JB Chemicals & Pharmaceuticals Ltd

Pharmaceuticals & Drugs - Domestic

Stock Info

Shareholding Pattern

Price performance

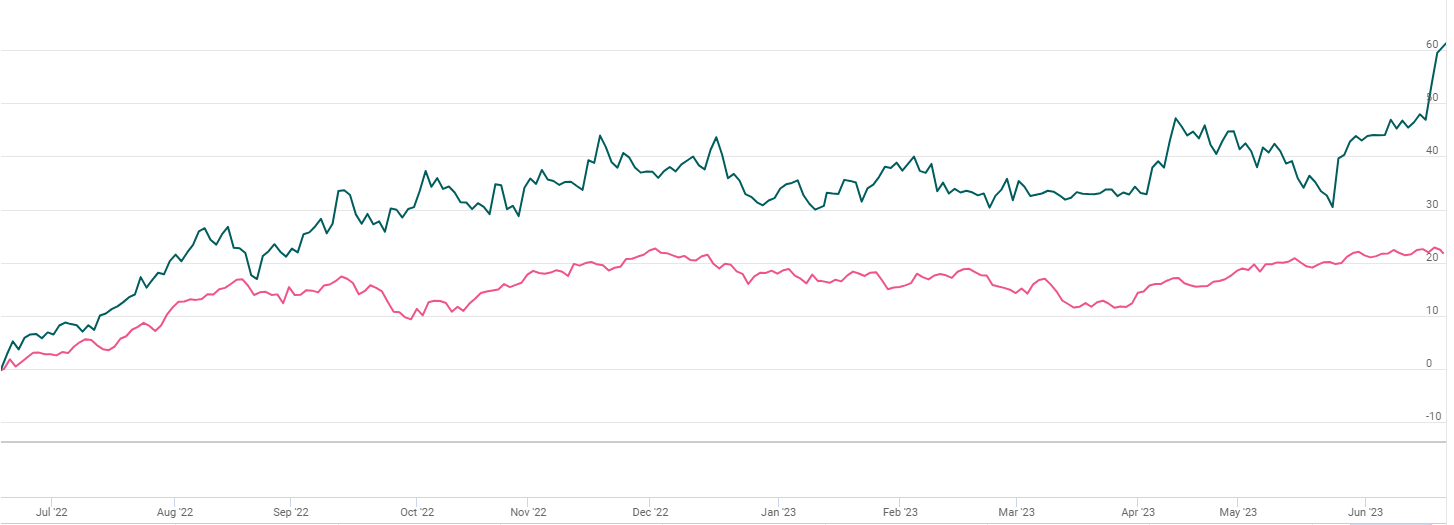

Indexed Stock Performance

Growth levers in place

Company Profile

J. B. Chemicals & Pharmaceuticals Ltd (JBCP), established in 1976, is a 40-year old pharma company is one of the fastest growing pharmaceutical companies in India and a leading player in the hypertension segment. Besides its strong India presence, which accounts for the majority of its revenue, its other two home markets are Russia and South Africa. In India, the company has five brands among the top 300 IPM brands in the country. The company exports its finished formulations to over 40 countries including the USA. Besides supplying branded generic formulations to several countries, it is also a leader in the manufacturing of medicated lozenges. The company ranks among the top 5 manufacturers globally in medicated and herbal lozenges. It has seven state of the art manufacturing facilities in India including a dedicated manufacturing facility for lozenges. The manufacturing facilities are certified by leading regulators across the world.

JBCP has several well-established brands in the domestic market and a wide geographical presence in export markets with a focus on both regulated and semi-regulated territories. The company is ranked 34th by sales value and 19th by a number of prescriptions in the Indian pharma market (IPM). A focused strategy around the brand building has aided JBCP to consistently outperform IPM growth by ~300-350bps pa during the past few years. Cardiac and Gastro are the major therapies for JBCP accounting for 90% of the company’s India revenue. The company’s key export markets include Russia/CIS, South-Africa, and the US.

Investment Arguments

Well diversified business model

JB Chemicals and Pharmaceuticals Ltd. (JBCP) is one of India’s fastest growing pharmaceutical companies with more than four decades of strong existence in the industry. It exports to over 30 countries, including key markets such as South Africa (rainbow nation), Russia, CIS followed by USA (who contribute ~ 50-55% of its overall revenue). The company has 7 State-of-the-art manufacturing units in Gujarat, India (approved by various regulatory authorities) producing wide range of dosage forms i.e. Tablets, Capsules, Liquids, Iv Infusions, Ampoules, Vials, Ointments, Cold Rubs, Lozenges & Sips. It is a leading player in the hypertension segment and has five brands among top 300 brands with more than 30% market share that contributes over 70-74% of domestic formulations revenues and ranks among top 5 manufacturers globally in medicated and herbal lozenges.

Domestic business on strong footing

JBCP’s domestic formulation biz (including contrast media) contributes ~50% to its total revenues. The company is well placed to outperform IPM (India Pharma Market) led by 1) focus on core chronic therapies, 2) leveraging of existing field force (2100 MRs) to expand and launch new therapies and 3) top 3-4 brands becoming larger post distribution reach going beyond Tier 1 & 2 cities (that contribute the majority of revenues). JBCP’s top brands Metrogyl, Nicarida, and Rantac are under price control. Rantac has taken a price hike of 50% in 70% of its SKUs, effective from Q4FY22. (NPPA has allowed a one-time price hike of 50%).

The company’s recent Sanzyme acquisition in the high growth probiotics and reproductive health segment has marked its entry into the fast-growing probiotics segment. Currently, probiotic segment is growing annually by 12-14%, besides the acquisition is expected to create new synergies with a strong prescriber base in the gastroenterology and nephrology segments. Additionally, the Azmarda acquisition too is expected to strengthen JBCP’s presence in India’s Cardiology segment and consolidate a position in IPM.

Diversified export segments

Exports contribute 50% to JBCP’s total revenue. We are positive on long term growth drivers in the exports segment led by 1) consolidation of business through a deeper presence in existing markets 2) focus on high-margin CMO business 3) expansion of OTC presence and launch of new products in Russia-CIS markets 4) portfolio augmentation in private and public markets of South Africa and 5) increased focus on ANDA filings in the US and selective backward integration for US business.

Focus on CDMO

The company aspires to increase Domestic+CDMO contribution from 65% to 75-80% in the medium to long term. The CDMO business is largely OTC in nature with Lozenges constituting 80% of the product portfolio. The company has the capacity to produce 2.5bn Lozenges and this facility is operating at 45% utilization level. It has also invested to remove production bottlenecks relating to packaging. Demand for Lozenges remains robust and the company is trying to cross-sell the products to multiple geographies through partners. It has launched products in India and other international geographies as well.

Q4FY23 Financial Performance

JBCP consolidated revenues grew by 22% YoY to Rs762 cr. Domestic formulation grew by 29% YoY on acquired brands including Azmarda sales, while organic growth for JBCP was in the mid‐teens. Export formulation recorded sales up by 17% YoY mainly led by RoW and US sales. CMO business clocked sales of Rs1bn up by 18% YoY. Gross margin improved 166bps QoQ to 64% (vs 66% in Q4’22) implying Azmarda volume pick‐up. Consolidated EBITDA stands at Rs.168 cr in March 2023 up 32.45% from Rs. 127 cr in March 2022. EBITDA margin for the quarter remains stable at 21.5% on strong operating performance. PAT for the quarter grew merely by 3% YoY to Rs.87.63 cr (down 17% QoQ) mainly due to high-interest cost.

The Company aspires to grow at 14-15% growth and 16‐18% profit growth for the next few years. JB Chemicals and Pharmaceuticals reiterate the focus on margin between 24‐26% for FY23. Long term 60% of revenues should come from India, led by an increase in the chronic portfolio. CMO business would contribute 20% to sales in coming years. The management has guided for US$10-12 mn of annual capex. It intends to add a third line for packaging in the Lozenges unit. Capacity utilisation for the overall business stands at 75-80%. The company is not looking for any major capex in the near term.

Key Risks & Concerns

Susceptibility to intense competition and fluctuation in foreign exchange (forex) rates

The group mainly caters to therapeutic segments such gastro, cardiovascular, antibiotic and pain management. High concentration in the relatively slow-growing acute therapeutic segments (50% of domestic sales) exposes the group to pricing and competitive pressure in a mature market, more especially as products under price control account for almost 35% of sales. The group is also susceptible to fluctuations in forex rates in semi-regulated markets.

Susceptibility to regulatory changes

The group remains vulnerable to regulatory changes in domestic and international markets. Addition to lists under the Drug Price Control Order impacts product pricing and, thereby, profitability of players, though the extent of the impact may vary. Increasing scrutiny and inspections by authorities such as the US Food and Drugs Administration (US FDA) and Therapeutic Goods Administration further, intensify the regulatory risk.

The slowdown in export markets

Any slowdown in export markets or macro uncertainty could adversely impact the company’s earnings performance and acts as a key risk for the company.

Outlook & Valuation

We believe JB Chemicals will continue with its growth momentum driven by 1) geographical expansion of legacy brands 2) improvement in MR productivity 3) scale up in Sanzyme, Azmarda and Razel franchise 4) launch of new products & therapies 5) scaling up contract manufacturing business 6) improvement in FCF generation 7) strong execution in the acquired portfolios 8) new launches/customers in high-margin CMO business and steady revenue growth in exports market led by new launches.

At a CMP of Rs.2382, the stock is currently trading at 28x FY25E EPS (Rs.85.7) which appears reasonable and we recommend BUY on the stock.