Zensar Technologies Ltd

IT - Software Services

Stock Info

Shareholding Pattern

Price performance

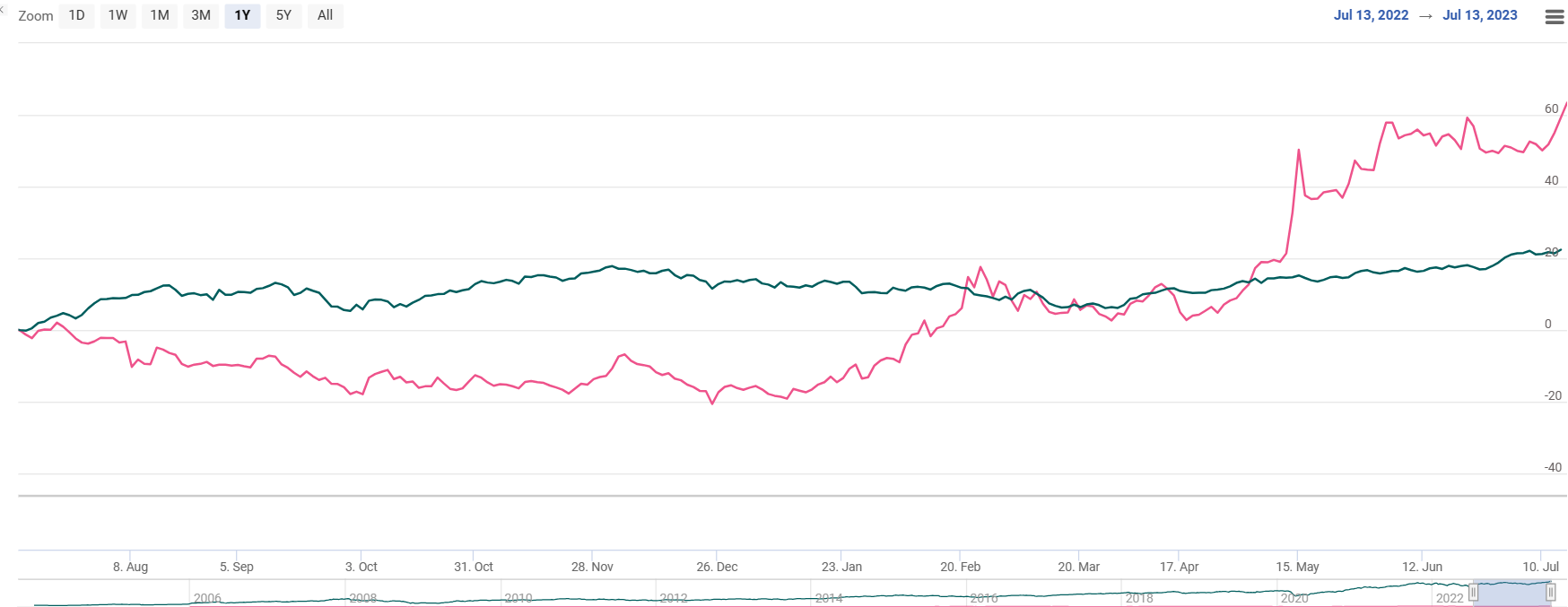

Indexed Stock Performance

Diversified revenue model supported by a healthy order book

Company Overview

Zensar Technologies Ltd. (Zensar) was incorporated in the year March 1963. It is a technology-based services company engaged in offering digital solutions to its clients. It is a part of the Mumbai-based RPG Group and is headquartered in Pune, India. The company's business model is divided into two segments~ (a) Application Management Service and (b) Infrastructure management service. The company delivers its services to multiple industries which are focused on Hitech & manufacturing, consumer services, banking, financial services, and insurance. Its operations are based out of the USA, UK, Europe and South Africa.

Investment Rational

· Diversified revenue model supported by healthy order book

During the quarter under review the Top 5, Top 10 and Top 20 clients of the company contributed 33%, 46% and 62% respectively the overall quarterly revenue of the company. On the business vertical front HTM, BFSI and CS contributed 48%, 36% and 16% respectively. Consequently, geographically the USA, UK/EU and South Africa contributed 70%, 18% and 12% respectively to the overall revenue of the company. Order book during the quarter stood at USD 174.9 mn (+34% QoQ) which is the highest in last 6 quarters. The Company won orders worth USD 572 mn during FY23 (book to bill of 0.95x).

· Revenue to increase on increasing addressable market for the company

The company over past few years have expanded its services from two service line like Infra & ADM to SAAS (with Salesforce, SAP & Oracle), data, advance engineering (new tech services) and experience. These services collectively account for 35% of revenues and the company plans to cross sell the same to existing clients thereby improving growth in longer run.

· Sustainable margin improvement

The company continues its margin improvement endeavour and in Q4Fy23 the EBITDA margin improved 320 bps QoQ to 14.5%. The company mentioned that the levers for margin improvement were as follows: i) +230 bps impact of decline in cost of delivery due to lower subcontractor cost & operational efficiency, ii) +190 bps impact due to increase in utilisation and iii) +30 bps impact of currency benefits mitigated by the headwinds impact of 130 bps due to increase in SG&A expenses due to reversal of one-time benefit in Q3. The company also mentioned that its subcontractor cost during the quarter declined 330 bps QoQ to 12.1%. The company also mentioned that reduction of subcontractor’s costs was one of the main levers for margin expansion in Q4 and further reduction is possible, which will aid margin expansion despite its continued investments in sales and marketing.

Q4 FY3 Analysis

During the quarter that ended 31st March 2023, the revenue of the company was Rs 1213 crores, which increased by 5% on a YoY basis. EBITDA of the company was at Rs 176 crores, which increased by 7% on a YoY basis. EBITDA margins of the company were at 14%, with no change as compared to the corresponding quarter of the previous year (Q4 FY22). PAT during the quarter was at Rs 119 crores, which decreased by 9% on a YoY basis.

Zensar reported a strong EBITDA margin expansion of ~324bps QoQ (substantial beat), while the revenue remained flat sequentially (+0.4% QoQ CC). The strong and sustainable margin improvement during the quarter was on account of lower sub-contracting, higher utilization, better productivity & business mix (lower passthrough) and FX. Margins are now expected to be in the range of mid-teens level, supported by continued gains in productivity—subcontracting expenses, pyramid rationalisation and utilisation improvement, going forward. PAT increased by 55.9% om QoQ basis.

Risk & Concerns

· Exposed to intense competition

The company operates in a highly competitive industry. Technological advancements and innovations are significant for the company to stay ahead of its peers.

· Longer than expected recovery in key verticals

The management expects challenges in consumer and hi-tech verticals going ahead and cited the uncertainty in the current demand environment with delay in decision-making. Longer than expected recovery in key verticals will impact Zensar;s profitability.

Outlook & Valuation

Zensar is taking the right steps to improve revenues in the long run — like restructuring of organisation from geo focus to vertical focus, hired COO and CB, and incentivising sales for large deals and cross sell to drive growth. Strong order book provides revenue visibility. New service lines such as experience and advance engineering are gaining strong traction and are growing faster than traditional ADM and Infra. Zensar saw good traction in new offerings from existing clients. We believe margin will expand in coming quarter on account of improvement in utilisation & lower subcontractor cost.

At a CMP of Rs 418, the stock is trading at PE 18x, its FY25E earnings. We recommend the 'BUY' rating for the stock.