Texmaco Rail & Engineering Ltd

Railways Wagons

Stock Info

Shareholding Pattern

Price performance

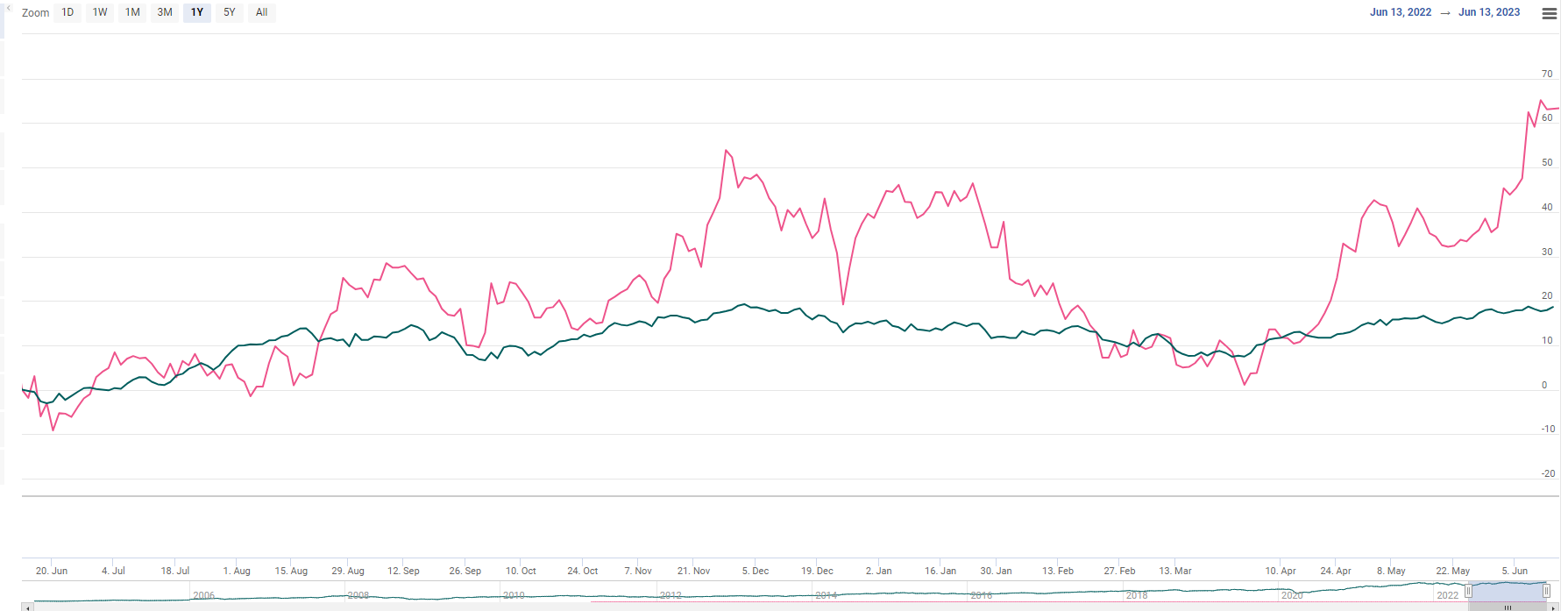

Indexed Stock Performance

Healthy Order Book Provides Revenue Visibility

Company Profile

Texmaco Rail & Engineering Ltd. (TexRail) was incorporated post its demerger from Texmaco Limited in the year 2010 and is engaged in the business of engineering and steel foundry. It is a faction of the erstwhile K. K. Birla group and is currently part of the Adventz group of Kolkata. The company has an installed capacity of 10,000 Vehicular Units of wagons, 20,400 MTPA of structural, 10,000 MTPA of bridges, and 42,000 MTPA of steel castings. Texmaco Rail has a diversified product basket comprising railway freight cars, hydro-mechanical equipment, industrial structures, steel castings, loco shells, electrical mechanical unit (EMU), railway bridges, and pressure vessels which are manufactured across four manufacturing facilities in West Bengal. The company also has a presence in overseas markets.

Investment Rationale

· Strong industry tailwinds

Union Budget 2023-24, Railway capital outlay is INR 2.4 lakh cr which is 9x of the 2013-14 capital outlay. The wagon manufacturing is ramping up due to demand for freight & passenger wagons. There is a shift in commercial vehicles to Rail for transportation. Recently, National transporters raised a demand for 90,000 wagons and awarded 72,358 wagons to 7 manufacturers. Further, the industry is expected to manufacture around 30,000 wagons in the next 10 to 15 years. The government is coming up with 50 000 wagons in global tenders. These are strong industry tailwinds for wagon manufacturers. The railways currently operate 3,00,000 wagons and new wagons are expected to add going forward. The wagon manufacturing was impacted due unavailability of wheel sets. Indian wagon manufacturers majorly procure wheelsets from China which was impacted due to supply chain issues. Post-Dec-22, wagon manufacturing ramped up due to the normalization of wheelset supplies.

· Healthy Order book provides revenue visibility

As on April 01, 2023, TexRail had a healthy order book position of Rs 9,033 crore. The order book includes orders from Indian Railways worth Rs 6061 crore along with orders from private players for wagons. The order book of the Kalindee Rail Nirman (Engineers) Limited (KRNL) division stands at Rs 790 crore and the Bright Power Projects (India) Private Limited (BPPPL) division at Rs 450 crore. Furthermore, the subsidiaries/JVs had an order book worth Rs 225 crore. The company's EPC order book is around INR 1,500 crores, with a delivery timeline of 2-4 years.

Additionally, the company executed around 3,200 wagons in FY22 and has an order book of around 20,000 wagons in hand. The company expects a further ramp-up of around 30-35% in the current year (FY24) to execute the order book. TexRail is making rigorous capacity expansions to fulfill the hefty order book demand. It aims to produce >5000 wagons.

· Diversified revenue profile

On a segment basis, the sales for FY23 accounts for the Heavy Engineering division, Rail EPC, and Steel foundry at Rs 1319 crores, Rs 735 crores, and Rs 546 crores respectively. The company has a rich experience in manufacturing railway wagons and has diversified its business over a period of time into commodity-specific wagons for private parties, electric locomotive shells, and sub-assemblies supplied to private parties. Over the years, it has added capacity for the manufacturing of hydro-mechanical equipment, heavy steel structures, process equipment, and steel foundry products. Additionally, the company is actively engaged in the operations related to rail EPC for railway track laying, signaling, and telecommunication through the acquisition of Kalindee Rail Nirman (Engineers) Limited (KRNL) and railway electrical contracts for overhead lines, transformers, and other equipment through Bright Power Projects (India) Private Limited (BPPPL). Both companies are now the merged entities of TexRail.

Financial Analysis

Past Five Year Financial Analysis (FY18-FY23)

The five year Revenue and PAT CAGR of the company are at 15% & 16% respectively. In FY23 the Revenue of the company stood at Rs 2243 crores, which increased by 38% on a YoY basis. EBITDA for the year was at Rs 145 crores, increased by 4% on a YoY basis, on account of higher sales achieved by the company during the year ended FY23. PAT for the year was at Rs 26 crores, which increased by 24% on a YoY basis.

Q4 FY23 Financial analysis

For the quarter ended 31st March 2023, the revenue of the company was at Rs 835 crores, an increase of 87% on a YoY basis. EBITDA for the year was at Rs 55 crores, which increased by 96% on account of operational leverage. EBITDA margins for the quarter were at 6.5%, an increase of 100bps as compared to the corresponding quarter for the previous year. (Q4 FY22~ 6%). PAT for the year is at Rs 18 crores, increased by 200% on a YoY basis.

Risk & Concerns

· Susceptible to raw material price fluctuations

The major raw materials used by the company are iron and Steel. Rigorous fluctuations on account of various macroeconomic factors impact the prices of these commodities globally.

· Tender based business and competition:

TexRail receives a majority of its orders from Indian Railways and other government and semi-government entities as well as for exports based on tender. Hence, the revenue is dependent on the company’s ability to successfully bid for these tenders. The company faces stiff competition from other established players in the wagon segment. Furthermore, in the rail EPC segment also it is exposed to competition from larger players in the industry.

Outlook & Valuation

TexRail is expected to be a significant beneficiary of various initiatives and opportunities presented by the government in the Railway sector. The government's focus on the rolling stock division and rail infra segment is expected to benefit the company in growing its Rail business in the coming years. Additionally, the company is expected to ramp up its production by 30-35% in the coming year. Robust order book also provides revenue visibility. Overall, we are confident in the growth of the company.

At a CMP of Rs 66.9, the stock is trading at a PE of 65.47x its FY22 EPS. We recommend, a ‘BUY’ rating to the stock.