Tilaknagar Industries Ltd

Breweries & Distilleries

Stock Info

Shareholding Pattern

Price performance

Indexed Stock Performance

Strong traction in new product launches coupled with diverse product portfolio to sustain growth for Tilaknagar Industries

Company Profile

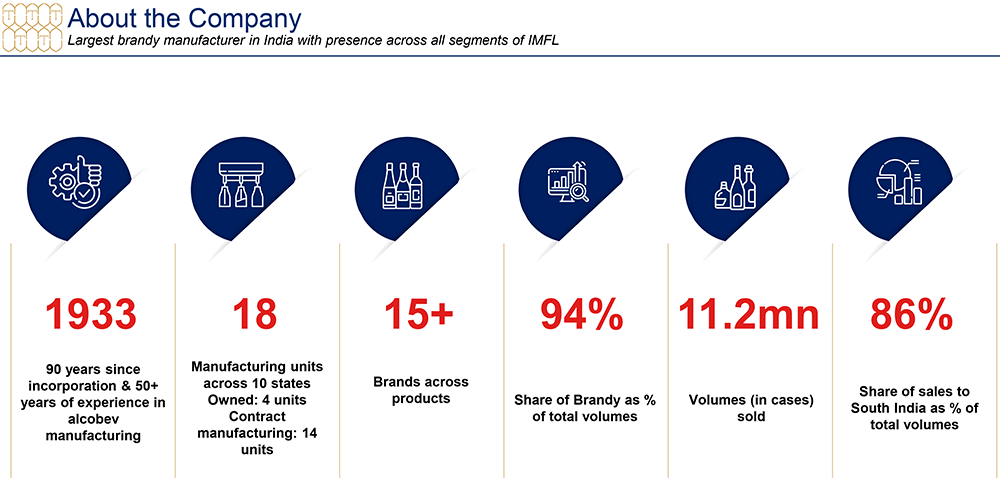

Tilaknagar Industries Ltd. (TIL) was incorporated in July 1933. The company is primarily

engaged in the manufacturing and sale of Indian-made Foreign Liquor. The company

has a diverse product portfolio of brands with various varieties of liquors such

as brandy, whisky, vodka, gin and rum. Its brand portfolio holds 15+ brands across

all the aforementioned liquor categories. Its products are sold under the brand

names ~ Mansion House Brandy, Courrier Napoleon Brandy, Madiraa, Mansion House Whisky

and Senate Royale Whisky.

The Company has a strong distribution network across the country, selling primarily through state corporations and direct sales and distributors. It also exports its products to East and South-East Asia, Africa, the Middle East, and Europe.

The primary manufacturing facility is in Srirampur, Ahmednagar district, Maharashtra. In Srirampur, TIL has a 100 KLPD grain-based distillery (currently non-operational) and a 50 KLPD molasses-based distillery. TIL is a significant player in the brandy segment; Brandy forms 22% of overall IMFL market in India. TIL is the largest player in the brandy segment having ~20% market share excluding Tamil Nadu (market dominated by local players). TIL has a strong foothold and brand-recall in South Indian market (A.P, Telangana, Karnataka, Kerala and Pondicherry) contributing ~86% of total volume.

Investment Arguments

Established market position in the brandy segment of Indian manufactured foreign

liquor (IMFL) industry

TIL, which was setup as a sugar manufacturing company in 1933 gradually exited the

same and has been involved in manufacturing and bottling of IMFL since 1974.

TIL enjoys leadership position in the brandy segment (93% of total volumes) of IMFL industry with market share of ~20% excluding Tamil Nadu. Further, within the Prestige and above segment of brandy, TIL has ~30% market share. Brandy is the second largest in spirits category in IMFL with ~20% plus volume share after whiskey, which has ~55% share. South India is a key region for IMFL manufacturers with almost 60% consumption coming from the region. TIL has a major presence in the Southern market with ~86% of total volumes coming from this region.

Prestige and above constitutes only ~34% of overall brandy segment, which is much lower compared to whiskey and vodka. Increasing premiumisation is expected to augur well for the company as more than ~80% of its products are in the premium category. This along with new product launches is expected to drive revenue growth in the near-to-medium term.

Strengthening presence in non-southern States

Tilaknagar Industries (TI) currently drives 86 percent of its sales from the southern

markets. It plans to increase the revenue contribution from other markets like North

and North-East in the current financial year. Currently, Andhra Pradesh, Telangana,

Karnataka, Kerala, Puducherry, and Tamil Nadu are prominent markets in southern

India.

Established track record and extensive experience of the promoters

TIL, which was setup as a sugar manufacturing company in 1933 gradually exited the

same and has been involved in manufacturing and bottling of IMFL since 1974. The

company has a strong distribution network of ~40,000 outlets across the country,

primarily selling through state corporations, direct sales, and distributors. It

also exports its products to Africa, the Middle East, East and South-East Asia and

Europe.

The company is a major player in the Southern Indian states, which account for ~86% of total revenue. The promoters have experience of more than five decades in this field and have strong relationships with dealers/distributors. Mr Amit Dahanukar, the current Chairman cum Managing Director joined the board in 2001 and has been instrumental in guiding the company through its troubled phase and reviving the business prospects.

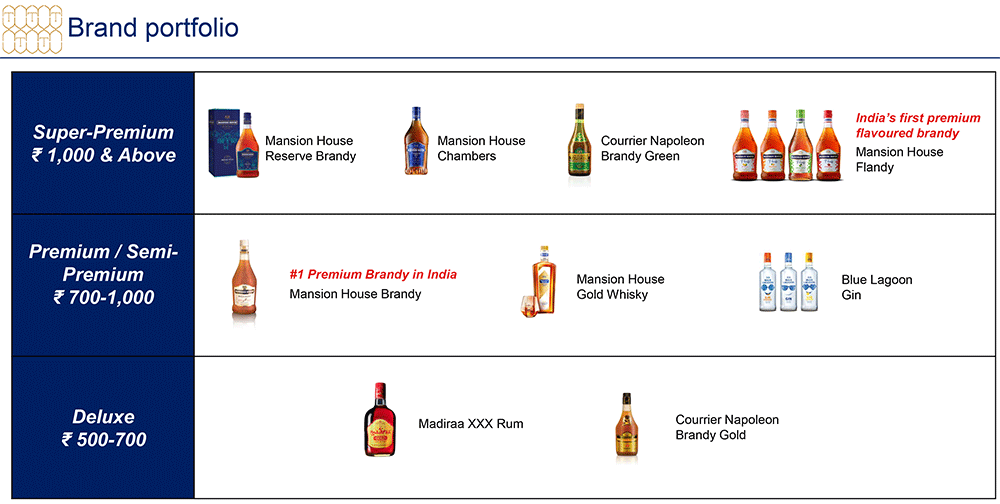

Strong traction in new product launches coupled with diverse product portfolio

TIL recently launched Green Apple Flandy (Flavoured Brandy) in Telangana and Andhra

Pradesh and within first quarter of launch, it achieved 20% share of Flandy volumes

across flavours in the two states. Courrier Napoleon Brandy (“CNB”)

straddles across Prestige & Above (“P&A”) as well as Popular

& Below segments; P&A CNB has seen a growth of more than two times, indicating

premiumization trend playing out in CNB as well. The company also offers diversified

product portfolio across different price points including Mansion House, Courrier

Napoleon Brandy Gree, Blue Lagoon Gin etc.

Q2FY25 Financial Performance

Tilkanagar industries registered healthy earnings growth for the quarter ended Q2FY25.

For Q2FY25, revenue growth stood at 6% YoY to Rs. 375 crore, with underlying volume

growth at 3.1%. Revenue for the first half increased by 4.5% to Rs. 688 crore. The

net sales realisation (NSR) per case was at Rs. 1,274 in the 2nd Quarter, while

the 1st Quarter NSR stood at Rs. 1,264 per case. Q2 also saw company delivering

highest ever EBITDA; EBITDA for the quarter showed significant growth of 39% YoY

to Rs. 66 crore on the back of superior brand mix and ongoing cost optimization

efforts. EBITDA margins expanded by 422 basis points to 17.6%, and adjusted for

the subsidy income, EBITDA stood at Rs. 56 crore at a margin of 15.3%, showing a

188-basis points margin expansion on adjusted EBITDA. For H1 FY25, EBITDA reached

Rs. 116 crore with margins at 16.9%, marking an expansion of 385 basis points. Similarly

PAT increased by 82% to Rs. 58 crore, up from Rs. 32 crore in Q2 of last year. For

the first half, PAT grows to Rs. 98 crore which saw a 70% increase from Rs. 58 crore

in the same period last year.

Market share and leadership position:

- Continue to be the 3rd largest P&A IMFL player in Telangana and Karnataka in Q2FY25.

- Continue to be the largest IMFL player in Puducherry in Q2FY25.

Brands:

- Launch of Mansion House Whisky in Assam in the Semi-Premium segment.

- Flandy continued to increase saliency as % of MHB in relevant states.

- Courrier Napoleon Brandy (“CNB”) P&A saliency within CNB family of brands continues to grow; from 33% in Q1 FY25 to 38% in Q2FY25.

Strategic Investments

- Follow-up investment in Spaceman Spirits Lab Pvt. Ltd., the makers of ‘Samsara Gin’ and ‘Sitara Rum’. Investment of Rs. 13.15 crs across 3 tranches over an 18 months’ period. Post all 3 investments, TI shareholding on a fully diluted basis in SSL will increase to 20% from 10% pre-deal.

- Investment in Round the Cocktails Pvt. Ltd., the makers of ‘Bartisans’, a ‘Ready to Pour’ cocktail mixers brand. Aggregate investment of Rs. 8 crs for a 36.2% stake on a fully diluted basis.

Key Conference call takeaways

- Management attributed the strong financial performance to a superior brand mix and successful cost optimization efforts, even amid somewhat muted volume growth.

- Volume growth for Q2FY25 was impacted by industry-wide challenges, such as higher consumer prices in Karnataka, delayed receivable cycles in Telangana, and the route to market transition in Andhra Pradesh.

- The company believes the most challenging period of inflation is behind it. They are optimistic about expanding profitability, even with increased investment in advertising and sales promotion.

- Key Developments in Andhra Pradesh including the move towards private retail, are expected to boost industry growth. TI, a leading player in the state, is well positioned to capitalize on this expansion with its strong brand portfolio, particularly in the brandy category.

- TI is targeting mid-teen volume growth in the H2FY25. Factors contributing to this optimistic outlook include the easing of regulatory challenges in Andhra Pradesh, pricing adjustments in Karnataka leading to improved sales, and anticipated seasonality benefits in brandy sales.

- On the product front, TI launched Mansion House Whisky in the semi-premium segment in Assam. This move aligns with the company's strategy to explore categories beyond brandy and expand its footprint beyond its traditional southern markets.

- The company plans to enter the luxury brandy market in Q3 FY25, further strengthening its presence in the premium segment.

- As part of its inorganic growth strategy, TI has made strategic investments. These include a follow-on investment in Spaceman Spirits Lab, increasing its stake to 20%, and an investment in Round the Cocktails Private Limited, securing a 36.2% stake.

- The investment in Spaceman Spirits Lab, makers of Samsara Gin and Sitara Rum, is accompanied by a usership agreement. This enables TI to sell these brands in selected regions in India and internationally, contributing to the company's diversification efforts.

- TI has exited its investment in Incredible Spirits at cost due to the relatively small size of the investment.

- Management sees immense growth potential in the Indian alcoholic beverage (AlcoBev) sector and is confident in its ability to play a significant role in this growth.

Key Risks & Concerns

Regulatory Risk: Limited geographical and category diversification in the highly regulated alcohol industry: The liquor industry is highly regulated with the state government controlling its selling and distribution. Any change in government policies with respect to production and distribution, or significant variation in the duty structure may impact the liquor industry, and therefore, the company.

Geographical concentration: TIL’s large portion of overall revenues is derived from Southern India (86% of total volumes), where any unfavourable regulatory policy may impact its business. The company has been taking steps to gradually reduce its geographical concentration by expanding into newer regions.

High Competition: The markets of the IMFL industry are dynamic in nature and are rapidly evolving. Over the past 10 years period in order to boost domestic businesses in this industry-government has eased the barriers to entry rules, which has allowed many competitors to enter these markets. Growing consumer demand and new tastes & preferences in the industry are also one of the reasons for increased competition.

Procurement Risk: Inflationary tailwinds lead to hikes in raw material prices raw materials e.g. molasses and grains or packing materials e.g., glass, and packaging materials may impact the operating margins and profitability of the company. Also, dependence on limited suppliers may expose the company to supply risk.

Outlook & Valuation

Tilaknagar Industries delivered another impressive set in Q2FY25. The company is betting big on the growing prominence of brandy in the Indian-made foreign liquor (IMFL) market. The company has delivered a strong quarter in Q2FY25, and we expect the growth to continue on account of expansion in the eastern part of the country, strong distribution network, diverse product portfolio, market leadership position in brandy segment, new product launches. Revenue is expected to grow in double digits over the near-to-medium term driven by strong demand for existing products, increasing revenue contributions from new product launches in the premium category such as Flandy and Chambers and increasing geographic penetration Management is confident of industry-beating growth, with focus on a good mix of market share gains in our existing portfolio, as well as innovative launches within brandy and beyond. Going forward we expect volume growth to normalize, as well as resume trajectory of market share gains. At CMP of Rs.345, the stock is trading at 36x FY26E. We recommend BUY rating on the stock.