Radico Khaitan Ltd

Breweries & Distilleries

Stock Info

Shareholding Pattern

Price performance

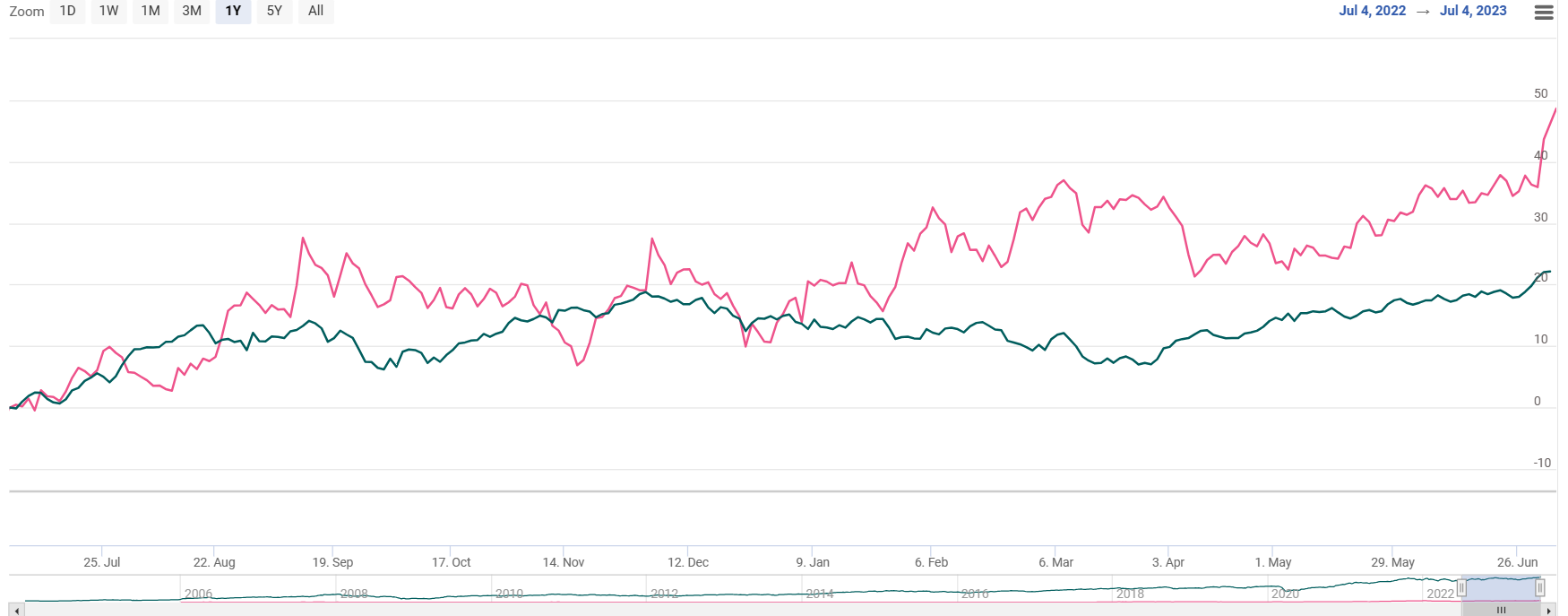

Indexed Stock Performance

Expansion Will Drive Future Growth

Company Profile

Radico Khaitan ltd, (RKL), was incorporated on 31st July 1983. RKL is engaged in the manufacturing of rectified spirit (RS), ENA, country liquor, and IMFL. It has one of the largest Distilleries plants in Rampur, India with a molasses-based distilling capacity of 55 KLPD, 100 KLPD grain-based distilling capacity, and a dual feed capacity of 145 KLPD. The company’s business model includes five owned bottling units with tie-ups with 37 bottling units spread across the country. The company’s current product portfolio includes seven millionaire brands, namely, 8 PM Whisky, Contessa Rum, Old Admiral Brandy, Magic Moments Vodka, 8 PM Premium Black Whiskey, Morpheus Premium Brandy, and 1965 Spirit of Victory Premium Rum.

Investment Rationale

· Well-established brand with high supply chain efficiency

The company is a well-established player in the branded Liquor industry with a diverse product portfolio across multiple product categories. The company’s 1st brand was in 1998 under branded liquor segment with the launch of ‘8 PM Whisky’. With time the company launched several products in the market and gained popularity across these products. The company’s supply chain is efficient due to a wide spread of bottling units across India. It has 42 bottling units in India on an aggregate basis with a vast retailers and on-premises network of 75,000 retail and 8,000 on-premises outlets. Over time, the company has also evolved its go-to-market strategies to continue its operations at a high pace and maintain a stronghold in the market.

· Expansion will drive future growth

During Q4 FY23, RKL successfully commissioned the dual feed plant at Rampur and started bottling operations at Sitapur. The distillery operations of Sitapur are expected to start commercial operations from the beginning of Q2 FY24. The company’s focus for the coming 2-3 years is on achieving the premiumization of its premium category brands. The capacity expansion of these units will support the availability of additional grain-based ENA which will further strengthen the value propositions of the business. Consequently, the bottling plant at Sitapur provides a strong position to the company and facilitates it to capitalize on future growth opportunities in the branded business.

· Premiumization and price hike tailwinds in states of its focus are expected to improve margins.

During FY23, Radico’s GM was under pressure owing to the high input costs witnessed across the industry. The sustained high prices of ENA and glass coat, tapers GM expansion estimates over the short term. This in turn is also expected to offer lower operating leverage to the company. However, its drive for premiumization and price hike tailwinds in states of its focus is expected to improve margins. The k-shaped consumption pattern in the economy also bodes well for revenue growth in coming years. Overall, we expect Radico to deliver higher growth over the industry growth on account of a better product mix (increasing contribution from the premium segment), market share gains, and new product launches.

· New product launches in premium segment

During the year FY23, the sales volume growth was highest for Luxury brands at 110% on a YoY basis followed by Semi-Luxury at 73% and super-premium at 53% on YoY basis. During the year the company launched new products to its product basket where the company engaged itself in a renovated edition of 8 PM Premium Black whisky, Sangam World Malt Whisky, Morpheus brandy, and 1965 Spirit of Victory rum. Additionally, they received positive responses for ready-to-drink vodka and luxury portfolio including Rampur, Jaisalmer, and Ranthambore. The company has received an astounding response for its products across various categories with global rankings for growth in Whisky and Brandy at the following levels~ the 2nd Fastest growing whisky and 4th Fastest growing brand overall.

Q4 FY23 Financial Analysis

During the quarter that ended 31st March 2023, the revenue of the company was at Rs 832 crores, an increase of 2% on a YoY basis. EBITDA for the quarter was at Rs 79 crores, which decreased by 1% on a YoY basis. EBITDA margins at 9%, decreased by 100 bps on a YoY basis. PAT during the quarter was at Rs 37 crores, which decreased by 20% on a YoY basis.

Management is confident of expanding margins and mitigating cost push (850bps) through its premiumization strategy supported by high price. Improved product mix and backward integration would also contribute toward expansion. Management has guided to achieve mid-teen margins in FY24 and high teens over the medium term.

Risk & Concerns

· Highly regulated industry

The company operates in a highly regulated industry with restrictions across various different levels. Such restrictions at times may impact the operations of the business.

· Susceptible to Cyclicality in raw materials and Commodity risk

The company’s main raw materials are sugar and grain. These agricultural products depend on climatic conditions and agricultural products every year. Additionally, they are also imposed commodity risk which may impact the operating margins of the company.

Outlook & Valuation

RKL is a well-established player in the branded liquor industry with a strong product portfolio and a supply chain. The company has maintained a strong presence in the market over the years and it continues to diversify its product portfolio with the addition of several new products across multiple product categories. RKL is expected to witness strong revenue growth from the P&A category. On the margins front, the operationalisation of its backward integration units at Sitapur and Rampur will provide sufficient grain-based availability to the company for conducting the smooth flow of operations. The company has recently taken price hikes which will also add to the overall profitability of the coming in coming years. We believe sustained momentum in P&A; price hikes in IMFL; softening RM; efficiency gains from in-house capacities, and premiumization are growth drivers for Radico Khaitan.

At a CMP of Rs 1320, the stock is trading at a PE of 41x its FY25E earnings (EPS FY25 Rs 32).

We recommend, a ‘BUY’ rating to the stock.