Ircon International Ltd

Engineering - Rail Construction

Stock Info

Shareholding Pattern

Price performance

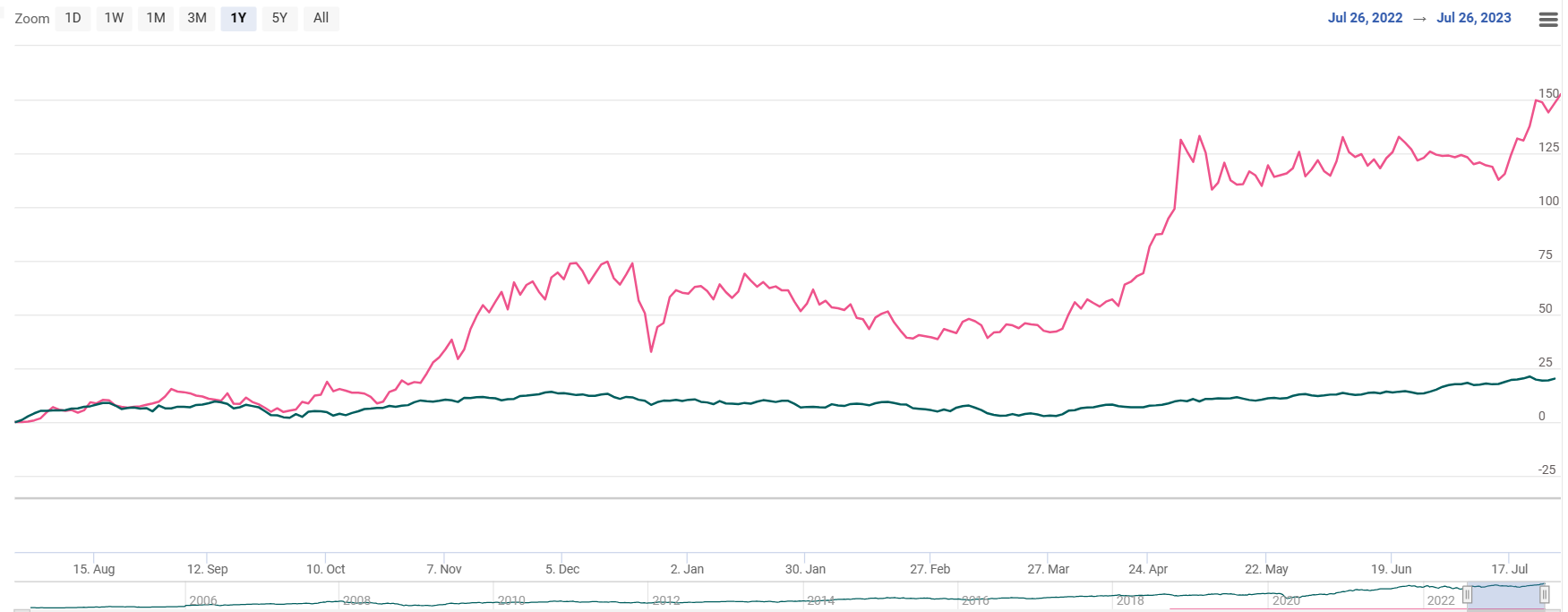

Indexed Stock Performance

Robust Order Book

Company Profile

IRCON International was established in April 1976 as Indian Railway Construction Company Limited, majorly for the construction of railway projects in India and abroad.It is a Central Government company under Section 617 of the Companies Act, 1956, with a 73.18% shareholding held by the GoI (Government of India).The company’s business operations have diversified over period of time in segments likeroads, buildings, electrical substation and distribution, airport construction, commercial complexes, and metro, though the major part of revenues is from the Railway segment. The company launched its IPO in September 2018 and is listed on BSE and NSE both.

Investment Rationale

· Strong order book

IRCON International caters for projects from both Domestic and International markets. As on 31stMarch 2023, the order book of the company stood at Rs 35000 crores. As per FY23 data provided by management the segmental revenue contribution is as follows~ Railway, Highways and other segments for Rs 26243 crores, Rs 6985 crores and Rs 1967 crores, which is 75%, 20% and 6% of the total order book.

As on 31st March 2023 on the geographical front, the revenue from the Domestic and International market comprises Rs 32247 crores and Rs 2948 crores which are 92% & 8% respectively. The company has won these orders through Bidding' which contributes Rs 18470 crores which constitutes 53% and Nomination contributes Rs 16725 crores which are 48% each of the total revenue.

· Established track record with high potential for operations

In 1976 post incorporation, the company began its operations majorly as a railway construction company. Over the years it has diversified its operations under many construction segments. At present the company majorly deals in Railway and highway projects. It has made a dominant presence in Domestic markets and continues to perform well in international markets as well.

· Barriers to entry

The company operates in a highly regulated industry. It deals in government-related contracts majorly under the railway and highway segment. These projects require high capabilities and capital and are designed according to required specifications as per the government and are subject to various regulations. The company is also governed by the Central government of India, which helps it stand unique and strong among its peers.

· Strong financial risk profile

The company has a very strong financial risk profile with Reserves of Rs 474 crores as of 3st March 2023, cash & cash equivalents of Rs 5123 crores and borrowings of Rs 1505 crores. The current Debt to Equity ratio of the company is 0.29x. On the operational front company has witnessed growth in revenues of 20-40% over the period of 5 years with an EBITDA margin stable between the ranges of 7%-11%. Currently, the Return on Assets (ROA) is at 5.1% while ROE, ROCE & PE of the company is at 15.5%, 16% &12x respectively.

Q4 FY23 Analysis

For the quarter ended 31st March 2023, the revenue for the quarter stood at Rs 3781 crores, an increase of 28% on a YoY basis. EBITDA for the quarter stood at Rs 183 crores, with no change in EBITDA compared to corresponding quarter of previous fiscal year. EBITDA margins for the quarter were at 5%, decreased by 100 bps on a YoY basis on account of increased raw material prices. PAT for the quarter was Rs. 256 crores, an increase of 6% on a YoY basis.

Risk & Concerns

· Challenges susceptible to the construction industry

The company uses raw materials like iron and Steel majorly, which are subject to raw material price fluctuations, aggressive bidding, and delays in project completion due to regulatory clearances, which further leads to increased payment cycle and high working capital requirements are some of challenges to this industry.

· Moderate profitability

The company's turnover depends on winning the projects through bidding and in order to win the projects low bidding is required. For the past 5 years, the profit margins are range bound between 5-7% and are expected to remain in that range due to which profitability is expected to be moderate.

Outlook & Valuation

IRCON is expected to be beneficial on Railway capex theme going forward. IRCON International‘s strong orderbook provides revenue visibility. MoA with IRSDC for station development also expected to bring good orders. Ircon is maintaining minimum IRR and RoE is 14% to bid projects.

At a CMP of Rs 95, the stock is trading at 12x its FY22 earnings.We recommend a 'BUY' rating for the stock.