Zydus Lifesciences Ltd

Pharmaceuticals & Drugs - Global

Stock Info

Shareholding Pattern

Price performance

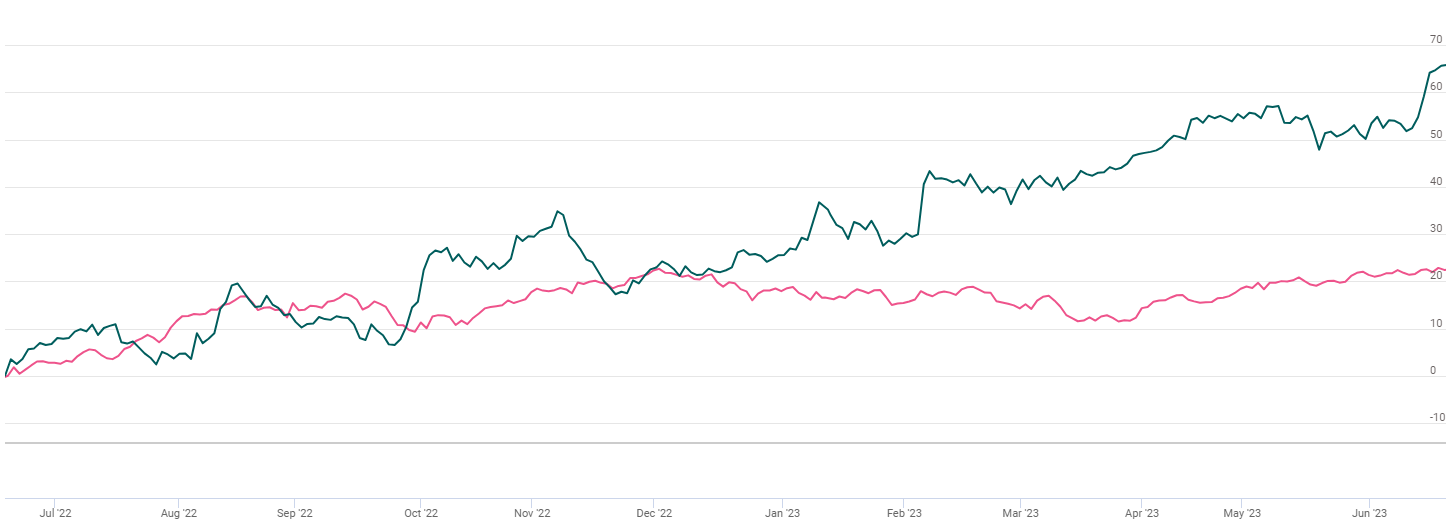

Indexed Stock Performance

Healthy growth outlook on the back of new product launches

Company Profile

Zydus Lifesciences (Zydus) is one of the leading pharmaceutical companies in India. The company is present across the pharmaceutical value chain of research, development, manufacturing, marketing, and selling of finished dosage human formulations (generics, branded generics, and specialty formulations, including biosimilars and vaccines), active pharmaceutical ingredients (APIs), animal healthcare products, and consumer wellness products. The company has a global presence and sells its products in the US, India, Europe, and emerging markets, including countries in Latin America, the Asia Pacific region, and Africa. The company is also engaged in research and development activities focused across the value chain of API process development, generics development for simple as well as differentiated dosage forms such as modified release oral solids, transdermal, topicals and nasals, biologics, vaccines, and new chemical entities (NCE).

Investment Arguments

Strong market position

The Zydus group is one of the top five players in the domestic formulations market, and domestic sales formed 32% of consolidated revenue in fiscal 2022. The group is ranked among the top 3 players in the high-growth segments such as respiratory, pain management, gynaecology, and dermatology, which account for about 11%, 10%, 6%, and 5%, respectively, of its domestic formulation sales. It has strengthened its marketing team over the past few years, putting greater thrust on market strategies such as growth in the categories, integration of channel partners, supply chain, and procurement to improve revenue and cost synergies. The group also has established a presence in the rest-of-the-world markets of Brazil, Mexico, Sri Lanka, and South Africa where it reported healthy revenue growth despite geopolitical challenges and adverse macro environment. Rest-of-the world segment (including Latin America) formed 8% of the consolidated revenue in fiscal 2022. The company also has a healthy pipeline of complex molecules and biosimilars in the domestic and emerging markets, which will be the growth drivers over the medium term.

Healthy growth outlook on the back of new product launches in the US

The US business is on a strong footing, helped by a sturdy new product pipeline and ramp-up in recent product launches, which would be growth drivers for the company. However, in the near term, high price erosion would act as dampener. Zydus expects 35-40 new product approvals/launches in the US, likely consisting of 25 plain-vanilla products and 8-10 niche complex generic products. We expect new products will offset price erosion in the US and also drive growth in the US business. The efforts to build up presence in the injectables space would also add to growth albeit over the medium to long term.

Chronic portfolio and biosimilars will drive growth in the India business

The India business has a robust growth outlook, backed by pickup in chronic as well as acute therapies and a few substantial high-value launches lined up. Over the long term, product launches such as Saroglitazar, gRevlimid, and Desidustat offer substantial growth potential. Zydus will continue to scale up key therapies of Respiratory, Cardiac, Gastro, and Gynec to drive growth in the India business. The growth will also be aided by novel products (such as Lipaglyn) and biosimilars.

Transdermals, Trokendi XR and Revlimid are growth drivers for the company

Zydus’ filed 9 transdermals filed in the US. While the company will likely launch 2 approved transdermals over the next 12 months, 1 product (fentanyl patch) will not be commercialized. Mgmt indicated that recently approved transdermals have an aggregate TAM of less than USD100mn. It became the first player to launch Topiramate ER capsules (gTrokendi) in the US in January 2023. Revlimid pricing environment for the US will remain favorable till FY26, given that the innovator’s settlements have capped volume MS for generic players.

Biosimilar filings in emerging markets

Zydus has the largest portfolio of biosimilar drugs approved in Indian markets, which is being leveraged for emerging markets. So far, the company has commercialized biosimilars in 9 emerging market countries, with Russia, Latin America, and Southeast Asian countries as key targeted markets.

Q4 Financial Performance Analysis

Consolidated Revenues grew 32% YoY to Rs.5010 crore. US sales, aided by gRevlimid and the limited competition launch of gTrokendi, grew 45% yoy to US$ 275mn (+17% qoq). EBITDA margin at 26.2% (adjusted for FX gain) was primarily led by gRevlimid. The margin excluding gRevlimid was 21% i.e. 280bps led by a better product mix of India and gTrokendi. Reported EBITDA was highest ever at Rs 1,315 cr (+62% yoy, +55% qoq). The reported PAT was lower at Rs 297 cr impacted by FX loss of Rs 590mn and impairment charges of Rs 601 cr relating to goodwill on Sentynl. The core PAT adjusted for the forex and one-off goodwill impairment was Rs 770 cr.

Outlook & Valuation

Zydus Lifesciences has been witnessing strong sales growth in India and the US on the back of strong product launches. Zydus has a rich US launch pipeline - three transdermals, gVascepa, two REMS, and 4-5 niche launches, which should translate into good earnings momentum. ZYDUSLIF expects to grow its US business in high single digits with 30-35 launches planned in FY24. Strong portfolio of existing products as well as a new launch product pipeline in the US, which provides revenue visibility. We believe that the company is well-paced to deliver steady earnings growth in the coming quarters owing to consistency from US business in terms of continued traction in base business and new launches momentum (post-Moraiya EIR), continued traction in Wellness and India formulations, Strong earnings prospects, healthy return ratios, and strengthening balance sheet. At a CMP of Rs.556, the stock is trading at 16x FY25 (EPS – Rs.35.5) which appears reasonable. Therefore, we recommend a BUY on the stock.