Rainbow Children's Medicare Ltd

Hospital & Healthcare Services

Stock Info

Shareholding Pattern

Price performance

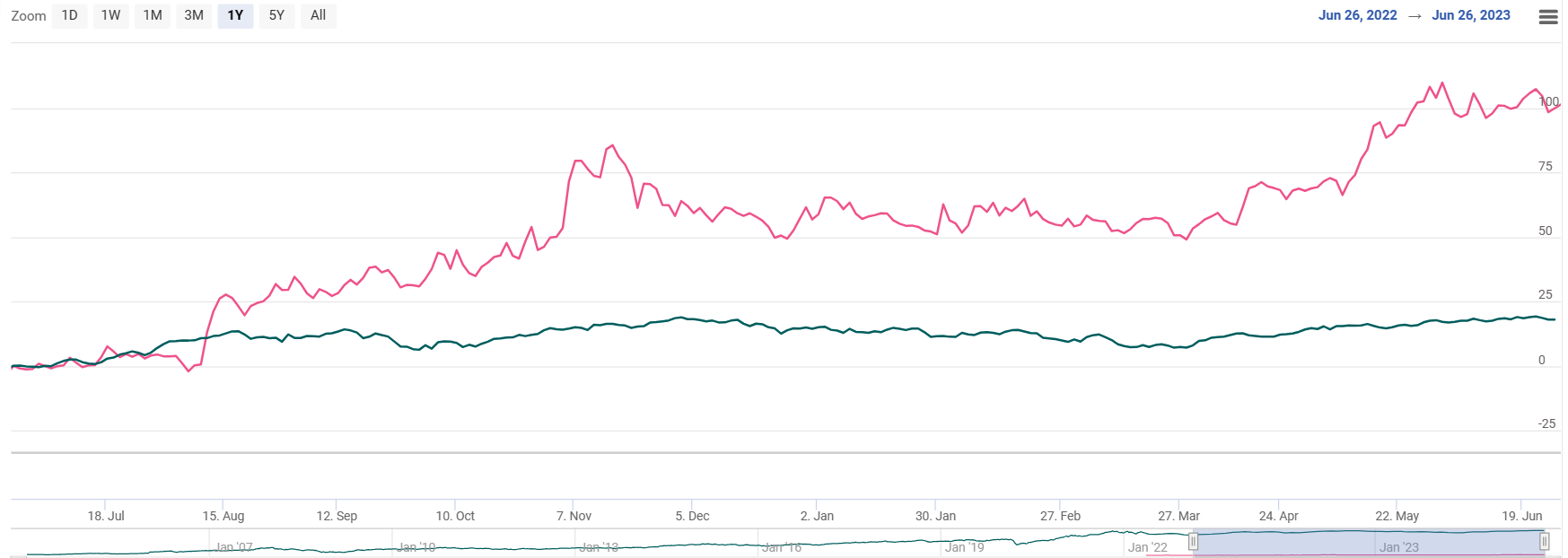

Indexed Stock Performance

Good Track Record Of Profitability, Operational Excellence

Company Profile

Rainbow Children's Medicare Ltd., (RCML) was established in the year 1999 by Dr Ramesh Kancharla in Hyderabad, with its focus on child and women's healthcare. The company has 7 hospitals in Hyderabad, 3 in Bengaluru, 2 in Delhi and Chennai each, and 1 in Vijayawada and Visakhapatnam each. The company operates under two brand names~ ‘Rainbow Children's Hospital” and ‘Birthright by Rainbow’.

The Company has the following subsidiaries~

· Rainbow Specialty Hospitals Private Limited (RSHPL), engaged in the Cardiac hospital’s segment in Hyderabad, and

· Rosewalk Healthcare Private Limited (RWHPL), a boutique maternity hospital in Delhi.

Investment Rational

· Hub and spoke approach to optimise the delivery of patientcare services at scale

RCML has adopted a hub and spoke model, which has helped it to grow over the past two decades from a single secondary care hospital in Hyderabad to seven hospitals and become a recognised supplier of tertiary and quaternary care services at its hub hospitals. While regional spokes provide paediatric and perinatal treatment in Tier-II cities and serve as a connecting bridge to address a sizable market, hub hospital provides tertiary and quaternary care for both inpatient and outpatient.

· Good track record of profitability, operational excellence

The company has followed a cost-effective model over the years. It has been able to successfully achieve operational break-even for new hospitals when it has been able to touch 30% occupancy or within 12-18 months of the operational period, whichever is earlier. This is on the back of better ARPOB (Rs 48744 in Q4FY23 against Rs. 48603 in Q4Fy22). Its average length of stay (ALOS) is one of the best in the industry, with 2.77 days in Q4FY23. Delivery volume in Q4 FY23 is 3,746. Delivery volume in Q4 FY22 is 2,716 and Delivery volume in Q3 FY23 is 4,019. We believe the solid average revenue per operating bed (ARPOB), annual price hike, and strong revenue mix would sustain annual growth rate momentum.

· Bed capacity expansion would fuel growth

The company is focused on executing the business plan, put forth during the IPO, of adding 1000 beds across the target markets to increase capacity by 1.5 times. The proposed expansion for the current financial year includes the addition of ~270 beds in Central Hyderabad (60 beds), Hydernagar (50 beds), Anna Nagar (80 beds), and Sarjapur (80 beds). Additional ~160 beds are slated for commencement in the next financial year at Rajahmundry (100 beds) and a new spoke hospital in Bengaluru (60 beds). Furthermore, the company aims to increase its bed count by ~400 across the National Capital Region by FY26-27.

Q4 FY23 Analysis

Rainbow Children's Hospital (RCML) Posts Stellar Q4 Results. During the quarter that ended 31st March 2023, the revenue of the company was at Rs 317 crores, which increased by 49% on a YoY basis. Impressive revenue growth on account of a significant increase in patient footfall across all hospitals. EBITDA was at Rs 98 crores, which increased by 104% on a YoY basis. EBITDA margins at 31%, increased by 800 bps on a YoY basis. PAT during the quarter was at Rs 54 crores, which increased by 339% on a YoY basis. Occupancy during the quarter under review improved significantly to 58.82 percent from 39.64 percent in the fourth quarter of the previous fiscal.

Risk & Concerns

· Regulatory risk

The healthcare industry is subject to many regulatory laws subject to strict follow-up. The requirements in the industry change from time to time for better treatment and care for patients. Any failure in meeting the regulatory requirements may raise concerns for the company.

· Revenue concentration risk

The company's major part of revenue is generated from Hyderabad hospitals, due to the large no of hospitals located in Hyderabad. This increases the geographical revenue concentration risk for the company.

Outlook & Valuation

The company shows robust operational and financial performance throughout the fiscal year FY23, with sustained progress during the fourth quarter, as demonstrated by significant growth in key operational metrics such as outpatient footfalls, inpatient volumes, and occupancy rates. Further, this capacity addition is expected to boost the revenue. Increased demand outlook, Higher occupancy level, solid average revenue per operating bed, annual price hike, and a strong revenue mix would sustain growth momentum. At the CMP of Rs 948, the stock is trading at PE of 35x of its FY25E earnings. We recommend a 'BUY' rating for the stock.