Abans Holdings Limited - IPO Note

Finance - NBFC

Abans Holdings Limited - IPO Note

Finance - NBFC

Stock Info

Shareholding (Pre IPO)

Shareholding (Post IPO)

Company Description

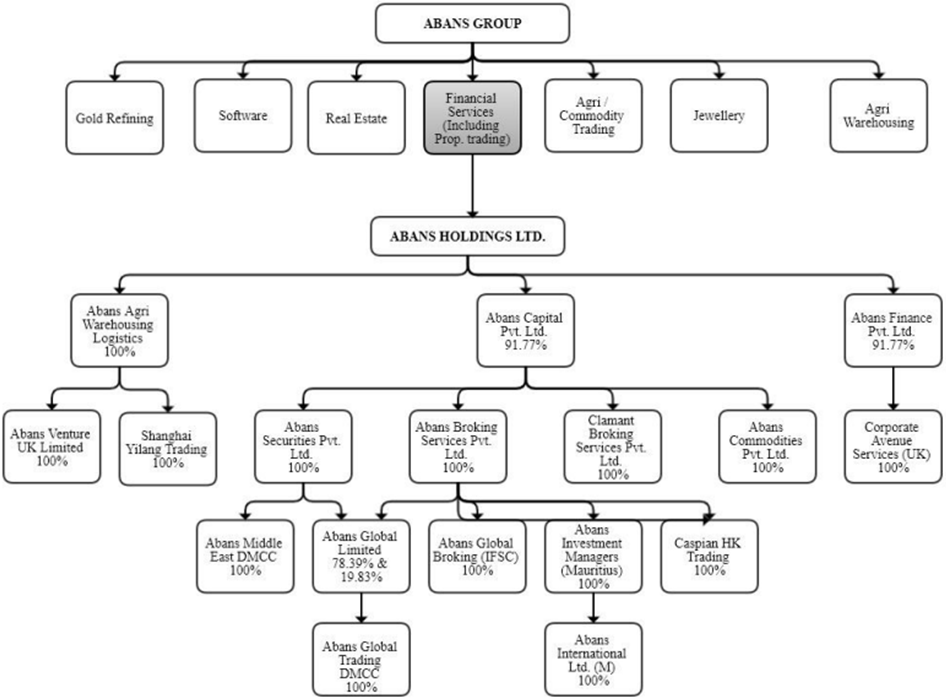

Abans Holdings Limited (“AHL”) was incorporated on September 24, 2009. The company is part of Abans Group, which is globally diversified organization engaged in Financial Services, Gold Refining, Jewelry, Commodities Trading, Agricultural Trading and Warehousing, Software Development and Real Estate. The group is founded by young entrepreneur - Abhishek Bansal.

AHL represents the financial services arm of the Abans Group. They operate a diversified global financial services business, headquartered in India, providing NBFC services, global institutional trading in equities, commodities and foreign exchange, private client stock broking, depositary services, asset management services, investment advisory services and wealth management services to corporate, institutional, and high net worth clients. The company is having varied financial services businesses which are mainly organized as under:

Finance Business: AHL operates as RBI Registered NBFC (Non-Deposit taking). Its Finance business is primarily focused on lending to private traders and other small and medium businesses involved in the commodities trading market.

Agency Business: AHL is SEBI registered Stock and Commodity Exchange Brokers with memberships across all the major stock exchanges in India, including BSE, NSE, MSEI, MCX, NCDEX and ICEX.

Capital and other Business: The Capital Business includes their internal treasury operations which manage their excess capital funds. AHL do so by investing their capital in low / medium risk strategies, maintaining positions in physical as well as exchange traded commodities and other instruments.

Competitive Strengths

Integrated financial services platform

AHL offers their clients an integrated financial services platform, offering various

financial services and products, including financing, institutional trading, private

client brokerage, asset management and investment advisory services. Further, these

services are provided not only in the Indian markets but across various markets

and exchanges globally. Besides being members of the BSE, NSE, MSEI, NCDEX, ICEX,

MCX and IIEL in India, they have memberships across various global commodity and

forex exchanges including London Metal Exchange (LME), Dubai Gold & Commodities

Exchange (DGCX), Dalian Commodity Exchange (DCE) and Shanghai International Energy

Exchange (INE). Further they have in-house NBFC business which provides lending

support to their clients.

Global exposure providing innovative financial products

AHL offer their clients with access to various commodity trading avenues through

their direct/ indirect memberships in LME, DGCX, DCE and INE. They specifically

offer a Contract for Difference (“CFD”) product to their institutional

and HNI clients with a risk appetite. The commodities traded globally also provide

their trading teams with ample arbitrage and short-term investment opportunities

for their internal treasury operations. Their international exposure helps their

customers diversify a portfolio, which in turn provides a balance between geographies.

Strong relationships with clients and market participants

Over the period AHL has grown their network of clients and traders not only in India,

but also on a global scale, mainly in UK, Mauritius, Hongkong and the Middle East.

Their focus on client coverage and their ability to provide ongoing and innovative

solutions in terms of diversity of investment avenues and global execution, enables

them to establish long-term relationships with institutional and high net worth

individual clients.

Peer Comparison

| Name of the company (2022) | Sales (Rs. In cr) | PAT (Rs. in cr) | ROE (%) | ROCE (%) | EPS(Rs) FY22 | PE(x) FY22 |

|---|---|---|---|---|---|---|

| Abans Holdings Limited | 284.89 | 29.74 | 9.13% | 8.00% | 13.37 | 20.19 |

| Edelweiss Financial services Limited | 6911.40 | 212.00 | 2.77% | 22.35% | 2.11 | 27.44 |

| Geojit Financial Limited | 480.79 | 143.00 | 20.00 | 26.73 | 6.31 | 7.28 |

Risks

Key Areas of concern

- Legal Proceedings – Abans Holdings Limited, their promoters and other group companies are subject to certain legal proceedings. Any adverse decision in such proceedings may have a material adverse effect on its business.

- Negative Cash Flows – Company have recorded negative cash flows consistently in the last 3 financial years. Cash Flow from operating activities as of FY22 stood at (-Rs.11.5 cr).

- Competitive intensity – Company operates in a highly competitive verticals such as NBFC Financing, Stock and Commodity Broking, Wealth Management activities, Treasury Operations, and its inability to compete with these players could adversely affect our results of operations and financial conditions.

- Volatility in capital markets -unexpected market movements and disruptions could affect its capital business making revenues and profits highly volatile.

Other Risks

- Offer for Sale (OFS) - The Offer consists of the Fresh Issue of Rs.102.6 cr and an Offer for Sale (Rs.243 cr). by the Promoter Selling Shareholder. Company will not receive any proceeds of the Offer for Sale.

- Contingent Liabilities – Company has contingent Liabilities worth Rs.141 cr.

Valuation

On the valuation front, Abans Holdings Limited is valued at 20x FY22E (EPS of Rs.13.37) calculated at the upper band of Rs.270.

Though the valuation appears reasonable but due to weak financial performance, competitive space, lack of triggers for growth, legal proceedings, and key risks & concerns mentioned above. We assign an AVOID rating to the issue.

Key Information

Use of Proceeds:

The total issue size is Rs.345.60 cr, of which Rs.102.60 cr is Fresh issue and balance

(Rs.243 cr) is Offer for Sale (OFS). The company will utilize the net proceeds from

the fresh issue for additional investment in its NBFC subsidiary for augmentation

of its capital base to meet its future capital requirements and remaining for general

corporate purposes.

| Sr. No. | Particulars | Amount (INR. CR.) |

|---|---|---|

| 1 | Further Investment in its NBFC subsidiary for augmenting the capital base to meet its future capital requirements. | 80 |

| 2 | General Corporate Purposes | 22.6 |

| 3 | Total | 102.6 |

Book running lead managers:

Aryaman Financial Services Limited

Management:

Abhishek Bansal (Chairman and Managing Director), Nirbhay Vassa (Whole time director),

Shivshankar Singh (Non-Executive Director), Rahul Dayama, Rachita Mehta and Ashima

Chattwal (Independent Directors).

Financial Statement

Profit & Loss Statement:- (Consolidated)

| Particulars (in Crores) | FY20 | FY21 | FY22 |

|---|---|---|---|

| Revenue | 2765.00 | 1325.51 | 638.63 |

| COGS | 2629.56 | 1171.00 | 519.00 |

| Gross Profit | 135.44 | 154.51 | 119.63 |

| Gross Margins (%) | 4.90% | 12.00% | 19.00% |

| Employee Benefits Expenses | 23.35 | 14.84 | 12.95 |

| Other expenses | 22.00 | 64.00 | 22.27 |

| EBITDA | 90.09 | 75.67 | 84.41 |

| EBITDA Margin (%) | 3.00% | 6.00% | 13.00% |

| Depreciation and Amortization | 1.36 | 1.11 | 0.72 |

| EBIT | 88.73 | 74.56 | 83.69 |

| Other Income | 6.67 | 5.85 | 7.61 |

| Finance Cost | 53.20 | 31.30 | 25.51 |

| Profit Before Tax & Exceptional items | 42.20 | 49.11 | 65.79 |

| Exceptional Items | 0.46 | ||

| Profit before tax | 66.25 | ||

| Tax Expenses | 3.11 | 3.31 | 4.28 |

| Effective Tax Rate (%) | 7.00% | 7.00% | 6.00% |

| PAT | 39.09 | 45.80 | 61.97 |

| PAT Margin (%) | 1.00% | 3.00% | 10.00% |

| EPS(Rs.) | 8.46 | 9.88 | 13.37 |