MTAR Technologies Ltd

Engineering

Stock Info

Shareholding Pattern

Price performance

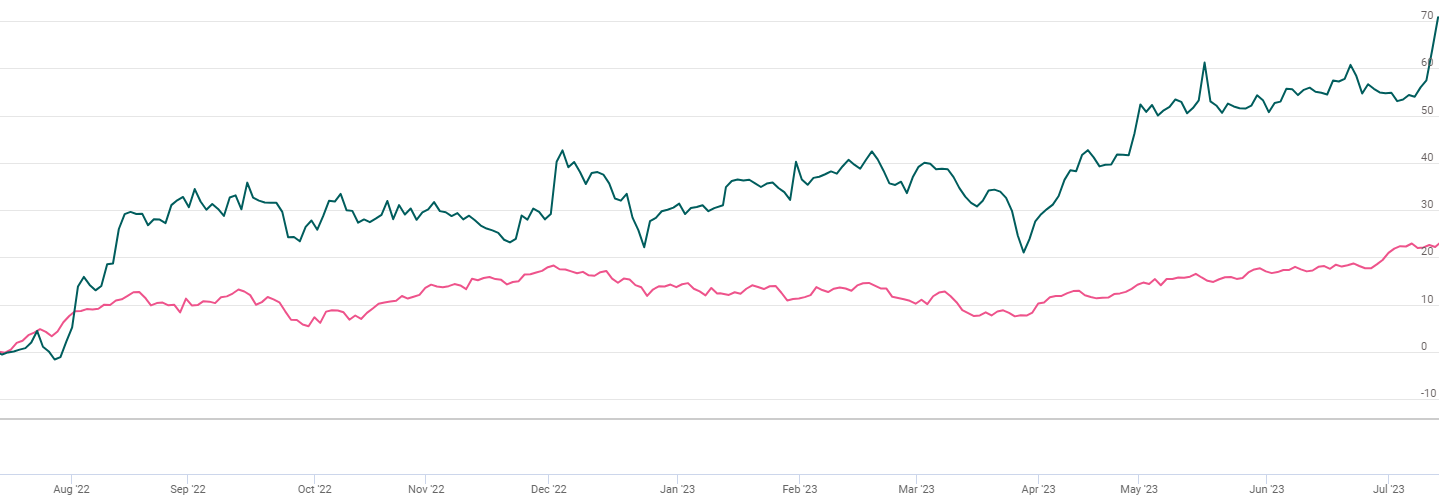

Indexed Stock Performance

Riding on clean energy

Company Profile

MTAR Technologies was incorporated on November 11, 1999. The company is a leading precision engineering solutions company engaged in the manufacture of mission-critical precision components with close tolerances (5-10 microns), and in critical assemblies, to serve projects of high national importance, through their precision machining, assembly, testing, quality control, and specialized fabrication competencies, some of which have been indigenously developed and manufactured.

MTAR Technologies operates in three segments viz. nuclear, space & defense, and clean energy, and manufactures 14 products in the nuclear sector, six in space & defense, and three in the clean energy sector. In addition, they also focus on clean energy as one of their key customer sectors and are accordingly, involved in the manufacture of power units, specifically hot boxes, and in the development and manufacture of hydrogen boxes and electrolyers, to serve Bloom Energy Inc., United States (“Bloom Energy”) with which, they have been associated with, for over 9 years.

Investment Arguments

Precision engineering expertise with complex product manufacturing capability

The company develops and manufactures a wide range of mission-critical assemblies and precision components with close tolerances (5-10 microns), through its precision machining, assembly, and specialized fabrication facilities, for onward usage by their customers in the clean energy, nuclear, and space and defence sectors in India, and abroad. These capabilities are further supported by an extensive and stringent testing and quality control mechanism undertaken at each stage of the production process. Towards this end, they use high precision quality inspection equipment such as 3D coordinate measuring machines (“CMM”), laser measuring, optical alignment instruments, non-contact measuring, and other non-destructive testing equipment to ensure ideal quality, as requested by the customers.

Wide product portfolio

The company’s major product portfolio includes 3 kinds of products in the clean energy sector, 14 kinds of products in the nuclear sector, and 6 kinds of products in the space and defence sectors. They strive to understand their customers’ specific business needs and provide products to meet their requirements and accordingly, their ability to provide quality products as per the customer specification, and their consistent customer servicing standards, have enabled them to increase their customers’ dependence on them.

Long-Standing Relationships with marquee customers

In clean energy, the company is involved in the manufacturing and specialized fabrication of critical assemblies for customers such as Bloom Energy, and Andritz, among others. Further, in the defence sector, the company has been supplying hi-Precision machined, fabricated systems to most of the leading programs of DRDO labs (ADA, GTRE, DRDL), DPSUs (BDL, BEL, HAL), and other defence R&D and Defense public sector Units (DPSUs) establishments of the Indian Defense and international players like ELBIT Israel, Rafael Israel etc. Within the space sector, it has established a relationship with ISRO.

Healthy order book lends earnings visibility

MTAR’s order book at the end of March 2022 stood at IRs.1170 as the company booked orders worth Rs.1100 cr in FY23. MTAR has a diversified order book with clean energy (fuel cell, hydel, and others) constituting the bulk (77%) of its order book. This is followed by clean energy (civil nuclear power), which comprises 8% of the order book, and space, which makes up 9%. Robust order book lends strong earnings visibility for the company.

Q4FY23 Financial Performance Analysis

MTAR tech reported healthy earnings growth for the quarter ended Q4FY23. Consolidated Revenues for the quarter nearly doubled and stood at Rs.196 cr as compared to Rs.98.5 cr in the same quarter of the previous fiscal largely driven by the clean energy segment reporting growth of 133% YoY to Rs.140 cr, while the ex-clean energy segment grew by 44% YoY to Rs.54.4 cr. On the operational front, consolidated EBITDA witnessed a growth of 78% to Rs.54 cr YoY. Gross margins were impacted due to a higher share of the clean energy segment and increased employee costs (Rs.100 cr impact) to retain its talent base, which led to a 310bps EBITDA margin decline to 25%. Order book remained healthy at Rs.1170 cr (+81% YoY) as the company booked orders worth Rs.1100 cr in FY23. PAT saw a growth of 57% to Rs.31 cr YoY.

The management has guided at a revenue growth of 45–50% in FY24.EBITDA margin of ~28% in FY24, with the expectation that employee expenses will trend down to less than 10% of sales. New order intake of ~Rs.1,200cr and an order book of ~Rs.1,500cr by FY24-end.

Key Risks & Concerns

High customer concentration risk - The company has high customer concentration — it derived more than 65% of its revenues from a single customer, Bloom Energy Corporation.

High Working Capital Requirement: All segments of the business are highly working capital intensive where payment schedules by clients are usually stretched.

Exposure to fluctuations in forex rates – The company’s margins are exposed to fluctuations in the forex rates as exports are not completely offset by raw material imports and the margins vary, depending on the segment and customer mix.

Outlook & Valuation

MTAR Technologies is a leading precision engineering solutions company & has offerings in the clean energy, nuclear and space, and defence sectors where the company manufactures critical and differentiated engineered products with a healthy mix of developmental and volume-based production, customized to meet the specific requirements of customers. The company’s financial performance looks strong with a healthy balance sheet position. The company has a wide product portfolio along with a marquee customer base & robust order book which gives strong revenue visibility going forward. We believe MTAR’s growth momentum will continue on account of the robust book, new client additions in the global aerospace and clean energy, and continued growth momentum from its biggest clients. At a CMP of Rs.1900, the stock is trading at 32x FY25E (EPS – Rs.65.8) and hence, we recommend BUY on the stock.