Netweb Technologies India Ltd

IT - Hardware

Stock Info

Shareholding Pattern

Price performance

Indexed Stock Performance

Well placed for sustained growth while maintaining leadership in technology

Company profile

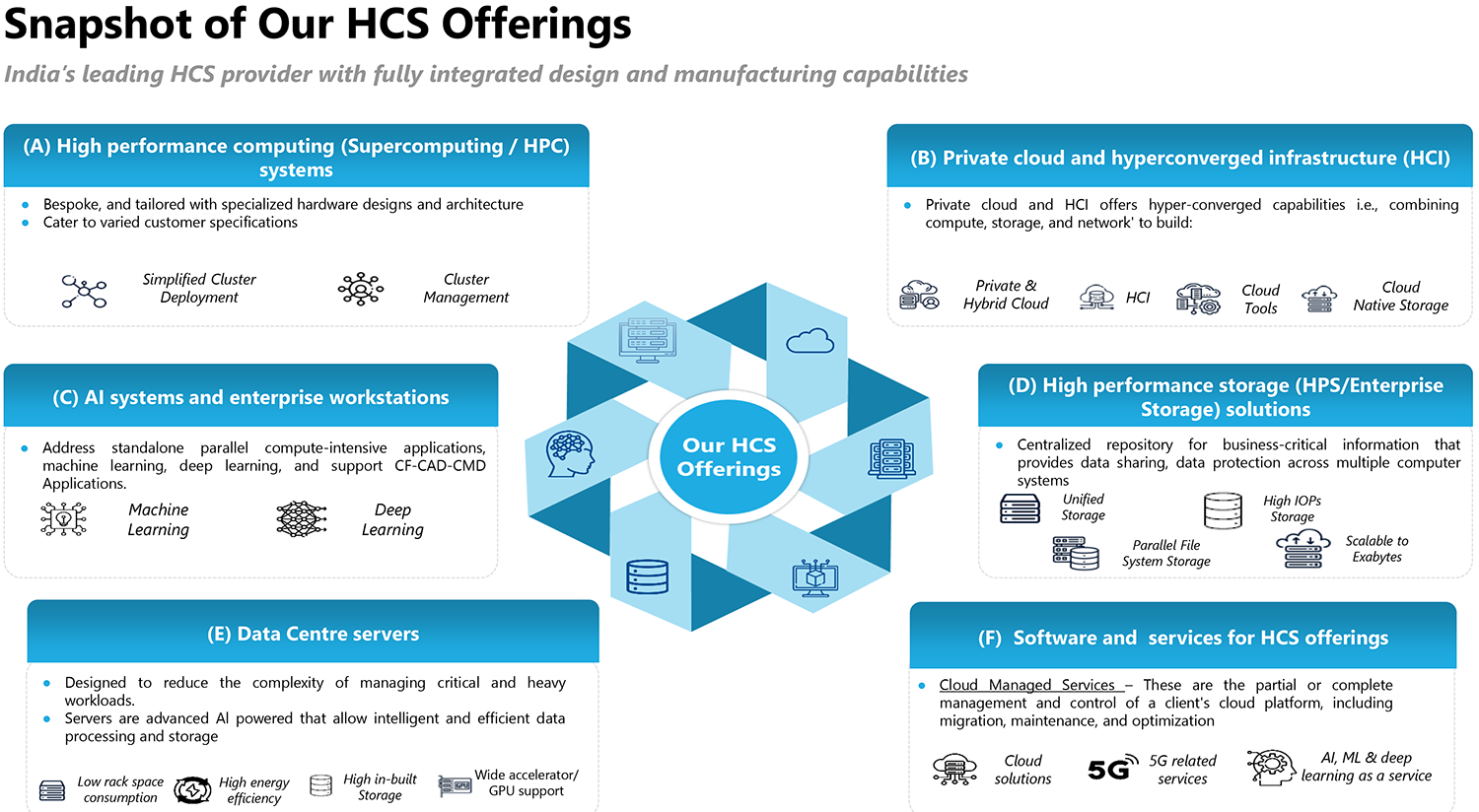

Netweb Technologies India Ltd (“Netweb Technologies”) is one of India’s

leading High-end Computing Solutions (HCS) providers, with fully integrated design

and manufacturing capabilities. Their HCS offerings comprises (i) high performance

computing (Supercomputing / HPC) systems; (ii) private cloud and hyper converged

infrastructure (HCI); (iii) AI systems and enterprise workstations; (iv) high performance

storage (HPS / Enterprise Storage System) solutions; (v) data centre servers; and

(vi) software and services for their HCS offerings. NetWeb Technologies is one of

India’s leading Indian origin owned and controlled OEM in the space of HCS

providing Supercomputing systems, private cloud and HCI, data centre servers, AI

systems and enterprise workstations, and HPS solutions.

In terms of number of HPC installations, they are one of the most significant OEMs in India amongst others. Since the inception of the erstwhile sole proprietorship, one of their Promoters, Sanjay Lodha, M/s Netweb Technologies, which the company had acquired in August, 2016, until February 28, 2023, they have undertaken installations of (i) over 300 Supercomputing systems, (ii) over 50 private cloud and HCI installations; (iii) over 4,000 accelerator / GPU based AI systems and enterprise workstations; and (iv) HPS solutions with throughput storage of up to 450 GB/ sec.

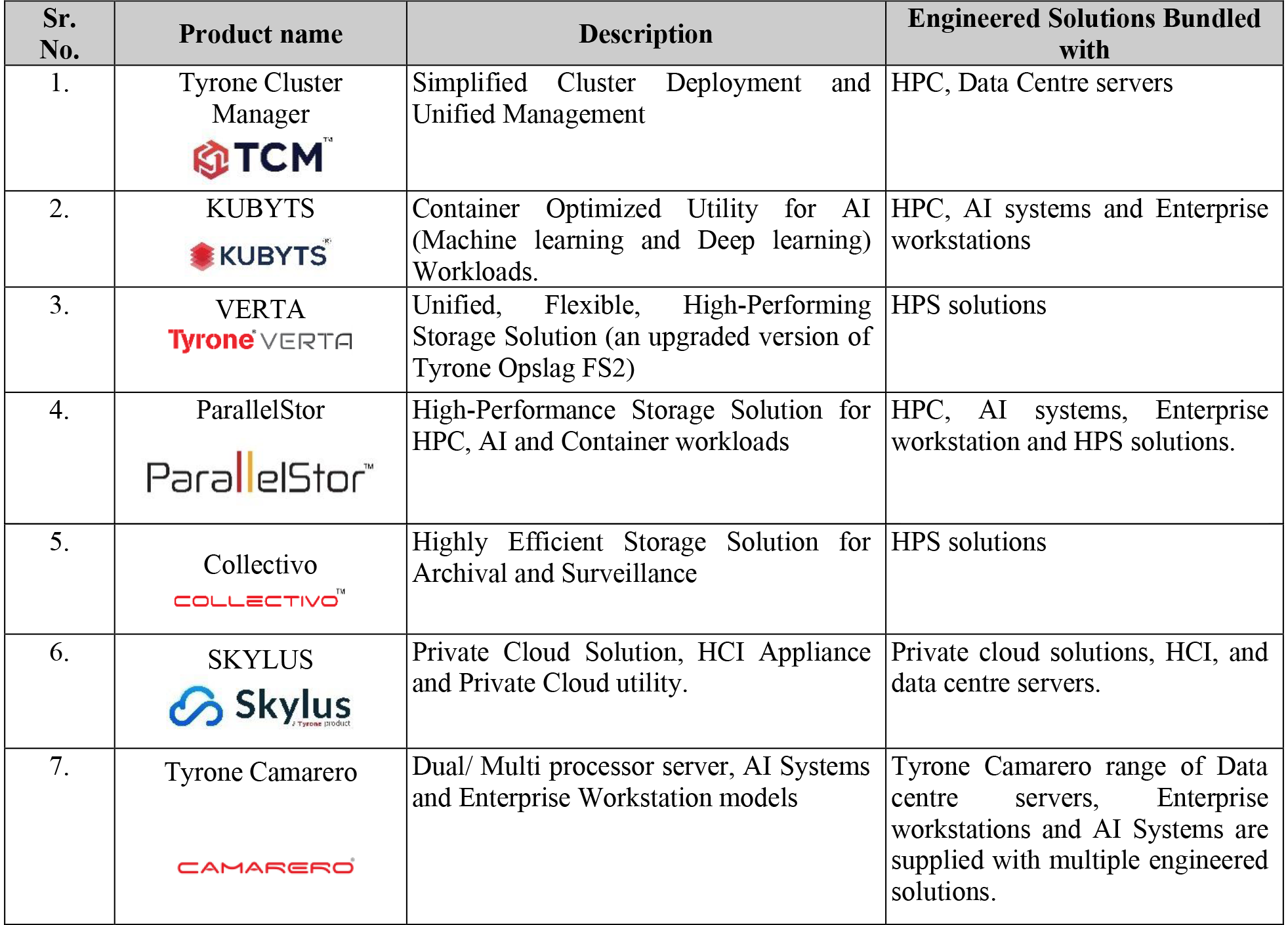

Company’s products and solutions offerings are sold under Tyrone brand and supported by engineering solutions.

Investment Arguments

One of India’s leading Indian OEM for HCS with integrated design and manufacturing

capabilities

Netweb Technologies Ltd is one of India’s leading OEM for HCS with integrated

design and manufacturing capabilities. They design, manufacture and deploy

HCS comprising proprietary middleware solutions, end user utilities and pre-compiled

application stack. The proprietary designs are cloud native which, in addition to

technological benefits, are capable of catering to the evolving needs of Customers.

They are one of the few players in India who can offer a full stack of product and

solution suite with comprehensive capabilities in designing, developing, implementing

and integrating high performance computing solutions. They are also an Indian origin

OEM to build Supercomputing systems, private cloud and HCI, data centre servers,

AI systems and enterprise workstations, and HPS solutions under the ‘Make

in India’ initiative of the Government of India.

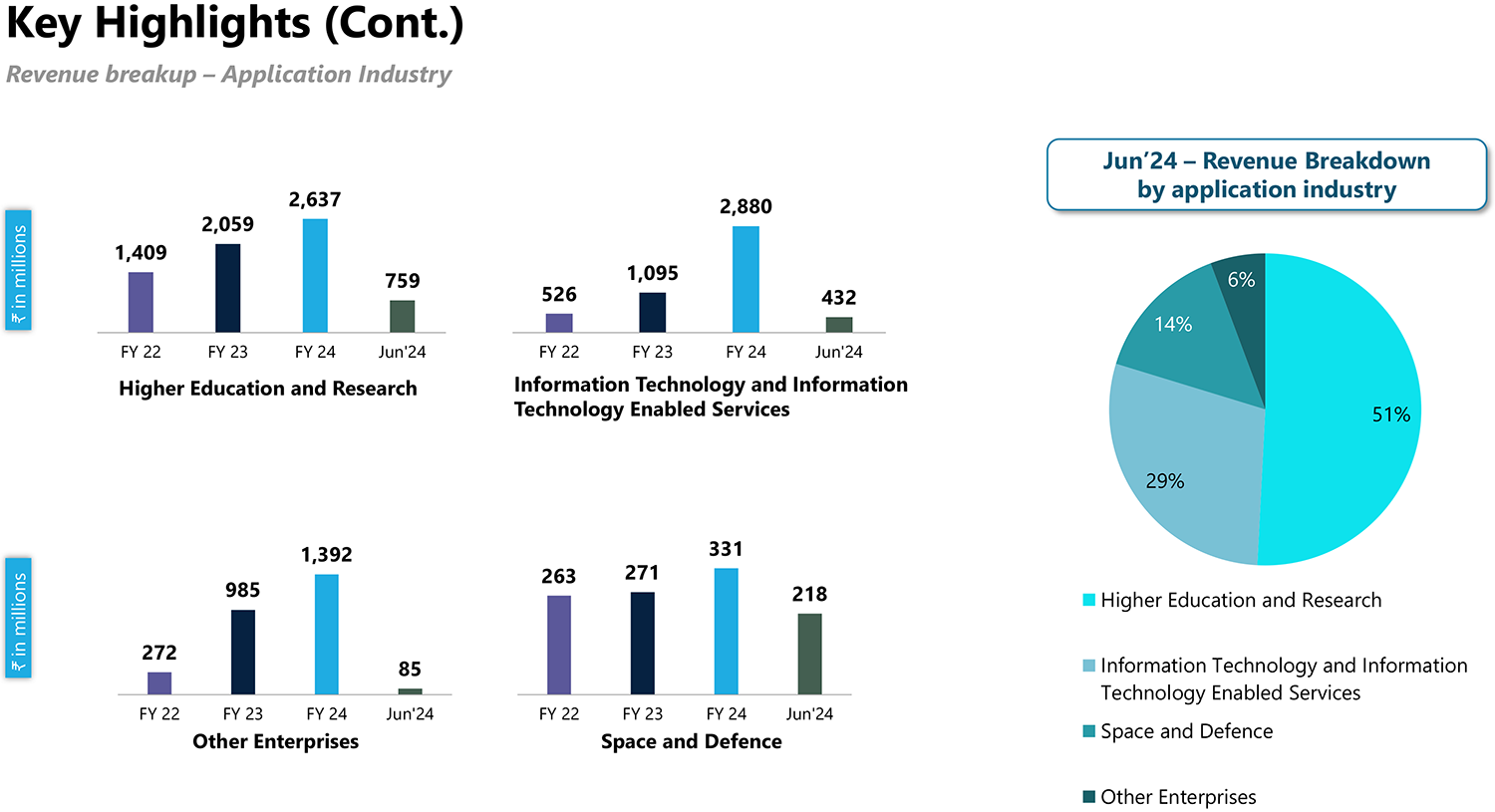

Established strong relationships with marquee customers and diverse customer base.

Netweb Technologies ability to provide end-to-end solutions right from design and

development to implementation and service support enables it to procure repeat orders

from existing clients and attract new clients. Their diverse customer base spread

across different Application Industries demonstrates the suitability of systems,

design and architecture across disparate applications. They cater to various end

user industries such as information technology enabled services, entertainment and

media, banking, financial services and insurance (BFSI), national data centres and

government entities including in the defence sector, education and research development

institutions (Application Industries) such as Indian Institute of Technology (IIT)

Jammu, IIT Kanpur, NMDC Data Centre Private Limited (NMDC Data Centre), Airamatrix

Private Limited (Airamatrix), Graviton Research Capital LLP (Graviton), Institute

of Nano Science and Technology (INST), HL Mando Softtech India Private Limited (HL

Mando), Dr. Shyam Prasad Mukherjee International Institute of Information Technology,

Naya Raipur (IIIT Naya Raipur), Jawaharlal Nehru University (JNU), Hemvati Nandan

Bahuguna Garhwal University (Hemvati University), Akamai India Networks Private

Limited (Akamai), A.P.T. Portfolio Private Limited (A.P.T.), and Yotta Data Services

Private Limited (Yotta), Centre for Computational Biology and Bioinformatics, Central

University of Himachal Pradesh (CUHP University). It also caters to an Indian Government

space research organisation and an R&D organisation of the Ministry of Electronics

and Information Technology, Government of India which is involved in carrying out

R&D in information technology and electronics and associated areas including

Supercomputing.

Significant product development and innovation through R&D

The company strives towards innovation in product range and have continued to build

R&D capabilities by continuously developing R&D team to improve systems

design and architecture and to expand products and solutions suite. R&D team

is led by Mukesh Golla, Chief R&D Officer and has 38 members team. R&D team’s

in-depth understanding of high-end computing solutions, their ability to meet the

advanced technological challenges and their constant efforts at innovation, coupled

with experience in working on innovative products in India, enables the company

to stay at the forefront of technological evolution and anticipate and envision

the future needs of our Customers and the market. The R&D Facilities have enabled

the Company to increase the product lines to 8 viz., Tyrone Cluster Manager, KUBYTS,

VERTA, ParallelStor, Collectivo, SKYLUS and Tyrone Camarero AI Systems and GPU System.

Netweb Technologies along with various technology partners design and innovates

products and provide services tailored to specific customer requirements. It also

independently designs and innovates products and solutions offerings and provides

services tailored to specific customer requirements.

Operates in a rapidly evolving and technologically advanced industry with high

entry barriers.

The rapidity of technological advancement necessitates continual innovation, improvement,

and customisation of our solutions. Modification of designs and changes in implementation

of the offerings requires technical skill set and expertise which is a significant

entry barrier in the industry for new entrants. With continuous innovation, the

Company has developed a huge product basket comprising of kernel level design (i.e.,

establishes complete and unrestricted access between software and the underlying

hardware) and development capabilities, hardware product designs, fine-tuned printed

circuit board layouts, optimized operating systems, dense architectures, mix workload

capabilities, deploying servers and a repository of HPC-AI codes.

Expanding and augmenting product portfolio

Netweb Tech proposes to set up a manufacturing facility for setting up SMT line

to eliminate reliance on third party for the purpose of manufacturing server motherboards

and related printed circuit board (PCB) assemblies for its products. It proposes

to continue to expand product portfolio by offering 5G and private 5G solutions

and Network Switches, particularly having focus on the BFSI segment which is expected

to emerge as the largest industry vertical for enterprise networking in India by

2027. The company have already forayed into this market and received approval to

participate in and seek production linked incentives under, the Telecom and Networking

PLI Scheme under the category of manufacturing of switches, 5G edge and enterprise

equipment, and 5G RAN equipment. It proposes to also expand portfolio to include

reduced instruction set computer architecture based HCS systems.

Q1FY25 Result Highlights

Netweb Technologies Ltd delivered stellar earnings growth for the quarter ended

Q1FY25. Consolidated net sales more than doubled to Rs.149 cr as compared to Rs.60

cr registered in the same quarter of corresponding fiscal. Operating EBITDA

for Q1FY25 surged 132% YoY to Rs. 20 Crores. EBITDA margin for the quarter witnessed

a contraction of 104 bps YoY to 13.4%. Profit after tax saw a highest-ever growth

of 203% YoY to Rs. 16 Crores in Q1FY25.

Conference Call Highlights

Recent Development

Inaugurated high-end computing server, storage, and switch manufacturing facility

in Faridabad. Revenue share from AI systems increased to 14.6% in Q1FY25 marking

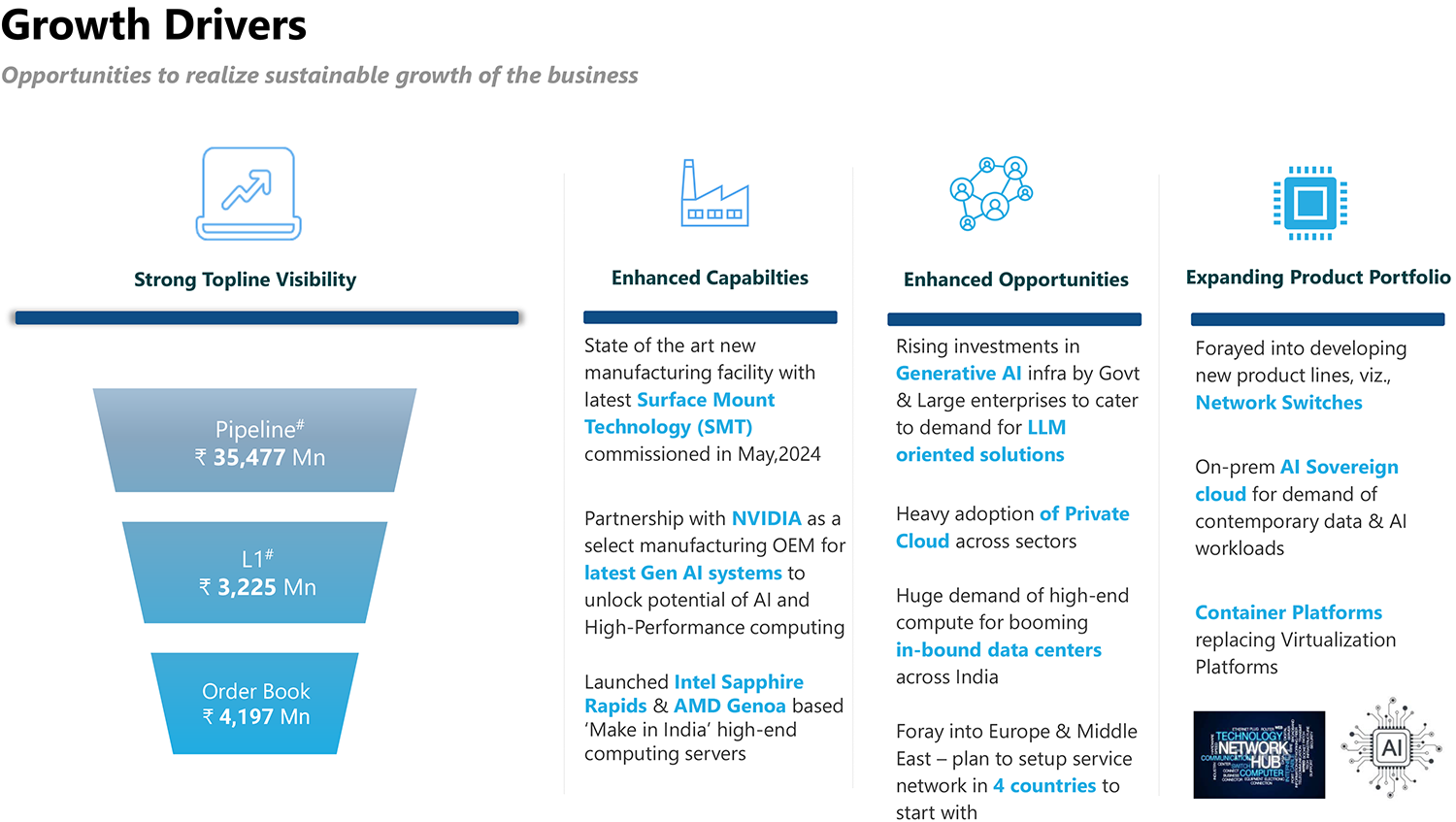

a 146% YoY growth. The company has a robust order book totalling Rs. 420 crores

as of Q1FY25.

Customers

The company onboarded 36 new clients in Q1FY25, while 163 repeat customers, associated

for over 5.21 years.

Future Outlook

Expecting continued revenue growth at a rate of 30-35% CAGR. Company is confident

of improving EBITDA Margins by 100-150 bps from next year onwards.

Execution of Rs. 150 Cr supercomputing order from Vikram Sarabhai Space Centre in the next two quarters.

The company is also exploring expansion into the Middle East and Europe, with sales efforts already initiated in the Middle East. They are also exploring strategic acquisition opportunities, primarily in areas related to existing product lines and technologies.

New Faridabad facility expected to be fully operational within the next 3-4 months.

Netweb is aiming to convert 30% of EBITDA to free cash flow.

Other Key details

Netweb highlights their focus on being a solution-oriented company offering hardware,

software, and services. There is a strong emphasis on research and development with

employee strength in the areas growing from 55 to 80+. Company is eligible for and

will be claiming benefits under both the IT hardware PLI and the Telecom and Networking

PLI schemes.

Key Risks & Concerns

High client concentration: Company’s top 5 clients together constituted 50.3% of revenue in FY24. Any unforeseen events impacting these 5 customers or change in outsourcing policies of these 5 clients could have a negative impact on Netweb.

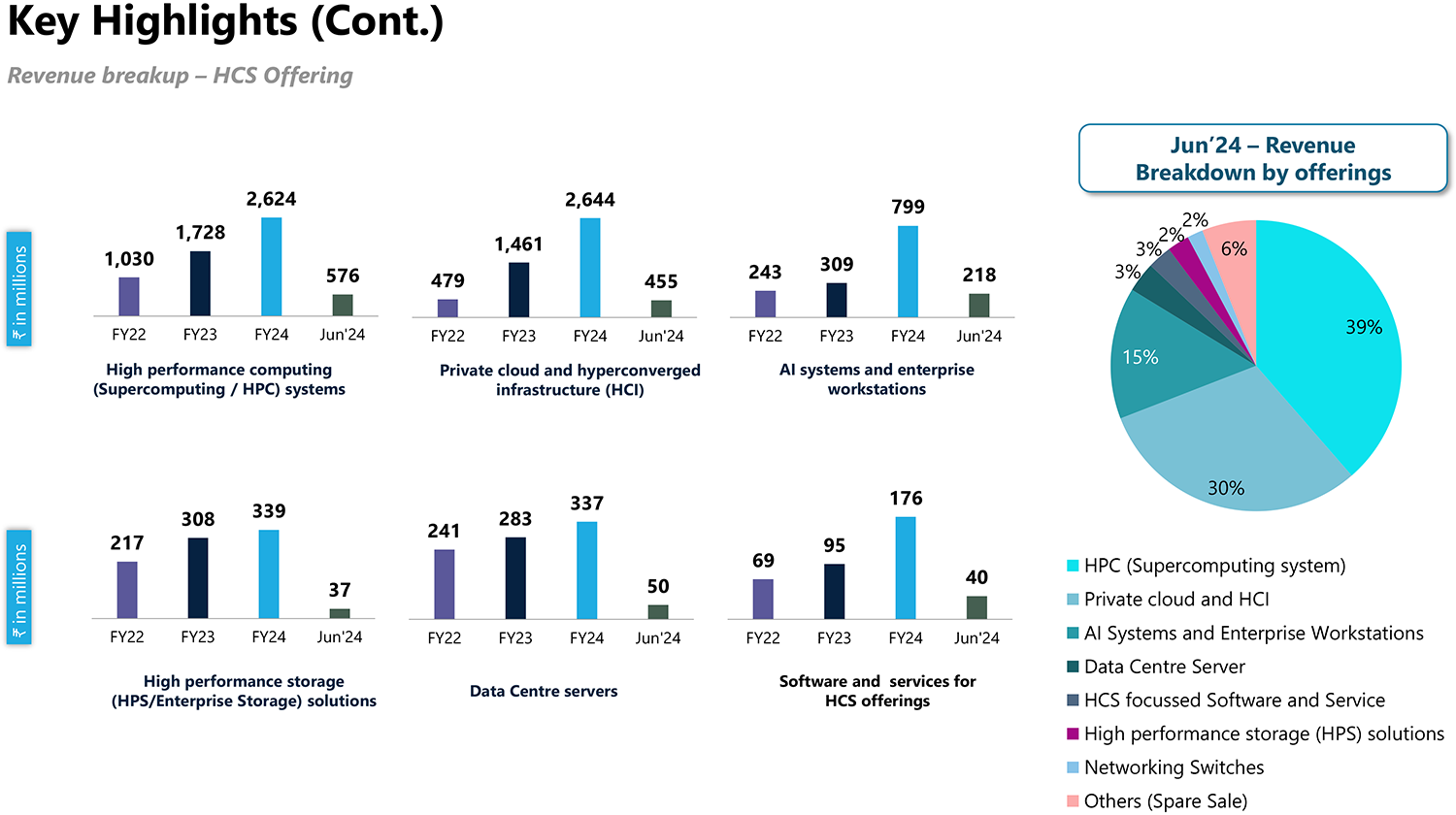

Heavy dependence on few of the HCS offerings: Out of the HCS offerings, Supercomputing systems, and private cloud & HCI have generally been the largest revenue generating business verticals contributing 39% and 30% of total revenue respectively in Q1FY25.

Foreign Exchange Fluctuations: The company does not enter into hedging transactions in respect of forex exposure. Any losses, on account forex rate fluctuations may adversely affect the business, results of operations and financial condition.

Outlook & Valuation

Netweb presents a unique business model and is the only domestic company offering HCS (High end Computing Solutions) offerings (with high entry barriers) due to the lack of listed domestic and international players in the field. Netweb Technologies intends to leverage its presence in the fast-growing HCS (High end Computing Solutions) industry with a focus on developing refined, customised computing systems to address the high-end computational requirements of customers. The company is a leading player in the controlled OEM (original equipment manufacturers) space for HCS offerings. Presently, the business has its manufacturing facility located in Faridabad, Haryana. There has been a significant surge in the application of High-Performance Computing (HPC), also known as supercomputing, across various sectors such as academia, R&D, FMCG, oil and gas, automotive, aviation, and weather forecasting.

Netweb’s growth drivers include focus on quantum computing and launching the latest technology servers for NVIDIA, Intel and AMD and their exploration of acquisition opportunities. Their partnership with NVIDIA for AI servers is expected to develop 10 variants of CPUs and servers. Their in-house design manufacturing and software development capabilities set them apart from their competitors. Netweb anticipates a 30-35% sales growth over the next five years. Their focus on R&D and the introduction of 304 new products indicates repetitive orders from their existing clients which cover almost 69% of overall sales.

Netweb boasts of strong business pipeline and order book, combined with ongoing enhancements in their capabilities and expansion of both operations and product portfolio, place them well for sustained growth while maintaining leadership in technology. At CMP 2673 the stock is trading at 88x FY26E. We recommend BUY rating on the stock.