Polycab India Ltd

Cable

Stock Info

Shareholding Pattern

Price performance

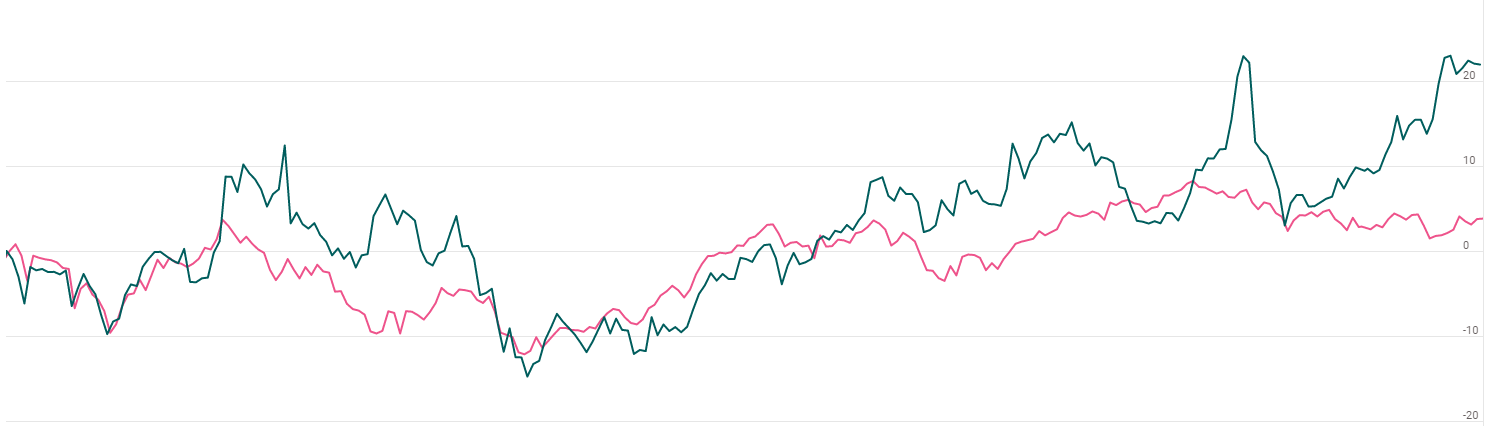

Indexed Stock Performance

Growth momentum to continue

Company Profile

Incorporated in 1996, Polycab India Limited is an integrated manufacturer and supplier of wires, cables, and fast-moving electrical goods (FMEG). It has 23 manufacturing facilities across India and each of these facilities manufacture specialized products. It is an industry leader with 22%-24% share of organized market in the wires & cables segment. The company is also present in Engineering, Procurement and Construction (EPC) business and executes limited projects. The company has 23 manufacturing facilities located across Gujarat, Uttarakhand, Maharashtra, and Daman.

Under the Wires & Cables product portfolio, the Wires portfolio includes house-wires, green wires, industrial flexible wires, speaker wires and the Cables portfolio includes EHV (extra high voltage) cables, fire survival cables, optical fiber cables, jelly filled telephone cables, high voltage cables, LAN (local area network) cables, power & control cables, thermos plastic high heat resistant nylon coated cable, instrumentation cables, co-axial cables, underground feeder & branch circuit cable, non-metallic sheathed cable, solar cables, railway signaling cables and other cables such as CCTV (closed circuit television), festoon and submersible cables. The FMEG (Fast Moving Electrical Goods) product portfolio includes fans & home appliances, solar products, IoT (internet of things) based smart range Hohm, switches and switch gears, LED lighting and luminaries and pumps, conduits & accessories. The group is also in the business of engineering, procurement, and construction (EPC) projects. It has over 11,000 SKUs (stock-keeping units) for Wires & Cables segment and over 6,000 SKUs for FMEG segment.

The marquee customer base is spread across various industrial segments and includes Reliance, Larsen & Toubro, Ambuja Cement, Tata Power, Tata Motors, Bosch, JSW Steel, ISRO, etc., to name a few. In the FMEG segment, it is growing through new product launches and dealer addition across India. The company has ~4600 dealers, serving ~2 lakh retail outlets.

Investment Arguments

Market leadership position in the wires and cables industry in India and growing fast-moving electric goods (FMEG) segment.

PIL is the market leader in the Indian wires and cables industry with around 22-24% share of the organized market. Its market position is supported by its strong dealer-distributor network of over 4,600+ entities. PIL has significant market share in west and south India, which contributed around 55-60% to its revenue in fiscal 2022. The FMEG segment, which was commenced in fiscal 2014, has witnessed sustained robust growth over the past few years and now contributes around 10% to revenue. The growth has been supported by a growing product mix across different price points and distribution network expansion.

Strong momentum in C&W likely to sustain

Strong Q3FY23 C&W revenue (+11.4% YoY and +13.2% QoQ) was driven by ~18% YoY volume growth (+26% in 9MFy23) mainly in the domestic distribution business (also drove 201bps QoQ jump in EBIT margin to 13.7%). The merger of HDC and LDC verticals too aided growth. Management expects strong traction in the domestic C&W business to sustain on the back of healthy public and private capex. Subdued exports (`2.2bn revenue, ~6% mix in Q3FY23) is also likely to revive to 8-10% of overall revenue on strong order book.

Muted FMEG performance likely to rebound in FY24 after re- organization of sales channel

Weak demand led to subdued revenue (flat YoY, +12% QoQ) while 4x QoQ rise in A&P spend (`636mn) resulting in `24mn EBIT loss in Q3FY23 (Q2FY23 loss at `27mn). Fans business grew 24% YoY on channel restocking ahead of transition to the new BEE norms. While prices were cut in Q3FY23, management sees scope for hikes once BEE norms are implemented in Q4FY23. Switchgears also grew at a healthy pace, driven by influencer incentive program and will be the focus category due to better margins. Management expects the segment to witness strong rebound in FY24, as it is on the verge of completing the realignment in its distribution strategy (separate teams for different channels, sales channel realignment based on product end use) in FY23. The +10% segment margin guidance given under ‘Project LEAP’ are intact. Focus on in-house manufacturing, alternate channels, and portfolio expansion stays.

For the FMEG business the management plans to reorient the current product mix (toward high margin switches and switchgears), product development and higher R&D on premium category products is essential to drive margins in the FMEG business. To this end, it has hired eligible talent, introduced a strategic framework and is improving its digital presence.

Capex and Foray into EHV cables segment to be a key growth catalyst for Polycab.

Management plans to incur a capex of Rs.700 cr in CY23, which will be funded through internal accruals. Three-fourth of this amount will be spent towards wires and cables while one-fourth will be used for the FMEG business.

Polycab will be entering the extra high voltage (EHV) cables space to cater to the growing demand for power across Tier 1 and 2 cities. The asset turnover of EHV is like the company’s current portfolio of cables & wires. The company will be setting up a facility in Halol, Gujarat for EHV cables. Production at the facility is expected to begin from 2025. Polycab has tied up with a Switzerland based company, Brugg Cables for technology procurement for EHV cables. As per the management, the EHV space has a revenue potential of ~Rs.4000- 5000 crore by FY26 which could potentially drive the rerating of the stock.

Q3FY23 Financial Performance

Polycab reported good set of numbers in Q3FY23. Revenues were up ~10% YoY to ~Rs.3715 crore led by ~13% growth in the wires & cable segment and 185 volume growth. FMEG segment revenue remained flat YoY at Rs.342 crore due to subdued demand conditions. Despite inflationary headwinds and about a 4x jump in advertising and publicity spends, EBITDA margin increased 280 bps to 13.6% YoY due to better operating leverage. PAT grew ~14% YoY to ~Rs.361 crore YoY tracking strong topline growth and EBITDA margin expansion.

Conference call highlights

Demand outlook

- Polycab is seeing strong demand for cables and wires on both B2B and B2C fronts. Domestic volume growth of cables & wires was ~18% YoY.

- Demand for wires has increased because of high demand from the real estate sector. Demand for cables is led by higher government capex

- Revenue contribution from cables and wires in past quarters was in the proportion of 70:30, which has now become 60:40.

- The management expects revenue contribution from B2B and B2C to be in the proportion of 50:50 by FY26.

- On the exports front, the company was undertaking project-based business and has gradually moved to distribution business. During 9MFY23, exports grew 32% YoY on the back of strong demand from sectors such as renewables, oil & gas and infrastructure.

- In Q3FY23, exports contributed ~6% to overall revenue. The company has a strong order book for exports and the management expects exports to contribute ~8-10% to the overall revenue in FY23.

- The company’s facility in Roorkee for fans is fully utilised. The capacity of switchgears will be expanded by ~1.5x in FY24.

Margins

- According to the management, the sustainable EBITDA margin in the cables & wires segment will be in the range of 11-13%.

- Polycab’s FMEG business’ profitability is under pressure due to higher A&P spends. The management expects recovery in FMEG business margins from FY24 onwards and aims to achieve 10% margin by FY26.

Capex

- The company will be incurring a capex of ~Rs.700 cr in CY23, which will be funded through internal accruals. Three-fourth of this amount will be spent towards wires and cables while one-fourth will be used for the FMEG business.

- The company will be setting up a facility in Halol, Gujarat for EHV cables. Production at the facility is expected to begin from 2025.

- As per the management, the EHV space has a revenue potential of ~Rs.4000- 5000 crore by FY26.

Key Risks & Concerns

Exposure to high competition: The wires and electrical cables industry is fragmented with a large number of unorganized players constraining the pricing power of organized players. Apart from the unorganized sector, PIL faces competition from several organized players as well. While the supply chain issues and liquidity pressure on small unorganized players because of the pandemic have resulted in some market share gain by large, organized players; the industry will continue to remain competitive.

Susceptibility to economic downturns: PIL is susceptible to the economic environment in India. Electrical cables and wires contribute significantly to PIL's revenue and end users include construction (real estate), power, telecommunication, and automobile industries. Growth in these industries is linked to the economic environment, and any economic slowdown could lead to moderation in demand.

Fluctuations in raw-material prices pose a key challenge: Any sharp increase or decrease in the prices of key raw material (copper and aluminium) could impact margins.

Outlook & Valuation

Polycab continues to maintain its leadership position in the organized Cables & Wires segment with a market share of over 24%. With a strong distribution network and a strong brand recall, the company continues to gain market share in Wires & Cables and FMEG segments. Furthermore, the entry into the EHV Cables segment will aid revenues in the medium to long term. The management has set a revenue target of ~Rs 20,000 Cr by FY26 led by faster and more profitable growth in the B2C segments and industry-leading growth in the B2C business and overall EBITDA margins in the range of ~13% going forward.

In the long term, Polycab is expected to benefit from government infrastructure investments, increase in housing demand and pick up in private capex spending. We expect its operating performance to improve given robust volume growth and backward integration. The company is well poised for a healthy growth trajectory given its widening distribution network and in-house manufacturing capabilities.

At Current Market Price of Rs.2970, the stock is trading at 48x FY22 (EPS – Rs.60.80) and hence, we initiate a BUY on the stock.