KDDL Ltd

Watches & Accessories

Stock Info

Shareholding Pattern

Price performance

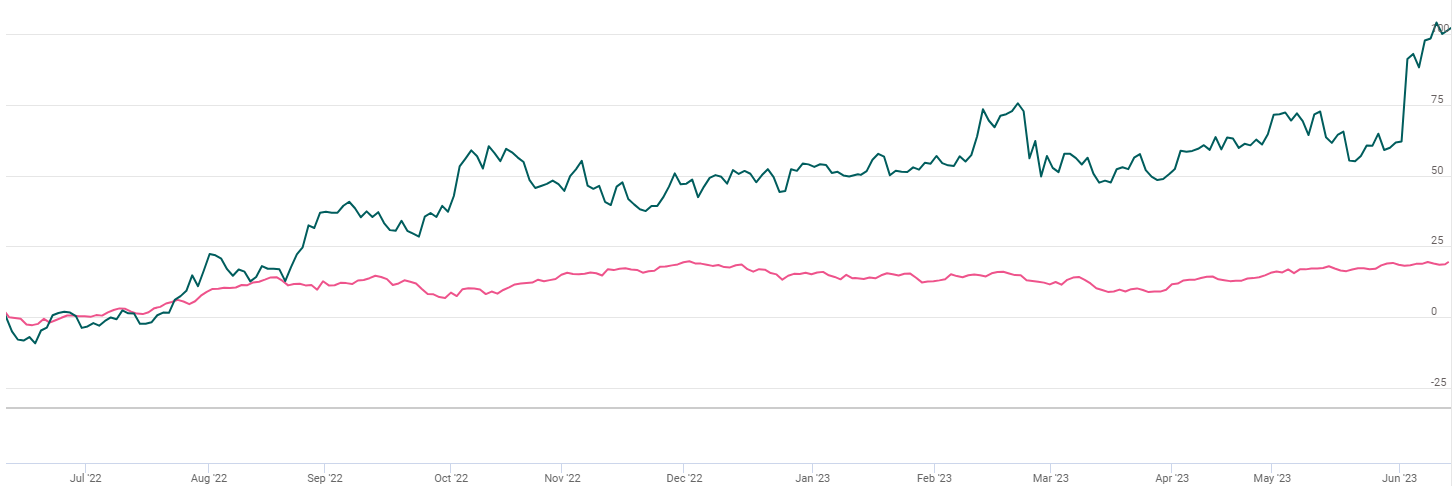

Indexed Stock Performance

Capex to drive growth for KDDL

Company Profile

Incorporated in 1981, KDDL manufactures watch components like dials and hands as well as precision engineering goods under the brand name, Eigen. The company is a leading supplier of high-quality dials and hands to watch manufacturers in India and Switzerland.

KDDL enjoys a presence in Switzerland through its subsidiary, Pylania SA & Estima AG, which are engaged in trading and manufacturing dials and hands for Swiss watch companies, respectively.

KDDL’s subsidiary Ethos was incorporated in 2003. Ethos is engaged in retailing luxury watches. It retails 50 premium and luxury watch brands such as Omega, Jaeger LeCoultre, Panerai, Bvlgari, H. Moser & Cie, Rado, Longines, and Tissot. The company runs 50 retail stores across 17 cities in India, including New Delhi, Mumbai, Bengaluru, Hyderabad, Chennai and Kolkata. Ethos was recently listed in May 2022.

Investment Arguments

Established market position

KDDL has a prominent market position in watch component manufacturing as a leading supplier of watch hands and dials, having established relationships with leading luxury watch manufacturers in the world like Swatch, Tag Heuer, Gucci, Edox, etc. Further, its subsidiary Ethos is the largest organised luxury watch retailing company in the country and operates 56 stores spread across India, as of May 2023.

New capex to drive growth

KDDL Ltd will incur a capex of Rs.25 cr which will be executed over the next two years (in FY23 and FY24) for Setting up a new plant for manufacturing top-quality steel bracelets for watches around Bangalore (Karnataka). The plant will cater exclusively to the mid and high-end Swiss and European watches market. The plant is intended to be set up with a capacity of 100k steel bracelets p.a.

They will also incur a capex of Rs.16 cr for the expansion of the Dials factory situated at Derabassi, Punjab. The expansion will enhance the capacity of the unit by 0.5 million pcs. per annum, especially to cater to exports to the medium-high watch segment of Swiss Watches. Capex is to be executed in phases over two years period (in FY23 and FY24). The new capex line up by the company will act as a key growth catalyst for KDDL Ltd.

Precision engineering solutions provider

KDDL manufactures watch components like dials and hands as well as precision engineering goods under the brand name, Eigen. Eigen offers a full package of services, ranging from design and development to full-scale production, providing customers with optimized supply chain solutions. It addresses various segments such as Electrical, Electronics, Automobile, Telecommunications, medical equipment, Aerospace, Consumer Durables, etc. Through the wide range of services it provides, it enables its customers to meet their design and production needs for over 12 years. It has some of the most well-known names in the industry as its esteemed customers.

Q4FY23 Financial Performance

KDDL Ltd reported good earnings growth in Q4FY23. Consolidated revenues grew by 32% yoy to Rs. 299 cr as against Rs.226 cr in the same quarter of the corresponding fiscal. Watch and retail business increased by 31% yoy to Rs 207 cr in Q4FY23. Manufacturing revenue (standalone) is up by 36.8% yoy to Rs 84.7 cr. Consolidated gross margins declined by 30bps from 43.16% in Q4FY22 to 42.86% in Q4FY23. EBITDA grew by 36.3% yoy from Rs 31 cr in Q4FY22 to Rs 42 cr in Q4FY23. Consolidated EBITDA margins expanded from 13.6% in Q4FY22 to 14.0% in Q4FY23. PBT increased from Rs 15.6 cr in Q4FY22 to Rs.29.6 cr in Q4FY23. Adjusted profit was at Rs 16.2 cr. Ethos profits grew from Rs 7.8 cr in Q4FY22 to Rs.13.3 cr.

In Fy23 Ethos revenue grew 36.6% YoY to Rs.790 cr, EBITDA up 72.1% YoY to Rs.113 cr, PAT up 56% YoY to Rs 59.8 cr. Management expects revenue growth of 20-25% in FY24. Same store growth was 30% in FY23 while it is expected at 12-15% going forward. Incremental growth is expected from 40 store addition over the next two years. Ethos has a cash balance of Rs 230 cr. It currently has 56 stores in 22 cities.

Key Risks & Concerns

Exposed to forex risks – The Company is exposed to forex fluctuations as it is a net exporter and a major portion of KDDL’s revenues are dependent on exports (Swiss market). For Ethos, as approximately 40% of its watches are imported with nil exports, the company remains exposed to foreign currency fluctuation risk.

Risk of fluctuating demand amid ongoing global scenario – The company’s performance is directly dependent on discretionary consumer spending. While the company has depicted growth in the recent past, the evolving nature of the economy and the situation prevailing in European markets might adversely impact the overall market sentiments. The demand in retail business also remains prone to regulatory headwinds such as changes in government policies regarding taxation.

Increase in competition - The company is exposed to competition from domestic players and international markets in the retail business and other global manufacturers in the component business.

Outlook & valuation

Strong recovery in the retail and manufacturing business and increasing sales of pre-owned watches will improve KDDL’s profitability. Considering its prominent market position in watch component manufacturing, leading supplier of watch hands and dials, established relationships with leading luxury watch manufacturers, store expansion, product portfolio expansion, and focus on digital marketing, KDDL Ltd is well-positioned to deliver healthy growth in the coming quarters.

At a CMP of Rs.1370, the stock is trading at 25x FY25E which appears reasonable. Hence, we suggest a Buy rating for the stock.