Archean Chemical Industries Ltd

Chemicals

Stock Info

Shareholding Pattern

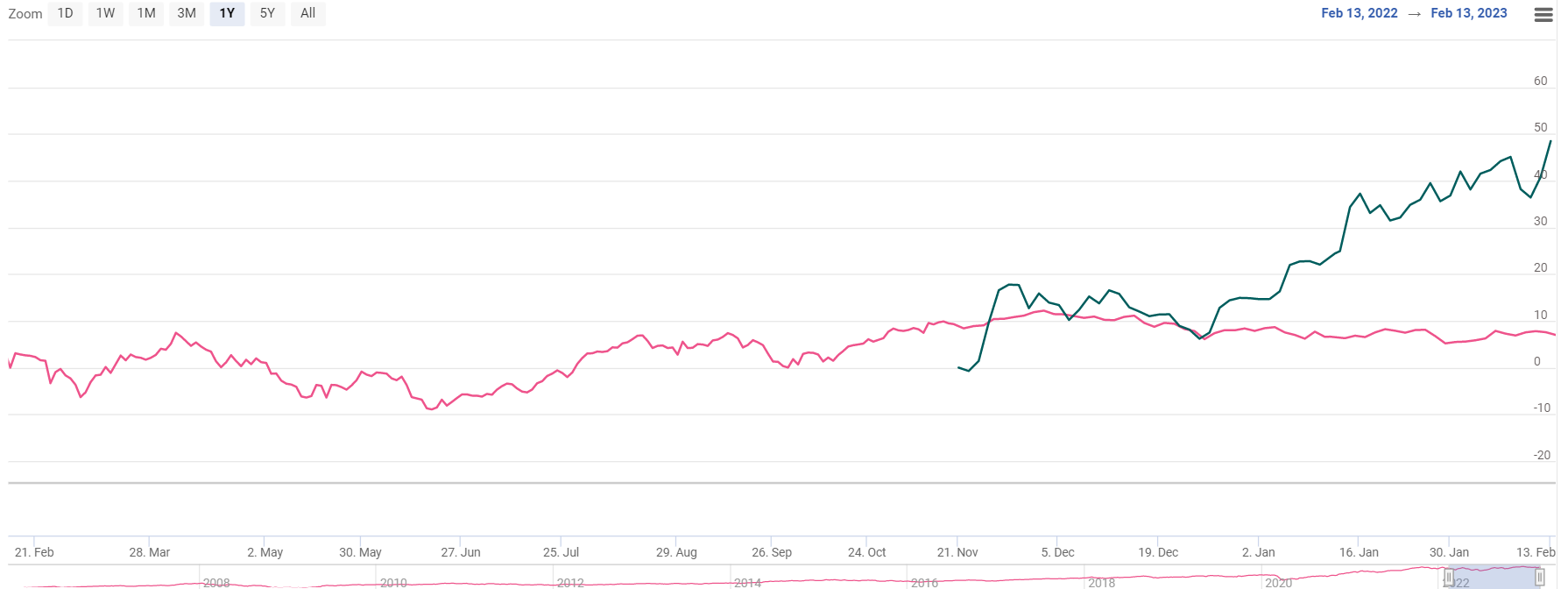

Price performance

Indexed Stock Performance

Strong Numbers Reported in Q3 FY23

Company Profile

Archean Chemicals Industries Limited (ACIL) was incorporated on November 20, 2003.

It is a leading marine chemical manufacturer in India and focused on producing and

exporting bromine, industrial salt, and sulphate of potash to customers around the

world. According to Frost & Sullivan, they were the largest exporter of bromine

and industrial salt from volume in India in Fiscal 2021 and have amongst the lowest

cost of production globally in both bromine and industrial salt.

The company produces all products from its brine reserves in the Rann of Kutch, located on the coast of Gujarat, and manufactures products at its facility near Hajipir in Gujarat. As of June 30, 2022, it marketed products to 18 global customers in 13 countries and to 24 domestic customers.

Bromine is used as key initial-level material, which has applications in pharmaceuticals, agrochemicals, water treatment, flame retardant, additives, oil & gas, and energy storage batteries. Industrial salt is an important raw material used in the chemical industry to produce sodium carbonate (soda ash), caustic soda, hydrochloric acid, chlorine, bleaching powders, chlorates, sodium sulphate (salt cake), and sodium metal. Sulphate of potash is used as a fertilizer and has medical purposes. Archean commands a leadership position in India in bromine merchant sales (traded bromine in the market) by volume. The company exported 100% of their industrial salt production, primarily to customers in Japan and China.

Sulphate of Potash, also known as potassium sulphate, is a high-end, specialty fertilizer for chlorine-sensitive crops and has medical uses to reduce the plasma concentration of potassium when hypokalemia occurs. Archean is the only manufacturer of sulphate of potash from natural sea brine in India.

Investment arguments:

Leading market position, expansion and growth in bromine and industrial salt

Archean attributes their strong market position to factors such as their long-standing

relationship with global customers, their established infrastructure and access

to brine reserves at the Rann of Kutch, their manufacturing facility, and their

consistent delivery of high-quality products. Their leadership position and low

cost-production offers them competitive advantages such as product pricing, economies

of scale, increase customer loyalty and expand their client base, all of which have

in turn resulted in the growth of revenues and EBIDTA in the last 3 fiscal years.

The market position in India and globally for each of their products:

| Product | Company Market Position in India | Volume Produced |

Volume CAGR (FY20-22) |

Revenue (Rs. in cr) FY22 | % of revenue from exports (FY22) |

|---|---|---|---|---|---|

| in Fiscal 2022 (MT) | |||||

| Bromine | Largest export and leader in merchant sales | 20,293 | 51.38% | 605 | 44.88% |

| Industrial Salt | Largest exporter | 35,86,269 | 11.11% | 513 | 100% |

| Sulphate of Potash |

Only producer in India |

2,483 | -63.88% | 114 | 90.75% |

High entry barriers in the specialty marine chemicals industry

The specialty marine chemicals industry in which Archean operates has high entry

barriers, which include 1) the high cost and intricacy of product development, manufacture,

and investment in salt beds, 2) the limited availability of raw materials necessary

for production, 3) the limited number of locations with a suitable climate and access

to reserves, and 4) the lead time and expenditure required for research and development

and building customer confidence and relationships, which can only be achieved through

a long gestation period.

Given the nature of the application of their products and the processes involved, their products are subject to, and measured against, high quality standards and sensitive and rigorous product approval systems with stringent impurity specifications. Thus, customer acquisition is difficult.

Further, bromine and certain raw materials that Archean use in production is highly corrosive, hazardous, and toxic chemicals. Therefore, handling these chemicals requires a high degree of technical skill and specialized expertise.

Company’s existing brine fields were established over a period of 3 to 4 years before commercial cultivation was possible and, accordingly, the development time of brine reservoirs creates an entry barrier to potential domestic competitors. In addition, the Rann of Kutch brine fields are in environmentally sensitive coastal areas which require several regulatory hurdles before production could be established.

Largest Indian exporter of bromine and industrial salt

As of June 30, 2022, Archean had 18 global customers and 24 domestic customers.

Its major customer for industrial salt includes Sojitz Corporation (which is also

a shareholder in the Company), Wanhau Chemicals and Qatar Vinyl Company Limited;

for bromine, Shandong Tianyi Chemical Corporation and Unibrom Corporation.

Key geographies to which they export their products include China, Japan, South Korea, Qatar, Belgium, and the Netherlands.

The exports and domestic sales as a percentage of the revenue from operations:

| Particulars | 3 months ended June 30 | Fiscal | Fiscal | Fiscal | ||||

|---|---|---|---|---|---|---|---|---|

| 2022 | 2022 | 2021 | 2020 | |||||

| Export | Domestic | Export | Domestic | Export | Domestic | Export | Domestic | |

| Bromine | 34.88% | 65.12% | 44.88% | 55.12% | 46.10% | 53.90% | 39.79% | 60.21% |

| Industrial Salt | 100% | 0 | 100% | 0 | 100% | 0 | 100% | 0 |

| Sulphate of Potash | 0.13% | 99.87% | 90.75% | 9.25% | 88.32% | 11.68% | 98.09% | 1.91% |

Long standing relationship with clients

ACIL enjoy relationships more than 5 years with 7 out of their Top-10 customers.

Their long-term relationships and ongoing active engagements with customers also

allow them to plan their capital expenditure, enhance their ability to benefit from

increasing economies of scale with stronger purchasing power for raw materials and

a lower cost base. Company’s strong customer relationships have enabled them

to expand its product offerings and geographic reach.

ACIL has benefited from its fixed sales contracts with agreed pricing and volumes of approximately 12 months duration with its bromine customers of approximately 24 months duration with its industrial salt customers.

Established infrastructure and integrated production with cost efficiencies

- Integrated facility: Archean has an integrated production facility

for their bromine, industrial salt, and sulphate of potash operations, located at

Hajipir, Gujarat, which is located on the northern edge of the Rann of Kutch brine

fields.

- Largest facility fully compliant with environment protection measures: They have one of the largest salt works at one single location in the world. Their industrial salt washing facility has 3 washeries, each having a capacity of 200 tons/hour. Their facility is equipped with their own quality department, effluent treatment plant, sewage treatment plant and stockyard. Their operations have an ISO 9001:2015 certification.

- Location advantage: Their manufacturing facility is in the proximity to the Jakhau Jetty and Mundra Port from, where they can transport their products to various international customers.

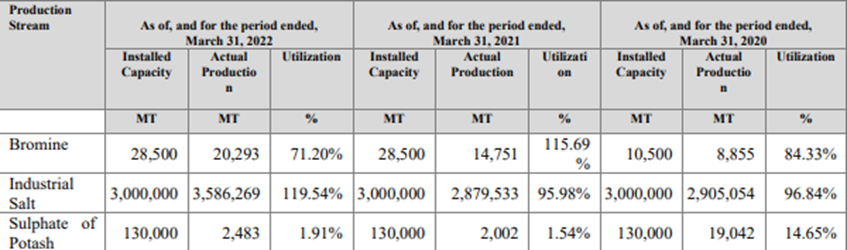

Expansion plan:

ACIL has planned product innovation, and capex to expand existing as well as new

manufacturing facilities ensures positive business growth.

Strong and consistent financial performance

Archean has demonstrated consistent growth in terms of revenues and profitability.

Their total revenue from operations has increased at a CAGR of 36.34 % from Rs.608

cr in FY20 to Rs.1130 cr in FY22. Revenue from exports has grown at a CAGR of 29.11%

from Rs.477 cr in Fiscal 2020 to Rs.795 cr in Fiscal 2022.

The company’s EBITDA has witnessed a robust growth from Rs.149 cr in FY20 to Rs.467 cr in FY22; increasing at a CAGR of 75% while EBITDA Margins has expanded to 41% in FY22 from 25% in FY20. ROCE stood at 34.62% at the end of June 30, 2022.

Archean Chemicals Revenue doubled in Q1FY23 to Rs.400 cr as against Rs.201 cr clocked in the same quarter of previous fiscal. EBITDA also saw a similar surge to Rs.160 cr from Rs.80 cr in Q1Fy22. PAT grew manifold to Rs.84 cr YoY reflecting strong financial performance in Q1FY23.

Q3 FY23 Analysis

For the quarter ended 31st December 2022, Revenue of the company stood

at Rs 365 crores, an increase of 25% & 19% on QoQ & YoY basis respectively.

EBITDA for the quarter stood at Rs 160 crores, 34% & 37% on QoQ & YoY basis

respectively. EBITDA margin for the quarter increased by 400 & 600 bps on quarterly

& yearly basis respectively to 44%. PAT for the quarter stood at Rs 98 crores,

an increase of 53% & 100% on QoQ & YoY basis respectively.

Key Risks & Concern:

High Debt: Company’s total debt as of June 30, 2022, stood

at Rs.915 cr comprising of secured non-current borrowings of Rs.841cr and current

borrowings (including current maturities of non-current borrowings) of Rs.71 cr.

On revenue base of Rs.1130 cr total debt of Rs.915 cr is too high and poses risk

to continuity of business in adverse macro – economic conditions.

Outlook and Valuation

We like Archean Chemicals due to its market leadership position, strong financial performance, Strong return ratios, Strong business moat. We believe that ACIL is poised for strong growth ahead on account of expansion plans & addition of new customers. At CMP of Rs.690, ACIL is trading at 38x FY22 EPS of Rs.18.26 which appears to be reasonable.

Hence we recommend a buy on the stock.