Apar Industries Ltd

Electric Equipment

Stock Info

Shareholding Pattern

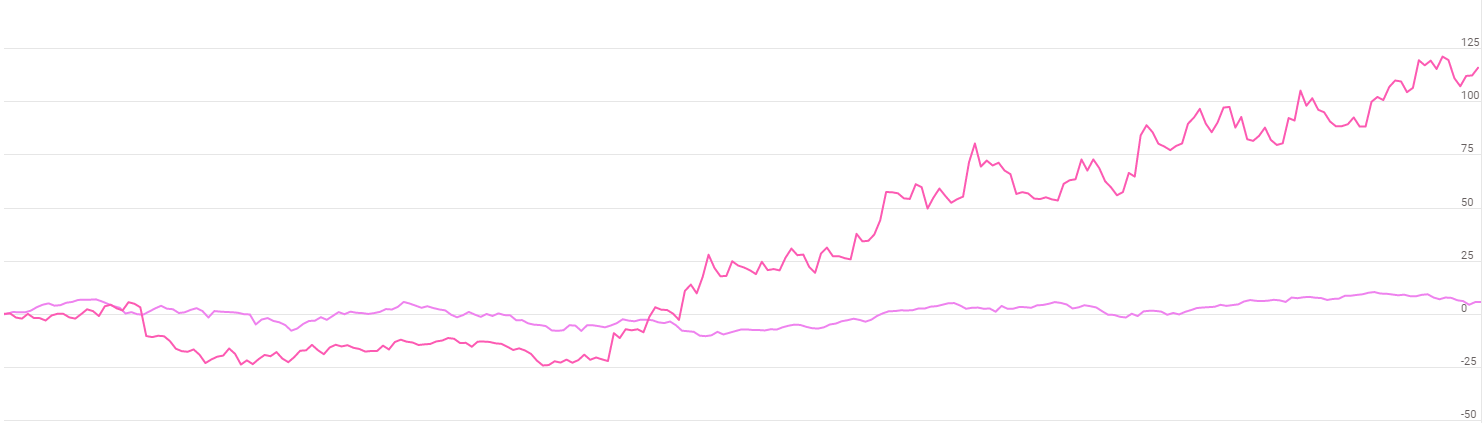

Price performance

Indexed Stock Performance

Growth to be driven by exports and premium products

Company Profile

Apar, founded by Mr Dharmsinh D. Desai in 1958, is engaged in three broad business segments-transformer oils and specialty oils (TSO), conductors segment and power/telecom cables. Company is a market leader in India; the company has a global presence, exporting to over 100 countries. APAR has total installed capacity of 5,42,000 KL of transformer oils and 1,80,000 MT of conductors as on March 31, 2022. Its manufacturing facilities are located at Rabale (Maharashtra), Silvassa, Athola and Rakholi (Dadra and Nagar Haveli), Umbergaon and Khatalwad (Gujarat), Jharsugoda and Lapanga (Orissa), Hamriyah (Sharjah). Further, APAR has commissioned the continuously transposed conductors facility, a value-added product, with total installed capacity of 7000 MT for supply of copper conductors to transformer industry.

Investment Rationale

One of the largest players in conductor segment

APAR is one of the largest companies, engaged in manufacturing of TSO and Transmission & Distribution Overhead Conductors with a total installed capacity of 5,42,000 KL and 1,80,000 MT respectively as on March 31, 2022. In the conductor division, APAR caters to prominent customers like Power Grid Corporation of India Limited, various state government entities, Adani Group, and prominent turnkey operators with whom it has a long-standing relationship. APAR also exports to major geographies with focus on Middle East, Latin America, North America and Africa among others and has presence in more than 100 countries.

Well established market position across segments

APAR is amongst the top three producers of conductors and specialty oils in the world. In the transformer oil segment it has a product offering of over 400 products with varied application in the industrial oil sub segment. To cater to the need of growing demand in Middle East and African markets, APAR commissioned its port-based plant at Hamriyah, Sharjah in FY18. It has also entered into a brand and manufacturing alliance for its automotive lubricant segment with the global energy leader ENI Italy.

In the conductor segment, APAR enjoys long standing relationship with customers like PGCIL, Kalpataru Power Transmission Limited, KEC International Limited. In the cables segment, APAR is engaged in electrical and telecom cables as well as elastomeric cables. This division supplies to various industry segments in India viz., power utilities, petrochemicals, steel, cement, nuclear power, defence, telecommunication, metros and shipbuilding, Railways, Renewable Energy sector etc. Major clients include Adani Group, Tata Power, Larsen & Toubro Limited, BHEL and Sterlite Technologies Limited etc.

Diversified revenue profile

APAR’s business segments comprise Conductors, TSO and Cables. The conductor segment contributed 43% to the gross sales of FY22 (FY21 - 45%), TSO segment contributed 37% in FY22 (FY21- 36%) and the balance was from the cables segment. APAR has a greater proportion of revenue contribution coming from the conventional conductors which typically have lower operating margins especially due to the volatile freight costs, however, freight costs are expected to moderate from H1FY23. The total order book for conductors stood at Rs.4,065 cr as on Sept 30, 2022, which includes around Rs.850 cr of high-margin conductors (HEC). The TSO segments revenue was up by 51% YoY in FY22 owing to increased exports. The cables segments Total Operating Income was also up by 57% YoY in FY22 owing to increased revenue from exports.

Q2FY23 Financial Performance

Apar Industries reported a robust quarterly performance in Q2FY23 driven by healthy exports growth, increasing contribution of premium products, price pass through and volume growth. Consolidated sales grew 42.6% YoY to Rs.3235 cr. Gross margin expanded by 227bps YoY to 24.2% aided by better product and geography mix. EBITDA grew 77% YoY to Rs.226 cr with EBITDA margins expanding by 136 bps YoY to 7%, owing to better gross margins. PAT grew 80.4% YoY to Rs.103 cr led by strong operational performance and higher other income (up 161.1% YoY).

Key Risks & Concerns

Working capital intensity of operations - The operations of the company continue to be working capital intensive due to inherent problems in the industry in which it operates, such as delays in order execution, delays in obtaining clearances and in funding arrangements by engineering, procurement, and construction (EPC) players.

Susceptibility of margins to volatility in raw material prices - The price of aluminium and copper which are a major raw material for conductors, have shown a lot of volatility in the past few years. In order to hedge against the volatility in the metal price, APAR books the metal at the LME rates on the day the order is booked for fixed-price orders. In the TSO segment, APAR uses base oil as its raw material. The base oil prices depend on crude oil prices to a certain extent, which are highly volatile.

Exposure to foreign exchange fluctuation - APAR is exposed to volatility in foreign exchange rates on account of its imports and borrowings in foreign currency. Majority of its raw materials are imported making APAR a net importer. APAR is affected by the price volatility of certain commodities viz. Aluminum, Copper and Oil.

Outlook & Valuation

We believe APAR’s focus towards value added products and exports business likely to benefit in long run and aid profitability going forward. Citing increasing contribution from premium products, expanding international footprints, strong outlook for cables business, diversified revenue sources, capacity to increase its product offering, well established market position across segments and management focus on profitable growth, company is poised to delivery steady growth in the coming quarters.

As on CMP of Rs.1650, the stock is trading at 25x FY22 (EPS Rs.67) and we recommend to BUY the stock.