Tega Industries Ltd

Engineering - Industrial Equipments

Stock Info

Shareholding Pattern

Price performance

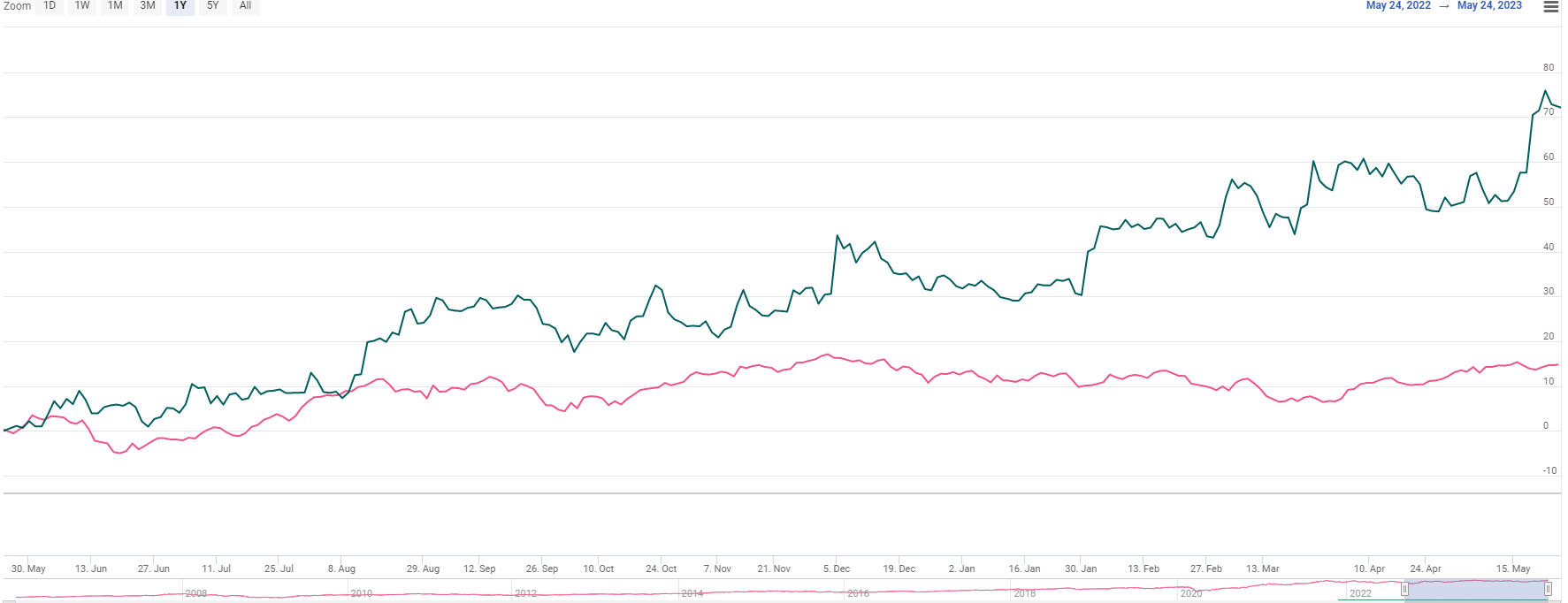

Indexed Stock Performance

Value Accretive Acquisition To Diversify Revenue Stream And Increase Product Offering

Company Profile

Tega Industries Ltd., (TIL) was incorporated in the year 1976. The company is engaged in manufacturing and distributing wear-resistant rubber products serving global mineral beneficiation, mining, and polyurethane lining. The group was established by the Mohanka family. Its facilities are located at Kalyani & Samali in West Bengal, and at Dahej in Gujarat.

The company has a wider presence globally through its subsidiaries~. In 2001 and 2002, the company set up two wholly-owned subsidiaries in the US and Australia. Further, In the year 2006, it established a wholly owned subsidiary in the Bahamas as a holding company that owns Tega Industries South Africa Pty Ltd, a manufacturing unit in South Africa. In March 2008, it established wholly-owned subsidiaries in Canada and Brazil with the motive of enhancing its presence in these regions. It acquired Australia-based Losugen Pty Ltd and Chile-based Tega Industries Chile SPA in 2011. Tega Industries Chile SPA manufactures fluid transportation products (pipe-lining products) and has an established position in Chile, Peru, Argentina, and Bolivia, which benefits the company in covering business operations in these locations. Tega Industries (SEZ) Ltd, a wholly-owned subsidiary of TIL, was merged with the latter in 2016, to improve financial strength and flexibility, management control, and operational efficiency.

Investment Rationale

· Evolution into a Global Multi-product Player

The founder and Promoter Mr. Madan Mohan Mohanka, in 1975 collaborated with Sweden-based Skega AB. Over the years the company advanced its business operations through several acquisitions and expansions of subsidiaries across diverse locations such as South Africa, Australia, and Chile for increasing its revenue. In 2013, the company entered into a Greenfield Project with the commencement of the Dahej, Gujrat plant an SEZ unit. Further in 2019, the company received a Grant of the trademark in relation to ‘DynaPrime’. All this resulted in adding benefits of Growth with Operational Efficiency & High Repeat Business. Additionally, the company's strong R&D leading to Multiple Patents, with a focus on Quality has played a vital role in establishing a strong business over the years.

· Established market position

The company is one of the worlds leading and experienced players in the wear-resistant products and components segment. It holds a wide product profile which includes both mill and non-mill products such as grinding mills, wear components, screens, conveyors, and hydro cyclones. As per a credit rating agency's report Demand is highly stable with 70-75% of revenue coming from repeat orders and the group has grown both organically and inorganically in the recent past. The company also receives the benefit of geographical diversification for its revenue base since its operations are widespread globally in countries like Africa, North America, Asia Pacific, EMER, and Europe.

· High ‘Barriers to Entry’ business model

The company operates in an oligopolistic market with limited established global competitors. The firm has a presence with high entry barriers on account of technology and knowledge. Over the years they have built a strong business model integrated with the customized design, supply chain, strict quality control, global distribution channel, and proximity.

Additionally, the company’s long-lasting engagement with its clients is on account of a strong research-driven approach engineered into customized product designs. It also has low reliance on outsourcing which minimizes its dependence on vendors and mitigates the possibility of failure rates. The company has 18 overseas and 14 domestic sales offices in key geographies. Consequently, International manufacturing operations are proximate to the world’s major copper and gold mining locations in Chile, South Africa, and Australia as per the management of the company.

· Value accretive acquisition to diversify revenue stream and increase product offering

Tega Industries acquired McNally Sayaji Engineering Ltd (MSEL) through CIRP process. McNally Sayaji Engineering offers solutions in the field of manufacturing and marketing of crushing, screening, grinding, material handling, and mineral processing equipment coupled with integrated customer support and aftersales service. The acquisition was made for a consideration of INR1.65bn which will be funded through mix of debt and equity. The rationale was that Tega was looking at an acquisition in the equipment space, considering the opportunity where global players do designing and get manufacturing done from smaller players. Tega does both designing and manufacturing, thus making it a perfect fit for the company. For 9M levels, sales for MSEL stood at INR1.2bn with an EBITDA margin of 4.5% and the company could grow by 5-10% in FY23 and 15-20% thereafter.

Q3 FY23 Analysis

For the quarter ended 31st December 2022, revenue was at Rs 297 crores, increased by 15% on a YoY basis. EBITDA was at Rs 67 crores, which increased by 31% on a YoY basis. EBITDA margins increased by 300 bps on YoY basis to 23%. PAT for the quarter stood at Rs 48 crores, which increased by 41% on a YoY basis.

Risk & Concerns

· Global economy slowdown risk

The company has a presence in several countries like the USA, Brazil, Chile, and Australia. Any changes in macroeconomic conditions or slowdown in the economy may impact the firm's business operations severely.

Outlook & Valuation

Over the years the company has focused on its growth consistently through various expansions and acquisitions. The government's increased focus on expanding infrastructure in the country has increased demand for Mining and Mineral processing, screening, grinding, and material handling activities of the industry. We are upbeat on Tega Industries due to the higher penetration opportunity for Dynaprime liners (addressable market at USD 900mn), Value accretive acquisition, and increase in the product portfolio. We expect the margin will improve going forward due to operating leverage.

At, a CMP of Rs 755, the stock is trading at a PE of 22x to its FY25E Earnings.

We recommend a 'BUY' rating to the stock.