Mahindra & Mahindra Ltd

Automobiles - Passenger Cars

Stock Info

Shareholding Pattern

Price performance

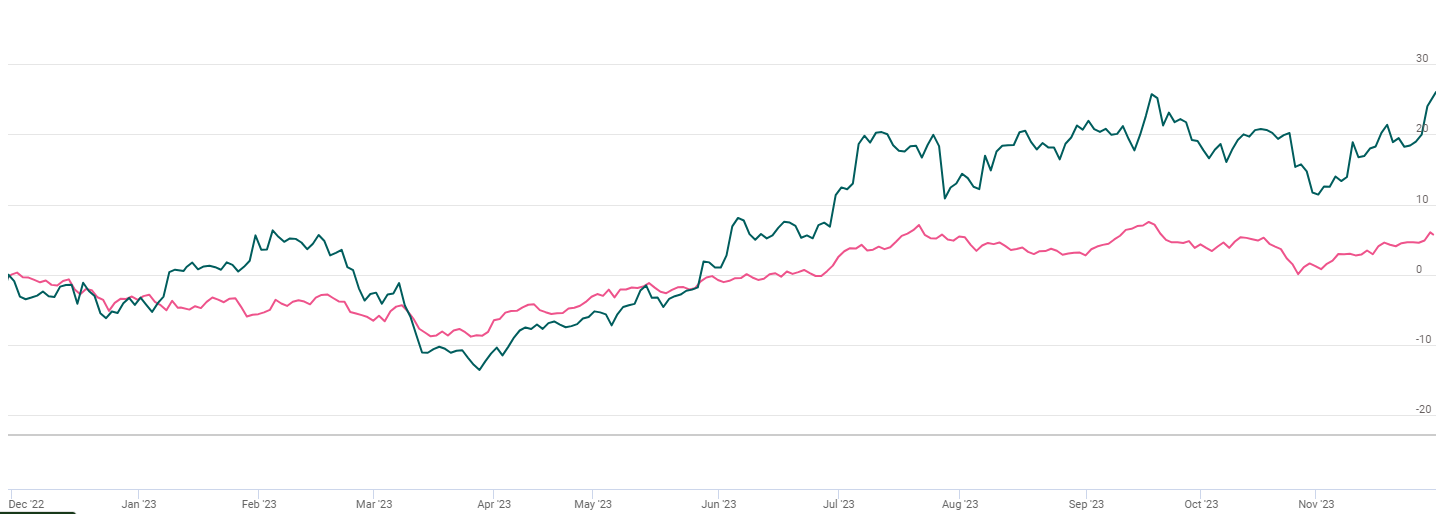

Indexed Stock Performance

Strong demand for automotive segment and new product launches to spur growth for M&M

Company profile

Incorporated in 1945, Mahindra & Mahindra Limited (M&M) is the flagship company of the Mahindra Group. M&M is the most diversified automobile company in India with a presence across two-wheelers, three-wheelers, PVs, CVs, tractors, and farm equipment. M&M has a strong position in the domestic large UV and tractor markets, with a market share of ~43%. In terms of volumes, M&M is the world’s largest tractor manufacturer and among the top four PV manufacturers in India. Through its subsidiaries and Group companies, M&M is present in financial services, auto components, hospitality, infrastructure, retail, logistics, steel trading and processing, IT businesses, agribusinesses, aerospace, consulting services, defence, energy, industrial equipment, etc.

Investment Arguments

Strong position in the domestic tractor industry with an established rural franchise; diversified automotive company

M&M has been the dominant market leader in the domestic tractor market, commanding a market share of 41.6% in Q2FY24 (41.2% in FY2023). With its offerings across different brands of Mahindra, Swaraj, Trakstar, and soon-to-be-launched Oja and its well-entrenched sales and service network, it is expected to maintain its leadership position going forward as well. Additionally, it enjoys a strong position in the domestic UV market, and in the light commercial vehicle (LCV) market (especially the 2-3.5T segment), with a 49.6% share in Q2 FY2024 in the latter and 18.5% in the former (in terms of volumes). It has also carved out a leadership position in the domestic electric three-wheeler (e-3W) market with a 67.6% market share in FY2023.

A new introduction in the EV and pickup segments to bolster growth for M&M

M&M has unveiled its electric SUV – Thar e concept, which would be developed as part of the born electric range and would not be an electric conversion of the ICs Thar. Thar.e will be based on its new INGLO platform. Thar.e will have a new Mahindra Logo as copper twin peak will be used only on one EV – XUV400. The timeline to launch Thar.e is yet to be decided. Broadly, M&M has a healthy pipeline to introduce five products on the INGLO platform from December 2024. Along with OJA, tractor platform, and Thar.e, M&M has also unveiled the Global PikUp concept on the global stage to penetrate new overseas markets. Global PikUp is part of Mahindra’s global strategy, and the company believes this new pikUp vehicle would help it to enhance its penetration in its existing markets like South Africa and Australia and would make inroads for it in new territories.

Strong demand for automotive segment and new product launches to drive growth for M&M

We expect M&M to benefit from its leadership status in the tractor segment, strengthening its position in the LCV segment, and regaining its market share in the highly competitive SUV segment. M&M is on track with its growth roadmap in the EV segment. The company eyes 10x growths in its farm equipment business by FY2027E, while strengthening its SUV segment via new launches. M&M is timely addressing capacity constraints in the PV segment. Given the high exposure to the rural economy, M&M is expected to do well in recovery in rural areas. M&M generates 65% of its volumes from the rural segment. The company has been a market leader in the tractor segment. While growth in the tractor industry is expected to moderate due to a high base, we believe M&M would grow ahead of the industry due to its market leadership position and deep penetration in the rural market. Besides its core tractor business, the company has been focussing on the expansion in the farm machinery business. Currently, M&M is focussing on the expansion of the agribusiness in place of targeting a specific operating performance. The company has laid down a strong roadmap for its automotive segment by investing in technology and launching new products regularly to regain its market share in the segment. M&M’s focus continues to drive bookings in key brands – Thar, XUV-300, Scorpio, and Bolero, despite long waiting periods.

M&M is currently on a strong growth trajectory in the automotive segment led by SUVs.

The demand for premium SUVs like XUV700, Thar, and Scorpio-N is expected to boost net ASP per vehicle and margin expansion. The monthly booking rate exceeds supply, with a rate of 51k per month compared to 38k vehicles. In the LCV segment, market share has increased by 280bps to 49.6%, supported by new launches and entry into the 2-ton volume segment. Further improvement in automotive margins is anticipated for FY24 due to economies of scale. Production capacity has expanded to 42k units per month, with a planned additional capacity of 49k units by Q4FY24. Another capacity addition plan beyond 49k units may be announced soon.

Steady Volume Outlook and Market Share Expansion in Tractor Segment

The company anticipates a stable volume growth in FY24. In H1FY24, M&M achieved an 80 basis points increase (150 basis points year-on-year) in market share in the tractor segment, reaching 42.3%. This growth was attributed to new launches and the expansion of the network. M&M has recently introduced OJA, Naya SwaraJ, and set Swaraj targets in the tractor segment.

Q2FY24 Financial Performance

Mahindra & Mahindra (M&M) delivered steady earnings growth for the quarter ended Q2FY24. Standalone net sales rose 16% YoY to Rs.24,310 cr driven by automotive segment that grew 20% on lower realization. Adjusted EBIT margin expanded to 7.9% (+40bps QoQ). Farm equipment revenue was flattish YoY but came higher than expected, while margins were lower than estimates contracting 30bps YoY to 16%. It had one-time launch-related costs of 90bps and 0.2% impact on account of the mix factor due to OJA. Also, operating de-leverage had a 100bps impact on margins QoQ. However, standalone EBITDA grew 23% YoY to Rs.3066 cr driven by operating leverage benefits, and softening of commodity prices. PAT surged 67% YoY to Rs.3452 cr owing to healthy topline growth and better than expected operational performance.

Key Risks & Concerns

Susceptible to cyclicality in the Auto and Tractor segment

The demand for tractors is vulnerable to monsoon conditions in a year. If the monsoon fall is less during a particular year the demand decreases and vice-versa. Moreover, the auto industry is cyclical in nature and multiple factors like Income level, consumption capacity, and other economic conditions like the demographic composition of the economy play a vital role. Additionally, regulations especially pertaining to the usage of diesel persist.

High working capital requirements and intense competition

The company operates in a highly competitive industry where capital expenditure and working capital requirements are very high. These expenditures are required for promoting the R&D of the brand to stay ahead of the competition. The R&D facilitates technological advancements required for building the brand. Such brands focus on providing luxury experience to their customers and brand building requires a lot of research. All this is possible with a sufficient amount of Capex expenditures and sufficient working capital requirements.

Increase in key raw material prices.

Any significant increase in key raw material prices could adversely affect company’s operating profitability and thus, its financial performance.

Outlook & Valuation

M&M delivered steady earnings growth for the quarter ended Q2FY24 driven by growth in the automotive division. Its EV projects are on track. Historically M&M’s operating performance is largely dependent on the tractor segment; however, we believe the auto segment is expected to drive its operating performance in the coming years due to increasing volumes going ahead. Consistent demand in its Automotive division especially for its utility vehicles will drive the volume higher for the company while new launches in the LCV segment and Farm Equipment would further aid in volume growth in the respective segments.

The company has been consistently improving its market share across divisions, indicating healthy response for products and strong execution of its strategy. Further, traction in its EV business in the passenger vehicle and LCV segment shall provide the next leg of growth for the company. With a favourable demand scenario in the Auto Division, a strong growth outlook in the Farm Equipment business, a healthy order book in the PV segment, market leadership in the tractor segment, the opportunity to grow in the farm machinery segment, and its road map to play the EV space, M&M is poised to deliver strong growth in the coming years.

At a CMP of Rs.1634, the stock is trading at 16x FY25E which appears compelling. Hence, we recommend a BUY rating on the stock.