Sundram Fasteners Ltd

Fasteners

Stock Info

Shareholding Pattern

Price performance

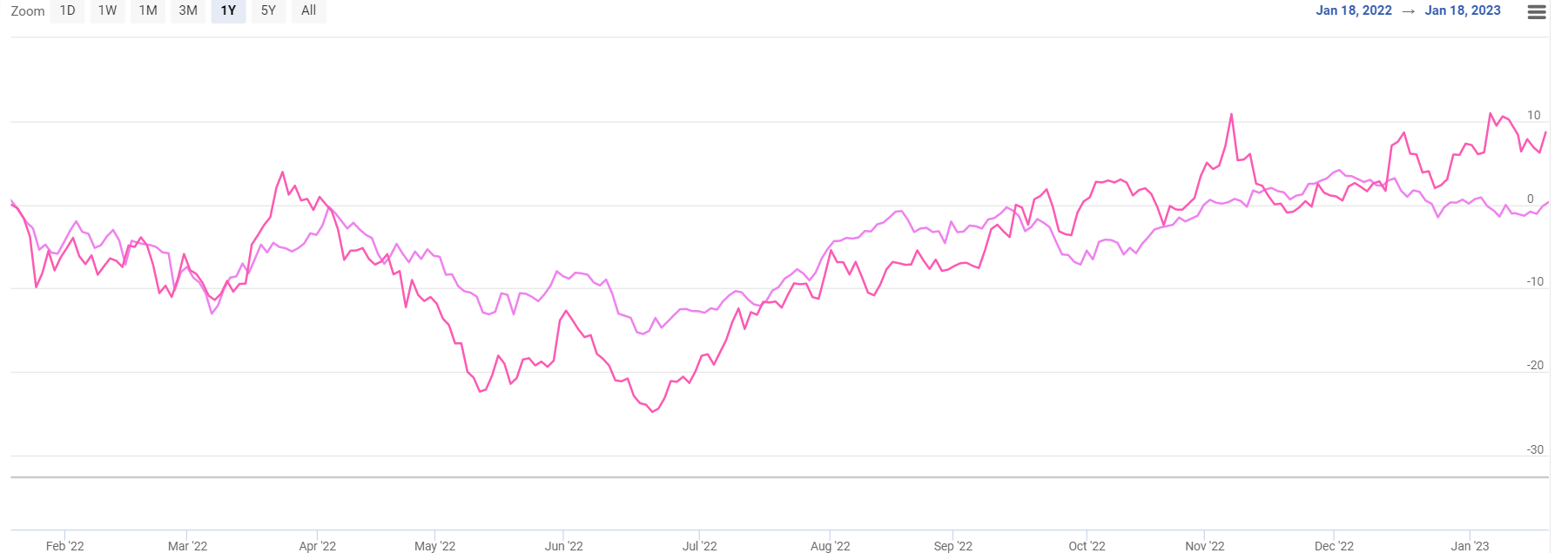

Indexed Stock Performance

Strong Demand Outlook in Both Domestic & Exports Market

Company Profile

Sundram fasteners Ltd. was incorporated in 1966. Sundram Fasteners Limited (SFL) is a global leader in manufacturing critical, high-precision components for automotive, infrastructure, windmill and aviation sectors and is one of the leading manufacturers of fasteners. The company has a diversified product portfolio of products which encompasses both auto and non-auto products. The auto and non-auto components contributed 69% & 31% respectively in FY22. It manufactures products such as fasteners, power train components, sintered metal products, iron powder, cold extruded parts, radiator caps, water pumps, oil pumps and wind energy components. As of FY22 the revenue mix of the company for the domestic and exports market stood at 65% & 35% respectively.

Investment Rationale

· Strong market leadership position in the fasteners segment with a diversified product portfolio

The company enjoys a market leadership position in the fasteners space. In FY22 the revenue mix of the company was healthy with domestic sales (including OEMs and aftermarket) accounting for ~65% and exports of ~35% on a consolidated basis. The company has taken significant measures to de-risk its business model by putting due diligence on the development of auto and non-auto segments equally. Along with EV its focus on serving the non-auto segments such as defence, aerospace, industrial fasteners wind and solar remains intact. Its diversified product portfolio of fasteners, metal forms, radiator caps, and automotive pumps and assemblies gives it an extra edge to compete over its peer competitors in spaces such as commercial vehicles, passenger vehicles, tractors and two-wheeler efficiently. SFL has deepened its engagement with its existing customers. The company is also focusing on increasing its penetration in new and existing geographies.

· Strong operational efficiency

The company has maintained efficiency in its operations throughout its production process with a strong focus on cost reduction, and quality improvisation. It has taken strong steps to implement internal automation measures to boost higher levels of productivity. This has rigorously helped the company to achieve operational efficiency and quality standards expected by clients. Timely delivery of products is maintained due to well-connected supply chain channels of the company with an infusion of high-end technology assisted from abroad-based manufacturing units.

· The strong demand outlook in Domestic & exports market

SFL’s demand traction in domestic markets from original equipment manufacturers remains strong due to improved levels of demand across commercial and passenger vehicle segments, similar to pre-COVID levels. The company is also witnessing higher demand in sectors such as farm implements, printed circuit boards and industrial power generation. The aftersales market (mainly for fasteners, caps, pumps, and sockets) is receiving strong traction. On the exports front, the company is witnessing strong demand from US and Europe. The company is highly focused on growing its high margin export segment. As of FY22 the export market of the company accounted for 34% of the total revenue of company. Going forward SFL intends to increase this size to 50%. The company's key export clientele includes General Motors, Cummins, American Axles, Navistar, etc. However, General Motors and Cummins contribute a major part to the overseas revenue of the company.

· Increase exposure to non-auto segment to de-risk business

SFL is focussing on non auto segment e.g. windmills, industrials, etc. The company want to increase its contribution from 35% to 50% in the long term to de-risk business from auto down cycles. The company has a planned CAPEX of Rs 350-400 crores which will be split over a period of two years. Currently, the company has revised its CAPEX plan for FY23E, which will be Rs 300 crores and the remaining Rs 100 crores CAPEX will be made in FY24E. This deferment in the partial amount of CAPEX is on account of the current order book situation. The CAPEX expenditure will be towards building new capacities to meet the strong demand arising from EV and other new business segments. This CAPEX will also be utilised towards manufacturing advanced automotive technology components such as powertrain assemblies for EVs and select ICE vehicles and also for different varieties of shafts such as input, output and intermediate shafts for EVs. The company has announced a further CAPEX of Rs. 300 crores over the next two years to meet increasing demand in the wind energy business.The company has planned new products such as tower fasteners, valve body housing and swash plate for hydraulic power systems, electric water pumps for passenger utility vehicles, and sintered pulleys for electric scooter applications. All the CAPEX expenditures are expected to be met by internal accruals majorly and some might be by external sources if required.

Financial Analysis

SFL’s Revenue and EBITDA 10-year CAGR is 6% & 10% respectively. For FY22 the ROE & ROCE of the company was at 18% & 20% respectively. In Q2Fy23 Consolidated revenue improved by 12.8% y-o-y to Rs. 1,402 crore, led by improved offtake from OEMs. Consolidated EBITDA margin contracted 140bps q-o-q in Q2, led by higher other expenses and staff costs, partially offset by softening raw material costs. Consolidated PAT declined 5.8% y-o-y to Rs. 116.8.

Risk & Concerns

· Working capital intensive operations

The company's operations are subject to higher working capital requirements on account of the high inventory.

· Failure to pass on price hikes

Failure to pass on price hikes may impact the profitability of the company going forward.

· Auto sector cyclicality

Down cycle in auto sector can affect Sundram Fasteners profitability.

Outlook & Valuation

Over the years the company has maintained a strong leadership position in the market. The company has good revenue visibility due to rising demand and opportunities in the automotive business both in domestic & exports market. Sundram Fasteners is the beneficiary of strong growth traction in CVs, PVs, two-wheelers, and tractors. Profitability improved going forward due to SFL’s increasing focus on high margin exports business & non auto segment. We are positive about the growth of SFL due to rising demand for its products, diversified product portfolio, strong client relationships and prudent capital allocation. At a CMP of Rs 972, the stock is trading at 20.3x its FY25E earnings.

We recommend a 'BUY' rating for the stock.