Avanti Feeds Ltd

Aquaculture

Stock Info

Shareholding Pattern

Price performance

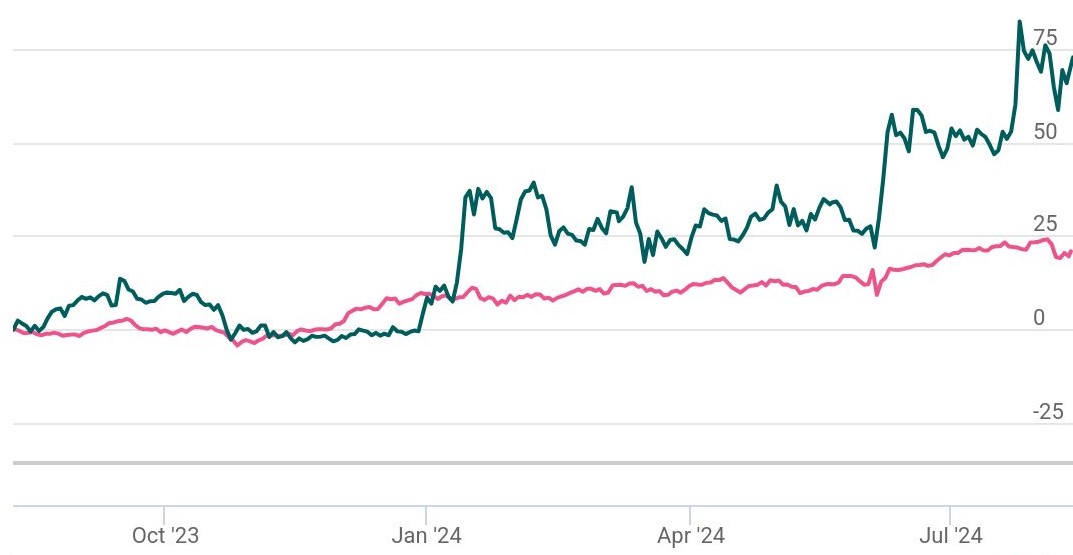

Indexed Stock Performance

Higher Top & Higher Bottom For New Highs

AVANTI FEEDS is in an uptrend making higher highs and higher lows on daily and weekly charts. The stock is currently placed above all its 20SMA & 50SMA moving averages on daily and weekly time frames which indicates positive setup. The stock has bounce from the recent swing low of Rs.589.95 with increased in delivery volume, which show bullishness for this stock. The stock is trading above the median line of Bollinger Band indicating the volatility expansion on the higher side. RSI (14) on daily chart is pegged at sub 57.05 levels, indicating the stock has not yet been over bought. The Parabolic SAR is trading below its price action on weekly charts reflect up trend in the stock will remain intact in near term. The ADX trading at 45.28 on weekly chart, well above 40 marks, which shows overall strength is likely to bring in sustained buying from the current levels.

As a trader one can accumulate around current level and while any correction around Rs.670 – Rs.680 can be utilized to average while keeping a stop loss below Rs.630 for target of Rs.815.