Landmark Cars Ltd

Trading

Stock Info

Shareholding Pattern

Price performance

Indexed Stock Performance

A proxy play for premium automobile dealership with a strong focus on high-growth segments

Company profile

Landmark cars Ltd. (LCL) isa leading premium automotive retail business in India

with dealerships for Mercedes-Benz, Honda, Jeep, Volkswagen, and Renault. They also

have a commercial vehicle dealership with Ashok Leyland in India. They have a presence

across the automotive retail value chain, including sales of new vehicles, after-sales

service, and repairs (including sales of spare parts, lubricants, and accessories),

sales of pre-owned passenger vehicles, and facilitation of the sales of third-party

financial and insurance products. They started their operations and opened their

first dealership for Honda in CY1998.

The companyhas expanded its network to include 112 outlets in 8 Indian states and union territories, comprised of 59 sales showrooms and outlets and 53 after-sales service and spares outlets, as of June 30, 2022. They are focused on the premium and luxury automotive segments. LCL was the number one dealer in India for Mercedes in terms of retail sales for Fiscal 2022, the number one dealer in India for Honda and Jeep in terms of wholesale sales for Fiscal 2022, and was the top contributor to Volkswagen retail sales for the calendar year 2021. In addition, it was the third-largest dealership in India for Renault in terms of wholesale sales contribution for the calendar year 2021.

The company buys and sells pre-owned passenger vehicles at each of its dealerships. It operates on 2 business models

- Facilitating the sale of used vehicles through the appointed panel of agents on a commission basis;

- Taking the vehicles on book for sale after any needed refurbishment.

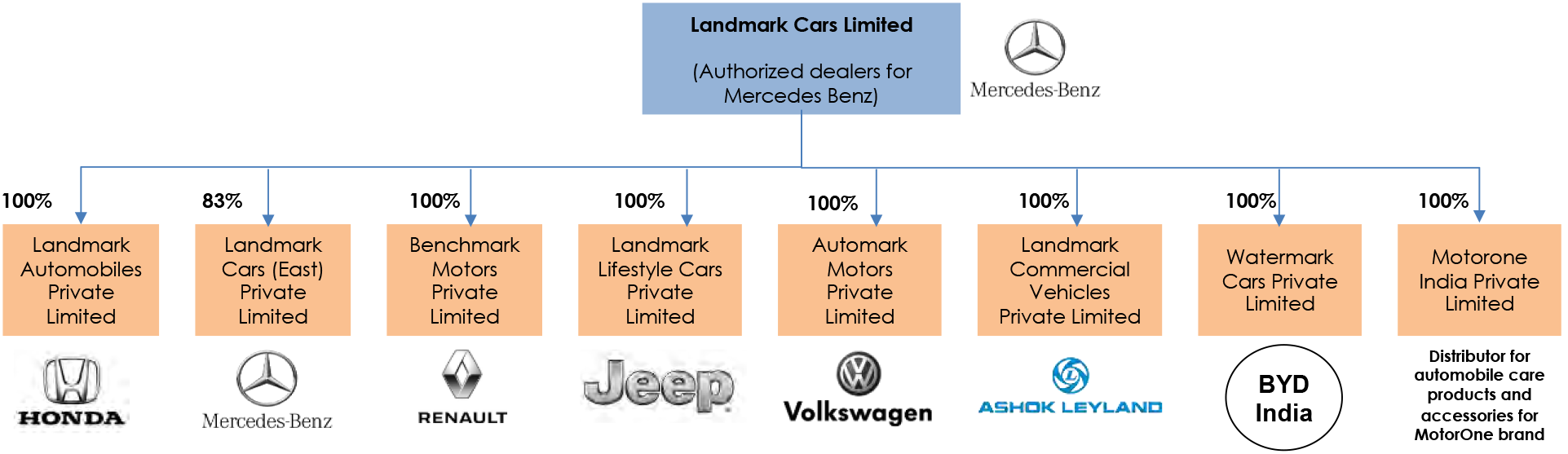

Corporate Structure

Its business comprises thefollowing:

- New Vehicle Sales

- Expansion into pure EV

- After Sales Services & Spare Parts

- Pre-owned Passenger Vehicles

- Third-Party Insurance and Financial Products

Investment Rationale

Presence across entire customer value-chain

The company’s business caters to the entire customer value chain including

retailing new vehicles, servicing and repairing vehicles, selling spare parts, lubricants,

and other products, selling pre-owned passenger vehicles, and distribution of third-party

financial and insurance products. They benefit from the synergies of these complementary

businesses as well as increased customer retention from servicing their customer’s

various automotive needs. There is ample opportunity for new businesses in other

segments by utilizing their synergies in complementary businesses.For example, each

sale of a new or pre-owned passenger vehicle provides them the opportunity to sell

the customer an extended service contract or a financial product such as vehicle

financing and insurance.

Leading automotive dealership for major OEMs with a strong focus on high-growth

segments

LCL’s longstanding relationships with their OEM partners and their market

leadership positions offer them several competitive advantages including:

- opportunities from the OEMs allowing them to expand their business into new cities and geographies

- Sharing infrastructure and manpower across brands to increase margins

- Attracting suitable inorganic dealership acquisition targets (with the support of the OEMs)

- Opportunities to expand across their business verticals like after-sales service, sales of pre-owned vehicles, and sales of financial and insurance products

- Attracting talented sales and technical personnel

- Executing large-scale marketing and advertising campaigns and

- Centralizing certain backend and support functions all of which leads to economies of scale and margin improvement.

Growing presence in the aftersales segment leading predictable growth in revenues

and superior margins

Their services and repair offerings at each of their dealerships comprise repair

and collision repair services and include warranty work, insurance claim work, and

customer-paid services. They operate as authorized service centers for Mercedes-

Benz, Honda, Volkswagen, Jeep, Renault, and Ashok Leyland, and they provide after-sales

service and repairs through their 53 after-sales service and outlets across eight

Indian states and union territories. They also sell spare parts, lubricants, accessories,

and other products from these outlets. Their after-sales service and spares business

provides a stable revenue stream and contributes to higher-margin revenues at each

of their dealerships, which helps mitigate the cyclicality that has historically

impacted some players in the automotive sector. Their after-sales service and spare

revenue contributed 20.60% in the three months ended June 30, 2022.

OEMs offer manufacturers’ warranties and maintenance programs packaged with vehicle sales and, generally, only permit warranty work to be performed at their authorized service centers. This creates a significant barrier to entry for new competitors. In addition, their emphasis on selling extended warranties and packaged service contracts has bolstered their after-sales service business in each of their dealerships by helping them to retain customers beyond the term of the standard manufacturer warranty period.

Robust business processes leveraging technological innovation and digitalization

They have established robust business processes which assist them in reducing costs

and increasing efficiency as well as ensuring faster operationalization of new facilities.

These processes ensure their ability to replicate their successes as they expand

organically and in the new businesses that they acquire.

They have established processes for operationalizing new outlets including purchasing inventory, selecting and leasing premises, and hiring sales and technical personnel. Further, they also focus on customer processes and data to provide insights into customer engagement. They target campaigns to existing customers by email, online campaigns, and social media for upgrades, after-sales service offers, and loyalty benefits. They also provide customers third party offers and loyalty benefits when they enter into after-sales service transactions with them and check out rewards on their websites.

FY22Financial Performance

Landmark Cars reported healthy earnings for the financial year 2022.

Consolidated Revenues for FY22 stood at Rs.2976 cr as against Rs.1956 cr in FY21; registering a growth of 52%. On the operational front, EBITDA witnessed a growth of 59% to Rs.174.6 cr YoY. EBITDA Margins stood at 6%. PAT saw a stellar growth of 496% to Rs.66.19 cr as against 11.11 cr clocked in the same quarter of the previous fiscal thereby reflecting a significant improvement in its overall performance.

Consolidated Revenues and PAT for Q1FY23 stood at Rs.800 Cr and Rs.18 cr respectively.

Key Risks & Concerns

Highly competitive business: Automobile retailing is a highly competitive business. Increasing competition among automotive dealerships through online and offline marketing and competition from unauthorized service centers may have an adverse impact onbusiness, results of operations, and financial condition.

Restrictions imposed by OEMs: LCL is subject to the significant influence of, and restrictions imposed by OEMs pursuant to the terms of its dealership or agency agreements that may adversely impact the business, results of operations, financial condition, and prospects, including its ability to expand into new territories and acquire additional dealerships.

Outlook & Valuation

We believe rising income levels, new models launched by partner OEMs, and changing lifestyle preferences leaning towards a rise in premium/luxury automobile ownership are growth drivers for the company.LCL is growing its presence in the after-sales segment leading to predictable growth in revenues and superior margins.Its comprehensive business model captures the entire customer value chain and focuses on the expansion of its overall business with experienced promoters and business leadership. The company is expected to pick up its sales pace once there is a pace coming into the global economy.

Further, we believe that it is well placed in its target markets with little threat from bigger players. Considering its presence inthe entire customer value chain, entering the EV segment, and robust business leveraging upon innovation and digitization, the company is well poised to grow its market share in the years to come.

At CMP of Rs.616, the stock is trading at 34x FY22 (EPS – Rs.18.1) and we recommend a BUY on the stock.