Elecon Engineering Company Ltd

Engineering - Industrial Equipments

Stock Info

Shareholding Pattern

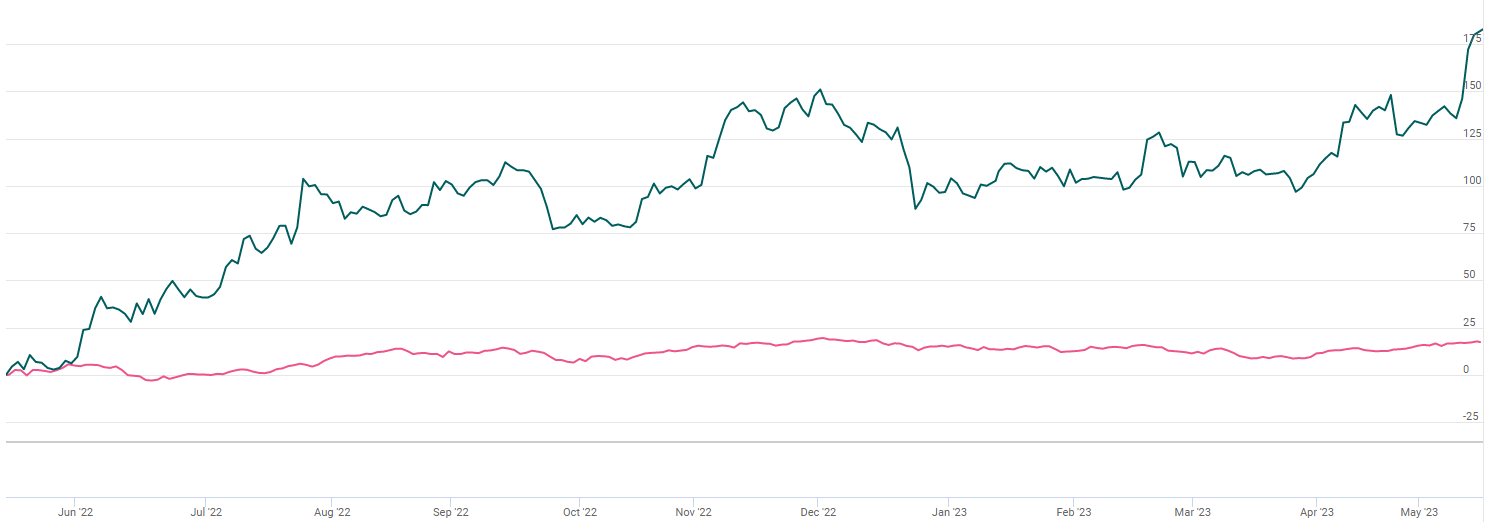

Price performance

Indexed Stock Performance

Steady performance in Q4, rerating on the cards

Company Profile

Elecon Engineering Company Limited manufactures and sells power transmission and material handling equipment in India and internationally. The company operates in two segments: Material Handling Equipment and Transmission Equipment. It offers helical and bevel helical, planetary, worm, high speed, wind turbine, marine, and custom-built gearboxes; customized gearboxes; vertical roller mill drives; and align geared, el flex flexible couplings, fluid, scoop controlled variable speed-controlled fluid, and torsion shaft couplings.

The company also provides material handling equipment, such as raw material handling systems, stackers, reclaimers, bagging and weighing machines, wagon and truck loaders, crushers, wagon tipplers, feeders, idlers and pulleys, magnates/weighers/detectors, port equipment, and cable reeling drums; and alternate energy products. In addition, it engages in the steel and non-ferrous foundry business. Furthermore, the company offers gearbox repair and refurbishment services; and material handling equipment support services. It serves cement, sugar, steel, power, plastic, material handling, chemical, palm oil, crane, elevator, paper, rubber, marine, mining, and fertilizers industries, as well as ports. The company was founded in 1951 and is based in Anand, Gujarat.

Investment Arguments

Leading player in the transmission products segment

EECL is a market leader in the transmission products segment, specifically gears, with a 38% market share in India. In the past, the company had a strong presence in the material handling equipment segment for both products and EPC (Engineering, Procurement, and Construction) services, with a revenue contribution of 40% in FY17. However, in recent years, it has limited its exposure to the products and after-sales segment, even as it completes some legacy EPC projects with an 11% revenue contribution in FY2022.

The company benefits from strong design and engineering capabilities, technical collaborations as well as backward-integrated facilities with an in-house foundry that has allowed it to enhance its product offerings over the years with increased complexity, reflected in its ability to bag orders for marine gears from the Indian Navy.

Strong geographic presence across the globe

Over the years, the company has widened its product offerings and geographic presence in transmission products through in-house development and acquisitions globally. The company expects to increase the share of revenue from exports to 50% in the long term (current exports account for 35%).

Additionally, the company has developed a reasonable global footprint in recent years and its revenue mix is diversified across geographies with international sales accounting for 35% of the consolidated revenues in FY22. The company is also focused on increasing its presence in the US, South America, and Europe whose revenue contribution is expected to increase going forward.

Established and Reputed Customer Base

The company’s customer base consists of reputed parties, namely, Garden Reach Shipbuilders & Engineers Ltd, Mazagon Dock Shipbuilders Ltd, Larsen & Toubro, NTPC Ltd, and Shree Cement. Over the years of operation, the company has been able to develop healthy business relations with its customers, leading to repeat orders.

Strong order intake provides revenue visibility

The order book remains healthy at INR714cr (flat QoQ). It comprised orders worth INR569cr (up 1% QoQ) from the gears segment and INR145cr (down 8% QoQ) from the MHE division. The product offerings encompass the standard/catalogue products as well as engineered products in the gears division. Standard products, which account for 55% of the gear sales, are available off the shelf and have a shorter execution cycle. The execution cycle of engineered products varies between three months and eight months. The order inflow is expected to remain strong going forward with increased demand from end-users such as steel, cement, sugar, and power (flue gas desulphurisation or FGD projects) sectors.

Q4FY23 Financial Performance

Elecon posted a good set of earnings for Q4FY23, led by strong execution in gears. Revenue grew 29% YoY to 425 cr. EBITDA grew 32% YoY to 93cr. EBITDA margin remains healthy at 21.9%. PAT grew 44% YoY to 68cr. The management maintained its consolidated revenue guidance of 2,000cr for FY24, with 1,200cr from the standalone gears business, 500 cr from subsidiaries, and the balance from the MHE segment.

Key Risks & Concerns

- The MHE division, which is dependent mainly on the thermal power sector to provide turnkey project services, has been making losses for the last five years ended FY22. Delays in project execution, lengthy working capital cycles, and headwinds in the thermal power sector have led the company to register losses continuously.

- Company’s revenues are exposed to the cyclicality in the domestic capex cycle and any economic slowdown could impact its revenues as witnessed in the past.

- The company’s margins are susceptible to fluctuations in raw material prices due to a lag of two to three months in manufacturing lead time, especially for engineered products.

- Competition from other smaller players who bid at lower margins will have a negative impact on the company’s business growth.

Outlook & Valuation:

Elecon is a manufacturer of industrial gears (~90% mix) & material handling equipment (MHE) (~10% mix). It is a play on industrial capex across various sectors, especially in cement, steel, power, sugar and other sectors. Elecon is the leader in industrial gears with a market share of 35% in India. Strong industrial capex is likely to drive higher utilisation in the industrial gear segment. Elecon offers strong growth visibility with an improved balance sheet. Healthy order intake provides strong revenue visibility in the coming years.

At the current market price of Rs 525, the stock trades at 17.5x its FY25E EPS (Rs.29.7), and hence we recommend a BUY rating.