Kalyan Jewellers India Ltd

Diamond & Jewellery

Stock Info

Shareholding Pattern

Price performance

Indexed Stock Performance

Store expansion and wide product offerings to drive growth

Company profile

Kalyan Jewellers India Ltd. (KJIL), founded in 1993 by Chairman and MD Mr. T.S. Kalyanaraman, designs, manufactures, and sells a variety of gold, studded, and other jewellery products across various price points. As one of India's largest jewellery retailers, Kalyan Jewellers has a well-established market presence spanning over three decades. Its product range includes items suitable for special occasions, such as weddings, as well as pieces ideal for everyday wear. Their wide product offerings make KALYAN a one-stop destination for all their jewellery needs. The company has expanded to become a pan-India jewellery player, with 217 showrooms located across 23 states and a union territory in India. Additionally, it has an international presence with 36 showrooms located in the Middle East as of March 24.

Investment Arguments

Strong demand despite higher gold prices

Despite higher gold prices, demand for jewelry remained strong, and the company experienced robust volume growth during the mini wedding and festive season, particularly driven by Akshaya Tritiya. Kalyan's average store size ranges between 3,000-4,000 sq. ft., with an average inventory of approximately Rs 20-25 crores. The company is focusing on expanding its presence in Tier 2 and Tier 3 markets by opening more Franchise-Owned, Company-Operated (FOCO) stores. Kalyan believes its hyper-local model is well-suited for semi-urban and rural regions, as it caters to local preferences for gold and studded jewelry. Mature stores are achieving low double-digit Same Store Sales Growth (SSSG), and the contribution from new buyers remains robust at over 40%. With a higher share of studded jewelry, the ticket size is better than in South markets. The competitive environment, coupled with rising gold prices, has led to attractive consumer offers, such as 50% off on making charges, driving footfalls. Looking ahead, the company expects the festive season to further increase footfalls.

Favourable industry growth prospects

Increasing regulatory restrictions in the jewelry sector, aimed at enhancing transparency and compliance, are leading to a shift in market share towards organized jewelry retailers. This trend is expected to benefit KJIL (Kalyan Jewellers India Limited) due to its widespread presence across India and strong brand equity. KJIL will continue to expand its revenue base, leveraging industry tailwinds in the medium term. This growth is supported by a loyal customer base and an extensive network of 'My Kalyan' stores.

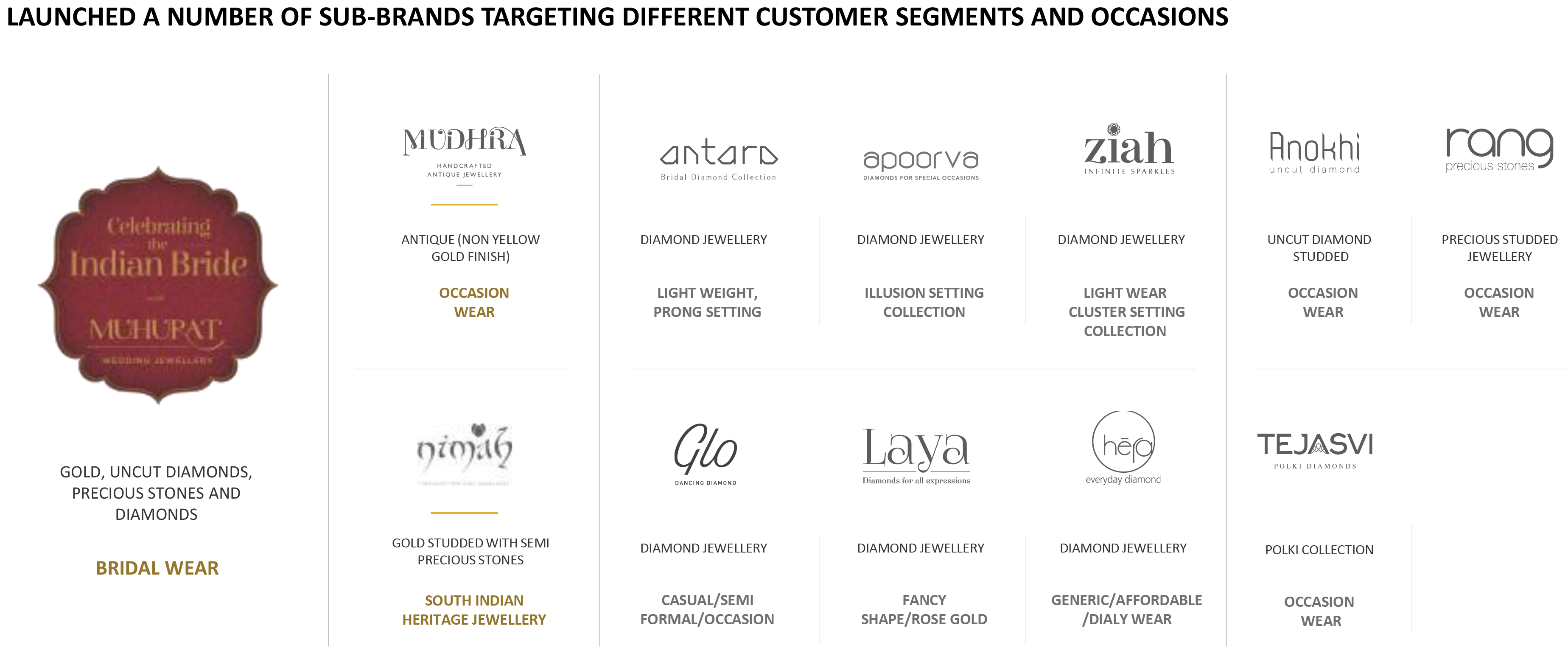

Established Brand Image; Diversification across Geography and Products

Kalyan is among India’s top five gold jewellery retailers, accounting for about 6% of the total organised market share as per the company. As of March 31st, 2024, KALYAN operated a total of 217 showrooms in India, which includes 13 Candere showrooms, spanning across 23 states and a union territory. These showrooms collectively cover an area of 700,000 square feet. Additionally, KALYAN has 36 showrooms in the Middle East, covering a total area of 44,000 square feet.

Approximately 86% of KALYAN's showrooms, including Candere, are located in India, while the remaining 14% are situated in the Middle East. Regionally, KALYAN has a presence in 38% of its stores in the South and 62% in non-southern regions. Furthermore, 30% of the showrooms are located in metropolitan areas, with the remaining 70% situated in non-metro areas.

Nationwide expansion into non-southern regions to boost margins

KALYAN, originally based in Kerala, has expanded its operations to 23 states and a union territory in India. The favourable industry dynamics for organized players are expected to continue driving store-led growth for nationwide brands like KALYAN and Tanishq. KALYAN's success in non-southern markets has encouraged it to accelerate its store expansion plans. The company aims to leverage the strong demand for studded jewellery in these regions.

In India, studded jewellery accounts for 22% of sales in southern markets and 35% in non-southern markets. Studded jewellery typically carries a higher gross margin of around 35% in India, with margins in non-southern markets exceeding those in the south, compared to plain gold jewelry, which typically has margins of 11-12%. Hyper-local strategies for different geographies and customer segments

Hyper-local strategies for different geographies and customer segments

KALYAN's hyper-local strategy allows it to provide tailored services across diverse regions and customer segments in India, where jewellery preferences vary widely. This approach requires a deep understanding of local preferences and the use of region-specific inventory models. The company employs region-specific campaigns featuring localized content and brand ambassadors who appeal to national, regional, and local audiences. Each showroom is staffed with local personnel who understand the local language and culture, and the showroom designs reflect local tastes. Moreover, KALYAN's "My Kalyan" network hires employees from local communities to ensure they have relevant language skills and local relationships. This strategy enhances the brand's connection with customers and strengthens its presence in various regions across India.

Focusing on the asset-light FOCO model

KALYAN has developed a strategy to operate using both the Company Owned, Company Operated (COCO) and Franchise Owned, Company Operated (FOCO) models in both Indian and international markets. This approach is aimed at adopting an asset-light strategy to reduce leverage on its balance sheet. In the upcoming fiscal year, FY25, the company plans to open 80 new FOCO stores in India and six stores internationally. Additionally, it intends to shift its focus more towards the FOCO model compared to the COCO model in the Middle East. Over the long term, KALYAN aims to convert 20 stores from COCO to FOCO. To facilitate this transition, KALYAN has partnered with a global investment bank. This strategic move is expected to strengthen the company's presence in key markets and improve its financial performance by reducing asset ownership and associated costs.

Q4FY24 Financial Performance

KJIL demonstrated robust financial performance with impressive YoY growth. Overall, revenue surged to Rs 4,535 crores from Rs 3,382 crores, marking a stellar 34% increase, driven by strong footfalls ahead of the wedding season. EBITDA surged 19% to Rs 306 crores, from Rs 256 crores in Q4FY23, despite 80bps decline in EBITDA margin due to higher operating expenses. Notably, PAT soared to Rs 137 crores from Rs 70 crores, marking a growth of 97%.

Its India business recorded a 38% YoY growth in Q4FY24, up from Rs 2805 crores to Rs 3876 crores in Q4FY24 on the back of healthy same-store sales growth, the highest in all FY24 quarters. PAT was standing at Rs 131 crores from Rs 66 crores in previous year's quarter which is an upside of 99%.

In Q4 FY24, revenue from operations in the Middle East amounted to Rs 624 crore, marking a 14% increase from Rs 549 crore in the previous fiscal year's Q4. The quarter's PAT reached Rs 9.9 crore, up by 76% from Rs 5.6 crore in the corresponding quarter of the previous year.

In Q4 FY24, Kalyan's digital platform, Candere, generated revenue of Rs 36 crore, compared to Rs 32 crore in the same quarter of the previous year. The quarter reported a loss of Rs 70 lakh, a decrease from the loss of Rs 1.9 crore in the corresponding quarter of the previous year.

India Performance:

- India business recorded a 38% YoY growth in Q4FY24, to Rs.3876 crores in Q4FY24 on the back of healthy same-store sales growth, the highest in all FY24 quarters. PAT nearly doubled to Rs.131 crores from Rs 66 crores in previous year's quarter.

- Strong revenue growth in South driven by 18% SSSG.

- Non-South region also showed robust growth at 16% SSSG.

- Non-South region's revenue share increased to 49% from 44% YoY.

- Studded jewellery outperformed gold, with a growth of 29% and increased share to 29% from 28% YoY.

Middle East Performance:

- Positive consumer sentiment in the region.

- Stable showroom-level gross margins YoY.

- Revenue from FOCO showrooms impacted overall gross and EBITDA margins as expected.

- Two new showrooms successfully launched in Q4FY24.

- Higher finance costs due to rising interest rates in the region.

Key Conference call takeaways

Capex and Debt Reduction Strategy:

- Aim to reduce debt by around INR 400 crores next year.

- Estimated capex for the next year is around INR 250 crores.

- Plan to cut working capital loans by INR 350-400 crores by March 2025.

- Starting discussions with banks to release real estate collaterals linked to the working capital loans reduced during FY24.

Franchise Model:

- Expected franchise revenue share is around 20%.

- New franchise stores projected to achieve a PBT margin of 5%.

- Other income includes rent from franchise partners.

- Premises leased and subleased to franchise owners.

Future Plans:

- Plan to open 130 showrooms in India: 80 under the Kalyan brand and 50 under Candere.

- Aim to launch 6 overseas showrooms during the current financial year.

- Free cash flow to be used to further reduce working capital loans.

- Focus on cutting non-GML loans and securing additional GML limits.

- With a focus on growth and customer-centric strategies, Candere is poised to achieve exponential market expansion and strengthen its position as a leading player in the industry.

Market Insights:

- Strong SSSG observed in both South and non-South regions.

- Encouraging consumer demand momentum, especially for wedding purchases.

- Stable competition intensity with no major impact on pricing over the past 4-5 quarters.

- Increased advertising spend, impacting margins due to heightened ad campaigns by competitors.

- Franchise revenue share expected to rise, affecting overall margins.

Financial Outlook:

- PBT margins expected to improve due to debt reduction and leverage benefits.

- Interest costs to decrease, as debt is reduced, enhancing profitability.

- Depreciation likely to remain stable with a focus on reducing capex.

- Revenue growth and cost management are key factors for achieving higher profitability in the future.

FY25 Expansion: Launching 80 FOCO Kalyan showrooms across India.

Middle East Expansion: First FOCO showroom launched in FY24, with 5 more Letters of Intent (LOIs) signed for FY25.

Candere Showrooms: First FOCO Candere showroom opened in FY24, totaling 8 FOCO showrooms by March 31, 2024, and a robust pipeline with 50 signed LOIs for FY25.

Conversions: Two owned showrooms in South India converted to FOCO in FY24, with additional conversions planned for FY25.

Key Risks & Concerns

Exposure to Regulatory Risks: The domestic jewellery sector remains susceptible to regulatory risks, potentially adversely impacting the business. Past regulations, such as restrictions on bullion imports, mandatory PAN disclosure for transactions above a threshold limit, and the imposition of excise duty, have affected business prospects.

Intense Competition: Kalyan Jewellers India Ltd. (KJIL) faces significant competition from both organised and unorganised local jewellers. The highly fragmented nature of the jewellery retail business limits the pricing flexibility enjoyed by retailers.The stagnant volume growth and aggressive expansion by several large jewellers further increase competitive intensity and constrain margins.

Volatility in gold prices: Volatility in gold prices can impact Kalyan Jewellers' profitability and balance sheet, as rapid price changes affect material costs, inventory valuation, and consumer demand.

Outlook & Valuation

Kalyan Jewellers is poised for robust growth driven by strategic initiatives and favourable market conditions. The company is implementing an asset-light expansion strategy, focusing on the FOCO (Franchise Owned Company Operated) model, which is expected to enhance capital efficiency and boost return ratios. The expansion plans include launching numerous new showrooms in India and the Middle East, leveraging the strong Kalyan brand and the infrastructure of franchise owners.

The market is set to grow significantly due to increasing disposable incomes and shifting lifestyle preferences. With a strategic and cautious approach, the Middle East presents significant growth potential for KALYAN. Recent performance in the region indicates a positive trend, and management plans to maintain this momentum by focusing on franchise expansion.

The company’s performance is further bolstered by a favourable competitive environment, strong consumer demand, and increasing market share in the organized jewellery sector. With strategic debt reduction, efficient capital management, and a focus on higher-margin products, Kalyan Jewellers is well-positioned to achieve higher profitability and solidify its market leadership.

The company is now embarking on an aggressive expansion plan in the rest of India, targeting higher margins. This expansion will be facilitated through a successful franchise model. At CMP of Rs.497, the stock is trading at 38x FY26E. We recommend BUY rating on the stock.