Ircon International Ltd

Engineering - Rail Construction

Stock Info

Shareholding Pattern

Price performance

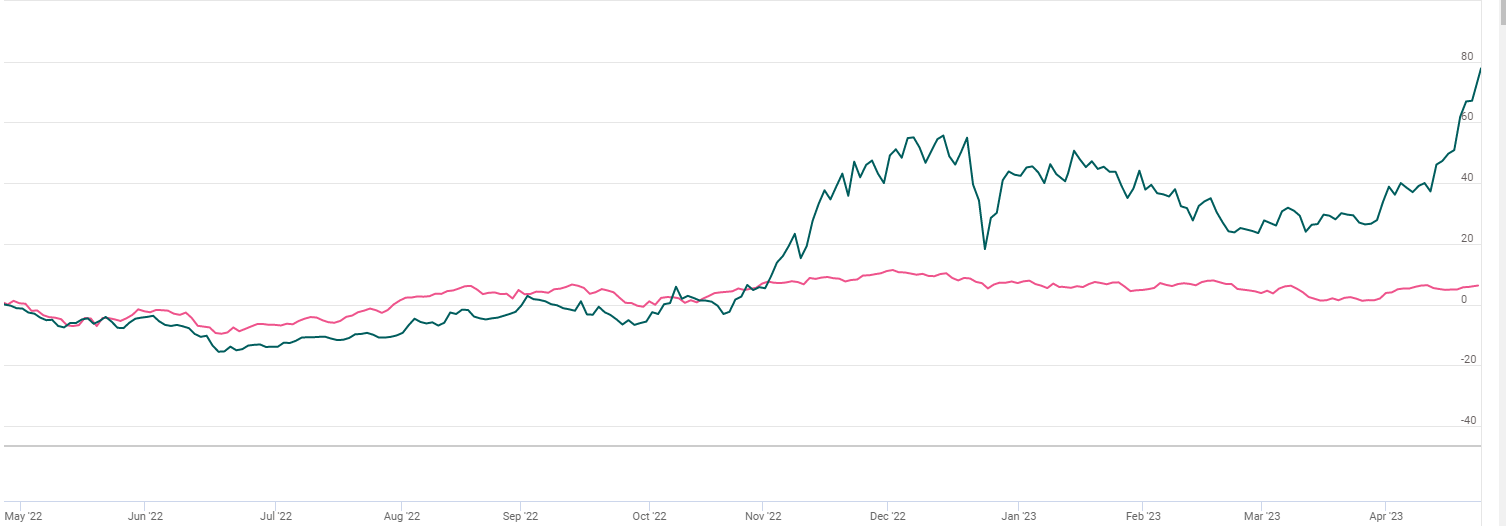

Indexed Stock Performance

Robust order book and strong industry tailwinds to spur growth

Company Profile

IRCON International was established in April 1976 as Indian Railway Construction Company Limited, majorly for the construction of railway projects in India and abroad.It is a Central Government company under Section 617 of the Companies Act, 1956, with a 73.18% shareholding held by the GoI (Government of India). The company’s business operations have diversified over period of time in segments like roads, buildings, electrical substation and distribution, airport construction, commercial complexes, and metro, though the major part of revenues is from the Railway segment. The company launched its IPO in September 2018 and is listed on BSE and NSE both.

Investment Rationale

Strong order book

IRCON International caters for projects from both Domestic and International markets. As on 31st December 2022, the order book of the company stood at Rs 38,023 crores. On the segmental front the revenue contribution is as follows~ Railway, Highways and other segments for Rs 28834 crores, Rs 72220 crores and Rs 1969 crores, which is 76%, 19% and 5% of the total order book.

On the geographical front, the revenue from the Domestic and International market comprises Rs 35151 crores and Rs 2872 crores which are 92% & 8% respectively. The company has won these orders through 'Nomination and Bidding' which contributes Rs 19053 crores and Rs 18970 crores which are 50% each of the total revenue.

Established track record with high potential for operations

In 1976 post incorporation, the company began its operations majorly as a railway construction company. Over the years it has diversified its operations under many construction segments. At present the company majorly deals in Railway and highway projects. It has made a dominant presence in Domestic markets and continues to perform well in international markets as well.

Barriers to entry

The company operates in a highly regulated industry. It deals in government-related contracts majorly under the railway and highway segment. These projects require high capabilities and capital and are designed according to required specifications as per the government and are subject to various regulations. The company is also governed by the Central government of India, which helps it stand unique and strong among its peers.

Strong financial risk profile

The company has a very strong financial risk profile with Reserves of Rs 474 crores as of 30th September 2022, cash & cash equivalents of Rs 5680 crores and borrowings of Rs 1430 crores. The Debt to Equity ratio of the company is 0.29x. On the operational front company has witnessed growth in revenues of 20-40% over the period of 5 years with an EBITDA margin stable between the ranges of 7%-11%. Currently, the Return on Assets (ROA) is at 4.6% while ROE, ROCE & PE of the company is at 13%, 14% & 9.32x respectively.

Financial Analysis

Past 5-year Financial analysis

For the past 5 years (FY17-22) revenue and PAT CAGR of the company stood at 19.19% & 7.06% respectively. The ROE & ROCE of the company currently is at 13% & 14% respectively. In FY22 the revenue of the company was at Rs 7380 crores, an increase of 38% on a YoY basis. EBITDA for the year was at Rs 702 crores, an increase of 16% on a YoY basis. EBITDA margins of the company were at 8%, decreased by 100 bps on a YoY basis on account of increased raw material prices. PAT for the year was at Rs 592 crores, an increase of 51% on a YoY basis.

Q3 FY23 Analysis

For the quarter ended 31st December 2022, the revenue for the quarter stood at Rs 2347 crores, an increase of 33% on a YoY basis. EBITDA for the quarter stood at Rs 158 crores, an increase of 3% YoY. EBITDA margins for the quarter were at 7%, decreased by 200 bps on a YoY basis on account of increased raw material prices. PAT for the quarter was Rs 190 crores, an increase of 40% on a YoY basis.

Risk & Concerns

Challenges susceptible to the construction industry

The company uses raw materials like iron and Steel majorly, which are subject to raw material price fluctuations, aggressive bidding, and delays in project completion due to regulatory clearances, which further leads to increased payment cycle and high working capital requirements are some of challenges to this industry.

Moderate profitability

The company's turnover depends on winning the projects through bidding and in order to win the projects low bidding is required. For the past 5 years, the profit margins are range bound between 5-7% and are expected to remain in that range due to which profitability is expected to be moderate.

Outlook & Valuation

IRCON is expected to be beneficial on Railway capex theme going forward. IRCON International‘s strong orderbook provides revenue visibility. MoA with IRSDC for station development also expected to bring good orders. Ircon is maintaining minimum IRR and RoE is 14% to bid projects.

At a CMP of Rs 71.2, the stock is trading at 9x its FY22 earnings. We recommend a 'BUY' rating for the stock.