00% of liquid and 61.00% of total LPG import volumes in India, enabling efficient distribution and affording accessibility to the company's customers.

The location of storage terminals at specific ports is a major differentiator in the terminalling business, and storage terminals at ports that are closer to major shipping routes enjoy a competitive advantage as shipping from those ports will help importers and exporters save cost.

The strategic and well-connected location of terminals increases evacuation speed by offering pipeline, rail, and road options, reducing last-mile delivery costs, improving delivery times, and mitigating the risks associated with LPG transport by road. The company terminals are located at ports, which create a unique ‘necklace of terminals’ that enables the company to cater to storage requirements in different regions across India. Among ports with more than 0.50 MTPA throughput in Fiscal 2024, throughput at Pipavav grew at a CAGR of 13.53% from Fiscal 2020 to Fiscal 2024, followed by Kandla (CAGR of 11.44%) and Mundra (CAGR of 11.33%) from Fiscal 2020 to Fiscal 2024.

Track Record of Consistently Expanding Capabilities and Well-Equipped Storage Infrastructure The company leverages one of the company's Promoters Aegis’ experiences in capacity expansion, network of cost-effective materials procurement, contracting strategy, and proven construction and project execution capabilities, to undertake expansion and upgrades of the company's tank storage capacities and associated infrastructure.

Aegis is responsible for construction, working on an arm’s length basis with the company, which ensures that the company is not exposed to any construction-related risks. This separation of responsibilities allows the company to focus entirely on efficiently operating and managing the terminals, leveraging their expertise without being encumbered by the complexities or risks associated with the construction process. As a result, the company can maintain operational efficiency, optimizing the performance of the terminals once they are completed.

The company infrastructure at liquid storage terminals, including stainless steel tanks, stainless steel jetty pipelines, inner tank coating, tank heating and chilling, nitrogen blanketing, vapors treatment facility, among others, ensures safe storage and reduced product loss while handling toxic, flammable, volatile, and viscose products. Further, to ensure efficient evacuation, the company terminals are connected with pipelines and rail gantry, and the company has over 100 loading bays as of June 30, 2024.

Backed by established promoters and supported by a Strong Management Team The company operates as a joint venture between two of the company's Promoters, Aegis, a listed Indian company providing sourcing, storage, and third-party logistics services in the oil, gas, and chemicals sector, and Vopak India BV, a part of Royal Vopak. The company incorporation represents the company Promoters’ vision of servicing the expansive LPG and liquid chemicals storage industry in India.

With over five decades of experience, Aegis is among India’s key tank storage companies in terms of installed capacity as of June 30, 2024. At Mumbai port, Aegis operates a liquid terminal with a storage capacity of 275,000 cubic meters and owns and operates a 21,000 MT cryogenic LPG terminal capable of handling a throughput of 1.5 MMTPA, as of June 30, 2024.

Vopak India BV, is part of Royal Vopak, a listed company headquartered in the Netherlands, which is among the world’s leading tank storage companies with an experience of over 400 years in the storage industry. Royal Vopak has a network of 76 terminals in 23 countries, with an aggregate storage capacity of approximately 34. 65 million cubic meters as of June 30, 2024, along major trade routes.

Relationships with Diversified Customer Base Aegis has established long-standing relationships with several Indian and global customers in course of its operations for over five decades. Through strategic locations, distinct from Aegis and complementing its offerings, they have been able to procure business from Aegis’ customers, whom it continues to service. As of December 31, 2024, it boasts of a diversified customer base of over 400 customers, including major national OMCs. The company has successfully diversified its customer base to include a wide array of industries and sectors, including traders, end users, manufacturers, and fuel marketing companies from private and public sectors, as well as local and international businesses. This diverse spectrum of customers reduces concentration risks.

The overall scale and reach extend to 23 countries, 77 terminals, 250 products, 500 industrial connections, and 400 jetties and berths. The company’s focus on quality, ability to provide advanced infrastructure in a safe and secure manner, along with well-connected terminals, has helped them establish and maintain long-term customer relationships.

Peer Comparison

| Name of the company (FY24) | Revenue (Rs. In cr) | EBITDA Margin (%) | ROE (%) | ROCE (%) | Operating Cash Flow (Rs. In cr) |

|---|---|---|---|---|---|

| Aegis Vopak Terminals Ltd | 562.00 | 71.19% | 8.68% | 8.39% | 337.00 |

| Adani Ports and SEZ | 26711.00 | 61.55% | 14.86% | 14.29% | 15018.00 |

| JSW Infra Ltd | 3763.00 | 55.40% | 14.10% | 21.09% | 1803.00 |

Key Risks & Concerns

Operates in a competitive environment – AVTL operates in a competitive industry. If it fails to compete successfully, it may lose market share in their existing markets, which could have an adverse effect on business, financial condition and results of operations.

Capital intensive business – The Company’s business is capital intensive and requires a substantial level of funding. Further, it intends to expand terminal storage facilities at New Mangalore in Karnataka and Pipavav in Gujarat as a part of the growth strategy. If the company is required to raise additional funds through the incurrence of debt, its interest and debt repayment obligations will increase, and could have a significant effect on the profitability and cash flows.

Operational risks – The Company’s terminal services and other operations are subject to operational risks that could adversely affect their business, results of operations, and financial condition. The operation of terminal services may be adversely affected by many factors, such as the breakdown of equipment, accidents, fatalities, labour disputes, and hazards associated with liquids and gases such as petroleum, oil and lubricants, LPG and various categories of chemicals, including fires, explosions, chemical spills or other discharges or releases of toxic or hazardous substances or gases, storage tank leaks, and other environmental risks.

Outlook and Valuation

Aegis Vopak Terminals Ltd., a JV between India's Aegis Logistics and Netherlands-based Royal Vopak, is India's largest third-party operator of tank storage terminals for LPG and liquid products. With a diversified portfolio spanning key coastal locations and a strategic focus on safety, sustainability, and scalability, the company plays a vital role in India's energy and chemical logistics infrastructure. The company has also leveraged its promoter Aegis' five decades of industry expertise to inherit and expand long-standing customer relationships, building a diverse base of over 400 clients, including major national OMCs. With strategic locations complementing Aegis, the company continues serving inherited clients while securing new business across traders, end users, manufacturers, and fuel marketing firms in private, public, and international sectors. This broad diversification strengthens market flexibility and fuels long-term growth in India's evolving energy and chemical storage industry. The company's proven track record in capacity expansion and infrastructure upgrades positions it well to meet the changing liquid and gas storage needs.

India is poised to play a pivotal role in the global energy transition through various strategic initiatives. One such initiative is the establishment of a manufacturing hub for green hydrogen and its derivatives, such as green ammonia and green methanol. As these new energy sources gain traction, the demand for specialized storage facilities will increase significantly. Aegis Vopak Terminals Limited offers a compelling investment opportunity as India’s largest independent operator of LPG and liquid storage terminals. With strong promoter backing (Aegis & Royal Vopak), strategic port presence, high operational efficiency, and robust financial growth, the company is well-placed to benefit from rising energy demand and infrastructure expansion. Its forward-looking investments in capacity, sustainability, and energy transition infrastructure position it for long-term growth.

The company's business model is primarily driven by capital expenditures, with its main strength lying in the ability to maintain the storage of gas and high-value products under optimal conditions. The ongoing capital expenditures of the company are fully financed, and the repayment of debt amounting to Rs 2,016 crore is expected to enhance profitability in the future. The company’s ongoing LPG capacity expansion and planned future ventures into green ammonia present substantial long-term growth potential. At the upper price band of Rs 235, the company is assessed at an EV/EBITDA and EV/Sales ratio of 56.5x and 41.6x, respectively, based on its annualized earnings for the first nine months of FY25. Adani Ports & JSW infra are trading at 10.8 & 14.0 times respectively on an EV/sales basis. We believe the issue is priced very aggressively in comparison to peers. This makes the issue very risky. We also expect modest listing gains. Given the growth is too far, we are assigning an Avoid rating to the issue, and we will evaluate this company following the announcement of its results after the listing.

Key Information

Use of Proceeds: Objects of the Offer – The total issue size is Rs.2800 cr, which is a complete fresh issue with no Offer for Sale component (OFS). The company intends to utilize a portion of the Net Proceeds for prepayment of in full or in part, of certain outstanding borrowings availed by the company (Rs.2015.95) cr as of March 31, 2025, Funding capital expenditure towards contracted acquisition of the cryogenic LPG terminal at Mangalore (Rs.671.30 cr) and rest Rs.112.75 cr to be utilized for general corporate purposes.

Book running lead managers: ICICI Securities Limited, BNP Paribas, IIFL Capital Services Limited (formerly known as IIFL Securities Limited), Jefferies India Private Limited and HDFC Bank Limited

Management: Raj Kapurchand Chandaria (Chairman and Managing Director), Murad Mohammed Husein Moledina (Non-Executive Director), Kanwaljit Singh Sudarshan Nagpal (Independent Director), Raj Kishore Singh (Independent Director), Deepak Gajanan Dalvi (Non-Executive Director, Wilfred Lim Swee Guan (Non-Executive Director, Uma Mandavgane (Independent Director), Lars Erik Mikael Johansson (Independent Director), Manoj Sharma (Chief Financial Officer and Assistant Vice President).

Financial Statement

Profit & Loss Statement:- (Consolidated)

| Particulars (Rs.in cr) | 9MFY25 | 9MFY24 | FY24 | FY23 |

|---|---|---|---|---|

| Revenue from operations | 464.00 | 375.00 | 562.00 | 353.00 |

| Other Income | 12.00 | 5.00 | 8.00 | 3.00 |

| Total Income | 476.00 | 380.00 | 570.00 | 356.00 |

| Employee benefit expenses | 33.00 | 34.00 | 44.00 | 31.00 |

| Finance costs | 145.00 | 125.00 | 171.00 | 138.00 |

| Depreciation expenses | 95.00 | 85.00 | 114.00 | 91.00 |

| Other expenses | 89.00 | 90.00 | 120.00 | 93.00 |

| Total expenses | 362.00 | 334.00 | 449.00 | 353.00 |

| PBT | 114.00 | 47.00 | 121.00 | 3.00 |

| Tax expenses | 28.00 | 14.00 | 34.00 | 3.00 |

| PAT | 86.00 | 34.00 | 87.00 | -0.75 |

| EPS (Rs.) | 0.92 | 0.39 | 1.00 | - |