Shivalik Bimetal Controls Ltd

Metal - Non Ferrous

Stock Info

Shareholding Pattern

Price performance

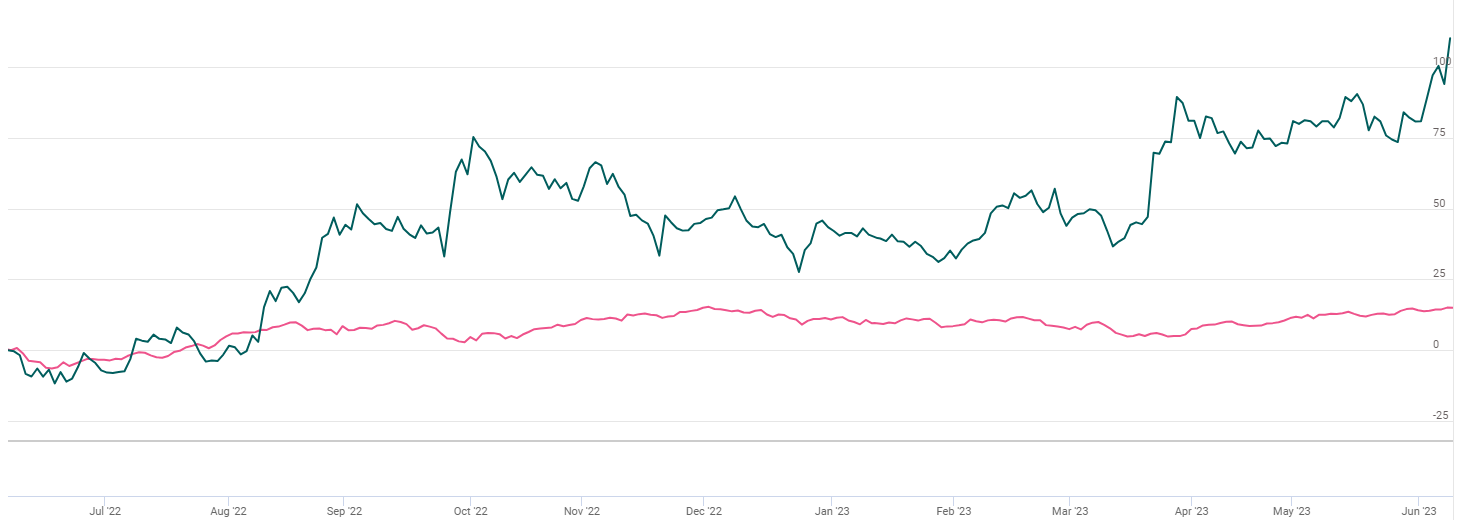

Indexed Stock Performance

Niche technology pioneer at the tipping point of quantum growth

Company profile

Incorporated in 1984, Shivalik Bimetal Controls Ltd (SBCL) is promoted by Mr. S S Sandhu and Mr. N S Ghumman. Shivalik is a global leader in next-generation thermostatic bimetal trimetal strips, electrical contacts, and shunt resistors. Shivalik Bimetal Controls Ltd. is a company specializing in the joining of material through various methods such as Diffusion Bonding/Cladding, Electron Beam Welding, Solder Reflow, and Resistance Welding. Its present program includes Thermostatic Bimetal, Clad metal, Spring rolled stainless steels, Electron beam welded material with Multi-gauge and Multi-materials strips, and Thermostatic edge-welded strips for a board spectrum of industries. Shivalik can offer precision manufactured components specific to the application requirements. Its units are located in Chambaghat, Himachal Pradesh.

Investment Arguments

Strong market position in the niche linear bimetals segment

Being one of the few manufacturers of bimetal parts and shunt resistors in India, SBCL faces limited competition. The company caters to a broad spectrum of applications, including switchgear, energy meters, electrical applications, and automotive and electronic devices. Thus, growth remains correlated with the performance of the electrical, electronics, and automotive industries.

Rising demand for switchgear, battery management, and smart metering systems

SBCL caters to a broad spectrum of applications which include Switchgears, Energy Meters, Industrial, Electrical applications, Automotive & Electronic Devices. It is a promising sign that the government’s plans and policies are conducive towards the growth of the smart meters. The most promising market for the company will be the EV sector as its products find many applications not only in the Electric Vehicle itself, but also in the charging stations. The charging stations will require both switchgear as well as Current Sense Resistors.

Highly specialized in manufacturing precision-engineered solutions for diversified end Applications.

Shivalik Bimetals Controls is the only company in the world to provide a portfolio of Shunt Resistors, Thermostatic Bimetals, and Electrical Contacts under one roof.

Shunt Resistors - Shunt Resistors are electrical components that “regulate the flow of electrical current” in an electrical circuit. Shivalik, one of the preferred suppliers globally, produces a wide range of highly dependable Resistors that are used in the electronics, electrical, and automotive industries.

Thermostatic Bimetals - Thermostatic Bimetals are “critical components used in overload protection devices”. Shivalik is the largest supplier of Thermostatic Bimetal in India with more than grades and possesses the potential to satisfy global demand.

Electrical contacts - Electrical contacts are key components that are connecting points when a switch is turned on or off. Shivalik specializes in the production of electrical contacts with its core competency focused on specialized joining processes.

Application for thermostatic bimetal/trimetal strips is mainly in switching components used in electrical, electronics, automotive, agricultural, medical, defence, and industrial use while shunt resistors find use in the high growth automotive and industrial equipment segments.

A global pioneer in bonding & welding

SBCL is a global pioneer in joining metals to form bimetal and trimetal strips and components which use niche technology such as electron beam welding, hot diffusion bonding, resistance welding, and continuous brazing. These are critical components used in switchgear, automobiles (including EVs), and in Energy Meters.

Cemented as a technology leader in a difficult-to-enter industry

Shivalik is a niche technology-based business, with expertise accumulated over decades in metallurgical innovations involving diffusion bonding and electron beam welding of metals. These are complex processes with high barriers to entry. With its unique business model based on proprietary bimetal technologies and niche solutions that OEMs demand, SBCL thrives in an industry with high entry barriers

Catalysing growth through series of strategic acquisitions & Alliances

Shivalik’s strategic acquisition of CHECON’s (USA) stake in SEPPL expands the Company’s offerings to manufacture and design Silver and Silver Alloy based electrical contacts and assemblies. Shivalik has a joint venture with Arcleor Mittal Stainless & Nickel Alloys called ICS located in Indore, MP, India. Both these initiatives broaden Shivalik’s offerings and provide entry into complementary market segments alongside bimetal, trimetal, and shunt resistors.

Q4FY23 Financial Performance Analysis

Shivalik Bimetal Controls registered strong earnings performance in Q4FY23. Total income for Q4 FY23 increased by 23.30% compared to Q4 FY22, reaching Rs.110.13 cr. reflecting a strong revenue generation. This accomplishment underscores the growing global demand for electrical and battery management systems using these components. EBITDA also served with an impressive 39.44% growth in Q4FY23 compared to the same period last year, indicating a significant improvement in operating levels. Shivalik also demonstrated remarkable growth in profit after tax (PAT) for Q4 FY23. PAT for Q4FY23 amounted to Rs.18.89 crores, up by 41% compared to Q4FY22.

The sales value of shunt resistors for FY23 grew by 23.25% year-on-year to reach Rs.211 cr and the sales value for bimetals grew by 37% year-on-year to reach Rs.209 cr. In Q4FY23, thermostatic bimetal/trimetal strips comprised 52% of the total revenue, while shunt resistors accounted for 48% of overall revenues.

Key Risks & Concerns

Susceptibility to volatility in raw material prices and forex rates: With metals such as nickel and copper forming around 50% of overall cost, the operating margin remains susceptible to volatility in commodity prices. Though metal prices may continue to fluctuate, this risk is mitigated by order-backed processing undertaken by SBCL on highly customized products.

SBCL is exposed to volatility in foreign exchange risk as the company has substantial exports and imports. The risk is partially mitigated on account of natural hedging as the company is engaged in both import of raw materials and export of finished goods.

Slowdown in the economy – Any slowdown in the economic growth in the markets in which the company operates could impact its financial performance.

Outlook & Valuation

Shivalik Bimetals is a diversified product reengineering player with a global presence. With its technological prowess and robust customer relationships, Shivalik can harness the potential growth in diverse segments such as automotive, defence, medical, and electrical appliances, whilst also capitalizing on the ongoing electrification wave. It is a promising sign that the government’s plans and policies are conducive towards the growth of the smart meters. The most promising market for the company will be the EV sector as its products find many applications not only in the Electric Vehicle itself, but also in the charging stations. The charging stations will require both switchgear as well as Current Sense Resistors. Shivalik bimetals looks ripe for strong growth in the coming quarters.

At CMP of Rs.570, the stock is trading at 44x FY23 Which appears reasonable considering strong growth prospects. Hence, we recommend to BUY the stock.