Transrail Lighting Ltd

Rs. 627.80

Reco. Date: May 28, 2025

-

Rating: Buy

-

BSE Code: 544317

-

NSE Symbol: TRANSRAILL

Stock Info

- Face Value (Rs) 2

- Equity Capital (Rs cr) 27

- Mkt Cap (Rs cr) 8,260.10

- 52w H/L (Rs) 718.90 - 394.55

- Avg Daily Vol (BSE+NSE) 609,640

Shareholding Pattern

- (as on 31-Mar) %

- Promoter 71.12

- FIIs 0.61

- DIIs 14.08

- Public & Others 14.20

Price Performance

- Return (%) 1m 3m 12m

- Absolute 24.90 27.07 -

- Sensex 1.66 9.30 8.17

Indexed Stock Performance

Transrail Lighting Ltd Sensex

Data Source: Ace equity, stockaxis Research

Transrail Lighting Ltd

A Compelling Power T&D Play with Strong Growth Potential and Strategic Global Footprint

Company Profile Transrail Lighting Ltd (TLL) is an Indian engineering, procurement and construction (“EPC”) company primarily focusing on power transmission and distribution business and integrated manufacturing facilities for lattice structures, conductors, and monopoles. It has a track record of four decades in providing comprehensive solutions in the power transmission and distribution sector, on a turnkey basis globally and have been a trusted and long-standing partner. They have completed more than 200 projects in power transmission and distribution vertical since inception, along with comprehensive and extensive project execution capabilities in terms of manpower, supply of materials (including self-manufactured products) and availability of world class machinery, both in India and internationally (majorly across Asia and Africa). Their position in the power transmission and distribution sector is owing to the following factors

- Has a footprint in 59 countries like Bangladesh, Kenya, Tanzania, Niger, Nigeria, Mali, Cameroon, Finland, Poland, Nicaragua etc. including turnkey EPCs or supply projects.

- As of March 31, 2025, they have undertaken EPC of 35,000+ circuit kilometers (“CKM”) transmission lines and 30,000 CKM distribution lines, domestically and internationally. It provides EPC services in relation to substations up to 765 kilovolts (“kV”).

- The company has presence in all the power transmission and distribution segments and majorly in high voltage (“HV”) and extra high voltage (“EHV”) segments.

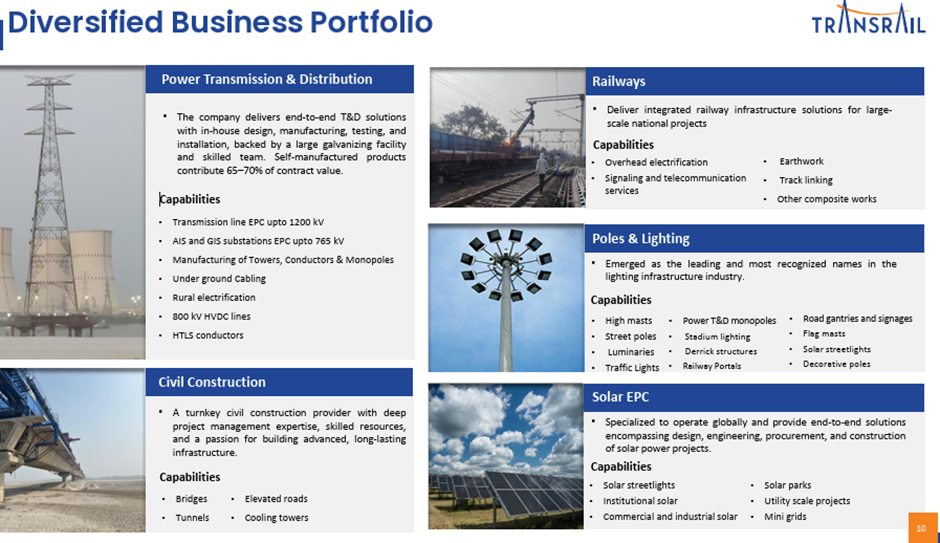

- Other than the power transmission and distribution business, they have other business verticals, such as, civil construction, poles and lighting, and railways.

The company has four operational manufacturing facilities including one tower testing facility.

- Supply as well as design, engineering, procurement and construction of transmission linesand distribution lines - They have designed, engineered, procured and constructed 35,000+ CKM transmission lines and 30,000 CKM distribution lines, respectively, both domestically and internationally. The company operates as EPC service providers and as a supplier of engineered products in the power transmission and distribution segment. It also provides EPC services in relation to air insulated and gas insulated substations.

- Civil Construction - It provides EPC services including design in relation to bridges, tunnels, elevated roads and cooling towers. They have been awarded with the Kosi bridge project which is the largest civil construction project currently being executed in India by the company.

- Poles and Lighting – The company has a diverse product manufacturing set-up, including high masts, street poles, luminaries, power transmission and distribution monopoles,stadium lighting, derrick structures, road gantries and signages, flag masts, solar streetlights, decorative poles etc. It operates as both manufacturers as well as supply, installation, testing and commissioning service providers in the poles and lighting segment. Their products have been used in many landmark projects across India and have also been exported to many countries. A few examples include Mumbai Trans Harbour Link, M. Chinnaswamy cricket stadium in Bengaluru, Samruddhi Highway, LED traffic lights in Mumbai, Qatar’s sports and decorative lightings, Zambia’s Lusaka city de-congestion project etc. Recently, they have expanded factory by adding a dedicated facility for signages.

- Railway services – TLL provides several services in relation to railways including overhead electrification, signalling and telecommunication services, earthwork, track linking and other composite works. Their manufacturing units have supplied railway portals and overhead contact rods. The railways vertical has operations only in India. They have provided services to government undertaking and corporations of the Ministry of Railways in India, in this segment.

Investment Arguments

Established position in the EPC business The four-decade-long experience of the management, the integrated services offered by the company, and healthy relationships with customers should continue to support earnings for TLL. These factors ensure repeat orders from clients such as Power Grid Corporation of India Ltd, Renew Power Private Ltd and Tamil Nadu Transmission Corporation Ltd. Substation business and high-end transmission line projects enhance the range of offerings and enable the company to bid for turnkey projects in the T&D segment. Transrail is also backward integrated through its manufacturing of towers, poles and conductors, which supports stronger operating margins. Diversification into related and other segments, such as civil construction, supports the business profile.

TLL has completed more than 200 projects in power transmission and distribution vertical, along with comprehensive and extensive project execution capabilities in terms of manpower, supply of materials (including self-manufactured products) and availability of worldclass machinery, both in India and internationally. With the company foraying into underground cabling and substations, they have a comprehensive execution profile for overhead transmission lines, monopole lines, underground cables, distribution networks as well as sub-stations.

Strong and diversified Order Book lends earnings visibility The company’s orderbook has a healthy balance of international and domestic clients and has consistently witnessed growth over the past few years. It primarily focuses on the quality of the products and services which help them in honing strong relationships with its clients.The company reported Highest Annual Order Intake so far of Rs. 9,680 Crore in FY25. Un-executed Order Book including L1 stands at impressive Rs. 15,915 crore as on March 31, 2025. TLL received new orders worth Rs. 4,965 crore in Q4FY25 taking to total order intake for the FY25 to Rs. 9,680 crore, majorly coming from Transmission and Distribution segment. T&D segment accounts for 92.49% of total order book. Within the T&D, the geographical mix remains well-balanced, with 51% from domestic projects and 49% from international markets. We expect the orderbook to remain healthy over the near to medium term, due to the company’s strong pre-qualifications in the T&D segment. FY25 order inflow comprises of 65% from the domestic market and the rest 35% from international market.

Strong in-house designing and engineering The company undertakes EPC business in an integrated manner. It has developed key competencies and resources in-house to deliver a project from conceptualization until completion. They have an experienced team of 114 designers and engineers who are specialists in each segment of business with a total cumulative experience of more than 17,000-man months. They also have access to industry leading software for design and engineering including software such as PLS Tower, PLSPoles, I tower, Bocad, Staad Pro, PLS Star, PLS CAAD, PLS Lit, DiLux, AGI 32, Autocad 3D, Solidworksetc.

The company provides leading-edge solutions in areas such as execution safety, workforce management and quality. One example of such leading-edge solution is the use of light detection and ranging (“LiDAR”) survey by the Company to survey the surface of the Earth in Niger, Benin and Cameroon. Their in-house integrated model includes a design and engineering team for each business vertical and has contributed to successfully complete projects on time, without compromising on quality and allowing them to capture a larger proportion of the value chain in the EPC business.

Established manufacturing facilities The company’s first manufacturing facility was in Vadodara, Gujarat, where it manufactured galvanized lattice steel towers, and was established in 1994. The manufacturing facility located in Deoli, Maharashtra, for manufacturing of galvanized steel towers was established in the year 2009. In parallel, they expanded business by setting up two manufacturing facilities in Silvassa, Dadra and Nagar Haveli, in 2007 and 2010, for manufacturing conductors and poles, respectively. Their factories are fitted with advanced computer numerical control (“CNC”) machines, plasma / gas-cutting machines, shearing machines, welding facilities, large sized galvanizing baths, wire drawing machines and furnaces.

Further, the Company has an in-house tower testing facility located in Deoli, Maharashtra which houses research and development team providing tower testing services with provisions for online viewing of the tower tests. It also manufactures railway masts and copper rods for railways vertical and poles and high masts for poles and lighting vertical. Their tower manufacturing and testing unit in Deoli, Maharashtra, pole manufacturing unit in Silvassa, Dadra and Nagar Haveli are CE certified and all their in-house testing facilities are NABL accredited. They also manufacture advanced high-tension low sag (“HTLS”) and high temperature conductors (“HTC”) at conductor manufacturing unit in Silvassa, Dadra and Nagar Haveli. It aims to achieve full backward integration and their manufacturing facilities also have the capacity to manufacture the key components of towers, conductors and poles that it typically requires in the construction of transmission lines. These manufacturing facilities help them reduce dependence on third party suppliers for its key products.

Diversified Product Portfolio TLL boasts of a diversified product portfolio particularly in the power transmission and distribution sector. They offer a wide range of services including engineering, procurement, and construction (EPC) for transmission and distribution lines, as well as civil construction, poles and lighting, and railway projects.

Power Transmission & Distribution Transrail Lighting designs, engineers, and constructs overhead and underground transmission lines, distribution networks, and substations. They have integrated manufacturing facilities for lattice structures, conductors, and monopoles. They have extensive experience in executing large-scale projects both in India and internationally.

Civil Construction The company offers EPC services for various civil infrastructure projects. A turnkey civil construction provider with deep project management expertise, skilled resources, and a passion for building advanced, long-lasting infrastructure.

Poles and Lighting

- Pole Structures: Transrail Lighting designs and supplies various types of poles, including high masts, streetlights, distribution monopoles, and stadium masts.

- Lighting Solutions: They offer comprehensive lighting solutions for various applications.

Railways

Railway Electrification: They specialize in railway electrification, including overhead electrification, signaling, and track linking.

Solar EPC: Specialized to operate globally and provide end-to-end solutions encompassing design, engineering, procurement, and construction of solar power projects.

Q4FY25 Financial Performance Transrail Lighting Ltd reported healthy earnings growth for the quarter ended Q4FY25. Consolidated net sales witnessed robust growth of 40% YoY to Rs.1946 cr as compared to Rs.1358 cr underpinned by robust orderbook and improved execution. In Q4FY25, revenue growth was driven by the core T&D segment, reflecting improved execution pace and steady project milestones achieved during the quarter. On the operational front, consolidated EBITDA saw a solid growth of 41% YoY to Rs.237 cr while margin improved to 12.20% from 12.11% in the corresponding quarter of preceding fiscal. PAT soared to 127 cr; registered a growth of 36% YoY.

Key Highlights

- Received new orders worth Rs. 4,965 crore in Q4FY25 taking to total order intake for the FY25 to Rs. 9,680 crore, majorly coming from Transmission and Distribution segment.

- Un-executed Order Book was Rs. 14,551 crore as on 31stMarch, 2025 registering a growth of 44% on YoY basis and additionally L1 position stood at Rs. 1,364 crore.

- T&D segment accounts for 92.49% of total order book. Within the T&D, the geographical mix remains well-balanced, with 51% from domestic projects and 49% from international markets.

- To cater to increasing demand and support the execution of a growing order book, the company is expanding its manufacturing facilities for towers and conductors.

Business Highlights FY25

- Successfully commissioned 765kV D/C Transmission Line at Khavda & 400kV D/C Transmission Line at Neemuch for PGCIL.

- Successfully commissioned 220kV/33kVGIS Substation in Dholera.

- Awarded a package as part of the 800kV HVDC KPS2 – Nagpur Transmission Line.

- Secured first Solar EPC order in international market for an 80MW DC ground-mounted Solar PV Project, including an associated substation.

- Received EPC contract 400kV DC Transmission Line in Nepal.

- Received orders for supply of Railway Mast and Metal Fencing for India’s first bullet train project.

- Successfully commissioned one of the highest Natural Draft Cooling Tower NDCT in India (199 meters at Yadadri, Telangana).

- Successfully commissioned 400kV AIS Bay Extension and 220kV GIS Bays at PGCIL Banka Substation.

- Received upgrade from CRISIL for ratings on the long-term bank facilities to ‘CRISIL A+/Stable’.

Key Conference call takeaways

Segmental Orderbook Mix

- Power T&D – 92%

- Railway – 4.48%

- Civil – 1.80%

- Pole & Lighting – 1.24%

Capacity Expansion Plan

Towers

- Existing Capacity – 84,000 MTPA

- Post Ongoing expansion – 1,73,000 MTPA

- Post Future expansion – 1,96,000 MTPA

Conductor Segments

- Existing Capacity – 24,000 KM

- Post Ongoing expansion - 40,800 KM

- Post Future expansion – 49,500 KM

FY26 Guidance Revenue growth is pegged at 23-25% while EBITDA Margin is guided at – 12-12.5%

The company expects a strong order inflow growth in FY26, potentially maintaining or bettering the order intake level in India, partly driven by PowerGrid’s capex plan.

Market Share

- In the T&D business in India, the company has a 10-12% market share.

- Specifically with PowerGrid, their current market share is around 8-10%, which they intend to achieve this year.

Other Key Highlights

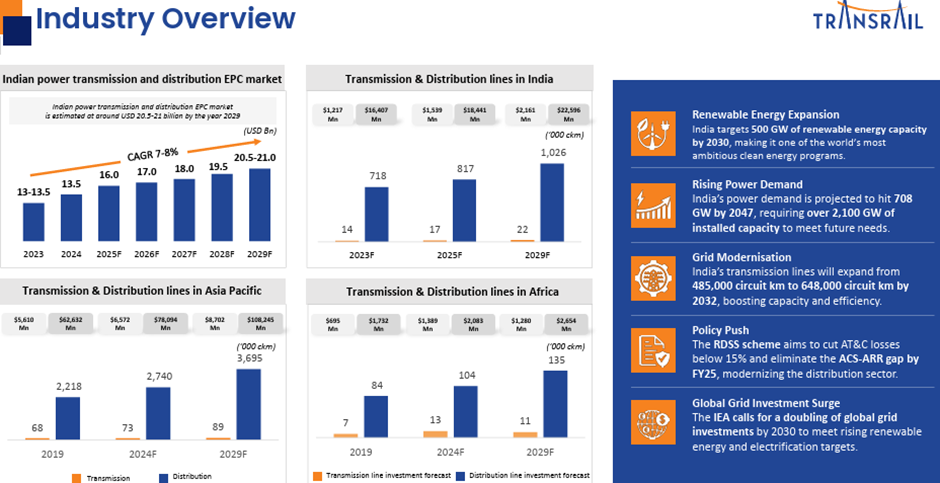

- The total addressable market in India’s T&D sector is estimated to be around Rs.1 lakh cr, with at least Rs.50000-60000 cr in India, potentially doubling in the following year.

- The current bid pipeline (both domestic and global) is more than Rs.1 lakh cr. The company aims for an 8-10% win ratio from this pipeline.

- The Bangladesh order book concentration has decreased from 20% in December to 15% in March and is expected to be 12% in May and 5-6% by year end, with the job expected to finish by June 2027. Payments or on schedule. The company does not intend to bid for new orders in Bangladesh as of now.

Key Risks & Concerns

Execution Risk: As is the case with EPC business, delay in execution of projects could lead to increase in cost. Additionally, execution is dependent on availability of workers, shortage of skilled and unskilled workers could also result in higher cost (employee or other operational), thereby impacting results of operation.

Exposure to intense competition and other risks being an EPC player: Competition is intense in the power T&D business due to low entry barriers. Profitability is susceptible to any downturn in demand and structural issues and volatility in the power sector. Any large-scale project deferrals or slow project execution due to macroeconomic factors could lead to cost overruns, which would impact profitability, given the limited flexibility to pass on cost increases.

Exposed to foreign currency fluctuation risks: TLL is exposed to foreign currency fluctuation risks, particularly in relation to the import of raw materials, receivables from their foreign projects and their trade receivables, which may adversely affect their results of operations, financial condition and cash flows.

Outlook & Valuation

Transrail Lighting Limited is one of the leading Indian EPC Company with a wide global footprint, with major focus on Power T&D with integrated manufacturing facilities for lattice towers, conductors and monopoles. Power T&D market is witnessing significant surge in demand both domestically and internationally owing to upgradation of existing infrastructure renewable energy adoption and rising per capita electricity consumption. Transrail Lighting Ltd presents a compelling investment opportunity citing healthy orderbook, diversified product portfolio, established manufacturing facilities, strong industry tailwinds, consistent financial performance, strong in-house design and engineering capabilities, government reforms augmenting growth, encouraging growth prospects and a strong presence in a high-growth sector. Its strategic expansion plans and proven operational efficiency positions it as a strong contender for long-term growth. Transrail Lighting stands to benefit from India’s rapid infrastructure development and electrification drive, fueled by initiatives like Power for All and Make in India. The company’s growth prospects may be further boosted by sectoral tailwinds such as increased investments in power transmission, railway electrification and renewable energy integration. With robust cash flow management and a diverse portfolio of multi-lateral contracts, including those with the World Bank, Transrail effectively mitigates risks and positions itself for sustainable growth. At CMP of Rs.615, the stock is trading at 25x. We recommend BUY rating on the stock.