KFin Technologies Ltd

Depository Services

Stock Info

Shareholding Pattern

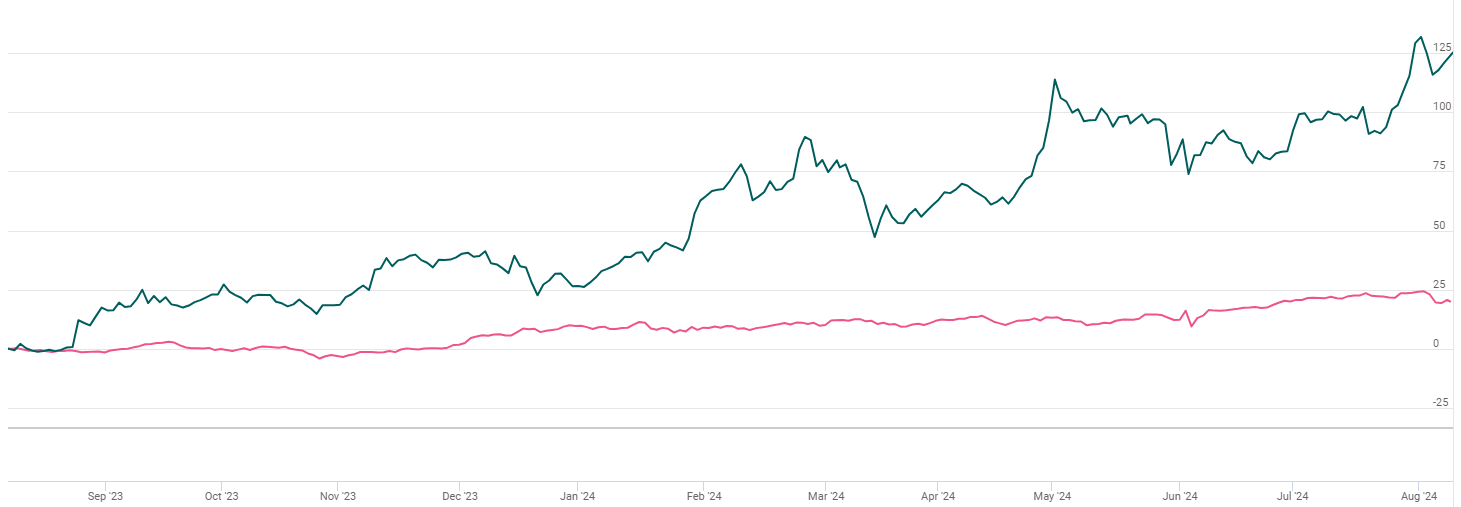

Price performance

Indexed Stock Performance

Strong Q1 earnings, well poised to seize the opportunity leveraging its product suite and sales efforts

Company Profile

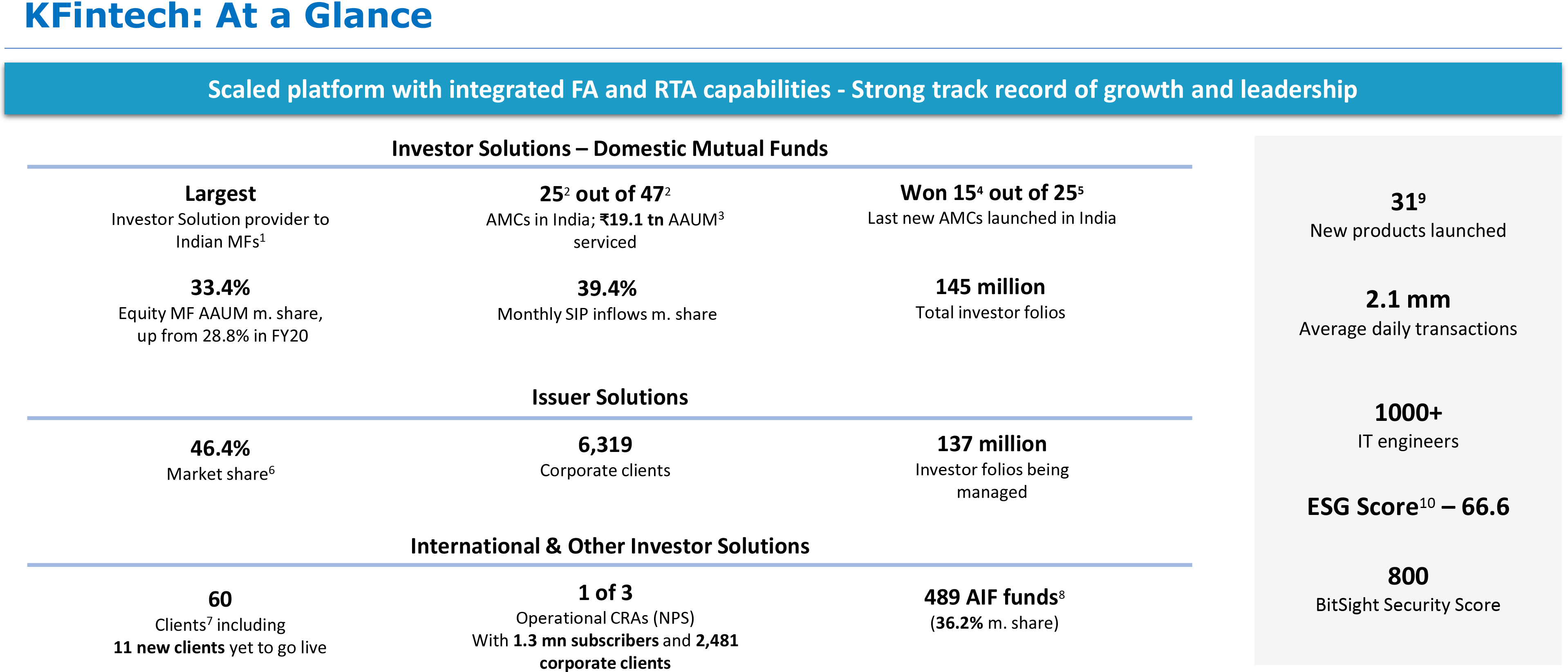

KFin Technologies Limited (“KFintech”) is a leading technology-driven

financial services platform providing comprehensive services and solutions to the

capital markets ecosystem including asset managers and corporate issuers across

asset classes in India and provide comprehensive investor solutions including transfer

agency, fund administration, fund accounting, data analytics, digital onboarding,

transaction origination and processing for alternate investments, mutual funds,

unit trusts, insurance investments, and private retirement schemes to global asset

managers in Malaysia, Philippines, Singapore, Hong Kong, Thailand and Canada. In

India, KFintech is the largest investor solutions provider to Indian mutual funds,

based on the number of AMCs serviced as of December 31, 2023, and the largest issuer

solutions provider based on several clients serviced as of December 31, 2023. KFintech

is the only investor and issuer solutions provider in India that offers services

to asset managers such as mutual funds, alternative investment funds, wealth managers,

and pension as well as corporate issuers and is one of the three operating central

record keeping agencies for the National Pension System in India.

Investment Arguments

Diverse multi-asset servicing platform is well-positioned to benefit from strong

growth across large markets in India and South-East Asia

KFintech operates in multiple large markets in India, Hong Kong, Malaysia and Philippines,

along with presence in Oman and Maldives, across several of these asset classes.

This has allowed them to grow as a regional business and not just as an India focused

business. Their market leadership in India and their client relationships provide

them with the platform to benefit from this anticipated growth in the Indian economy.

The countries in South-East Asia and Hong Kong represent a large mutual fund AUM and such growth in mutual fund AUM across these countries and India is expected to enable KFintech to continue to grow their domestic mutual fund solutions business and their international investor solutions in Southeast Asia. The combination of macro factors in the markets in which KFintech operates such as relevant government push, increased investor pool and client engagement, broadening distribution channel, digital disruption, sustainable finance, and shift in attitude of investors provides them with a significant growth opportunity across these markets.

Unique “platform-as-a-service” business model providing comprehensive

end-to-end solutions enabled by technology solutions developed in-house

The company’s “platform-as-a-service” business model provides

their clients with comprehensive end-to-end solutions. Their technology offering

enables transaction lifecycle management combined with highly secure data collection,

processing, and storage. They work with a data centre that houses over 350 servers

and a data storage handling capacity of over 250 TB. They provide the flexibility

of addressing all major asset classes for asset managers and corporate clients through

their platform. They have implemented a platform-based cross-sell approach on a

deep product stack. Their core service offerings provide end-to-end support across

the front office, middle office, and back end combined with a suite of VAS. Their

VAS such as ‘white labelled’ digital platforms such as AMC websites,

mobile apps, distributor platforms, platforms for AMC employees for assisted sales,

platforms for institutional investments, business insights reports, to CXOs of AMCs,

electronic AGMs, electronic voting, and compliance platform, have helped them to

increase wallet share with their existing clients.

The company has created a varied set of solutions for the wealth management business like a digital onboarding solution, wealth aggregation platforms that accommodate customer relationship management tools, financial planning, multiple asset class transactions, order management, and various client reporting activities along with this.

Deeply entrenched, long-standing client relationships with a diversified and expanding

client base

Due to the comprehensive nature of their platform and the reliance of their clients

to source end-to-end services from them, KFintech is integral to the business and

operations of their clients which results in long-term engagement with limited client

churn. They intend to further deepen their client relationship by offering multiple

platform solutions such as digital platforms for intermediaries, synchronized transfer

agency and fund accounting platforms, scalable and secure technology and infrastructure

with cyber-security-as-a-service, data analytics-as-a service (“DAAS”),

and a customer data platform.

Further expand the client base and market share through enhanced sales and marketing

In addition to the growth of existing clients, KFintech is actively pursuing new

client acquisition across its service offerings and different businesses. They undertake

marketing and sales initiatives across their platform to target new clients and

expand their client base. They have undertaken investments in their sales capabilities

in the past including building separate sales capabilities within key businesses

as well as internationally. They follow a client-centric approach by providing customized

solutions to cater to specific customer requirements.

Among their solution offerings, alternative and wealth management investor solutions, pension services, international investor solutions, and global business services are relatively new offerings added to their platform. They intend to increase the scale and operations of these businesses, by leveraging on relationships with existing clients in other businesses, through new client acquisitions, increased value-added offerings, and increased digitization of their offerings.

Q1FY25 Financial Performance

KFIN Tech exhibited robust earnings growth for the quarter ended Q1FY25 driven by

strong performance across diverse business segments led by new client wins, revenue

and profitability growth, and expansion in margins Q1FY25. Consolidated net sales

rose 31% YoY to Rs.238 cr as compared to Rs.182 cr in the same quarter of preceding

fiscal. International and other investor solutions revenue up by 56.6% YoY; VAS

revenue up by 49.6% YoY. Operating EBITDA surged 42% YoY to Rs.100 cr while EBITDA

Margin expanded to 42%. PAT soared 57% YoY to Rs.68 cr.

Business Highlights

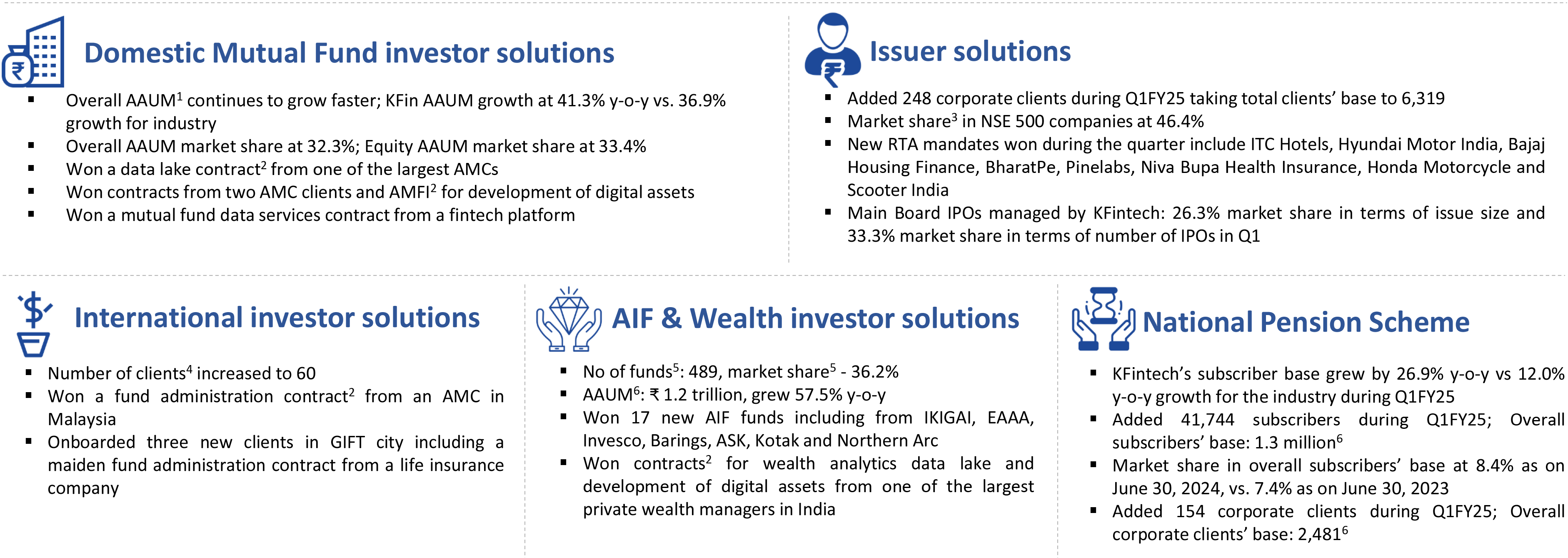

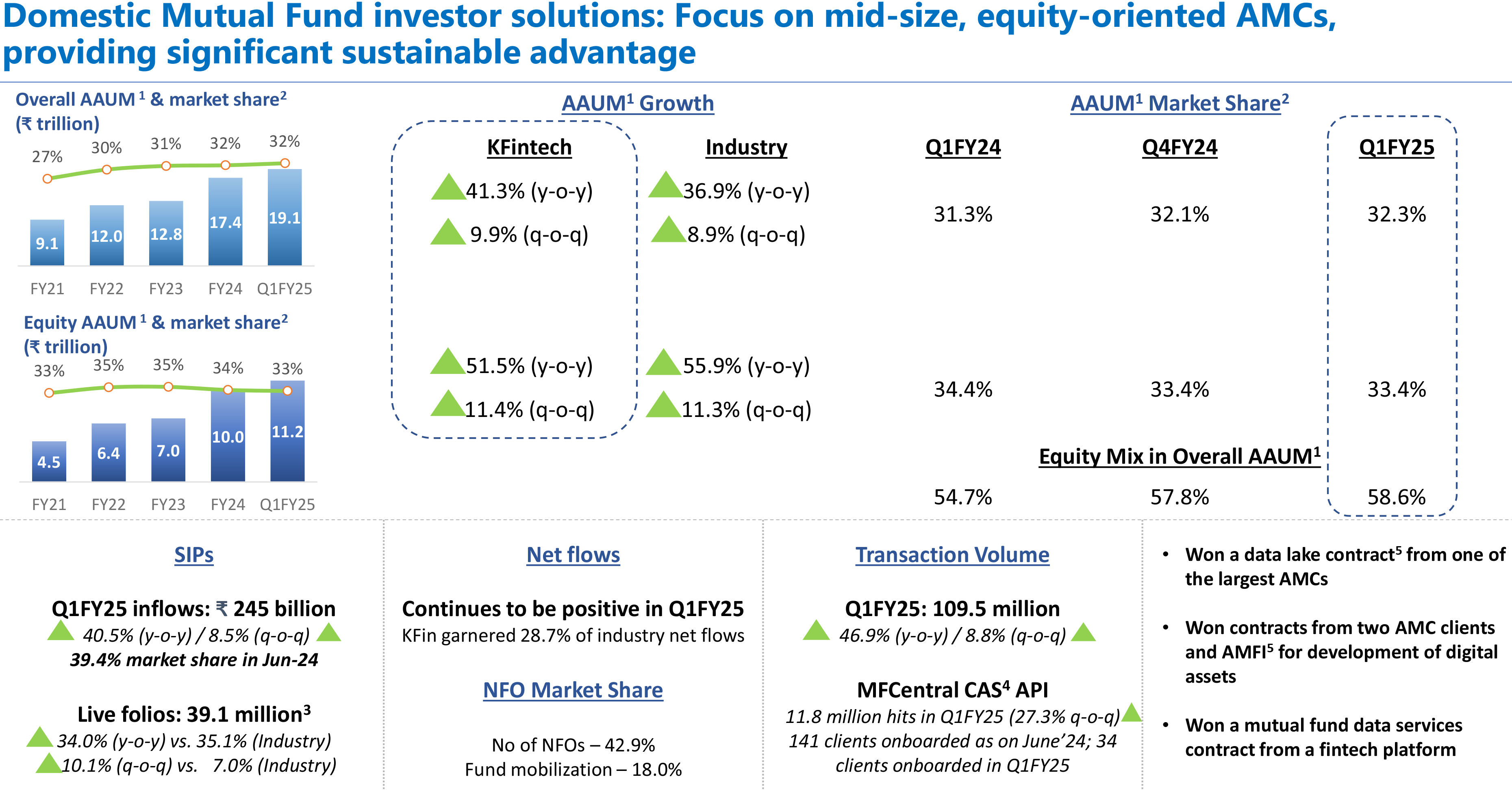

- Overall AAUM growth at 41.3% y-o-y vs. 36.9% for the industry, market share1 at 32.3%.

- Equity AAUM growth at 51.5% y-o-y vs. 55.9% for the industry, market share1 at 33.4%.

- Won a data lake deal from one of the largest AMCs; Won contracts from two AMC clients and AMFI for the development of digital assets; Won a mutual fund data services contract from a fintech platform.

- Added 248 new corporate clients and 12.2 million investor folios under issuer solutions; Market share4 in NSE500 companies at 46.4%; New RTA mandates won during the quarter include ITC Hotels, Hyundai Motor India, Bajaj Housing Finance, BharatPe, Pinelabs, Niva Bupa Health Insurance, Honda Motorcycle and Scooter India.

- Number of international clients increased to 60; Won a fund administration contract from an AMC in Malaysia; Onboarded three new clients in GIFT city including a maiden fund administration contract from a life insurance company.

- No of alternate funds at 489; Market share at 36.2%; AAUM grew 57.5% y-o-y to Rs.1.2 trillion; Won 17 new AIF funds including from IKIGAI, EAAA, Invesco, Barings, ASK, Kotak, and Northern Arc; Won contracts for wealth analytics data lake and development of digital assets from one of the largest private wealth managers in India.

- NPS subscriber base grew to 1.26 million, up 26.9% y-o-y vs. 12.0% y-o-y growth for the industry; Market share in overall subscribers’ base at 8.4% as of June 30, 2024, up from 7.4% as on June 30, 2023.

Other Key Highlights

Key Risks & Concerns

- Significant disruptions in its information technology systems or breaches of data security could adversely affect its business and reputation.

- A decline in the growth, value, and composition of AAUM of the mutual funds managed by its clients may adversely impact the average revenue earned by the company from mutual funds and may have a significant adverse impact on future revenue and profit.

- Certain legal proceedings involving the company, Subsidiaries, Group Companies and certain of its Directors are pending at different levels of adjudication before various courts, tribunals, and authorities. Further, an adverse outcome in any of these proceedings may affect its reputation, standing, and future business, and could have an adverse effect on its business, prospects, financial condition, and results of operations.

Outlook & Valuation

KFIN Technologies Ltd is one of the leading technology-driven companies dealing in varied financial services. Kfin Tech boasts of a strong pipeline of deals in the international markets which we believe will propel overall growth for the company. KFintech is uniquely positioned to offer a full suite of fund administration services to global asset managers using its state-of-the-art technology stack and innovative value-added solutions. With the launch of the industry's first platform XAlt, KFintech aims to set new standards in the global fund administration space to offer a fully automated system to global alternate asset managers that aligns with the evolving requirements. India’s alternate asset management industry is at an inflection point and with global industry too expected to grow at a rapid pace, KFintech is well poised to seize the opportunity leveraging its product suite and sales efforts.” At a CMP of Rs.860, the stock is trading at 43.5x FY26E. We recommend a BUY rating on the stock.