UNO Minda Ltd

Auto Ancillary

Stock Info

Shareholding Pattern

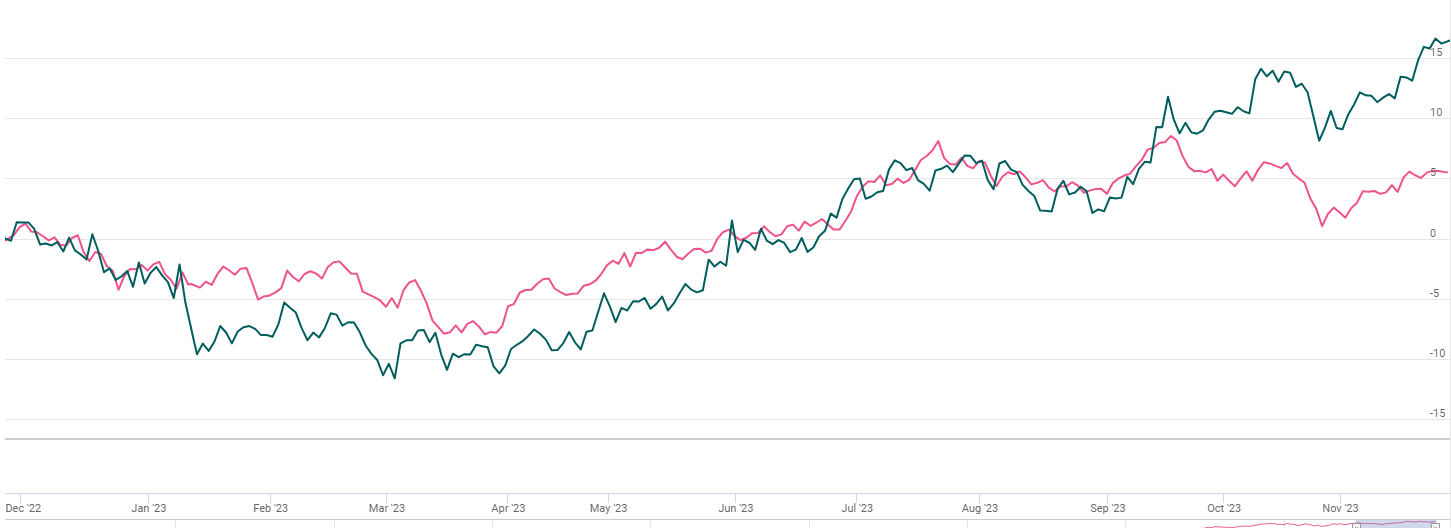

Price performance

Indexed Stock Performance

New product launches, robust order wins and focus on EVs to spur growth for UNO Minda

Company profile

Uno Minda Limited (formerly known as Minda Industries Limited) is a leading global manufacturer and supplier of proprietary automotive solutions and systems to OEMs as Tier-1. Incepted in 1958, it is one of the leading manufacturers of automotive switching systems, automotive lighting systems, automotive acoustics systems, automotive seating systems and alloy wheels in India. It manufactures and supplies over 20 categories of automotive components and systems to leading Indian and international OEMs based in India, Asia, South and North America and Europe. It has a leadership position in India in almost all the products it manufactures. Technology and innovation are the two strong pillars of the organization, on the basis of which it has continued to lead the emerging trends in the automotive sector, over the past few decades.

The Group is a global player in the automotive sector with overseas manufacturing facilities in Indonesia, Vietnam, Spain, and Mexico, as well as R&D Centers in India, Germany & Spain. It has over 73 manufacturing plants globally and has JVs/Technical Agreements with world renowned manufacturers from Germany, Korea, Japan etc.

Investment Arguments

Diversified business profile in terms of segments, customers, and products

UML’s business profile is well diversified, with presence across multiple automotive and product segments, catering to a wide portfolio of automotive OEMs. About 26% of the consolidated revenues were derived from automotive switches in Q2FY24, ~26% from switches, ~23% from lighting, ~21% from castings, 8% from seatings, and ~6% from acoustics. The rest of the revenues are driven by products like blow-moulded components, batteries, sensors, controllers, EV Products etc. through multiple JVs. In terms of automotive segments, two wheelers (2Ws) and three-wheelers (3Ws) account for ~43% of revenues, while four-wheelers (4Ws; primarily passenger vehicles) account for 50%. The diversified business profile helps UML mitigate the impact of any downturn in demand from specific product segments/ customers, while providing healthy revenue visibility.

Well-established market position in most product segments

Uno Minda Ltd is the largest automotive switch; automotive seating and PV alloy wheel manufacturer, the second largest player globally in automotive acoustics, and the third largest player in India for automotive lightings. Together these five product segments accounted for approximately 84% of the company’s consolidated revenues in Q2FY24. In other product segments as well, UML enjoys a leadership position in the domestic market through its subsidiaries/ JVs. The strong market position of the company provides healthy revenue visibility, going forward.

New product segments and technological capabilities to boost growth for UNO Minda

UML has focused on expanding into new product segments and improving its technological capabilities by entering JVs and technical collaborations with foreign players. These collaborations have helped UML expand its product portfolio and content per vehicle with OEMs. Over the years, Uno Minda has also built strong in-house research and development (R&D) capabilities with its more than 30 R&D and engineering centers across the globe. Its principal R&D centre called CREAT (Center for Research, Engineering and Advance Technologies) works on new technologies and making existing product line smarter. The most recent of its collaborations include a JV with FRIWO AG, a German company manufacturing innovative power supply units and e-drive solutions, and Buehler to develop, manufacture and market traction motors in India and other SAARC nations. These JVs are expected to substantially increase UML’s presence in the EV industry. Even as the company’s product portfolio remains majorly powertrain agnostic, thereby limiting risks arising from a transition towards e-mobility, it has steadily diversified to cater to the EV industry to enhance its content/vehicle and revenue growth prospects.

Strong Order Wins to spur growth

During the quarter, the company won new orders a) In the Switches segment for capacitive touch-based switch (first time) from Indian 4W OEM, b) In Ambient lighting from Indian OEM for its EV model, c) Orders worth Rs 350 Cr (peak annual value) in EV chargers from multiple OEMs, d) From new-age 2W EV OEM in seating division (supply starts over the next 6 months). The management noted that some of the new business wins, especially in EVs are price competitive and hence, profitability for this will improve gradually as the ramp-up happens.

Focus on EVs to boost growth.

The peak annual order value from EV OEMs stands at Rs.3,043 Cr, of which Rs 1,703 Cr is for EV-specific components. Sales to 2W EVs grew to Rs.143 Cr in Q2FY24 (vs. Rs.44 Cr in Q2FY23), primarily led by increased sensor and controller volumes. The first JV with FRIWO (for BMS, Chargers, RCD cables, and Motor controllers) rolled out in Q1FY24 has commenced operations and the second JV with Buehler (for traction motors) is expected to begin operations in Q4FY24. Uno Minda is well-positioned in the long run with its strong order book and execution capabilities.

Q2FY24 Financial Performance

Uno Minda delivers strong financial performance with highest ever quarterly revenue. Consolidated net sales rose 24% YoY to Rs.3,621 cr as against Rs.2,877 cr in the same quarter of corresponding fiscal driven by growth amongst all its product segment led by Alloy wheel, Automotive Lighting and Automotive Switches. The company has continued to demonstrate significant outperformance in current quarter as well compared to Industry volumes. On the operational front, consolidated EBITDA surged by 25% YoY to Rs.402 cr. EBITDA Margin expanded 14 bps to 11.1% YoY. PAT spiked 26% YoY to Rs.238 cr.

Key conference call takeaways

- The Company has also announced plan to set up a new greenfield plant with capacity of 120,000 flow forming GDC alloy wheels per month in phased manner. The plant will be set up in three phases comprising of first phase of 60,000 wheel and 30,000 wheels in second and third phase each. The total cost of the project will be Rs 542 Crores to be incurred over next 5 years basis the phased expansion. The location is expected to be finalized in next 3-4 months.

- Revenue mix: Revenue from Switches (26% share of total revenue) stood at Rs 933 Cr, up 17%/11% YoY/QoQ, Lighting (23% share) grew by 27%/17% YoY/QoQ to Rs 834 Cr, Castings (21% share) grew 23%/21% YoY/QoQ to Rs 753Cr, Seating (8% share) grew by 8%/6% YoY/QoQ to Rs 289 Cr, Acoustic segment (6% share) grew 16%/1% YoY/QoQ to Rs 210 Cr. Other business segments (17% share) grew by 69%/36% YoY/QoQ to Rs 601 Cr in Q2FY24.

- Exports:13% of total revenue. Channel-wise contribution: OEM – 93%, Aftermarket – 7%. Segment-wise: 42% of revenues came from 2W, while 4W stood at 50%. Aftermarket – The revenues were at Rs 259 Cr (Rs 249 Cr in Q1FY24).

- EBITDA margins: The management aspires to reach ~12% in the medium term. In the short term, a drag on margins is possible (multiple project expansion work underway) with higher fixed costs and lower operating leverage. However, in the long run, once production stabilizes, operating leverage is expected to have a positive impact on margins. Also, lower depreciation and interest costs in future will improve the bottom line.

- Net Debt: Consolidated Net debt for the company as of H1FY24stood at Rs ~1,190 Cr against ~Rs 1,100 Cr as of Mar’23 on account of capacity expansions.

Key Risks & Concerns

Susceptible to inherent cyclicality of automotive industry - As UML derives most of its revenues (83% in FY2023) from the domestic automotive market, its earnings remain susceptible to the inherent cyclicality of the market.

Inflationary pressures – Any significant increase in key raw material prices could adversely impact company’s operating margins and thus its profitability.

Outlook & Valuation

Uno Minda delivered healthy earnings growth in Q2FY24. With the introduction of new product launches, premiumization trends (higher kit value) and ramp up in capacity to meet industry demand, UNO Minda has been outpacing the industry growth in both 2W/4W segments and is poised to deliver robust growth in coming quarters. We like UNO Minda as a play on Auto, especially with a strong EV product portfolio, robust order book and capacity expansion projects, the benefits of which are expected in FY25 and beyond.

At CMP of Rs.723, the stock is trading at 42.5x FY25E (EPS – Rs.17) which appears reasonable citing strong growth prospects. Hence, we recommend BUY rating on the stock.