Metro Brands Ltd

Retailing

Stock Info

Shareholding Pattern

Price performance

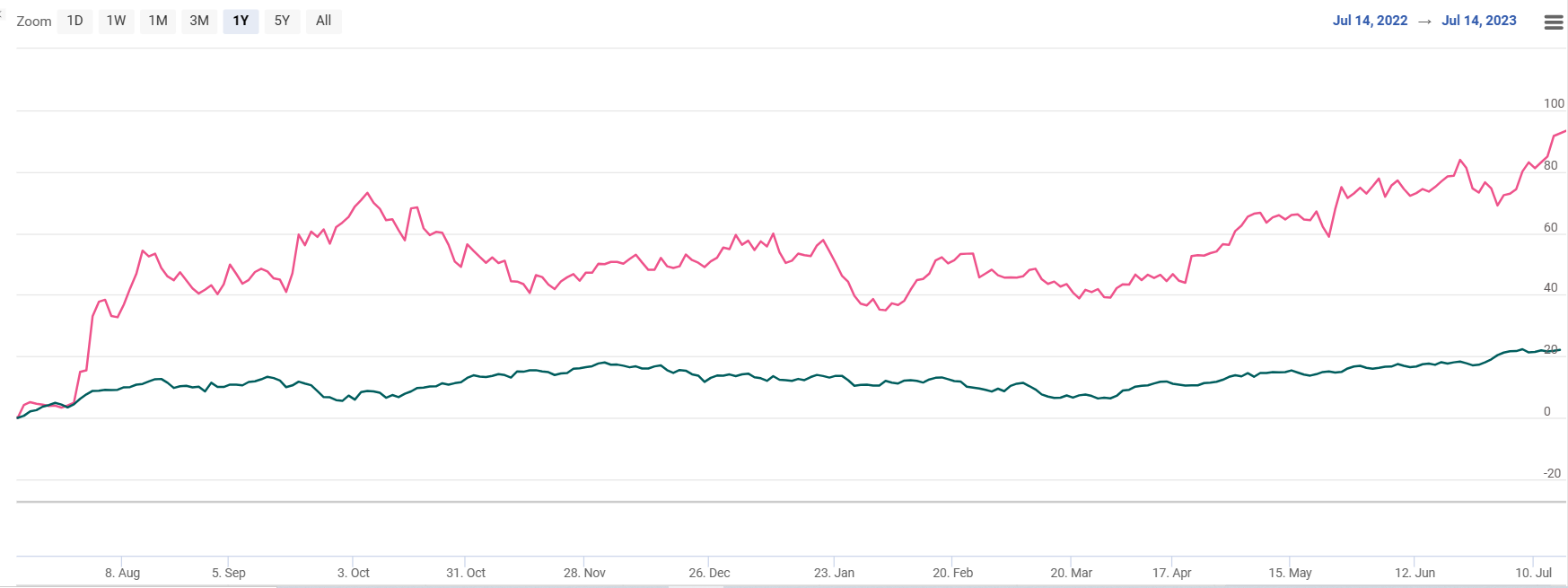

Indexed Stock Performance

Well-established market presence, product portfolio, and strong brand recognition

Company profile

Incorporated in 1977, Metro Brands Limited (MBL) owns and operates a chain of fashion footwear and accessories stores, and has a countrywide network of an exclusive 739 stores of Metro, Mochi, Walkway, and Crocs, among others, with a presence in more than 174 cities, spread across 31 states and UTs. MBL sells formal, casual, party, wedding, ethnic, and sports footwear for women, kids, and men, along with shoe-care and foot-care products. MBL also showcases a curated range of Indian and foreign brands, that retail their products through the company’s outlets. Such brands include Crocs, Skechers, Sparx, Buckaroo, Language, Clarks, Fila, and Fitflop. MBL’s in-house and private label brands like Metro, Mochi, Walkway, Da Vinci, J.Fontini, Princess, Gen-X, etc, have gained considerable popularity and acceptability among consumers. It also offers accessories such as belts, bags, socks, masks, and wallets, at its stores. It also retails foot-care and shoe-care products at its stores through a joint venture, M.V. Shoe Care Private Limited, making it a one-stop shop for all footwear and related accessories to its customers.

Investment Arguments

Well-established market presence, product portfolio, and strong brand recognition

MBL is one of the largest Indian footwear specialty retailers and is amongst the aspirational Indian brands in the footwear category. The company opened its first store under the Metro brand in Mumbai in 1955 and has since evolved into a one-stop shop for all footwear needs, by retailing a wide range of branded products for the entire family including men, women, unisex and kids, and for every occasion including casual and formal events. In addition to men’s, women’s, and kid's footwear, it also has a wide range of handbags, belts, wallets, etc. Metro Brands retail footwear under its own brands of Metro, Mochi, Walkway, Da Vinchi and J. Fontini, as well as certain third-party brands such as Crocs, Skechers, Clarks, Florsheim, and Fitflop, which complement its in-house brands. The Metro footwear range is specially curated based on regional sensitivity to cater to the needs of different regions. As of March 31st, 2023, the Company operated 5 formats & 739 Stores across 174 cities spread across 31states and union territories in India.

The beneficiary of the premiumisation trend

Demand for MBL is driven by products priced above Rs1,500 (especially Rs3,000+). This is evident from the fact that Rs3,000+ product category continued to grow fastest over FY20‐23. Contribution from RS 3,000+ range has increased from 34% to 44% while contribution of products priced between Rs500‐1,000 has declined from 17% to 10% over FY20‐23. As a result, blended ASP grew by ~4% while footwear ASP grew by ~7‐8% in FY23 vs. FY22. We have highlighted in our past channel check notes that the impact of inflation is felt least by the consumers of Metro. Management remains confident of maintaining the long-term healthy sales CAGR growth of ~18‐20% in a medium-term largely led by the premiumization trend and retail expansion.

Store Expansion to aid growth

The company is on track for a rapid store expansion. Store expansion picking pace with the net addition of 19 stores across all formats during the quarter. (115 net additions in FY23) - highest ever new store openings in FY23. MBL had indicated it would open 260 stores over the next three years. The company’s overall store count is 739, as of Mar’23.

Ramp up of new premium product launches and online business

MBL is improving its product mix by introducing footwear at higher price points. It received a strong response for the FitFlop brand of footwear (average realization of `5,600), which it launched towards the end of the previous fiscal. The share of premium footwear (priced above `3,000) in MBL’s sales increased from 34% in FY20 to 44% in FY23.

Growth momentum in online sales (including omni-channel sales) continues with 48% growth on YoY basis. [FY23 v/s FY22]. In FY23, Online sales (including omni-channel sales) contribution is 7.9%. (as compared to 2.5% in FY20, 7.3% in FY21 and 8.4% in FY22). Last 4 years online sales CAGR is 71%.

Asset light business model

Metro is among the few footwear retailers in India to source all products through outsourcing arrangements without their own manufacturing facility, resulting in an asset light model. Metro’s asset-light model is based on third-party manufacturing by longstanding vendor relationships, and supported by active brand portfolio management, optimum store size and layout, and long-term lease arrangements. Owing to Metro’s scale of operations and strong supplier network, Metro is able to leverage better margins with their vendors and enter into arrangements with third-party brands on favorable terms. For instance, under most of the arrangements for third-party brands, Metro is required to pay for products only once these products are sold.

Q4FY23 Financial performance

Metro Brands reported mixed earnings in Q4FY23. Consolidated revenues grew by 35% YoY to 544Cr driven by store addition and volume growth. In Q4, the average selling price for footwear was higher by 6-7% YoY and a better product mix (higher sales of premium products) also boosted top-line growth. EBITDA increased 10.8% YoY with a margin contradicting 580 bps to 26.5% YoY. This was due to higher expenses, led by advertisement & marketing costs and a CBL loss of `14 Cr. Store expansion picked pace with the net addition of 19 stores across all formats during the quarter. (115 net additions in FY23). Growth momentum in Ecommerce sales (including omni channel) continues as sales grew 32% (Q4 FY23 vs Q4 FY22) and 48% in FY23. Reported PAT marginally declined by 1.1% in Q4FY23 to Rs.69Cr. For Q4, PAT at the consolidated level includes a loss from CBL of Rs.14 Cr. Adjusted for Fila’s loss, PAT grew 19% YoY.

Key Risks & Concerns

Highly competitive and fragmented footwear retail space, resulting in pricing pressure

The footwear retail industry is highly competitive, characterized by the strong presence of the unorganized sector (includes small local brands, local brick and mortar shops, street vendors, and unbranded footwear sales) and the intensifying competition in the organized segment due to the increasing presence of large retailers as well as international brands, leading to pressure on margins. There is also competition within the organized segment from national and international organized retailers like Bata India Limited, Mirza Shoes, etc.

Increase in raw material prices

Any adverse movement in raw material prices could materially impact the company’s margins and profitability.

Outlook & Valuation

METRO’s store expansion is on track and Store addition guidance was increased to 100 from ~80 earlier. Contribution from its premium range is on the rise. This, coupled with store additions, should drive future growth. It is focused on the liquidation of CBL inventory. We expect the same to be completed over the next two quarters and a revival in CBL’s margin by H2FY24. We expect strong operating metrics, led by: i) continuous store expansion, ii) the addition of new formats and channels, iii) a higher mix of premium products in its portfolio, and iv) an expanding portfolio of accessories and adjacent categories V) Acquisition of the FILA and Proline brands (whose revenue can be scaled by 4–5x in the medium term) and partnership with FitFlop provides ample growth opportunities.

At a CMP of Rs.1074, the stock is trading at 56x FY25E (EPS – Rs.19.3) and hence, we recommend a BUY rating for the stock.