Siemens Ltd

Electric Equipment

Stock Info

Shareholding Pattern

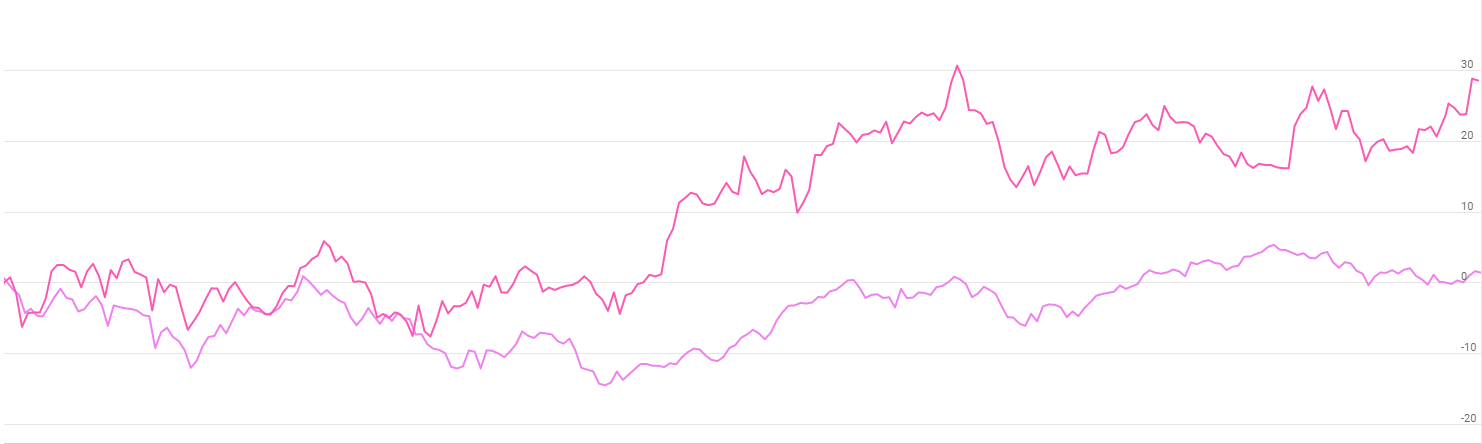

Price performance

Indexed Stock Performance

Strong order intake across segments to drive growth

Company Profile

Incorporated in 1957, Siemens Ltd, a flagship company of Germany’s Siemens AG, is an integrated technology provider, and a powerhouse in electronics and electrical engineering. The company focuses on the areas of power generation and distribution, intelligent infrastructure for buildings and distributed energy systems, and automation and digitalization in the process and manufacturing industries. It is also a leading supplier of smart mobility solutions for rail and road transport and infrastructure solutions for Smart Cities. It operates mainly in five key segments including energy/gas & power (34%), smart infrastructure (33%), digital industries (22%), mobility (7%), and Portfolio of Companies.

Investment Rationale

Strong market position and diversified business portfolio

Siemens operates in multiple business areas, mitigating risks associated with cyclicality in individual businesses. The company’s businesses have been classified as Energy, Smart Infrastructure, Mobility, Digital Industries, and Portfolio of Companies. The company’s strong market position is supported by access to the latest technology and brand equity of its parent, diverse product portfolio, wide geographical reach, and established track record of timely execution of projects.

Robust order inflows provide strong earnings growth visibility; backlog improves substantially

The railway and metro segment order pipeline stands extremely strong with another large ticket order of 200 Vande Bharat trainset worth INR 600 bn expected to be finalized in the near term, in which Siemens has participated in a bidding partnership with BEML. Siemens will be the dominant partner, as BEML's scope of work opportunity stands at INR 90 bn. Incrementally, multiple metro projects are up for bidding, which can further scale-up the ordering potential for Siemens. With this project being awarded, the company's order backlog jumps to a multi- year high of INR 430 bn. Siemens has also formally received an order worth INR 260 bn (excluding taxes & price variation) for the 9000 HP 1,200 electric locomotive project which has to be supplied over a period of 11 years, starting FY24. This will in turn result in Siemens experiencing a multi-year strong execution period and lead to a strong earnings trajectory.

Strong infrastructure in place to take advantage of the robust upcoming railway capex

In anticipation of the strong railway capex, Siemens has put up a strong infrastructure. Recently, Siemens set-up a factory in Aurangabad to cater to the incremental demand for bogies in India as well as for the export market. The bogies are based on a proven global design concept from Siemens-SF30 Combino Plus, which offers best-in-class passenger experience and easy maintenance. The factory has a highly flexible production line, capable of meeting domestic and global rolling stock requirements. It manufactures high-performance bogies for passengers, coaches, locomotives, electric multiple units, trams, and metros.

Technical support and knowhow from the parent, Siemens AG, Germany

Siemens benefits from the technical support and know-how it receives from Siemens AG. Support from the parent enables Siemens to make high-quality products and improve service capabilities, thereby maintaining its strong market position.

Q4FY22 Financial Performance

Siemens reported consolidated revenue at Rs.4657.1 crore, up 8.4% YoY. Gas & power (energy) segment grew 3.9% to Rs.1631.6 cr. Smart infrastructure segment grew 9.1% to Rs.1665.8 cr, Mobility segment revenue grew 41.7% YoY to Rs.441.8 cr and digital industries segment revenue grew 20.5% to Rs.944.4 cr. Gas & power, smart infrastructure, digital industries, mobility segments contributed ~35%, ~35%, 20%, 9%, respectively.

EBITDA came in at Rs.516 cr with EBITDA margin of 11.1% (vs. 10.4% in Q4FY21). Gross margins expanded 240 bps to 32.9% on a YoY basis and 70 bps on QoQ basis. Reported PAT came in at Rs.652.3 cr, up 102.8% YoY.

Key Risks & Concerns

Higher-than-expected inflationary pressures

Inflationary headwinds could have a material adverse effect on a company’s margins and profitability, and this proves to be a key risk for the company’s growth.

Susceptibility to project implementation risks, largely on account of exposure to structural issues in the power sector

The company's profitability is susceptible to structural issues and volatility in the power sector. A weak demand environment and investment climate may lead to slump in orders in the sector, wherein private power developers could shelve their expansion plans. Any large-scale project deferral could also lead to cost overruns for players in the industry, which would impact their profitability, given that they have limited flexibility to pass on cost overruns.

Exposure to intense competition

Siemens operates in an increasingly competitive market scenario, on account of the presence of many domestic and international players. Most of the orders are procured through competitive bidding, which along with the macroeconomic slowdown, has resulted in heightened competition and pressure on profitability.

Outlook & Valuation

We believe that the government’s impetus on infrastructure spending continues to translate into strong capital expenditure in the country, followed by investments in smart and green infrastructure, electrification, decarbonization technologies, automation, and digitization. We believe the company is in a strong position to leverage these growth opportunities given its capabilities across the verticals. Besides the various PLI schemes, ESG-related capex announced for multiple industries lends a fillip to private capex.

At a CMP of Rs.3060, the stock is trading at 87x FY22 (EPS – Rs.35). We recommend a BUY on the stock.