Texmaco Rail & Engineering Ltd

Railways Wagons

Stock Info

Shareholding Pattern

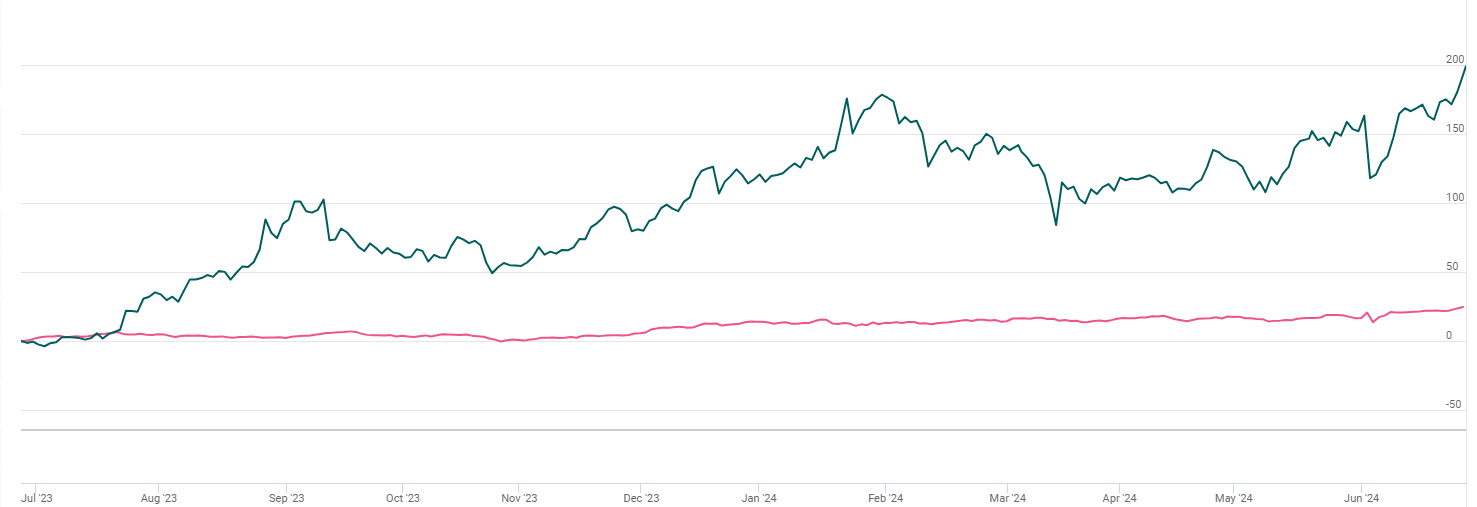

Price performance

Indexed Stock Performance

Poised for growth

Company Profile

Texmaco Rail & Engineering Ltd (Texrail) is an engineering infrastructure co. & part of the Adventz Group, The co. is involved in manufacturing Rolling stock, hydro-mechanical equipment, steel castings & construction of Rail EPC, bridges, and other steel structures. TexRail has an installed capacity of 10,000 Vehicular Units (VUs) of wagons which remains flexible, 20,400 MTPA of structurals, 10,000 MTPA of bridges, and 42,000 MTPA of steel castings. The product range of TexRail comprises of railway freight cars, hydro-mechanical equipment, industrial structurals, steel castings, loco shells, electrical mechanical unit (EMU), railway bridges and pressure vessels which is manufactured across four manufacturing facilities in West Bengal. Besides the domestic market, TexRail also has a presence in overseas markets.

TexRail acquired an equity stake in KRNL in FY14 and subsequently merged it with itself on February 11, 2017, with the appointed date being April 1, 2014. The business of KRNL for the execution of railway projects involving track laying, signaling, and telecommunication in India is running as the ‘KRN’ division under TexRail.

Furthermore, in January 2016, TexRail acquired a 55% shareholding in BPPPL. Later, BPPPL and another subsidiary Texmaco Hi-Tech Private Ltd were merged into TexRail vide NCLT order received in April 2019, with the appointed date being April 1, 2017. The BPPPL division undertakes electrical contracts for the erection, installation, commissioning, and maintenance of overhead lines, transformers, and other equipment for Indian Railways.

Investment Arguments

Experienced promoters with established presence in multiple businesses

TexRail is a part of Saroj Kumar Poddar faction of the K. K. Birla group, which was subsequently rechristened as Adventz Group. Adventz is an established business group in the country having interests in fertilizers, chemicals, financial services, real estate, and sugar. The promoters have significant business experience and demonstrate support to TexRail by infusion of funds as equity and unsecured loans as and when required. The support is expected to continue going forward as well.

Diversified business operations

TexRail has established a presence in railway wagon manufacturing and has gradually diversified into commodity specific wagons for private parties, electric locomotive shells, and sub-assemblies supplied to private parties. Over the years, it has added capacity for manufacturing hydro-mechanical equipment, heavy steel structures, process equipment, and steel foundry products. TexRail is one of the largest players in the domestic wagon manufacturing industry in India. It ventured into rail EPC for railway track laying, signalling and telecommunication through acquisition of Kalindee Rail Nirman (Engineers) Limited (KRN) and railway electrical contracts for overhead lines, transformers, and other equipment through Bright Power Projects (India) Private Limited (BPPPL), both of which had been merged with TexRail. The company has strengthened its position as a rail solutions provider with a presence in wagons, locomotive shells, coaches, bridges, track laying, tele-communications, electrification, etc.

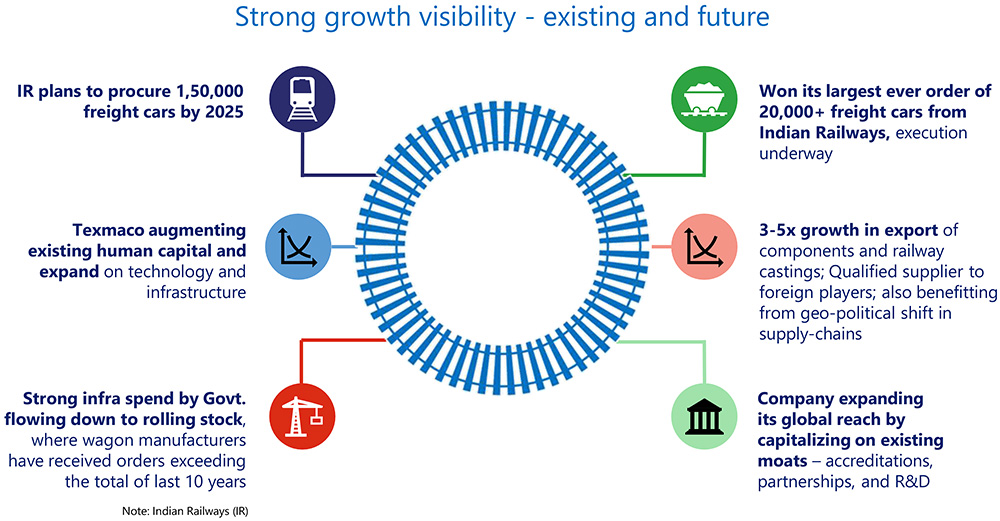

Healthy order book position given GoI thrust on railway infrastructure

TexRail had a healthy order book position of Rs.8,000 crore as on March 31, 2024. The breakup of the order book is freight car division stands at Rs.5,500 crores; Rail Infra and Green Energy would be Rs.750 crores; Infra Electrical which is Bright Power is Rs.1,150 crores. Their various joint venture and subsidiaries are close to Rs.500. The order book comprises of 88% from Indian railways and the remaining 12% from the private. The management has shifted its focus to contracts entailing smaller duration and lower requirements of working capital. During the quarter, the company won largest-ever order of 20,000+ freight cars from Indian railways and the execution is underway.

Well-positioned to capitalize on the highest-ever capital outlay by Indian Railways

Railways is the largest consumer of wagons in the country. The outlook for the wagon industry is predominantly dependent on the demand from the same and the budgeted allocation for such outlays. The Government of India is focusing on improving the railway infrastructure and ensure faster development and completion of tracks, rail electrification, rolling stock manufacturing and delivery of passenger freight services. The budgetary allocation towards railway projects have been increased to ₹2.55 lakh crore for 2024-25. This has resulted in the recent influx of orders from GoI for freight wagons. Apart from supplying wagons to railways, TexRail has been receiving large orders for commodity specific wagons from private sector companies. TexRail, with large capacity for manufacturing these wagons, is well-placed to take advantage of this growing demand.

Q4FY24 Financial Performance

Texmaco rail reported stellar earnings growth for the quarter ended Q4FY24. The company reported higher ever turnover and Profit in FY24. In Q4FY24, consolidated net sales rose 37% YoY to Rs.1,145 cr as compared to Rs.835 cr registered in the same quarter of corresponding fiscal. On the operating front, consolidated EBITDA witnessed a robust growth of 54% Yoy to Rs.91 cr while margin expanded by 90 bps at 8%. PAT more than doubled to Rs.42 cr.

Key Risks & Concerns

Exposure to volatility in prices of raw materials as well as their timely availability

Wagon manufacturers have to rely on Research Design and Standards Organisation (RDSO) approved vendors for the supply of major raw materials such as steel, cartridge tapered roller bearings (CTRB), wheel sets, etc. Furthermore, the company is exposed to significant volatility in prices of raw materials, though the same is mitigated to an extent due to presence of escalation clause with respect to variation in input prices in the long-term contracts of railways and private parties (except orders from private parties to be executed in short-term, i.e. 1-2 months). Furthermore, in the rail EPC segment also, the company is exposed to raw material price volatility.

Risk associated with tender based business and competition: TexRail receives majority of its orders from Indian Railways and other government and semi-government entities as well as for exports based on tender. Hence, the revenue is dependent on the company’s ability to successfully bid for these tenders. The company faces stiff competition from other established players in the wagon segment. Furthermore, in the rail EPC segment also it is exposed to competition from larger players in the industry.

Elongated receivables leading to weak return indicators: The nature of business of TexRail entails considerable dependence on working capital requirements both in the form of fund-based and non-fund-based borrowings. The debtors (including retention) increased from Rs.689 crore as on December 31, 2022 to ₹808 crore as on December 31, 2023. The increase in debtors mainly relates to the heavy engineering division wherein the company is executing the wagon orders for railways.

Outlook & Valuation

We believe that TexRail is well placed to capitalize on the highest ever capital outlay by Indian railways on the back of a robust order book providing earnings visibility for medium to long term, superior execution, diversified business operations, full-suite wagon building, and component manufacturing facilities, with export capabilities and credentials, strong R&D capabilities, strong industry tailwinds, government’s thrust to improve railway infrastructure augurs well for the company. The company has a strong order book position of ~Rs.8000 cr with the majority of it expected to be executed in the current FY and provides the necessary revenue visibility over the next couple of quarters as well. With the current monthly wagon production count of ~850, Texrail anticipates to scale up the same to ~1000 in the ensuing quarters. On the exports front, the company continues to witness traction for its products, particularly in the US and the European markets and Management intends to enhance its overall exports share in the near term. At a CMP of Rs.240, the stock is trading at 84x. We recommend BUY rating on the stock.