Craftsman Automation Ltd

Engineering - Industrial Equipments

Stock Info

Shareholding Pattern

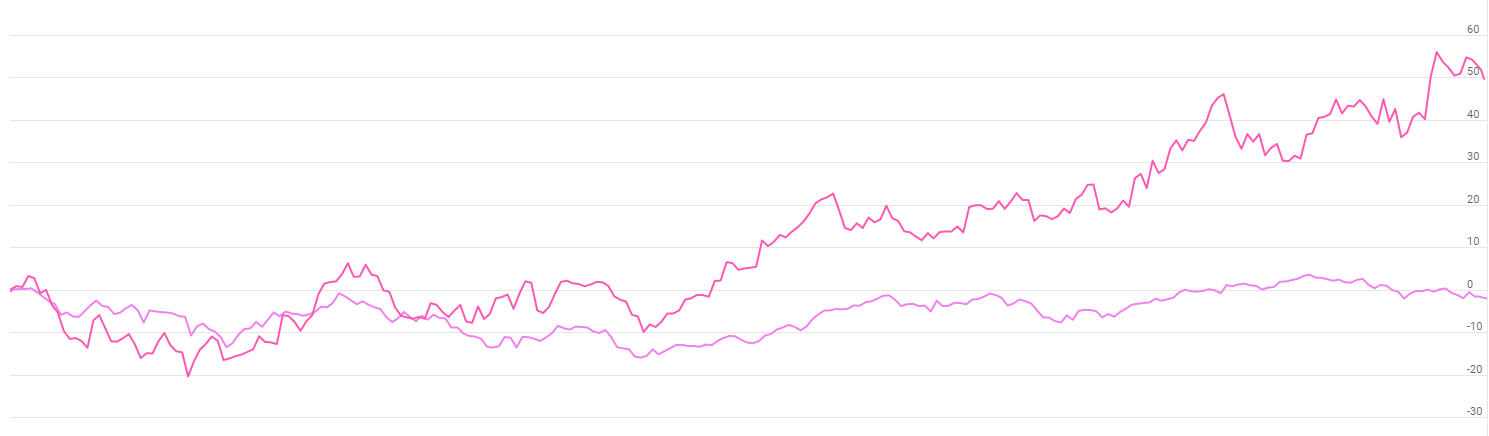

Price performance

Indexed Stock Performance

Growth Drivers remain Intact

Company Profile

Incorporated in 1986 in Coimbatore, Tamil Nadu, by Mr. S Ravi, Craftsman Automation Ltd. (CAL) is a leading player in the engineering contract-manufacturing sector, with a diversified clientele across industries. CAL is a diversified engineering company with niche capabilities that allow it to partner with global OEMs operating in India across the value chain – from design and development to manufacturing and just-in-time supply. The company has more than three decades of experience in catering to the complex and dynamic requirements of the automotive and industrial sectors. Key products in the auto segment include power train products, cylinder blocks, cylinder heads, camshafts and crankcases for CVs, sports utility vehicles, two-wheelers, farm equipment, and earthmoving and construction equipment. The company also has a non-ferrous sand foundry catering to power transmission equipment manufacturers. Its industrial and engineering segment has a wide range of products, including industrial gears, storage solutions, material handling, and locomotive engine components. CAL has a tool room that supplies dies for injection moulding and mould base. Moreover, it manufactures special-purpose machines for metal and non-metal cutting. Though CI powertrain is the key segment contributing ~65% of overall gross profit, aluminum casting/machining is the emerging business opportunity catering to vehicle light-weighting and EVs.

Investment Rationale

Strong market position backed by established relationships with customers

Craftsman Automation Limited (CAL) manufactures several components and sub-assemblies on supply and job-work basis according to client specifications in the auto, industrial and engineering segments. It has three business segments: auto-power train (~50% of revenues), aluminium products (~25% of revenues), and industrial and engineering (~25% of revenues). The auto-power train segment caters to CVs, farm equipment, construction and mining equipment, and passenger car segments of the auto industry. The aluminium products division supplies aluminium components to two & four-wheeler and power transmission manufacturers. The industrial and engineering segment offers goods and services such as gears, material handling equipment, storage products, special purpose machines, and other general engineering products to various industries.

The addition of capacity, products, and customers, and healthy customer relationships led to revenue growth of 45% in the first half of fiscal 2023. Besides the addition of new PV OEM customers post-acquisition of DRAIPL, steady offtake by key customers and an increase in business share with leading medium and heavy CV players should aid the maintenance of CAL’s market position over the medium term.

Healthy operating efficiency

Focus on niche products and better technical capabilities, supported by cost-optimization measures, have supported operating efficiency. Higher margins from machining operations led to a better-than-industry operating margin of over 20% on a sustained basis since fiscal 2020. In the first half of fiscal 2023, however, the share of the higher-margin machining business reduced, which along with inventory losses due to a reduction in aluminum prices resulted in the operating margin moderating to 23.05% in the first half of fiscal 2023 from 24.85% during the similar period of the previous fiscal.

CAL is continuously undertaking cost-control initiatives through automation, employee base optimization, and wastage reduction; this coupled with improved capacity utilization post-acquisition of DR Axiom India Pvt Ltd (DRAIPL) should aid in sustaining the operating margin at above 20% over the medium-term.

Revival in CV demand to sustain growth momentum

We believe that CV demand is expected to remain robust for the next 2-3 years, driven by an increase in infrastructure & mining activities and an uptick in economic growth. Export markets have witnessed a notable recovery in volume sales off-take. With strong earnings visibility, the company is well poised to benefit from a revival in automotive demand. Improving CV off-take, driven by M&HCVs and the off-highway segments augur well for long-term growth.

Automotive Aluminum products business to get a fillip from new business wins

In April 2022, the company won a big order from a client for whom they had to urgently increase their capex to ₹275 cr from an earlier target of ₹225 cr. This business should ramp up in FY24 and add ₹150 cr in FY25E according to the management. Electrification in Europe is also leading to good demand for the light-weighted Aluminum products of CAL.

The company is also in talks with a North American company for long lasting business over there. The PSA group opportunity at ₹2-2.5 bn is quite big and will pour revenues over the medium to long term as its production should start by Q3FY24. PSA is still in the testing phase before giving the green signal to CAL. Management expects 40% of the order to be done by FY24E. Management expects 20% growth in the Value Addition of this business which stood at ₹680 cr in Q2.

Q2FY23 Financial Performance

Craftsman Automation reported healthy growth for the quarter ended Q2FY23 despite a challenging environment. Consolidated revenues grew 36% YoY to Rs.776 cr. The Power Train business expanded 29.5% YoY despite the weakness observed in the farm segment. This growth was driven by the CV industry, which grew at a good pace during the quarter. The Automotive Aluminum products business has grown by 74.4% YoY and 14.6% QoQ to ₹196 cr as the company gained new businesses.

EBITDA saw a growth of 20% to Rs.172 cr as against Rs.143 cr in the same quarter of the previous fiscal despite elevated raw material costs. EBITDA margins came in at 22.2%, down 210 bps YoY and 290 bps QoQ led by margin fall at the Powertrain and Aluminium divisions. PAT grew by 25% YoY and 10.2% QoQ.

Key Risks & Concerns

Working capital-intensive nature of operations - Operations are working capital-intensive. CAL incurred a sizeable capex of Rs ~1,500 cr during fiscals 2017-2022. Given multiple strategic business units and clients, operations will continue to be working capital intensive which acts as a key risk for the company.

Vulnerability to cyclical demand in end-user industries - The Company caters to the auto, farm equipment, construction and earthmoving equipment, and locomotive industries, demand from which is typically linked to economic activity. The business risk profile is likely to remain susceptible to a sharp slowdown in the auto industry over the medium term, given that the segment accounts for over 50% of revenue. Any sharp downturn in the economy or industrial activity will also impact the company.

Outlook & Valuation

Management indicated a strong underlying recovery in both MHCVs (partly led by the replacement cycle and industrial segments, as economic growth and capex cycle pick up. The demand outlook for 2W is mixed, while PV continues strong footing. The non-auto segment is growing well with order inflows

We believe the Power Train business will be driven by the expected pick up in the Replacement cycle for HCVs in the coming quarters and fresh demand triggered by movement in the investment Capex cycle of the country. Rising infrastructure growth, construction, mining, agri-commodities transportation, increasing freight rates etc will all lead to very strong growth in the CV industry.

Exports business and electrification shall drive the Automotive Aluminum business. New orders from the latest undisclosed one along with PSA, Daimler, and geographies like Brazil, Japan etc shall diversify the business risks. Both Storage and non-storage businesses shall lead to strong growth in the Industrial Engineering business. We believe margin strength will come back in this business with the falling commodity prices, new businesses, and utilization rates moving up.

Further, we believe that Craftsman Automation will continue to benefit from its established market position, strong customer relationships, healthy operating efficiency, healthy demand from CVs aided by an uptick in economic growth, pick-up in private capital expenditure (capex) cycle, higher freight demand, revival in construction, infrastructure, and mining activities. Further, we believe the stock is ripe for re-rating as fundamentals improve significantly.

At CMP of Rs.3470, the stock is trading at 45.69x FY22 (EPS of Rs.75.94) and hence, we recommend a buy on the stock.