Computer Age Management Services Ltd

Depository Services

Stock Info

Shareholding Pattern

Price performance

Indexed Stock Performance

Increased focus on non-MF business to fuel growth for CAMS

Company Profile

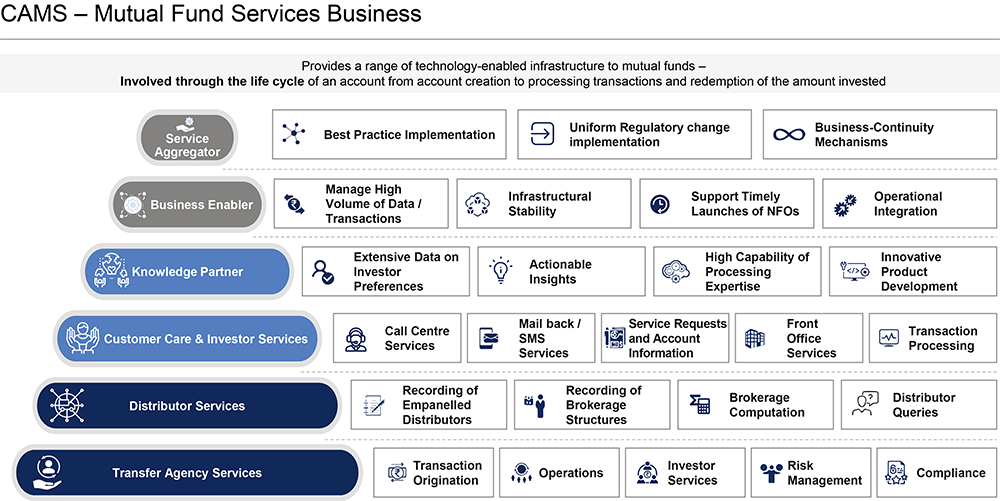

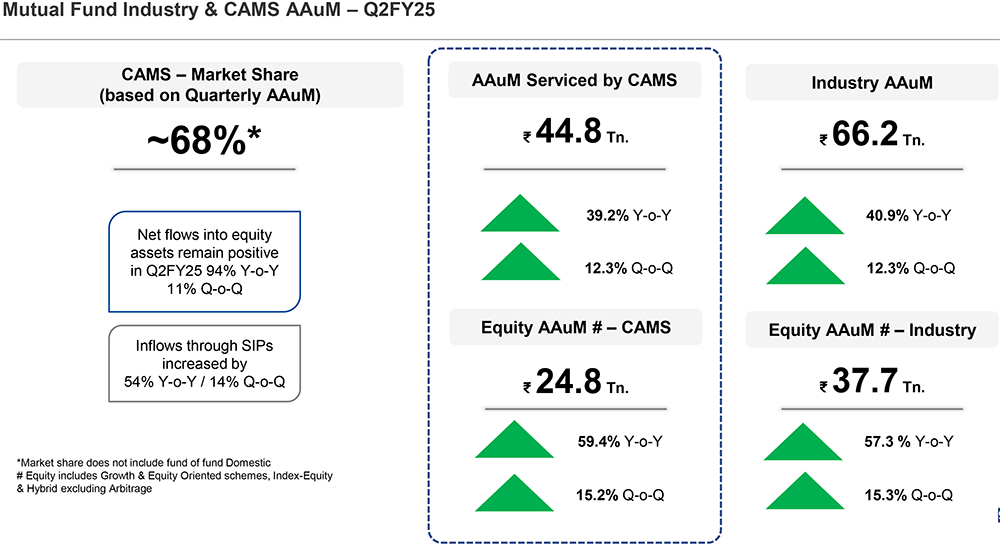

Computer Age Management Services (CAMS) is a Mutual Fund Registrar and Transfer Agent (MF-RTA). CAMS have been a technology-driven financial infrastructure and services provider to mutual funds and other financial institutions for over 25 years. Within the MF industry, CAMS is the largest RTA, with 68% market share based on Quarterly AAuM and 68% in a half yearly AAuM in a duopoly market (the other player being KFin Technologies). Of the 43 MF houses in the country, CAMS handles RTA operations for 19. More importantly, it services India’s top 9 of the 15 largest MFs by AUM in the country. In addition to the MF-RTA business, the company also offers RTA services to AIF and PMS, has an insurance repository, payment business, etc. which account for 13% of its revenues. Recently, the company has also started Account Aggregator (AA) services and NPS CRA services.

In addition, the company provides technology-enabled service solutions to Alternatives and Insurance Companies. Besides serving as a B2B service partner, CAMS also serves customers through a variety of touch points such as the pan-India network of service centres, white-label call centres, online, mobile apps, and chatbots.

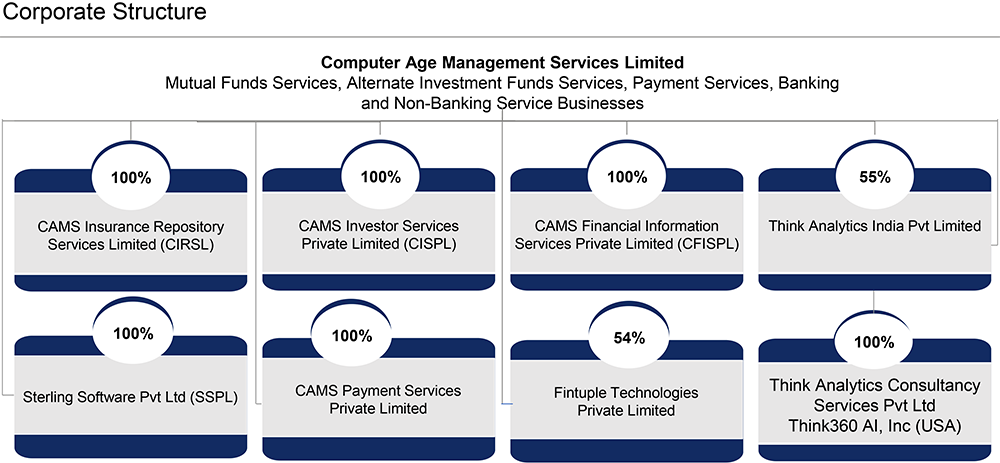

Other business verticals of the company (Apart from MF service business)

Electronic Payment Collection Services Business: In this business, CAMS manages mandated transactions, including registering of mandates, initiation of collections, reconciliation and the related reporting services for mutual funds, non-banking finance companies and banks.

Insurance Services Business: CAMS conduct its insurance services business through its Subsidiary, CAMS Insurance Repository Services Limited. In this business, CAMS offers processing of new business applications, holding policies in dematerialized form, servicing policies and other support functions to insurance companies.

Alternative Investment Funds services: In this business, CAMS provides services to investors manage records and perform fund accounting and reporting, among other services, for alternative investment and other types of funds.

Banking and non-banking services business: CAMS offers digitization of account opening, facilitation of loan processing and back-office processes services to banking and non-banking financial institutions.

Software solutions business: CAMS conduct its software solutions business through its subsidiary, Sterling Software Private Limited (SSPL). CAMS technology team develops software for its mutual funds services business and for mutual fund companies.

KYC registration agency business: CAMS operates its KYC Registration Agency Business through its Subsidiary, CAMS Investor Services Pvt. Ltd., which is one of 5 entities granted a KRA license by SEBI. In this, CAMS verifies and maintain KYC records of investors for use by financial institutions.

Investment Arguments

Largest Services Provider in a large and growing mutual fund industry

The Average Asset under management (AAUM) of the Indian mutual funds has grown to Rs.45 trillion as on October 31, 2024. The growth was led by the increase in the share of mutual funds in household savings as well as the number of individual and institutional investors investing in mutual funds. The company has captured a large part of this AUM and its market share in the mutual fund AAUM stood at 68%. The nature of CAMS’ services to mutual funds spans multiple facets of its relationship with its investors, distributors, and regulators. The company’s mutual fund clients include nine of the fifteen largest mutual funds based on AAUM with around 20 years of average relationship. Due to its domain expertise, established processes, technology-driven infrastructure, and marquee clients, the company is well-positioned to capitalize on growth emanating from the shift of household savings from traditional assets towards equities.

Solid Business Model with Long-term Client Relationships

Leveraging on its diverse portfolio of technology enabled services and pan India network, CAMS helps clients in reducing significant investments in operational infrastructure, thereby allowing its clients to increase their focus on their core business activities. The company has developed a committed client base. The average term of relationship with its ten largest mutual fund clients is 20 years as of October 31, 2024.

Diligent Focus on Processes and Risk Management

Clients of CAMS are regulated financial institutions and hence it is essential to provide them accurate, timely, technologically advanced and secure services. The company continuously monitors its systems and processes and endeavor to not only benchmark them against Indian competitors but also incorporate industry best practices and technological advancements in its operations. CAMS remains focused on automating processes and enhancing systems and risk management to ensure that all its obligations and regulatory requirements are duly met and without error.

High Entry Barriers

The MF RTA business is technology intensive requiring continuous upgradation of systems and processes in line with the increase in business volume as well as changing regulations. Further, it requires extensive branch network and high operating leverage. While an individual AMC’s initiatives like online products may meet a part of the investor needs, MF RTA’s applications address most of the investor and distributor needs. Notably, it is challenging for the clients to replicate CAMS’ physical network or technology platforms in-house. Also, moving to a competitor is time consuming as well as disruptive. CAMS’ pan-India physical network comprises of 280 service centres spread over 25 states and 5 union territories as of October 31, 2024, which are supported by call centres in four major cities – Mumbai, New Delhi, Chennai and Kolkata.

Technology-led services innovations along with non-mutual fund business to drive the next leg of growth

CAMS market position has been a function of its in-house technology capabilities that will support electronic transformation and advancement in the mutual fund industry. The company is engaged in several such initiatives in the areas of reconciliation, brokerage computation, digitization of paper transactions, and quality control, among others. Further, their mobile application myCAMS provides an individual investor interface and facilitates mutual fund transactions for them, as well as GoCORP, a technology platform for corporate investors. The company’s non-mutual fund business, which comprises AIF, CAMS Pay, CAMS REP, and Think360, has seen a consistent rise in its contribution to total revenue. The share of non-mutual fund business stood at 12.9% at the end of October 31, 2024. We believe that the non-mutual fund business has the potential to drive the incremental topline of the business in a significant way going forward.

Q2FY25 Financial Performance

CAMS delivered healthy earnings growth for the quarter ended Q2FY25. Consolidated net sales rose 33% YoY to Rs.365 cr as compared to Rs.275 cr in the same quarter of corresponding fiscal driven by robust AUM growth. Asset based revenue saw a growth of 33% YoY while Non-Asset based Revenue saw a growth of 34% YoY. EBITDA witnessed a robust growth of 40% YoY to Rs.171 cr while margins expanded 240 bps at 47% YoY. Pat surged 45% YoY to Rs.122 cr driven by healthy topline growth and better than expected operational performance.

Other Key Highlights

MF revenue grew by 33% YoY

Non-MF revenue grew by 32% YoY.

Sustained focus on expanding Non-MF businesses grew by 31.9% YoY. Share of Non-MF revenue@ 12.9% of overall revenue.

Mutual Funds

- At Rs. 45 Tn AuM, CAMS saw the fastest quarterly growth in overall AuM, adding Rs. 4.9 Tn during the quarter, a historic high in AuM accretion.

- Recorded solid performance in equity assets with 59.4% growth on Y-o-Y basis, vs. 53.5% for rest of industry. This share gain of nearly 100 basis points has driven Equity AuM market share to ~66%.

- Industry net sales set a new record of Rs.1.5 lakh Crs in Q2 FY’25. CAMS touched ~ 1 lakh Crs of net sales with 66% share.

- New milestone set in NFO collections both for industry (~ Rs 45k Cr) and CAMS ( Rs.27K Cr) on the back of several large sectoral funds launches.

- Record high SIP registrations witnessed in the quarter, with CAMS clocking 1.2 Crs new SIP registrations during the quarter.

- SIP collections scaled at a very healthy clip with CAMS collections growing by 54% Y-o-Y vs. 48% for rest of industry.

Beyond Mutual Funds

- CAMS Alternatives recorded a robust 21% Y-o-Y Revenue growth. Recorded highest ever quarterly win rate with 57 new mandates. Opened 2nd office @ GIFT to service expanding clientale of 20+ AMCs.

- CAMS KRA delivered a robust 56% Y-o-Y revenue growth in Q2 FY’25. Added 26 new financial institutions and FinTechs as its customers, significantly adding non-MF PANs to its stock.

- CAMSPay revenue recorded 69% growth Y-o-Y in Q2 FY’25 on the back of digital payment adoption, led by UPI Auto-Pay.

- BIMA Central unique user base crossed 2.5 lakh and mobile downloads crossed 50K. Processed 1 lakh service transactions on the platform in Q2. 10 lakhs new policies digitized during the quarter.

- CAMS Account Aggregator holds 16.5% market share of Customers successfully linked to AA ecosystem, vs 9.6% in Q2 FY24.

- CAMS NPS subscriber onboarding demonstrates 2.5x+ Y-o-Y growth. Crosses 1 lakh Subscriber onboarding to reach #2 in eNPS registrations.

- CAMS board approves formation of a joint venture along with KFin Technologies Ltd, to operate MF Central, an industry leading unified platform for mutual fund investors and intermediaries.

Key Risks & Concerns

Revenue concentration risk - CAMS derives 73.3% of its revenues from its mutual funds services business. Profitability might get impacted owing to decline in AAUM stemming from events such as declines in the Indian equity markets, changes in interest rates and defaults, accelerated customer withdrawals or redemptions and declines in systematic investment plans.

Significant disruptions in information technology systems or breaches of data security could adversely affect company’s business and reputation.

Contracts with mutual funds and AIF clients are typically perpetual in nature unless terminated by either party. For other clients, the validity of such contracts ranges between one to three years. They negotiate pricing terms with these clients on a periodic basis and their contracts permit them to terminate their arrangements with them by providing three to six months’ written notice, after which they may engage the services of its competitors.

Outlook & Valuation

CAMS has reported strong earnings growth in Q2FY25. We anticipate that this growth momentum will continue for CAMS due to several factors. Firstly, the industry in which CAMS operates has a duopoly nature and high-entry barriers, ensuring limited competition. Secondly, the risk of market share loss for CAMS is relatively low. Additionally, CAMS has a higher customer ownership compared to Asset Management Companies (AMCs). These factors, along with structural tailwinds in the Mutual Fund (MF) industry, are expected to drive absolute growth in MF revenue. Despite potential challenges from forthcoming TER regulations, we believe that the MF business is well-positioned to deliver steady earnings growth in the long term. Furthermore, with favourable macro triggers and strategic investments, CAMS is projected to increase its non-MF share of revenues to over 15% within the next three to five years.

In addition to its strong performance in the MF sector, CAMS has also started focusing on non-mutual fund business, which is expected to contribute value in the future. The company benefits from sustainable business moats, thanks to the high entry barriers and low risk of market share loss in its industry. The acceleration in revenue growth, profitability and market share of its non-MF segments will be driven by (a) track record of two wins a week in alternate investment funds (AIFs), (b) client base expansion with the GIFT City launch, (c) expansion of its KRA business to larger capital markets, (d) expansion of CAMSPay operations beyond MFs in new sectors like education and cards, (e) the acceleration of ePolicy conversions in CAMSRep by improving penetration, and (f) strong growth in transactions in CAMSFinserv. From a financial standpoint, CAMS demonstrates an annuity-like topline, high operating leverage, a robust balance sheet, and attractive return ratios. Considering these factors, CAMS presents a compelling long-term investment opportunity. At CMP of Rs.4514, the stock is trading at 48x FY26E. We recommend BUY rating on the stock.