Senco Gold Ltd

Diamond & Jewellery

Stock Info

Shareholding Pattern

Price performance

Indexed Stock Performance

Well positioned to benefit from structural shift from unorganized to organized sector

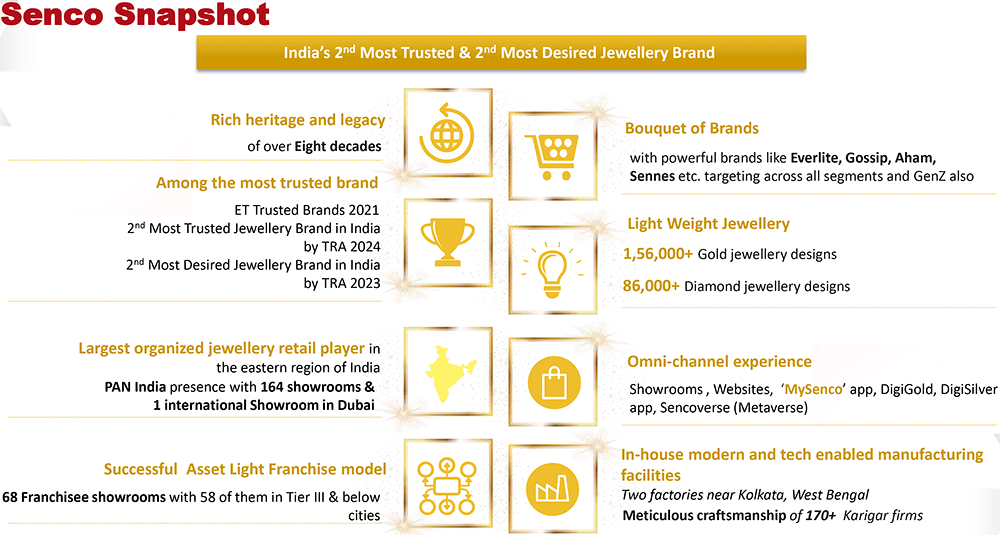

Company Profile

Senco Gold (SGL) is a pan-India jewellery retail player with a history of more than

five decades. Company is the largest organized jewellery retail player in the eastern

region of India based on number of stores. It primarily sells gold and diamond jewellery

and also sells jewellery made of silver, platinum and precious and semi-precious

stones and other metals. Other offerings also include costume jewellery, gold and

silver coins and utensils made of silver. Company’s products are sold under

the “Senco Gold & Diamonds” trade name, through multiple channels,

including 99 company operated showrooms and 67 franchisee showrooms and various

online platforms, including its own website. Company’s strategy of operating

through multiple channels enables it to allocate capital as required, as it continues

to expand geographic presence and work towards an Omni channel network. With a catalogue

offering more than 1,56,000 plus designs for gold jewellery and more than 86,000

designs for diamond jewellery, company offer a large variety of designs of handcrafted

jewellery, most of which are designed and manufactured in-house by its own designers

in close collaboration with skilled local craftsmen (generally termed Karigars)

in Kolkata and across the country.

Investment Arguments

Established market position along with strong brand recognition in eastern India.

SGL enjoys an established retail pan-India presence, with strong brand recognition.

SGL has a dominant market position in gold and diamond jewellery retail business

in eastern India, especially in West Bengal. The company’s established track

record of operations and long experience of the promoters strengthen its operating

profile. SGL’s strong brand recall, product quality and creative designs (especially

handcrafted jewellery) helped in strengthening its market position. In the recent

past, customers ‘preferences have shifted towards light weight and hand-made

jewellery. Given its strong design team, ability to identify taste and preferences

of consumers, and long association with skilled artisans, SGL manages to hold a

competitive edge over its peers in those regions where it has a dominant position.

The overall share of the studded jewellery increased by 100 basis points to 11.4%

in FY2024 on a YoY basis. They have strategically expanded their presence to 13

states across India. As on June 30, 2024, they have 93 Company Operated Showrooms,

and 68 Franchisee Showrooms located across 136 cities and towns in India with an

aggregate area of approximately 483,000 sq. ft.

Strong brand name with heritage and legacy of over five decades & a trusted

jewellery brand

Senco has legacy of over five decades and is now the largest organized jewellery

retail player in Eastern region of India based on number of stores. Senco now has

customized showroom formats catering to all segments of customers. Company has bouquet

of brands like Everlite (lightweight), Gossip (Silver and Fashion), Vivaha (Bridal),

Perfect Love (Solitaire Diamonds) and Aham (Mens). Company stringently follows the

hallmarking process for the gold jewellery. All the diamonds, comprising jewellery

and loose diamonds are certified by SGL Labs. Company has been consistently in the

league of most trusted jewellery brands and has improved its ranking from 4th most

trusted jewellery brand by TRA’s Brand Trust Report 2017 to 2nd most trusted

jewellery brand by TRA’s Brand Trust Report 2024. Senco has been awarded the

2nd most trusted brand in jewellery category for the past three years in India by

TRA and the Best Brand in Jewellery Category by The Economic Times in 2023.

Favourable long-term growth prospects for organized jewellery retailers

Increasing regulations in the jewellery retail industry, aimed at improving transparency

and standardization, over the recent years have accelerated the shift in the market

share from the unorganized players to organized ones. The industry tailwinds are

expected to benefit the organized jewellery retailers like SGL over the medium term,

supported by its expanding retail presence. An expected rise in the share of studded

jewellery is also likely to increase SGL’s margin over the medium term.

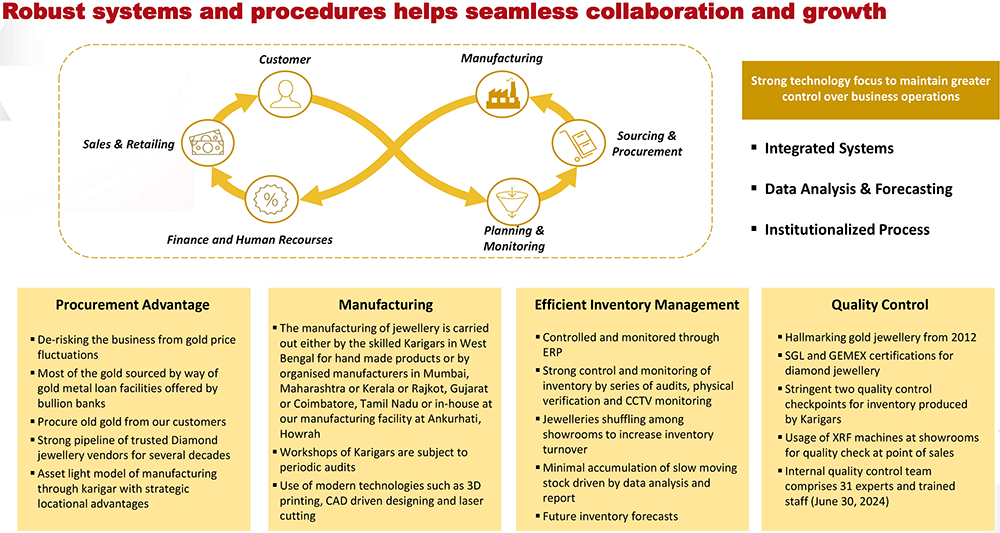

Established Systems and Procedures to mitigate risk and improve efficiencies

Company’s operational processes are set forth in an operating manual as:

- Efficient Inventory Management: company’s inventory of jewellery for both the Company Operated Showrooms and their Franchisee Showrooms is bar-coded and monitored and controlled through their ERP.

- Strong Technology Focus: Senco has POS systems at all Showrooms which are integrated with their centralised ERP system and use the ERP across all showrooms and offices in order to maintain greater control over business operations.

- Quality Control: Senco stringently follow the hallmarking process for all their gold jewellery. Most of their diamonds, comprising jewellery and loose diamonds are certified by SGL, and certain specific diamonds are certified by GEMEX.

- Procurement advantage: Company’s operations integrate their sourcing, manufacturing, retail and export sales with several competitive advantages. One of their key strengths lies in the meticulous craftsmanship of their Bengali Karigars.

- Safety, Security and Surveillance Systems: Safety, security and surveillance of their facilities and locations is a critical part of their business as well as risk management systems. Their factory and procurement departments are managed with their 24*7 CCTV surveillance. Additionally, all of their showrooms are equipped with night vision CCTV cameras, burglar alarms, fire management systems and remote sensors. Further, they have entered into agreements with security agencies for providing security services at most of their showrooms.

- Comprehensive Corporate Planning and Budgeting: The annual budgeting process is designed to achieve functional and divisional goals and profitability for the year. Their annual budget also accounts for new showroom expansion plans and estimated revenue expected to be generated from such new showrooms and rational allocation of expenditure for existing and projected showrooms.

Key demand drivers for jewellery in India

1. As a savings and investment vehicle- Gold and gold jewellery, over the years, have become an important investment asset in India, providing liquidity and a hedge against inflation.

2. Increasing share of the working population- Increase in share of working population is driving demand for light-weight, daily-wear fashion jewellery is expected to rise further with the younger generation entering the workforce. This augurs well for jewellery retailers since this group accounts for the bulk of gold demand.

3. Increasing disposable income- Jewellery demand in India is largely driven by a rise in disposable incomes. Industry estimates and studies indicate that all other factors being equal, gold consumption enjoys a positive co-relation with rise in per capita income.

4. Indian tradition- Tradition is one of the drivers for domestic demand for gold since it is a part of many rituals. In India, it is considered auspicious to purchase gold during festivals, weddings and birth. The most important festival for gold buying is Diwali, which usually takes place in October or November. Akshaya Trithiya is another important festival. This is one of the most auspicious days in the Hindu calendar – usually late April/early May– and gold purchases on this day are considered auspicious.

5. Bridal jewellery - Jewellery consumption in India can be broadly categorized as bridal, daily wear and fashion jewellery. Weddings play an important role in jewellery demand since Indian culture necessitates purchase of jewellery during weddings.

Q2FY25 Financial Performance

Senco Gold delivered steady earnings growth for the quarter ended Q2FY25. Consolidated

net sales rose by 31% YoY to Rs.1501 cr as compared to Rs.1147 cr in the same quarter

of preceding fiscal primarily driven by volume growth of 7% (Gold), and value growth

of 30% in Gold Jewellery & 9% value growth in Diamond Jewellery. In H1, we have

registered a YoY revenue growth of 18%. Further in SSSG showrooms the revenue growth

was 20% in Q2. The Stud ratio substantially improved to 11.1% in Q2. The growth

was secular across all zones with a higher growth in Tier III and Tier IV towns

represented by Franchisee stores. Out of this total growth, SSSG growth was 17%

YoY in Q2 and 12% YoY in H1 indicating strong performance from existing showrooms.

Consolidated EBITDA witnessed a robust growth of 32% while margins stood at 3.46%.

PAT stood flat at Rs.121 cr impacted due to custom duty cut.

Key Conference call takeaways

- The company successfully opened 8 showrooms (6 COCO and 2 FOFO) in H1, and we have a strong pipeline of both owned and franchisee showrooms to meet our annual target.

- Senco Gold Limited achieved its highest-ever sales in October 2024. The company crossed Rs.1,000 crore in sales during the festive period, which covers Navratri, Diwali, and Dhanteras.

- Strong sales in Q2 were driven by a cut in the gold import duty and pent-up demand from Q1. The Indian government reduced the duty on gold in July 2024, leading to lower gold prices and increased consumer demand. In addition, hot weather in Q1 FY25 may have caused some consumers to delay jewelry purchases until Q2.

- Earnings were impacted by a one-time loss related to the gold import duty cut. Senco Gold Limited booked a one-time loss of approximately ₹29.8 crore in Q2 FY25 due to the gold import duty cut. The company expects to book the remaining impact of the duty cut, approximately ₹30 crore, in Q3 FY25.

- The company is expanding its store network. Senco Gold Limited opened 8 new showrooms in H1 FY25 (6 company-owned and company-operated stores and 2 franchisee-owned and franchisee-operated stores). The company plans to open a total of 18-20 new stores in FY25, though it may reduce this target if gold prices continue to rise.

- Senco Gold Limited is launching a new brand, Senes, focused on lab-grown diamond jewellery and leather accessories. The company plans to open Senes stores in malls and target younger, aspirational consumers. Senes will also sell perfumes.

- The company is focused on unit economics, particularly for its new Senes brand. Senco Gold Limited is taking a calibrated approach to the rollout of the Senes brand. The company plans to analyze consumer data and rationalize marketing expenditures to ensure the long-term profitability of the brand.

- The company is optimistic about the outlook for the remainder of FY25. Senco Gold Limited expects the upcoming wedding season to drive strong demand for gold jewelry. In addition, recent declines in gold prices are expected to encourage consumers to make purchases.

Key Risks & Concerns

Intense competition - Jewellery retail business is very competitive, with a large share of unorganized trade. This coupled with robust store expansions by larger retailers into tier-2 and tier-3 cities in the recent years has intensified competition and limited the pricing flexibility of the players. SGL remains exposed to intense industry competition with limited pricing flexibility and presence of a large number of organized and unorganized players, which would keep its margins under check.

Regulatory risks in retail jewellery segment - The jewellery retail industry has witnessed increased regulatory intervention, like restrictions on bullion imports, limited access to gold metal loans, limitation on jewellery saving schemes, mandatory PAN disclosure on transactions above a threshold limit, implementation of the Goods and Service Tax etc, which impacted the operating environment and consequently the performance of the jewellers.

Exposure to high geographical concentration risk - At present, SGL has 93 company-owned showrooms and 66 franchise stores. Out of the company-owned stores, ~44% stores are in West Bengal, which contributed ~64% to its revenues in FY2024. Thus, the company is exposed to high geographical concentration risk. However, such risk has been reducing over the years and is likely to decline further with the company’s plans to add new showrooms outside West Bengal, widening its pan-India presence.

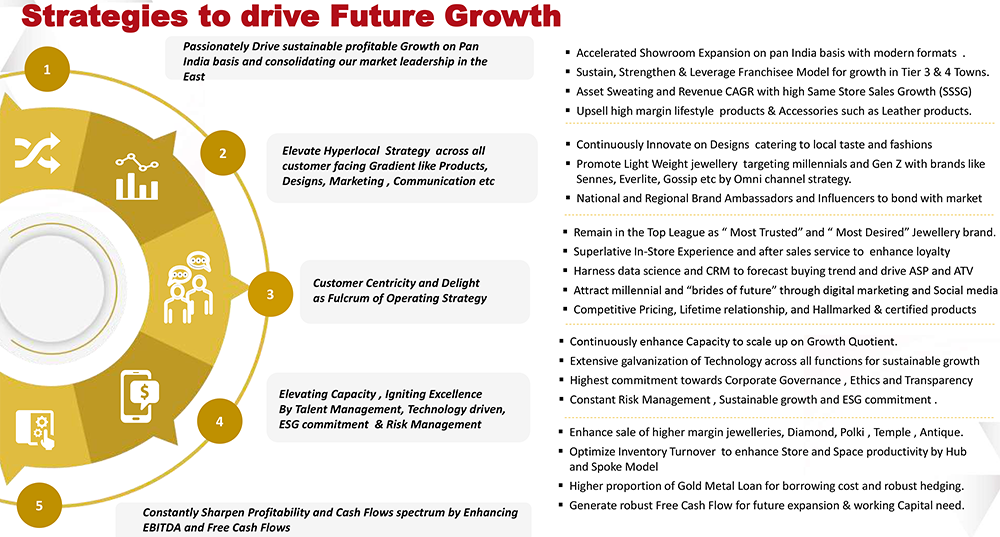

Outlook & Valuation

Senco is a pan-India jewellery retail player with a history of more than five decades. The company is the largest organized jewellery retail player in the eastern region of India based on the number of stores and among eastern India-based jewellery retailers. The company also strategically operates through multiple channels enabling them to allocate capital as required, as they continue to expand their geographic presence and work towards an omni-channel network. Further, the company has been serving customers for more than five decades now and are continuously trying to focus on customer retention initiatives through the adoption of quality norms, loyalty programs, hyper-local offerings, and also making sure that they design jewellery in line with the latest market trends and regional variations. Senco also focuses on attaining an optimal balance between their operated showrooms and expanding their asset-light franchisee model. They use a hub-and-spoke approach to enter new geographies and optimize their inventory management.

We believe that Senco with its strong brand name and a legacy of over five-decade is well placed to benefit from the expected growth rate in the jewellery industry and also benefit from structural shift from un-organized to organized sector. At CMP of Rs.1161, the stock is trading at 29x FY26E. We recommend BUY rating on the stock.