CG Power and Industrial Solutions Ltd

Electric Equipment

Stock Info

Shareholding Pattern

Price performance

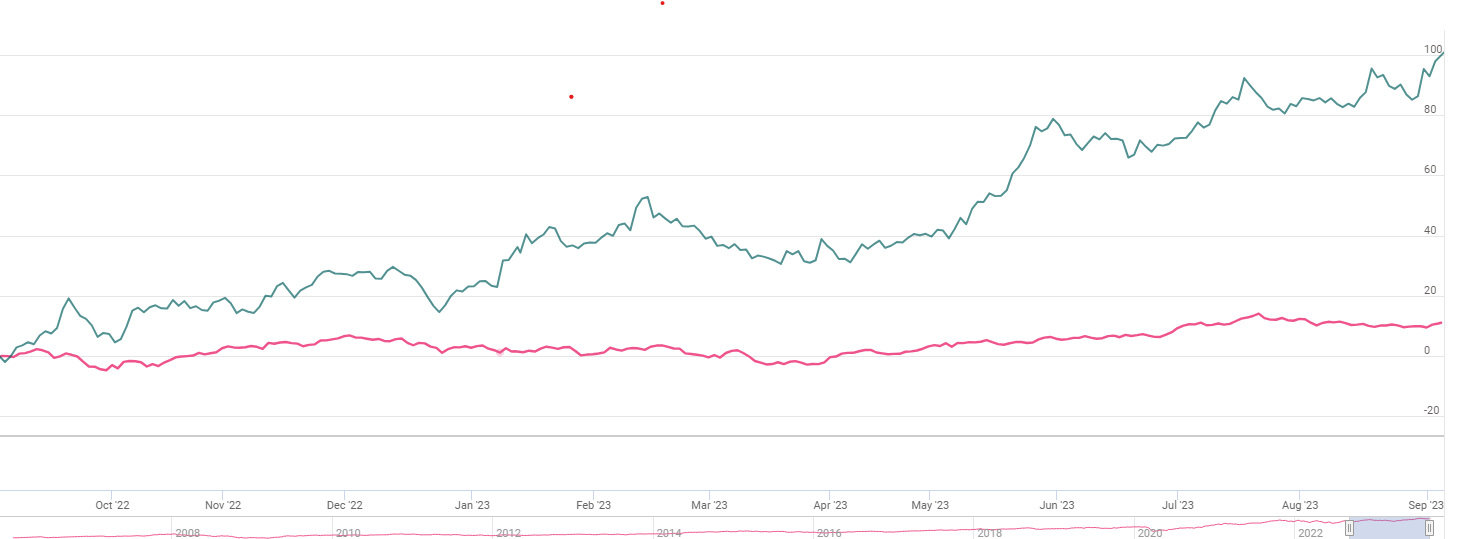

Indexed Stock Performance

Strong industry tailwinds and robust orderbook lends comfort

Company Profile

CG Power, part of the Murugappa group, has two segments - power systems and industrial systems. The power systems segment manufactures electrical products such as transformers, switchgear, and circuit breakers, which find application in power transmission. The industrial systems segment manufactures high- and low-tension rotating machines (motors and alternators), stampings, as well as railway transportation and signaling products. CG is primarily a B2B company that operates across the following two major lines of business:

A) Power Systems Business Unit (PSBU):

B) Industrial Systems Business Unit (ISBU):

Investment Arguments

Strong Order Book Visibility and Healthy Customer Diversification

At the end of June 2023, CG Power’s order book stood at around Rs.4900 cr, providing healthy revenue visibility. The order book is fairly diversified across segments with motor, railways, and transformers businesses contributing 25%-30% each. The top 10 customers accounted for only about 23% of the standalone revenue in FY23, indicating strong customer diversification.

Capex pick-up adding to medium-term growth visibility

CG Power derives the bulk of its revenue/EBIT from industrial products (motors, generators etc), which has a direct linkage to industrial capex. We see significant potential for increased demand in LT motors, wherein CG Power has a strong franchise with pan-India distribution. The Board of Directors approved a proposal to expand the manufacturing capacity of motors at its plants at Ahmednagar and Goa for an outlay of Rs.230 crores and for transformers at its plant in Bhopal and Malanpur, an investment of INR 126 crores. Capex could be a key growth catalyst for CG power going forward.

Leadership position, good products portfolio and, potential returns/cash flow scale-up

CG Power has a dominant product/distribution franchise in LT/HT motors and is amongst the top players in the power product portfolio. With market share ramp up & cyclical revenue ramp up, we see significant return/cash flow scale up potential by FY25, implying best in class fundamentals versus peers. LT motors, railways, etc account for the bulk of sales for CG Power, wherein it has a clear leadership position.

Execution and growth mindset; material TAM expansion underway

Since the new management took over, CG Power has seen a strong operational comeback, reflecting both top-line and margin scale-up in H1FY22. While the potential for a scale-up (cyclical and structural) in the industrial/power product range seems promising, a lot would depend upon competitive dynamics and CG Power’s execution.

Q1FY24 Financial Performance

CG power reported strong earnings growth for the quarter ended Q1FY24. Consolidated revenues grew by 12% YoY to Rs.1874 cr led by both power (+13.1% YoY) and industrial (+14.5% YoY) segments. While Gross Margins for Q1 improved 190bp to 30.2%, EBITDA/PAT margin surged to 14.2/10.5% (+280bp/300 bp YoY) respectively, led by strong volumes, softening of input costs, better product mix and procurement efficiencies. Consolidated EBITDA witnessed a growth of 43% to Rs.287 cr YoY. PAT saw a growth of 57% to Rs.204 cr YoY driven by healthy topline growth and solid operational performance.

Power segment top-line grew 13.1% on a YoY basis to Rs.510 cr while EBIT margin came in at 12.1% for Q1FY24 vs (8.3% in Q1FY23). Industrial segment revenue grew 14.5% on a YoY basis to Rs.1360 cr while EBIT margin came in at 16.9% for Q1FY24 (19.2% in Q1FY23). Order inflows for the quarter surged 53% YoY to Rs.2510 cr (power segment grew 79% YoY to Rs.1120 cr while industrial segment saw 36% YoY growth to Rs.1390 cr), taking the total order book to Rs.4900 cr as of Jun-23.

Key Risks & Concerns

Exposure to Intense Competition - CG Power operates in a competitive industry that has several established players and a large number of the orders are procured through competitive bidding.

Significant increase in raw material prices – Any significant increase in raw material prices has an adverse impact on its profitability. However, as the average execution cycle of these orders is five-to-six months, the risk is mitigated to some extent. Also, the company has taken various cost optimization and vendor rationalization measure to protect its profitability.

Outlook & Valuation

We believe that CG power is poised for growth given its robust order book of Rs.4320 cr, timely ordering of railway tenders, RE transmission capex (tier-2/3 beneficiary in both), EV ecosystem, and intention to expand pumps and fans in the consumer business (INR10bn top-line in three–five years) along with the exports ramp-up opportunity (in both transformers and motors) as the company enters the growth phase. Given its strong market presence (LT/HT motors) and the capex plans w.r.t. transformers/motors, we argue RE transmission, EV ecosystem, and railways shall be the growth segment going forward.

At CMP of Rs.442, the stock is trading at 55x FY25E (EPS – Rs.8) and hence, we recommend to BUY the stock.