PG Electroplast Ltd

Consumer Durables - Domestic Appliances

Stock Info

Shareholding Pattern

Price performance

Indexed Stock Performance

Strong Growth in Q4; Healthy outlook

Company profile

PG Electroplast Limited (PGEL) is the flagship company of PG Group, which had started its journey in 1977. PG Electroplast, formally set up in 2003, and is a leading, diversified Indian Electronic Manufacturing Services provider.PGEL specializes in Original Design Manufacturing (ODM), Original Equipment Manufacturing (OEM) and Plastic Injection Moulding, providing One Stop Solutions to 70+ leading Indian and Global brands. It manufactures a comprehensive range of consumer electroniccomponents and finished products such as colour television (CTV) sets & components, air conditioners (ACs) sub-assemblies, DVD players, water purifiers and Compact Fluorescent Lamps (CFL) for thirdparties.As backward integration, it also manufactures plastic injection moulding and manufacturePrinted Circuit Boards (PCB) assemblies for CTVs, DVD players and CFL. PG has 11 manufacturing units in Greater Noida (UP), Ahmednagar (MH), Bhiwadi (RJ) and Roorkee (UK). The company caters to industries such as automotivecomponents, consumer electronics mobile handsets and sanitaryware.

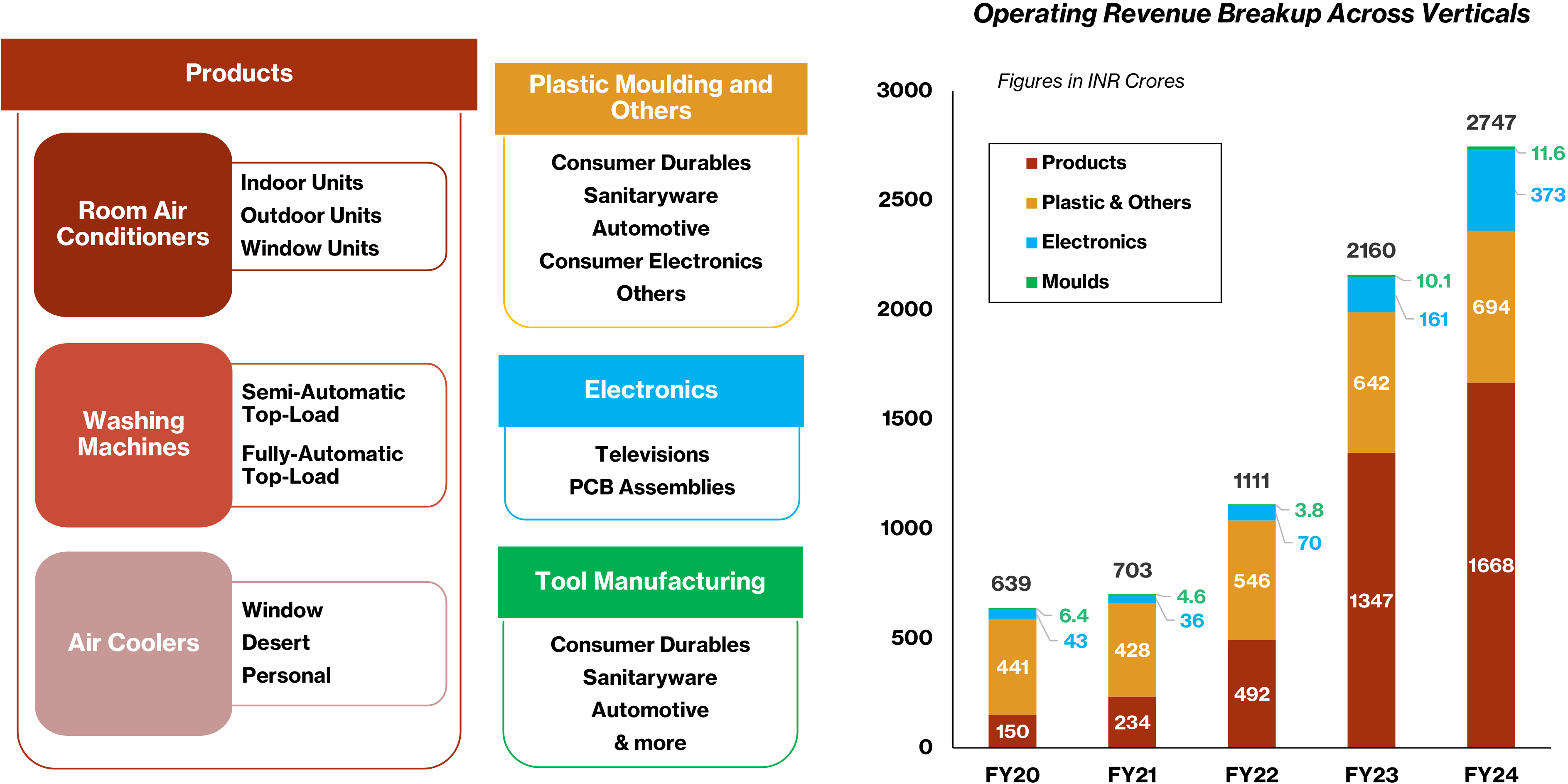

PGEL specializes in Original Design Manufacturing (ODM), Original Equipment Manufacturing (OEM) andPlastic Injection Moulding, catering to 50+ leading Indian and Global brands. PG Technoplast Private Limited (PGTL) is a wholly owned subsidiary of PG Electroplast which is engaged in the business ofmanufacturing Room Air Conditioners and various components for the Consumer Durables andConsumer Electronics industries. The business verticals in which company operates is showcased below

Investment Arguments

Established market position

The group is one of the leading contract manufacturers/vendors for air conditioners

(ACs), washing machines and otherplastic moulding components for white goods the

plastic components segment. The promoters’ experience of more than 30 years

in the consumer durables industry, the group's established position and their

healthy relationships with customers will continue to support the business. PGEL

has the capacity to offer product development and manufacturing solutions from designing,

tooling to final assembling and testing. Most of the operations are backward-integrated

and the processes are carried out in-house. Backward integration gives it the flexibility

to control the manufacturing processes and reduce dependence on external suppliers,

which has enabled it to become a consistent and reliable ODM supplier and contract

manufacturer.

Long – standing relationship with marquee customers

The group supplies to leading brands such as LG electronicsIndia Pvt Ltd, Whirlpool India Ltd, Voltas, Sansui, Honeywell, Hyundai, Daikin, Godrej, Blue Star, Astral etc. It supplies to all the leading players in the washing machine and domestic refrigeration and air conditioning (RAC) market. The group has large product portfolio manufacturing plastic parts for a comprehensive range of consumer electronic products such as air conditioners (ACs), air Coolers, refrigerators and washing machines. PGEL is one of the leading, diversified Indian manufacturing services provider and among the few companies in India specialising in ODM, OEM and plastic injection moulding for the consumer durables industry, thereby providing one stop and end to end solutions to consumer durable brands.

Strong Industry Tailwinds

The Rapid rate of urbanization, growth of young population with rising income levels is leading to largeemerging middle class in India Implying huge potential demand for the consumer appliance and durablemarket in coming years. Low penetration levels, falling prices of durables and electronics and changinglifestyle of the Indian consumer are expected to remain big demand drivers for the consumer durable and electronics Industry in India in near future. Government reforms such as Digital India, Make in India, Power for all and Jan Dhan-Aadhar Mobile Trinity are providing fresh impetus to the Consumerappliance and durable Industry. Further the Government’s initiatives of promoting electronicmanufacturing and treating the industry as one of the key pillars of the Digital India Program, opens newand exciting opportunities for the Industry. The Management is enthused about the overall opportunitysize and anticipates high growth rates in the industry segments where, company has presence.

Q4FY24 Financial Performance

PGEL showcased remarkable earnings growth for the quarter ended Q4FY24 driven by growth across all its key business segments. Consolidated net sales rose 30% YoY to Rs.1077 cr as compared to Rs.827 cr registered in the same quarter of corresponding fiscal. On the operational front, consolidated EBITDA witnessed a growth of 56% YoY to Rs.120 cr. EBITDA Margin expanded by 180 bps at 11.1% YoY. PAT surged 78% YoY to Rs.72 cr led by solid topline growth and robust operational performance.

Other Key Developments

- FY2024 has been strong growth period as Consolidated Revenues grew 27.2% and closed at INR 2746.50 crores for the company. This is despite the ASPs falling sharply across the board for all our product categories.

- The Product business contributed 60.7% of the total revenues in FY24. Room AC business at Rs.1,317 crores grew 26% during the period while the Washing Machines business had a growth of 20% YoY.

- PGEL’s 100% subsidiary, PG Technoplast, crossed Rs.1,456 crores in revenue in its third year of operations. Company’s Bhiwadi AC Unit became operational during the year.

- Order book for product business remains robust and the company hopes to accelerate the product business growth in FY2025.

- During the quarter and Financial year, operating margins have improved QoQ and YoY due cost control, softer commodity prices and operating leverage.

- Net debt has decreased by almost Rs.325 crores in FY24 despite Capex and acquisition of NGM. The operating cash flow during the year has been strong and working capital optimisation remains key focus area for the company.

- Company is seeing increased interest for business from new and existing clients, and we remain very confident on the future growth prospects of the business.

- For FY25, creating building blocks for next level of growth and improving capital efficiency will be the major priorities. R&D, New Product Development and Capacity Enhancement are the focus areas for future across product businesses. Company plans to strengthen its product offerings further in both AC and WMs.

Key Conference call takeaways

- For PGEL, Management has guided for consolidated revenues of Rs.3400 cr, which is a growth of 24% YoY over FY24 revenues of Rs.2,746 cr despite TV business revenues shifting to JV company Goodworth Electronics Ltd.

- Management expects Goodworth revenues to be at Rs.600 cr.

- Implying Group Revenues is pegged at Rs.4000 cr

- PGEL Net profit guidance is pegged at Rs.200 cr which is a growth of 46% over FY24 Net profit of Rs.137 cr.

- In FY2025, Management expects EBITDA margins to have slight upward bias.

- The growth in product business i.e., WM, RAC and Coolers is expected to be around 44% to over INR 2400 crores from INR 1668 crores in FY2024.

- Capex for FY2025 will be in the range of 350-370 crores. New Integrated Unit for Manufacturing RAC in Rajasthan, New Building in Greater Noida and new building along with further AC capacity expansion in Supa is being planned.

Key Risks & Concerns

Exposure to intense competition in the consumer electronics segment:

The domestic consumer electronics market is intensely competitive on account of entry of several large players over the past fewyears, which has affected profitability of most players such as PGEL.

Volatility in commodity prices and currency fluctuation:

Any adverse movement in raw material pricesaccentuate the pressure on profitability because of the players’ inability to pass on cost increases totheir customers.

Outlook & Valuation

PG Electroplast reported an all-round performance in Q4FY24 driven by strong growth across all its business segments. PGEL reported Growth in the product business driven by RAC and strong margin due to operating leverage. PGEL is receiving significant enquiries and commitment for new business across business segments. New customers are shifting from China to India. The company is uniquely positioned in the consumer durable & plastics space in India and would derive higher revenue growth by growing its market share in the customer outsourcing wallet. Management foresees large opportunities in plastic moulding in consumer durables in appliances like a) Washing machines b) Room Air Conditioners c) Refrigerators d) Ceiling Fans and e) Sanitaryware products and opportunities in the ODM space for products like a) Air coolers, b) Washing Machines and Room Air conditioners. PGEL will sustain its growth momentum aided by the emerging opportunities in the EMS space like Strong industry tailwinds, Capital expenditure, strong execution capabilities, new product launches, encouraging guidance from the management, improving operational efficiencies leading to better profitability & higher cash flows, established client relationships and diversified product profile.

The company is pursuing an organic growth strategy by ramping up its existing capacity and capabilities in each of its product verticals to achieve higher value addition, better economies of scale on the back of backward integration. At CMP of Rs.2565, the stock is trading at 29x FY26E. We recommend BUY rating on the stock.