Concord Biotech Ltd

Pharmaceuticals & Drugs

Stock Info

Shareholding Pattern

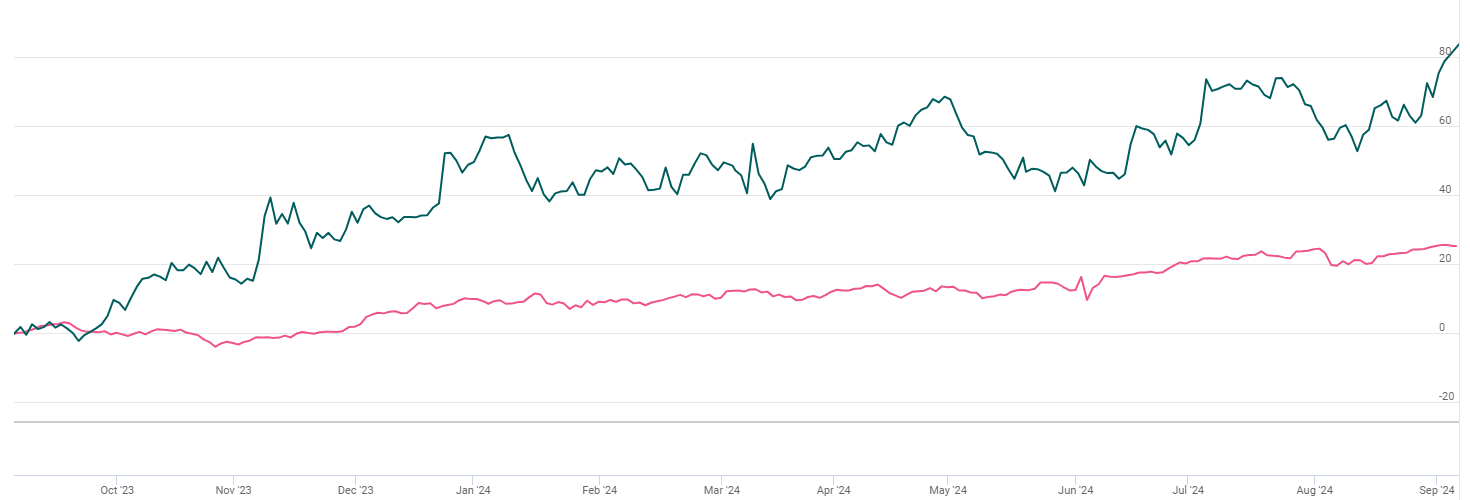

Price performance

Indexed Stock Performance

A niche API play on China-plus-one theme

Company Profile

Incorporated on November 23, 1984, Concord Biotech is an India-based biopharma company and one of the leading global developers and manufacturers of select fermentation-based APIs across immunosuppressants and oncology in terms of market share, based on volume in 2022, supplying over 70+ countries including regulated markets, such as the United States, Europe and Japan, and India. Concord is amongst the few companies globally that has successfully and sustainably established and scaled up fermentation-based API manufacturing capabilities. The company commanded a market share of over 20%+ by volume in FY24 across identified fermentation-based API products, including mupirocin, sirolimus, tacrolimus, mycophenolate sodium, and cyclosporine. As of June 30, 2024, Concord had a portfolio of 57 brands and 77 products manufactured by them, including 30 fermentation based APIs and 53 formulations. In addition, as of March 31, 2023, they had 98 approved products for formulations.

Investment Arguments

Established presence across the complex fermentation value chain.

The fermentation value chain encompasses aspects such as R&D, patents, key starting

materials, API and formulation manufacturing, as well as marketing and distribution

of fermentation-based products. Concord has established capabilities across the

fermentation value chain. In addition, they have honed their capabilities across

the fermentation value chain, which they leveraged to build a track record across

multiple products in various therapeutic areas. Over the last 2 decades since 2001,

Concord has been able to build difficult-to-replicate technical expertise in the

fermentation process, which has enabled them to develop and commercialize a wide

spectrum of fermentation-based APIs.

Their business model aims to capture opportunities within the fermentation segment across APIs, formulations, and other adjacencies, by combining their R&D and production capabilities. Their integration of R&D, patents, key starting materials, API and formulations manufacturing, and marketing and distribution allows them to cater to their customers’ specific requirements and provide them with customized solutions.

Key market player in niche product segment

The company’s key productscater to the immunosuppressants therapeutic segment.

These complex molecules are exposed to limited competition and generate healthy

margins.The molecules cumulatively contribute significantly to the revenues, and

CBL is one of the key players in the industry for these products, commanding a healthy

and increasing market share. Going forward, these APIsare likely to witness healthy

growth, given the strong market position of the company’s products,coupled

with favourable demand dynamics in its key exportand domestic markets.

Scaled manufacturing facilities with a consistent regulatory compliance track

record and supported by strong R&D capabilities.

Concord has 3 manufacturing facilities in the state of Gujarat, India. The API manufacturing

facilities in Dholka and Limbasi are divided into a total of 41 manufacturing blocks

to process different classes of APIs. Their manufacturing facilities have been subject

to inspections by overseas regulators on a periodic basis. In 2021, they launched

the manufacturing facility at Limbasi for capacity expansion. They intend for the

Limbasi facility to cater to major emerging and regulated markets, subject to inspections

from regulatory authorities in these markets, allowing them to serve these markets

with key APIs manufactured across 2 manufacturing facilities. They are currently

one of the companies approved by the Government of India to receive incentives under

the PLI Scheme. Through their continuous R&D initiatives, they optimize their

production processes.The company’s R&D centre is recognised by the Department

of Scientific and Industrial Research (DSIR), India and backed by a strongteam of

technocrats. Its API facility is approved by the US Food and Drug Administration

(USFDA), European Union’s Good Manufacturing Practices (EUGMP), Japanese ForeignManufacturer

Registration (FMR), Korea Ministry of Food and Drug SafetyandIndian Good Manufacturing

Practices (GMP), and its formulation facility is GMP and USFDA approved.

Diversified global customer base with long-standing relationships with key customers.

Concord has established long-standing relationships with certain key customers,

including leading global generic pharmaceutical companies. As of June 30, 2024,

Concord had relationships with Intas Pharmaceuticals Ltd and Glenmark Pharmaceuticals

Ltd, 2 of their Top-10 customers for around 11 years and 18 years, respectively.

Most of their customers are from regulated markets. In addition, they have developed

relationships with 60 new customers during the financial year 2023. Their APIs are

provided under a B2B model to pharmaceutical companies globally. For the formulation

business as well, they operate through a B2B model across the United States and

emerging markets under arrangements with distributors.

Global leadership in immunosuppressant APIs along with a wide spectrum of complex

fermentation-based APIs across multiple therapeutic areas.

Concord is one of the leading global developers and manufacturers of select fermentation-based

APIs across immunosuppressants and commanded a market share of over 20% by volume

in 2022 across identified fermentation-based API products. The global demand for

immunosuppressant APIs is expected to increase, driven by the growth of the immunosuppressant

formulation markets.

Q1FY25 Result Highlights

Concord Biotech delivered subdued earnings growth in Q1FY25. Consolidated revenues

grew by 11% YoY to Rs.216 cr. Sales were impacted due to lower API revenue. On the

operational front, consolidated EBITDA also witnessed a similar growth of 11% YoY

to Rs.81 while EBITDA Margins stood flat at 37.5% impacted by lower gross margins.

PAT grew by 9% YoY to Rs.59 cr.

Segmental highlights:

Product mix: API:Formulations sales mix stood at 79:21 in Q1FY25 (84:16 in Q1FY24). API sales grew by 5% yoy, while formulations sales grew by 40% yoy, during the quarter.

Geographical mix: Domestic business contributed 59% to overall sales in Q1FY25 (54% in Q1FY24). Domestic revenues grew by 22% yoy, while export sales declined by 2% yoy in Q1FY25.

Key Conference call takeaways

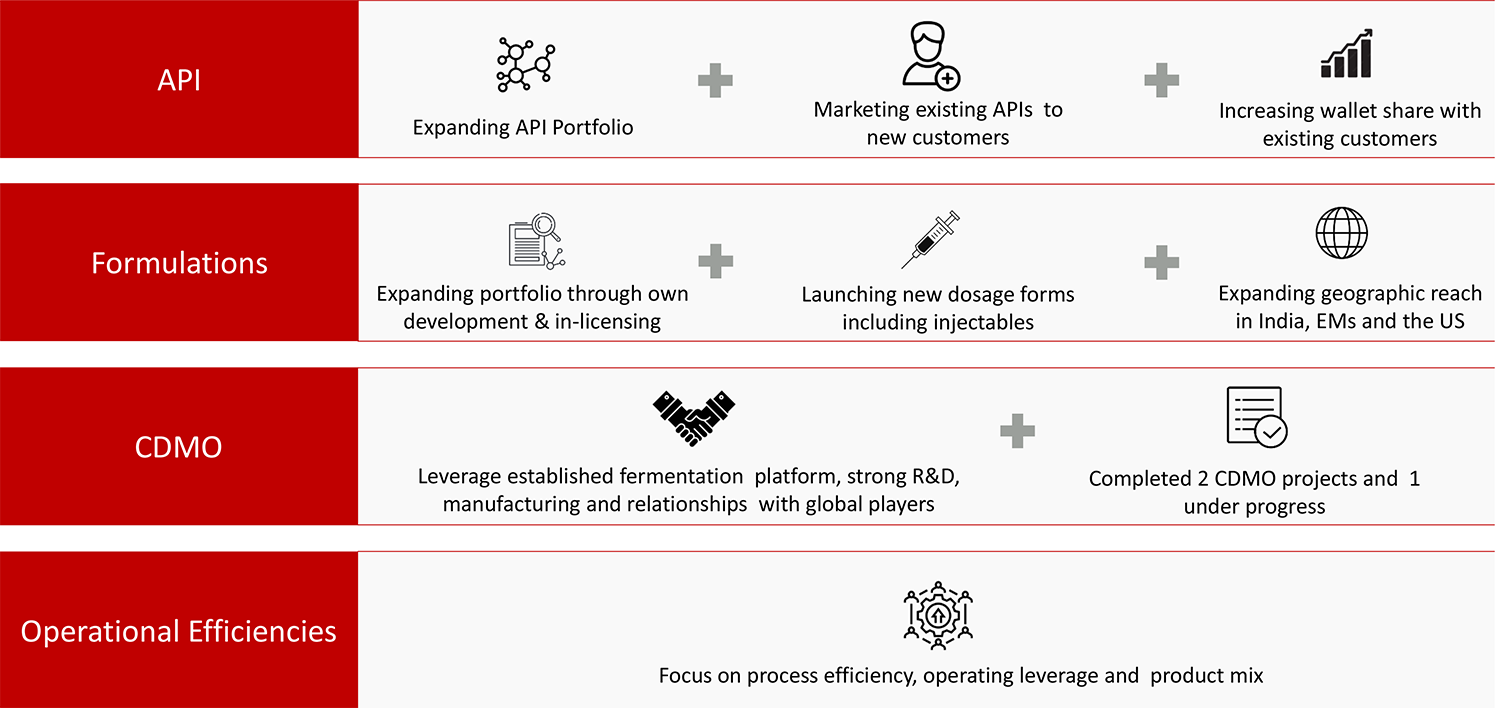

Guidance - Concord maintained its long-term guidance of reporting a ~25% overall sales CAGR, over the next five years. This growth will be led by commercialization of new 8-10 products, product approvals of customers from the Limbasi facility, commercialization of the injectables facility, increase in wallet share and new CDMO opportunities.

Product mix: Concord expects its API: Formulations revenue mix to remain in the range of 80:20, over the medium term.

API Segment

- Outlook: The management expects FY2025E API sales to be in line with internal expectations.

- The API segment recorded 5% YoY growth to Rs.170 cr, accounting for 79% of sales.

- Pipeline - The company aims to commercialize 8-10 products over the next 3-4 years in the therapeutic segments of Oncology, Anti-infective & Anti-fungal.

- CONCORDB remains focused on niche fermentation APIs with backward integration to KSM.

- The pipeline remains robust with more than 10 products across different therapeutic segments of Oncology, Anti-infective & Anti-fungal.

- Pricing - Pricing has been stable across API offering.

- Demand: Some of the products in the anti-infective space (like Teicoplanin), launched couple of years back, are seeing good traction.

- CONCORDB has been gaining market share in various molecules.

- In Q4, the company was facing issues in getting approval for products for the European market. Supplies for the same have now resumed.

- Seasonality: Usually Q1 is a weaker quarter, due to large shipments in Q4.

- Dholka: Current capacity utilization stands at 76-77%.

- Limbasi: Limbasi facility is scaling up as planned. Many customers have qualified this facility and are now procuring from both the Dholka and Limbasi facilities. Current capacity utilization stands at 38% vs 34% in 1QFY24 and 35.12% in FY2024. Improvement in utilization would be a key driver of further growth.

Formulations

- The formulations segment recorded 43% YoY growth to Rs.45 cr, accounting for 21% of sales.

- The company has 98 approved products and four approved ANDAs.

- The injectable facility has been progressing well and is expected to be commercialized by the end of FY25 and revenue contribution to begin from FY26.

- Good traction visible in OSD form in both export and domestic markets.

- Formulations margins are expected to improve, once the injectables facility gets commercialized.

- Current capacity utilization stands at 24% vs 20% in Q1FY24.

CDMO

- Concord has been filling out numerous RFQs, over the past couple of quarters. These potential opportunities pertain to contract manufacturing. Nothing has been finalized yet.

Other Key Highlights

- Concord aims to grow further by deepening penetration in developed markets, along with expanding into emerging markets.

- Concord does not see any challenges in exports. One customer shifted its facility from Puerto Rico to India, which impacted the export mix and growth.

- Japan sales had witnessed a dip in Q1FY25, which will improve in Q2FY25.

Key Risks & Concerns

High product concentration risk, with significant dependenceon API segment - The revenues remain exposed to high concentration risk, with its immunotherapy category contributing significantly to the total revenues. The scale and diversification are expected to improve in the medium term, with the increase in sales from the formulation segment and stabilisation of the new API unit. Though the competition is limited in the API segment, which is beneficial for the company, the same remained intense in the formulation segment.

High working capital intensity –The company normally provides a credit period of 115-120 days to its key customers and maintains a high inventory of various cultures (raw materials) to produce different APIs. The higher inventory levels are due tothe lengthy fermentation process, whereby it takes 30-50 days for the cultures to undergo fermentation and purification.Hence, elongated receivables cycle and high inventory holding requirements have resulted in high working capital intensity of operations in the past.

Outlook & Valuation

Concord Biotech delivered tepid earnings for the quarter ended Q1FY25. The company’s robust revenue growth, particularly in the formulations and core API segments, coupled with strategic expansion and new product launches, underscores its potential for long-term growth. The company maintained a significant market share in key molecules, reinforcing its competitive edge and enabling continued revenue growth. Adding new products across various therapeutic segments, including oncology and anti-infective, enhances the company's growth prospects and diversifies its revenue streams. Expected improvements in facility utilization and the commercialization of the new injectables unit will drive operational efficiencies, supporting margin expansion.

Concord Biotech remains the market leader with +30% market share in Tacrolimus, Cyclosporine, and Mycophenolate Sodium, along with double-digit market share in Mycophenolate Mofetil, Mupirocin, and Mupirocin Calcium. We believe there is scope for improvement in market share in most of these products as there are different dosage forms that are going off-patent in the coming years, and we expect Concord Biotech to remain the key beneficiary from these generic opportunities.

Overall, Concord Biotech is poised for robust growth over the next few years, driven by an expanding customer base, increased market penetration, and the launch of new products. The company’s focus on maintaining its leadership in key molecules, coupled with strategic initiatives in the CDMO space, positions it well for sustained growth. We remain bullish on the company’s growth prospects due to factors such as 1) Stable API prices, 2) High entry barrier with complex manufacturing process, 3) Long term contract with clients, 4) Sustained leadership position in key molecules, 5) A new growth avenue – injectable facility for formulations. We expect the company to improve its market share in its top 5 products on the back of genericization, coupled with new launches in the Anti-infective and Oncology segments. Besides these factors, commercialization of the injectable unit for formulations is also expected to drive positive operating leverage. At CMP of Rs.1810, the stock is trading at 40x FY26E. We maintain Buy rating on the stock.